Comprehensive Meaning In Insurance

In the realm of insurance, the term "comprehensive" holds a pivotal role, encompassing a broad range of coverage options and serving as a critical element in policy selection. Understanding the comprehensive meaning in insurance is essential for individuals and businesses seeking to safeguard their assets and future. This article delves into the intricacies of comprehensive insurance, exploring its definitions, scope, benefits, and real-world applications.

Unveiling the Comprehensive Insurance Concept

Comprehensive insurance, often referred to as “full coverage,” is a term used in the insurance industry to describe a policy that offers a wide range of protections and benefits. It is designed to provide extensive coverage for various risks and perils, ensuring policyholders are adequately protected against a multitude of potential losses.

The comprehensive nature of these policies is a key differentiator from more basic insurance plans, which typically offer limited coverage for specific risks. By contrast, comprehensive insurance policies aim to cover a broader spectrum of risks, providing policyholders with peace of mind and financial security.

Key Characteristics of Comprehensive Insurance

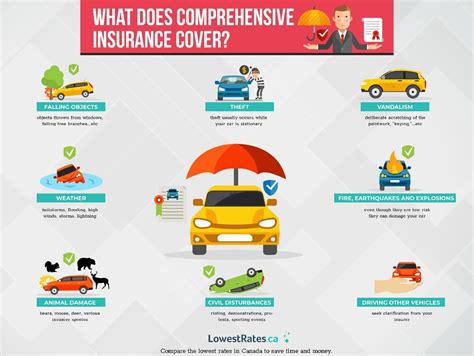

- Broad Coverage: Comprehensive insurance policies typically cover a wide range of perils, including but not limited to natural disasters, theft, vandalism, and accidents.

- Customizable Options: Policyholders can often tailor their comprehensive insurance to meet their specific needs, adding or removing coverage options as required.

- Financial Protection: These policies provide financial security, ensuring policyholders can recover from losses without incurring significant financial strain.

- Peace of Mind: With comprehensive coverage, individuals and businesses can rest assured knowing they are protected against a wide array of potential risks.

Real-World Applications of Comprehensive Insurance

Comprehensive insurance finds application in various sectors, offering tailored protection for different industries and entities.

- Automotive Insurance: Comprehensive car insurance provides coverage for damages resulting from accidents, theft, vandalism, and natural disasters. It offers a vital layer of protection for vehicle owners, ensuring they can repair or replace their vehicles in the event of unforeseen incidents.

- Homeowners’ Insurance: Comprehensive homeowners’ insurance policies cover a wide range of risks, including structural damage, theft, and liability claims. This type of insurance is particularly valuable for homeowners, as it protects their investments and provides financial support during unexpected crises.

- Business Insurance: Comprehensive business insurance packages offer coverage for a variety of risks, such as property damage, business interruption, and liability claims. This type of insurance is essential for businesses of all sizes, helping them mitigate risks and ensure continuity in the face of unforeseen events.

Benefits of Comprehensive Insurance

Opting for comprehensive insurance brings several advantages that can significantly impact individuals and businesses.

- Financial Security: Comprehensive insurance provides a robust financial safety net, ensuring policyholders can recover from losses without facing significant financial burdens.

- Peace of Mind: With comprehensive coverage, individuals and businesses can focus on their daily operations and personal lives without the constant worry of unforeseen risks.

- Tailored Protection: The customizable nature of comprehensive insurance allows policyholders to create a policy that suits their unique needs, ensuring they are protected against the risks most relevant to them.

- Enhanced Reputation: For businesses, comprehensive insurance can enhance their reputation and credibility, demonstrating a commitment to risk management and financial responsibility.

Key Considerations for Choosing Comprehensive Insurance

When selecting a comprehensive insurance policy, it’s essential to consider the following factors to ensure you obtain the right coverage for your needs.

- Risk Assessment: Conduct a thorough assessment of the risks you or your business face. Identify the perils most likely to impact you and prioritize coverage for those risks.

- Policy Comparison: Compare different comprehensive insurance policies offered by various providers. Evaluate the coverage options, deductibles, and premiums to find the best fit for your needs.

- Provider Reputation: Research the reputation and financial stability of insurance providers. Choosing a reputable and financially secure provider ensures you’ll have reliable coverage when you need it most.

- Policy Customization: Opt for a policy that allows for customization. This flexibility ensures you can tailor your coverage to match your evolving needs over time.

The Role of Deductibles in Comprehensive Insurance

Deductibles play a crucial role in comprehensive insurance policies, impacting the cost and coverage provided. Understanding how deductibles work is essential for policyholders to make informed decisions.

- Definition of Deductibles: Deductibles are the amount policyholders must pay out-of-pocket before their insurance coverage kicks in. They are a key component of insurance policies and can significantly impact the overall cost of coverage.

- Impact on Premiums: Higher deductibles generally result in lower premiums, as policyholders assume more financial responsibility. Conversely, lower deductibles lead to higher premiums, as the insurance provider bears more of the financial risk.

- Choosing the Right Deductible: The choice of deductible depends on individual financial considerations and risk tolerance. Higher deductibles may be more suitable for those with robust financial resources, while lower deductibles offer more immediate financial protection for those with limited means.

| Deductible Amount | Premium Impact |

|---|---|

| $500 | Higher Premium |

| $1,000 | Moderate Premium |

| $2,500 | Lower Premium |

Case Studies: Comprehensive Insurance in Action

To illustrate the impact of comprehensive insurance, let’s explore two real-world case studies.

Case Study 1: Automotive Insurance

Mr. Johnson, a car owner, opted for comprehensive car insurance with a 1,000 deductible. During a severe storm, his car was damaged by a fallen tree. The repairs cost 3,500. With his comprehensive coverage, Mr. Johnson only had to pay the 1,000 deductible, and the insurance provider covered the remaining 2,500.

Case Study 2: Homeowners’ Insurance

The Smith family, homeowners in a flood-prone area, purchased comprehensive homeowners’ insurance with a 2,000 deductible. Unfortunately, their home was damaged during a flash flood. The repairs and replacement of damaged items totaled 50,000. With their comprehensive coverage, the Smiths paid the 2,000 deductible, and the insurance provider covered the remaining 48,000.

Future Implications and Innovations in Comprehensive Insurance

The insurance industry is continually evolving, and comprehensive insurance is no exception. As technology advances and risk landscapes shift, we can expect several key developments and innovations in comprehensive insurance.

- Technology Integration: Insurers are increasingly leveraging technology to enhance their comprehensive insurance offerings. This includes the use of AI and machine learning for more accurate risk assessment and claims processing, as well as the integration of IoT devices for real-time monitoring and prevention.

- Personalized Coverage: With the availability of vast data and advanced analytics, insurers are moving towards more personalized coverage options. This allows policyholders to select coverage based on their unique circumstances and needs, ensuring they receive the most suitable protection.

- Sustainability Focus: As environmental concerns become more prominent, insurers are exploring ways to integrate sustainability into their comprehensive insurance packages. This may involve offering incentives for policyholders who adopt sustainable practices or providing coverage for eco-friendly initiatives.

- Global Reach: Comprehensive insurance is becoming more accessible on a global scale. Insurers are expanding their coverage to include international risks, providing protection for individuals and businesses with global operations or travel plans.

Conclusion: The Value of Comprehensive Insurance

In conclusion, comprehensive insurance serves as a vital tool for individuals and businesses to protect their assets and ensure financial stability in the face of unforeseen risks. By offering broad coverage, customizable options, and financial security, comprehensive insurance provides a robust safety net for policyholders.

As we've explored, the benefits of comprehensive insurance extend beyond mere financial protection. It provides peace of mind, enhances reputation, and allows for tailored protection. Whether it's safeguarding your vehicle, home, or business, comprehensive insurance is an essential component of a comprehensive risk management strategy.

As the insurance industry continues to evolve, comprehensive insurance will play an even more critical role in mitigating risks and supporting the financial well-being of individuals and businesses worldwide.

What is the difference between comprehensive insurance and basic insurance policies?

+Comprehensive insurance policies offer a wide range of coverage options, protecting policyholders against a broad spectrum of risks. In contrast, basic insurance policies typically provide coverage for specific, predefined risks, offering more limited protection.

How can I choose the right deductible for my comprehensive insurance policy?

+When selecting a deductible, consider your financial capacity and risk tolerance. Higher deductibles can result in lower premiums, but they also mean you’ll pay more out-of-pocket if a claim is made. Assess your ability to cover potential losses and choose a deductible that aligns with your financial situation.

Are there any disadvantages to comprehensive insurance?

+While comprehensive insurance offers extensive coverage, it can be more expensive than basic insurance policies. Additionally, the broader the coverage, the more complex the policy may be, requiring careful review and understanding to ensure you’re adequately protected.