Comprehensive Insurance For Car

In today's fast-paced world, ensuring the safety and security of our vehicles is of utmost importance. Car insurance is a vital aspect of responsible vehicle ownership, providing financial protection and peace of mind. However, with numerous insurance options available, it can be challenging to navigate the market and choose the right coverage. This article aims to provide an in-depth analysis of comprehensive insurance for cars, offering valuable insights and practical advice to help you make an informed decision.

Understanding Comprehensive Car Insurance

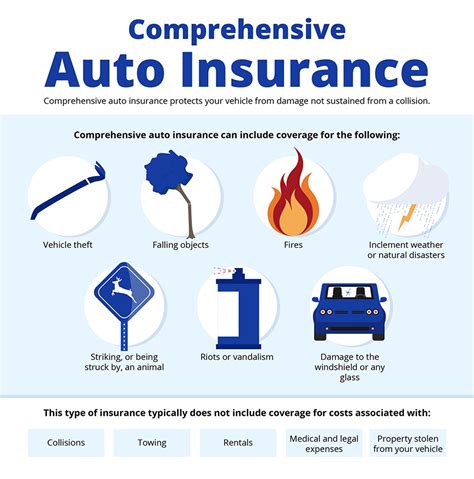

Comprehensive car insurance is an extensive coverage option designed to protect vehicle owners from a wide range of potential risks and damages. Unlike basic liability insurance, which primarily covers injuries and property damage caused by the policyholder to others, comprehensive insurance offers broader protection. It safeguards the insured vehicle from various unforeseen events, including accidents, theft, natural disasters, and even vandalism.

This type of insurance is essential for individuals who want to ensure their vehicle's safety and minimize financial losses in the event of an unfortunate incident. By opting for comprehensive coverage, policyholders can rest assured that their investment is well-protected, and they will receive the necessary financial support to repair or replace their vehicle in the face of unexpected circumstances.

Key Features of Comprehensive Car Insurance

Comprehensive car insurance policies typically include the following key features:

- Collision Coverage: This covers damages to the insured vehicle resulting from collisions with other vehicles or objects, regardless of fault.

- Comprehensive Coverage: As the name suggests, this part of the policy covers damages caused by non-collision incidents, such as fire, theft, vandalism, falling objects, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This provides protection if the at-fault driver in an accident does not have sufficient insurance coverage to compensate for the damages.

- Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault.

- Rental Car Reimbursement: Some policies offer rental car coverage to provide temporary transportation while the insured vehicle is being repaired.

The Benefits of Comprehensive Insurance

Opting for comprehensive car insurance offers several advantages that can significantly impact your financial well-being and peace of mind.

Financial Protection and Peace of Mind

One of the primary benefits of comprehensive insurance is the financial security it provides. In the event of an accident, theft, or natural disaster, comprehensive coverage ensures that you are not left with a hefty bill for repairs or replacements. The insurance company will cover the costs associated with fixing or replacing your vehicle, allowing you to focus on getting back on the road safely without worrying about financial strain.

Moreover, comprehensive insurance offers peace of mind, knowing that your vehicle is protected against a wide range of potential risks. This coverage gives you the confidence to drive, knowing that you are prepared for unforeseen circumstances and that your investment is safeguarded.

Enhanced Coverage Options

Comprehensive insurance policies often come with additional coverage options that can further customize your protection. These optional coverages may include:

- Gap Insurance: This coverage bridges the gap between the actual cash value of your vehicle and the amount you still owe on your loan or lease, ensuring you are not left with a financial burden if your car is totaled.

- Roadside Assistance: Many comprehensive policies offer roadside assistance services, providing help with towing, flat tire changes, fuel delivery, and other emergency situations.

- Custom Parts and Equipment Coverage: If you have customized your vehicle with aftermarket parts or accessories, this coverage ensures that these additions are also protected in the event of an accident or theft.

Factors to Consider When Choosing Comprehensive Insurance

When selecting a comprehensive car insurance policy, several factors should be taken into consideration to ensure you choose the right coverage for your needs.

Assess Your Risk Profile

Every driver has a unique risk profile, and it’s essential to evaluate your specific circumstances when choosing insurance. Consider factors such as your driving history, the age and value of your vehicle, the area where you live, and your daily commute. Understanding your risk profile will help you determine the level of coverage you require and whether comprehensive insurance is the best fit for you.

Compare Quotes and Coverage Options

Insurance companies offer a wide range of policies with varying coverage limits and premiums. It’s crucial to compare quotes from multiple providers to find the best deal. Look beyond the price and assess the coverage limits, deductibles, and additional perks offered by each policy. Ensure that the policy you choose provides adequate coverage for your vehicle’s value and your specific needs.

Understand Policy Exclusions and Limitations

While comprehensive insurance offers extensive coverage, it’s important to be aware of the policy’s exclusions and limitations. Read the fine print to understand what is and isn’t covered. Some common exclusions may include wear and tear, mechanical breakdowns, and damage caused by negligence or reckless driving. Understanding these exclusions will help you make informed decisions and avoid any unpleasant surprises in the future.

Real-Life Examples of Comprehensive Insurance in Action

To illustrate the value of comprehensive car insurance, let’s explore a few real-life scenarios where this coverage proved to be a lifesaver for vehicle owners.

Scenario 1: Natural Disaster Strikes

Imagine you live in an area prone to hurricanes or floods. One day, a severe storm hits your region, causing extensive damage to your vehicle. With comprehensive insurance, you can rest assured that your policy will cover the repairs or even the replacement of your car if it’s deemed a total loss. This coverage provides financial relief during a time of natural disaster, allowing you to focus on rebuilding your life.

Scenario 2: Theft and Vandalism

Unfortunately, vehicle theft and vandalism are all too common. If your car is stolen or damaged by vandals, comprehensive insurance can provide the necessary funds to repair or replace it. This coverage offers peace of mind, knowing that even in the face of criminal activity, your vehicle is protected, and you won’t be left with a financial burden.

Scenario 3: Hit-and-Run Accidents

In a hit-and-run accident, the at-fault driver flees the scene, leaving you with damages and no way to seek compensation. With comprehensive insurance, you can file a claim and receive the necessary repairs for your vehicle. This coverage ensures that you are not left stranded or financially burdened by the actions of a reckless driver.

| Scenario | Coverage | Benefits |

|---|---|---|

| Natural Disaster | Repairs or Replacement | Financial Relief |

| Theft and Vandalism | Repair or Replacement | Peace of Mind |

| Hit-and-Run | Vehicle Repairs | Compensation and Support |

Frequently Asked Questions (FAQ)

Is comprehensive insurance mandatory?

+Comprehensive insurance is not legally required in all states, but it is highly recommended. While it may not be mandatory, it provides essential protection against a wide range of risks and can save you from significant financial losses.

How much does comprehensive insurance cost?

+The cost of comprehensive insurance varies depending on several factors, including your location, the make and model of your vehicle, your driving history, and the coverage limits you choose. It’s best to obtain quotes from multiple insurers to find the most competitive rates.

Can I customize my comprehensive insurance policy?

+Yes, many insurers offer customizable comprehensive insurance policies. You can choose the coverage limits, deductibles, and additional coverages that best suit your needs and budget. This flexibility allows you to create a policy that provides the right level of protection for your vehicle.