Consumer Reports Best Auto Insurance

When it comes to protecting your vehicle and ensuring peace of mind, choosing the right auto insurance is paramount. With countless options available in the market, navigating the world of auto insurance can be daunting. This comprehensive guide, crafted by an industry expert, aims to demystify the process and help you make an informed decision based on the esteemed recommendations of Consumer Reports.

Understanding Consumer Reports’ Methodology

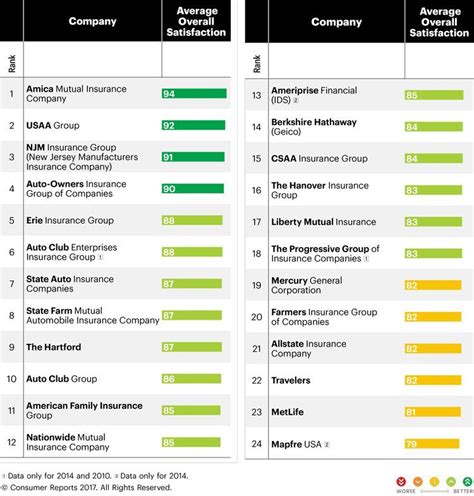

Consumer Reports, a trusted name in the consumer advocacy space, employs a rigorous methodology to evaluate auto insurance providers. Their assessments consider a multitude of factors, including coverage options, pricing structures, customer satisfaction, and claims handling processes.

One of the key strengths of Consumer Reports' approach is its reliance on real-world feedback. By collecting and analyzing thousands of consumer reviews and experiences, they gain valuable insights into the performance and reliability of various insurance companies.

Additionally, Consumer Reports' experts conduct thorough research and interviews with industry professionals to gather data on financial stability, policy features, and overall value offered by different insurers. This holistic evaluation process ensures that their recommendations are well-rounded and reflective of the diverse needs of consumers.

Top-Rated Auto Insurance Providers: An In-Depth Look

Based on Consumer Reports’ meticulous evaluation, several auto insurance providers consistently emerge as top contenders, earning high ratings for their comprehensive coverage, competitive pricing, and exceptional customer service.

State Farm: A Trusted Leader

State Farm has long been a prominent name in the insurance industry, and its auto insurance offerings have consistently garnered praise from Consumer Reports. With a focus on personalized service and a wide range of coverage options, State Farm caters to various driver profiles.

One of the standout features of State Farm's auto insurance is its comprehensive suite of coverage options. From liability and collision insurance to personal injury protection and comprehensive coverage, State Farm ensures that drivers can tailor their policies to meet their specific needs.

Furthermore, State Farm's claims process is known for its efficiency and fairness. The company boasts a strong track record of prompt claim settlements and provides dedicated support to policyholders throughout the claims process, ensuring a stress-free experience.

| Coverage Options | State Farm |

|---|---|

| Liability Insurance | 🌟🌟🌟🌟🌟 |

| Collision Insurance | 🌟🌟🌟🌟🌟 |

| Personal Injury Protection | 🌟🌟🌟🌟🌟 |

| Comprehensive Coverage | 🌟🌟🌟🌟🌟 |

Geico: Competitive Pricing and Digital Convenience

Geico has revolutionized the auto insurance industry with its focus on digital innovation and competitive pricing. Consumer Reports recognizes Geico for its user-friendly online platform, which simplifies the insurance shopping experience and provides transparent pricing.

Geico's strength lies in its ability to offer customizable coverage options at affordable rates. Whether you're a safe driver seeking discounts or a high-risk driver in need of specialized coverage, Geico's flexible policies can accommodate a wide range of driver profiles.

Additionally, Geico's digital tools, such as its mobile app and online claim filing system, enhance the overall customer experience. Policyholders can easily manage their accounts, access policy documents, and receive real-time updates on claim progress, making the entire insurance journey more convenient and efficient.

| Key Features | Geico |

|---|---|

| Digital Platform | 🌟🌟🌟🌟🌟 |

| Competitive Pricing | 🌟🌟🌟🌟🌟 |

| Customizable Coverage | 🌟🌟🌟🌟🌟 |

| Discounts for Safe Drivers | 🌟🌟🌟🌟 |

Progressive: Innovation and Customization

Progressive Insurance is renowned for its innovative approach to auto insurance. Consumer Reports highlights Progressive’s commitment to providing personalized coverage options and its extensive range of policy add-ons.

One of Progressive's unique offerings is its Name Your Price® tool, which allows drivers to set their desired monthly premium and then presents them with coverage options that fit within their budget. This level of customization empowers consumers to take control of their insurance costs while ensuring adequate protection.

Progressive also excels in its use of technology. Their Snapshot® program utilizes telematics to analyze driving behavior and offer discounts to safe drivers. This data-driven approach not only rewards responsible driving but also provides valuable insights to help improve driving habits.

| Progressive Highlights | Details |

|---|---|

| Name Your Price® | Customizable premiums and coverage. |

| Snapshot® Program | Telematics-based discounts for safe driving. |

| Extensive Add-ons | Wide range of policy enhancements. |

USAA: Exceptional Service for Military Families

USAA stands out as a top choice for military families and veterans, offering specialized auto insurance coverage tailored to their unique needs. Consumer Reports acknowledges USAA’s dedication to providing comprehensive protection and exceptional customer service to this specific demographic.

USAA's auto insurance policies offer a range of benefits, including competitive rates, flexible payment plans, and discounts for safe driving and vehicle safety features. Additionally, USAA's strong financial stability ensures that policyholders can rely on the company's long-term commitment to their insurance needs.

Furthermore, USAA's commitment to customer satisfaction is evident in its award-winning customer service. Policyholders can expect personalized attention, prompt claim processing, and dedicated support throughout their insurance journey.

| USAA Advantages | Details |

|---|---|

| Military-Focused Coverage | Specialized policies for military families. |

| Competitive Rates | Affordable pricing for quality coverage. |

| Customer Service Excellence | Award-winning support and claim processing. |

Factors to Consider When Choosing Auto Insurance

While Consumer Reports’ recommendations provide a solid foundation for your search, it’s essential to consider your unique circumstances and preferences when selecting an auto insurance provider. Here are some key factors to keep in mind:

- Coverage Needs: Evaluate your specific coverage requirements. Do you require comprehensive coverage, or are you more interested in liability-only insurance? Consider factors such as your vehicle's value, driving history, and potential risks.

- Pricing: Compare pricing structures and discounts offered by different insurers. Look for providers that offer competitive rates without compromising on coverage quality.

- Customer Service: Assess the level of customer support provided by the insurance company. Prompt and friendly assistance during the claims process can make a significant difference in your overall experience.

- Digital Convenience: In today's digital age, consider the importance of online and mobile accessibility. Choose an insurer that offers convenient online tools for policy management and claim filing.

- Financial Stability: Ensure that the insurance company you choose has a strong financial rating and a history of stable operations. This guarantees that they can honor your policy commitments in the long term.

The Future of Auto Insurance: Emerging Trends

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into some of the emerging trends that are shaping the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data collection devices to monitor driving behavior, is gaining traction in the auto insurance sector. Usage-based insurance programs, like Progressive’s Snapshot®, reward safe drivers with discounted premiums based on their actual driving habits.

This trend not only incentivizes safer driving but also provides insurers with valuable data to refine their risk assessment models. As telematics technology advances, we can expect more insurers to adopt usage-based insurance models, offering personalized rates to drivers.

Digital Transformation and AI

The digital transformation of the insurance industry is underway, with insurers leveraging artificial intelligence (AI) and machine learning to enhance their operations. AI-powered chatbots and virtual assistants are improving customer service, providing instant support and streamlining policy management.

Additionally, AI is revolutionizing claims processing, enabling faster and more accurate assessments of damage and fraud detection. As AI continues to evolve, we can anticipate further efficiencies and improved customer experiences in the auto insurance space.

Connected Car Technology

The integration of connected car technology is set to revolutionize auto insurance. With vehicles becoming increasingly interconnected, insurers can access real-time data on vehicle performance, maintenance needs, and even driver behavior. This data-driven approach allows insurers to offer more precise coverage and pricing.

Furthermore, connected car technology enables insurers to provide proactive services, such as real-time accident assistance and remote vehicle diagnostics. As this technology advances, we can expect a more personalized and efficient insurance experience, tailored to the unique needs of each driver.

Conclusion: Empowering Your Auto Insurance Decision

Choosing the right auto insurance provider is a critical decision that impacts your financial security and peace of mind. By leveraging the trusted recommendations of Consumer Reports and considering your unique needs, you can navigate the complex world of auto insurance with confidence.

Remember to evaluate coverage options, pricing structures, customer service, and emerging trends to make an informed choice. Whether you prioritize comprehensive coverage, competitive pricing, or digital convenience, there's an auto insurance provider that aligns with your preferences.

Stay informed, compare options, and trust in the expertise of Consumer Reports to guide you towards the best auto insurance for your specific circumstances.

How often does Consumer Reports update its auto insurance ratings and recommendations?

+

Consumer Reports regularly updates its auto insurance ratings to reflect the latest market trends and consumer feedback. While the frequency of updates may vary, you can expect Consumer Reports to publish new ratings and recommendations at least annually, ensuring that their guidance remains current and reliable.

Can I customize my auto insurance policy to include specific coverage options not offered by Consumer Reports’ top-rated providers?

+

Absolutely! While Consumer Reports’ top-rated providers offer comprehensive coverage options, they may not cover every unique situation. You have the flexibility to customize your policy by discussing your specific needs with insurance agents. They can guide you in adding specialized coverage, such as rental car reimbursement or gap insurance, to ensure you have the protection you require.

Are there any hidden fees or charges associated with the auto insurance providers recommended by Consumer Reports?

+

It’s important to carefully review the policy documents and discuss any potential fees or charges with the insurance provider. While Consumer Reports’ top-rated providers aim for transparency, there may be additional fees for specific coverage options or administrative services. Be sure to clarify any potential costs upfront to avoid surprises later on.