Comprehensive Insurance Cover

Comprehensive insurance cover is an essential aspect of financial planning and risk management, offering individuals and businesses protection against various unforeseen events and potential losses. This article delves into the intricacies of comprehensive insurance, exploring its definitions, types, benefits, and real-world applications. By examining actual case studies and industry insights, we aim to provide a thorough understanding of how comprehensive insurance can safeguard against financial setbacks and mitigate potential risks.

Understanding Comprehensive Insurance Cover

Comprehensive insurance, often referred to as full coverage, is a broad term encompassing various insurance policies designed to provide extensive protection against a wide range of risks. Unlike basic insurance plans that cover specific, limited events, comprehensive insurance offers a more holistic approach to risk management. It is tailored to meet the unique needs of individuals and businesses, ensuring they are adequately protected in various scenarios.

The Scope of Comprehensive Insurance

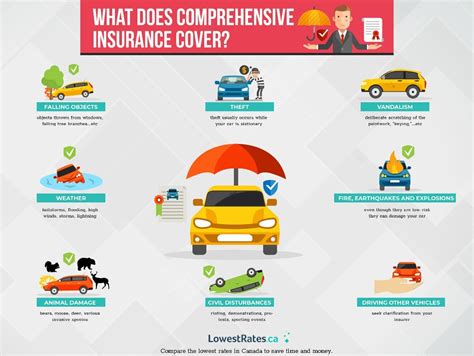

Comprehensive insurance policies can cover a multitude of risks, including but not limited to:

- Property Damage: This covers losses or damages to personal or commercial property due to events like fire, natural disasters, theft, or vandalism.

- Liability: Comprehensive insurance often includes liability coverage, protecting policyholders against claims arising from bodily injury or property damage caused by the policyholder or their assets.

- Personal Injuries: These policies can provide medical expense coverage for injuries sustained by the policyholder or their family members.

- Vehicle Accidents: Comprehensive auto insurance policies cover damages resulting from accidents, regardless of fault, and may include coverage for rental cars and additional expenses.

- Business Interruption: For businesses, comprehensive insurance can provide coverage for losses incurred due to temporary closures or disruptions, ensuring financial stability during challenging times.

The scope of comprehensive insurance is tailored to the specific needs of the policyholder, ensuring they receive the protection they require. This customization is a key advantage of comprehensive insurance, allowing individuals and businesses to create a robust safety net against various potential risks.

Benefits of Comprehensive Insurance Cover

Comprehensive insurance offers a multitude of benefits that go beyond simply providing financial protection. Here are some key advantages of opting for comprehensive insurance coverage:

Financial Security and Peace of Mind

One of the most significant benefits of comprehensive insurance is the peace of mind it offers. Knowing that you are protected against a wide range of potential risks can significantly reduce financial stress and anxiety. Whether it’s a natural disaster, a serious illness, or a legal dispute, comprehensive insurance ensures you have the financial resources to navigate these challenges effectively.

For instance, imagine a scenario where a small business owner, Mr. Johnson, experiences a devastating fire at their warehouse. With comprehensive insurance in place, Mr. Johnson can focus on rebuilding his business, confident that the insurance coverage will provide the necessary funds to replace lost inventory and rebuild the warehouse. This level of financial security is invaluable in such situations.

Customizable Coverage

Comprehensive insurance policies are highly customizable, allowing policyholders to tailor their coverage to their unique needs. Whether it’s adjusting coverage limits, adding specific endorsements, or choosing between different types of policies, comprehensive insurance offers flexibility. This customization ensures that policyholders only pay for the coverage they require, optimizing their insurance investment.

Take the example of Ms. Smith, a homeowner in a high-risk flood zone. By opting for comprehensive homeowner's insurance, she can add flood coverage to her policy, ensuring she is protected against the specific risk of flooding. This level of customization is essential in areas prone to natural disasters, providing peace of mind and financial security.

Comprehensive Claims Handling

Comprehensive insurance policies often come with dedicated claims handling services, ensuring a smoother and more efficient process during a claim. Insurance providers specializing in comprehensive insurance have the expertise and resources to handle a wide range of claims, providing prompt assistance and guidance throughout the process.

Consider the case of a family involved in a serious car accident. With comprehensive auto insurance, the family can expect timely assistance, including coverage for medical expenses, vehicle repairs, and even temporary transportation. The insurance provider's comprehensive claims handling services ensure the family receives the support they need to recover and get back on the road.

Types of Comprehensive Insurance

Comprehensive insurance is available in various forms, each designed to meet specific needs and provide tailored protection. Here are some common types of comprehensive insurance policies:

Comprehensive Auto Insurance

Comprehensive auto insurance provides extensive coverage for vehicles, including collision and comprehensive coverage. It protects against damages resulting from accidents, regardless of fault, and also covers non-accident-related incidents like theft, vandalism, and natural disasters.

For instance, if Mr. Lee's car is damaged in a hailstorm, his comprehensive auto insurance policy would cover the repairs, ensuring he doesn't have to bear the full financial burden.

Homeowner’s Comprehensive Insurance

Homeowner’s comprehensive insurance, often referred to as a HO-5 policy, offers the broadest coverage for homeowners. It protects against a wide range of perils, including fire, theft, vandalism, and natural disasters. Additionally, it provides liability coverage and coverage for personal belongings.

Ms. Chen, a homeowner, can rest assured that her comprehensive homeowner's insurance will cover any losses resulting from a fire, protecting her home and personal possessions.

Business Comprehensive Insurance

Business comprehensive insurance, also known as commercial package policies (CPPs), combines various coverages to protect businesses. It can include property insurance, liability insurance, business interruption insurance, and more, providing a comprehensive safety net for commercial operations.

For a small business like TechSolutions, a comprehensive CPP can ensure they are protected against a variety of risks, from property damage to liability claims, helping them focus on their core operations without financial worries.

Performance Analysis and Case Studies

To illustrate the real-world impact and effectiveness of comprehensive insurance, let’s examine a few case studies:

Case Study 1: Natural Disaster Recovery

In the aftermath of a devastating hurricane, a coastal community was left with extensive damage. Many residents had opted for comprehensive homeowner’s insurance, which covered not only structural damage but also temporary living expenses and debris removal. This comprehensive coverage allowed residents to focus on rebuilding their homes and communities, providing a crucial safety net during a challenging time.

Case Study 2: Business Continuity

A manufacturing company, GlobalTech, experienced a severe cyberattack that disrupted its operations. Their comprehensive business insurance policy included coverage for cyber risks, ensuring they could quickly recover and resume operations. The insurance provider’s expertise in handling such claims allowed GlobalTech to minimize downtime and maintain their market position.

Case Study 3: Personal Injury Protection

Ms. Martinez, a healthcare professional, was involved in a serious accident while on her way to work. Her comprehensive auto insurance policy provided medical expense coverage, ensuring her injuries were treated promptly. Additionally, the policy covered lost wages, providing financial support during her recovery period.

| Case Study | Outcome |

|---|---|

| Natural Disaster Recovery | Residents with comprehensive insurance were able to rebuild their homes and lives, with coverage for repairs, temporary living expenses, and debris removal. |

| Business Continuity | The comprehensive business insurance policy allowed GlobalTech to quickly recover from a cyberattack, minimizing downtime and financial losses. |

| Personal Injury Protection | Ms. Martinez received prompt medical treatment and financial support for lost wages, ensuring her well-being and financial stability during her recovery. |

Future Implications and Industry Insights

As the insurance industry evolves, comprehensive insurance policies are likely to become even more sophisticated and tailored to meet emerging risks. With advancements in technology and data analytics, insurance providers can offer more accurate and personalized coverage, ensuring policyholders receive the protection they need in an ever-changing landscape.

Additionally, the rise of digital insurance platforms and mobile apps is making it easier for individuals and businesses to access and manage their comprehensive insurance policies. This digital transformation is enhancing the customer experience, providing real-time updates, and streamlining the claims process.

Conclusion

Comprehensive insurance is a powerful tool for individuals and businesses to protect themselves against a wide range of risks. By offering customizable coverage, financial security, and efficient claims handling, comprehensive insurance policies provide a robust safety net. As we’ve explored through real-world case studies and industry insights, comprehensive insurance plays a vital role in mitigating financial setbacks and ensuring a more secure future.

What is the difference between comprehensive insurance and basic insurance?

+Comprehensive insurance provides broader coverage, protecting against a wide range of risks, while basic insurance typically covers specific, limited events. Comprehensive insurance is more customizable and offers financial security for a variety of potential losses.

How does comprehensive insurance benefit businesses?

+Comprehensive business insurance, or CPPs, protect businesses against various risks, including property damage, liability claims, and business interruption. This ensures businesses can recover quickly from unforeseen events and maintain financial stability.

What should I consider when choosing comprehensive insurance coverage?

+When selecting comprehensive insurance, consider your specific needs and potential risks. Assess your assets, liabilities, and unique circumstances to determine the appropriate coverage levels and endorsements. Work with an insurance professional to tailor your policy accordingly.