Compare Insurance Quotes Auto

The process of obtaining auto insurance quotes is an essential step for any vehicle owner, as it allows for a comprehensive comparison of coverage options and premiums. This guide aims to provide an in-depth analysis of the factors that influence insurance quotes, the steps involved in comparing quotes, and the strategies to secure the most suitable and cost-effective auto insurance coverage.

Understanding the Influence of Factors on Insurance Quotes

Auto insurance quotes are influenced by a multitude of factors, each playing a crucial role in determining the overall cost and coverage of a policy. These factors can be broadly categorized into personal, vehicle-related, and external influences.

Personal Factors

Personal circumstances such as age, gender, and driving history significantly impact insurance quotes. Young drivers, for instance, often face higher premiums due to their perceived risk level, while experienced drivers with clean records may enjoy more favorable rates. Additionally, marital status and credit score can also affect insurance costs, with married individuals and those with higher credit scores often benefiting from reduced premiums.

| Personal Factor | Influence on Quotes |

|---|---|

| Age | Younger drivers often pay higher premiums. |

| Gender | Insurance rates may vary based on gender. |

| Driving History | Clean records can lead to lower premiums. |

| Marital Status | Married individuals may receive discounts. |

| Credit Score | Higher scores can result in reduced insurance costs. |

Vehicle-Related Factors

The type of vehicle insured, its age, and its safety and security features can all impact insurance quotes. High-performance cars, for example, often attract higher premiums due to their association with increased risk of accidents. On the other hand, vehicles equipped with advanced safety systems or anti-theft devices may qualify for discounts.

External Factors

External influences, such as geographical location and claim frequency in a particular area, can also affect insurance quotes. Areas with a higher incidence of accidents or thefts may result in increased premiums. Furthermore, the overall claim environment, influenced by factors like weather conditions or economic trends, can impact insurance rates on a broader scale.

The Process of Comparing Insurance Quotes

Comparing auto insurance quotes is a systematic process that involves several key steps to ensure an informed decision.

Step 1: Define Your Coverage Needs

Begin by assessing your specific coverage requirements. Consider the level of liability protection you desire, the value of your vehicle, and any additional coverage options that may be beneficial, such as collision, comprehensive, or personal injury protection (PIP) coverage. Understanding your needs will help you tailor your search and make more accurate comparisons.

Step 2: Gather Quotes from Multiple Insurers

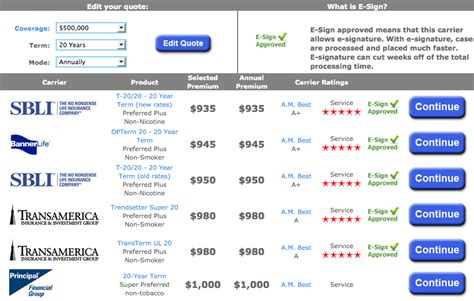

Reach out to a variety of insurance providers to obtain quotes. This can be done through online platforms, insurance brokers, or directly contacting insurance companies. Ensure that you provide consistent information to each insurer to ensure an accurate comparison. Aim to gather at least three to five quotes to have a diverse range of options.

Step 3: Analyze the Quotes

Once you have collected the quotes, delve into a detailed analysis. Compare the premiums, coverage limits, deductibles, and any additional perks or discounts offered. Look for policies that offer the coverage you need at a competitive price. Consider the financial stability and reputation of the insurance companies, as well as their customer service ratings.

Step 4: Evaluate Additional Benefits and Discounts

Insurance providers often offer a range of discounts and additional benefits to attract customers. These may include multi-policy discounts (if you bundle your auto insurance with other policies like home or life insurance), safe driver discounts, loyalty discounts, or discounts for completing defensive driving courses. Evaluate these perks to determine their potential value and how they could further reduce your insurance costs.

Step 5: Consider the Claims Process and Customer Service

The quality of an insurance provider's claims process and customer service can significantly impact your overall experience. Research the insurer's reputation for handling claims promptly and fairly. Read customer reviews and ratings to gauge their satisfaction levels. Consider factors like the insurer's availability, response times, and their willingness to assist with complex claims.

Strategies for Securing the Best Auto Insurance Quote

To secure the most advantageous auto insurance quote, consider implementing the following strategies.

Strategy 1: Bundle Policies

Bundling multiple insurance policies, such as auto and home insurance, with the same provider can often lead to substantial discounts. Many insurers offer multi-policy discounts as an incentive to encourage customers to purchase additional coverage. By bundling your policies, you not only save money but also streamline your insurance management.

Strategy 2: Explore Discounts and Perks

Insurance companies frequently offer a variety of discounts to attract and retain customers. These may include safe driver discounts, loyalty discounts, good student discounts, or discounts for belonging to certain professional organizations. Explore these options and discuss them with your insurer to see if you qualify for any additional savings.

Strategy 3: Improve Your Driving Record

A clean driving record is often rewarded with lower insurance premiums. If you have a history of accidents or traffic violations, consider taking steps to improve your record. This may involve taking defensive driving courses, avoiding aggressive driving behaviors, and ensuring you adhere to traffic laws. A cleaner driving record can significantly reduce your insurance costs over time.

Strategy 4: Shop Around Regularly

Insurance rates can fluctuate, and what may have been the best quote a year ago may no longer be the case. Regularly shopping around for insurance quotes, at least annually, can help you stay updated on the latest rates and coverage options. By comparing quotes on a consistent basis, you can ensure you're always getting the best value for your money.

Strategy 5: Understand Your Coverage Options

Auto insurance policies can be complex, and understanding your coverage options is essential to securing the right policy. Take the time to research and understand the different types of coverage available, such as liability, collision, comprehensive, and personal injury protection (PIP). Ensure you're aware of the limits and exclusions of each coverage to make an informed decision that aligns with your needs.

Frequently Asked Questions (FAQ)

How often should I compare auto insurance quotes?

+It is recommended to compare auto insurance quotes at least once a year, as rates can change based on various factors. However, if you experience significant life changes, such as a move to a new city or a change in marital status, it may be beneficial to compare quotes more frequently to ensure you're still getting the best deal.

Can I negotiate my auto insurance quote?

+While negotiating insurance quotes may not be as common as with other services, it is possible to negotiate certain aspects of your policy. You can discuss your options with your insurer, especially if you have a long-standing relationship with them or if you're bundling multiple policies. Negotiating discounts or additional coverage may be feasible, but it's important to maintain a respectful and professional tone.

What should I do if I find a better quote after purchasing my policy?

+If you discover a more competitive quote after purchasing your auto insurance policy, it's worth reaching out to your insurer. Many providers will allow you to adjust your coverage or premiums to match the better quote, especially if you've been a loyal customer. It's always beneficial to shop around and keep your insurer informed to ensure you're getting the best value.

Conclusion

Comparing auto insurance quotes is a vital process that empowers vehicle owners to make informed decisions about their coverage. By understanding the factors that influence quotes and following a systematic comparison process, individuals can secure the most suitable and cost-effective auto insurance policy. Implementing strategic approaches, such as bundling policies and exploring discounts, can further enhance the value of the chosen coverage. Regularly reviewing and comparing quotes ensures that vehicle owners remain protected and financially secure on the road.