Compare Vehicle Insurance Quotes

The Ultimate Guide to Comparing Vehicle Insurance Quotes: A Comprehensive Analysis

When it comes to vehicle insurance, making an informed decision is crucial to ensure you get the best coverage at an affordable price. With numerous insurance providers and policies available, comparing quotes has become an essential step in the process. This comprehensive guide will walk you through the key factors to consider, the steps to obtain accurate quotes, and provide valuable insights to help you navigate the complex world of vehicle insurance.

Understanding the Factors that Influence Insurance Quotes

The process of comparing vehicle insurance quotes starts with understanding the various elements that impact your premium. These factors are unique to each driver and vehicle, and they play a significant role in determining the cost of your insurance policy.

Vehicle Details

The make, model, and year of your vehicle are fundamental factors in insurance quotes. Generally, newer and more expensive cars tend to have higher insurance costs due to their replacement value and potential repair expenses. Additionally, the type of vehicle you own can also influence your quote. Sports cars, luxury vehicles, and certain SUVs often come with higher premiums due to their performance capabilities and potential for higher accident risks.

Another critical aspect is the safety features of your vehicle. Insurance providers often offer discounts for cars equipped with advanced safety technologies such as lane departure warning systems, blind-spot monitoring, and automatic emergency braking. These features not only enhance your safety on the road but can also reduce the likelihood of accidents, thereby lowering your insurance costs.

| Safety Feature | Potential Discount |

|---|---|

| Anti-lock Braking System (ABS) | Up to 5% |

| Airbags | Up to 3% |

| Electronic Stability Control | Up to 10% |

Driver Profile

Your driving history and personal details significantly impact your insurance quote. Younger drivers, especially those under 25 years old, often face higher premiums due to their lack of driving experience and higher accident risk. Similarly, drivers with a history of accidents, traffic violations, or DUI convictions may also see elevated insurance costs.

The distance you drive annually can also affect your quote. If you use your vehicle for long commutes or frequent travel, your insurance provider may classify you as a higher-risk driver, resulting in increased premiums. On the other hand, low-mileage drivers who primarily use their vehicles for short trips or occasional leisure travel may be eligible for mileage-based insurance policies, offering significant cost savings.

Location and Usage

Where you live and how you use your vehicle can have a substantial impact on your insurance quote. Urban areas often have higher insurance rates compared to rural areas due to increased traffic, higher accident rates, and potential for vehicle theft. Additionally, if you primarily drive in high-risk areas or use your vehicle for business purposes, your insurance costs may increase accordingly.

The type of coverage you require also plays a role in your insurance quote. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, typically costs more than basic liability coverage. However, the level of coverage you choose should be tailored to your specific needs and the value of your vehicle.

Steps to Obtain Accurate Vehicle Insurance Quotes

Researching Insurance Providers

Start by researching reputable insurance providers in your area. Consider established companies with a proven track record, as well as smaller, specialized providers who may offer more tailored policies. Online reviews and customer testimonials can provide valuable insights into the quality of service and reliability of these providers.

Gathering Necessary Information

To obtain accurate quotes, you’ll need to provide detailed information about your vehicle, driving history, and personal details. Ensure you have the following information readily available:

- Vehicle make, model, and year

- Vehicle identification number (VIN)

- Driver's license number and expiration date

- Driving history, including accidents, violations, and claims

- Estimated annual mileage

- Current or previous insurance policy details

Using Online Quote Tools

Most insurance providers offer online quote tools that allow you to quickly and easily obtain estimates. These tools typically guide you through a series of questions to gather the necessary information and provide a personalized quote based on your responses. While these quotes may not be entirely accurate, they can give you a good starting point for comparison.

Seeking Professional Advice

If you’re unsure about the process or have specific requirements, consider seeking advice from an insurance broker or agent. These professionals can provide valuable insights and guidance, helping you understand the various coverage options and ensuring you obtain accurate quotes tailored to your needs.

Analyzing and Comparing Quotes

Evaluating Coverage and Limits

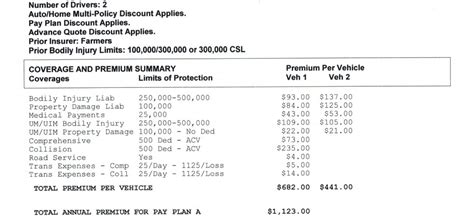

When comparing quotes, it’s essential to evaluate the coverage and limits offered by each provider. Ensure that the policies you’re comparing provide similar levels of coverage for liability, collision, comprehensive, and any additional coverage you require. Pay close attention to the policy limits, deductibles, and any exclusions that may apply.

Considering Additional Benefits

Insurance providers often offer a range of additional benefits and services to differentiate themselves from competitors. These can include roadside assistance, rental car coverage, accident forgiveness, and loyalty discounts. Consider which benefits are most valuable to you and ensure they are included in the policies you’re comparing.

Assessing Customer Service and Claims Process

The quality of customer service and the efficiency of the claims process are critical factors to consider when choosing an insurance provider. Research online reviews and customer feedback to gauge the provider’s reputation for prompt and courteous service. Additionally, inquire about the claims process, including the steps involved, response times, and any potential limitations or exclusions.

Reviewing Financial Stability

The financial stability of your insurance provider is another important consideration. Ensure that the provider you choose has a solid financial standing and is well-equipped to handle claims and provide long-term coverage. You can research financial ratings and reviews to assess the provider’s financial health and stability.

Making an Informed Decision

Understanding the Fine Print

Before finalizing your decision, carefully review the policy documents and understand the fine print. Pay attention to any exclusions, limitations, and conditions that may impact your coverage. Ensure that the policy meets your specific needs and provides adequate protection for your vehicle and yourself.

Negotiating and Seeking Discounts

Don’t be afraid to negotiate with insurance providers, especially if you’re a loyal customer or have a clean driving record. Many providers offer loyalty discounts, multi-policy discounts, or other incentives to attract and retain customers. Additionally, consider inquiring about discounts for safety features, low-mileage driving, or other relevant factors.

Bundling Policies for Savings

If you’re in the market for other types of insurance, such as home or life insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts when you purchase multiple policies from them. This can be a cost-effective way to save on your insurance premiums while also simplifying your insurance management.

Future Implications and Considerations

Keeping Your Policy Up-to-Date

Vehicle insurance is an ongoing commitment, and it’s essential to keep your policy up-to-date to ensure continuous coverage. Regularly review your policy to ensure it aligns with your current needs and circumstances. If your vehicle, driving habits, or personal details change, inform your insurance provider to make necessary adjustments to your policy.

Monitoring Insurance Market Trends

The insurance market is dynamic, and rates can fluctuate over time. Stay informed about market trends and changes in insurance regulations that may impact your policy. Regularly compare quotes from different providers to ensure you’re still getting the best value for your insurance needs.

Utilizing Technology for Better Coverage

With advancements in technology, insurance providers are offering innovative solutions to enhance coverage and customer experience. Telematics devices, for example, can monitor your driving behavior and offer personalized insurance rates based on your actual driving habits. Consider exploring these technologies to potentially lower your insurance costs and improve your coverage.

Frequently Asked Questions

How often should I compare vehicle insurance quotes?

+It's generally recommended to compare quotes annually, especially if your circumstances have changed. However, if you're in the market for a new vehicle or considering switching providers, it's advisable to obtain quotes more frequently to ensure you're getting the best deal.

Can I get multiple quotes from the same insurance provider?

+Yes, you can request multiple quotes from the same provider by providing different scenarios or coverage levels. This allows you to compare various options and choose the one that best suits your needs and budget.

Are there any hidden costs associated with vehicle insurance quotes?

+Insurance providers are required to disclose all costs associated with the policy, including any fees or surcharges. However, it's important to carefully review the policy documents to understand any potential additional costs that may arise, such as administrative fees or penalties for early policy cancellation.

What factors can I control to lower my insurance premiums?

+There are several factors within your control that can help lower your insurance premiums. These include maintaining a clean driving record, reducing your annual mileage, and installing safety features in your vehicle. Additionally, shopping around and comparing quotes can often result in significant savings.

How can I ensure I'm getting the best value for my vehicle insurance policy?

+To ensure you're getting the best value, compare quotes from multiple providers, assess the coverage and limits offered, and consider the provider's reputation for customer service and claims handling. Additionally, don't hesitate to negotiate with providers and explore potential discounts to maximize your savings.