Consumer Reports Best Medicare Supplemental Insurance

In the ever-evolving landscape of healthcare, understanding your insurance options is crucial. For those navigating the U.S. healthcare system, Medicare Supplemental Insurance, often referred to as Medigap, plays a pivotal role in filling the gaps left by original Medicare.

Consumer Reports, a trusted name in consumer advocacy, has undertaken extensive research to identify the best Medicare Supplemental Insurance plans. This article delves into the findings, offering an in-depth analysis to guide you toward informed decisions regarding your healthcare coverage.

Understanding Medicare Supplemental Insurance

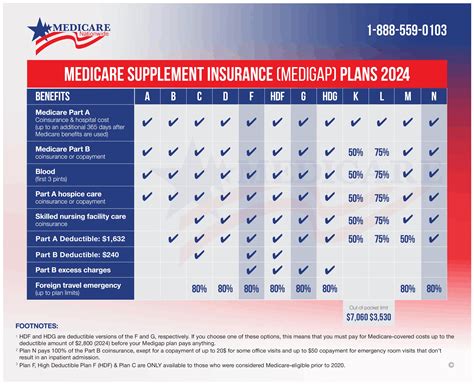

Medicare Supplemental Insurance, or Medigap, is designed to cover the costs that original Medicare (Parts A and B) doesn’t, including copayments, coinsurance, and deductibles. It’s an essential tool for individuals seeking comprehensive healthcare coverage.

Consumer Reports emphasizes the importance of Medigap for those who want to minimize out-of-pocket expenses and have more flexibility in choosing healthcare providers. With a variety of plans available, each offering different levels of coverage, it's crucial to select one that aligns with your specific needs.

Consumer Reports’ Methodology

Consumer Reports employs a rigorous methodology to evaluate Medicare Supplemental Insurance plans. Their research team assesses a range of factors, including:

- Coverage: Plans are scrutinized for the breadth of their coverage, ensuring they address a comprehensive range of healthcare needs.

- Premiums: Cost is a critical factor. Consumer Reports analyzes premium costs to help consumers find plans that offer the best value.

- Financial Stability: The financial health of insurance providers is assessed to ensure their long-term viability and ability to meet policyholders' needs.

- Customer Service: A key aspect of any insurance plan is the level of service provided. Consumer Reports evaluates the responsiveness and quality of customer support.

- Plan Availability: Not all plans are available in every state. Consumer Reports takes into account the geographical reach of each plan.

By considering these factors, Consumer Reports provides an unbiased, data-driven analysis to assist consumers in making informed choices.

The Top-Rated Medicare Supplemental Insurance Plans

Based on their comprehensive evaluation, Consumer Reports has identified the following plans as the best Medicare Supplemental Insurance options:

Plan F

Plan F is a comprehensive Medigap plan that offers the widest coverage. It covers all the gaps in original Medicare, including Part A and Part B deductibles, coinsurance, and copayments. This plan is ideal for those seeking maximum protection against healthcare costs.

| Coverage | Premium |

|---|---|

| Part A Deductible | $1,556 (average) |

| Part B Deductible | Included |

| Part A Coinsurance | Included |

| Part B Coinsurance | Included |

| Blood Deductible | Included |

| Excess Charges | Included |

Plan G

Plan G is another top-rated Medigap plan that offers nearly the same coverage as Plan F. The only difference is that Plan G does not cover the Part B deductible. However, this plan is often more affordable and provides excellent value for those who want comprehensive coverage.

| Coverage | Premium |

|---|---|

| Part A Deductible | $1,556 (average) |

| Part B Deductible | Not Covered |

| Part A Coinsurance | Included |

| Part B Coinsurance | Included |

| Blood Deductible | Included |

| Excess Charges | Included |

Plan N

Plan N is a cost-effective option that provides good coverage at a lower premium. It covers many of the gaps in original Medicare but does not cover all Part B coinsurance or the Part B deductible. It’s a suitable choice for those who want a balance between coverage and cost.

| Coverage | Premium |

|---|---|

| Part A Deductible | $1,556 (average) |

| Part B Deductible | Not Covered |

| Part A Coinsurance | Included |

| Part B Coinsurance | Not Covered (up to $20 copay for office visits and up to $50 copay for emergency room visits) |

| Blood Deductible | Included (first 3 pints) |

| Excess Charges | Included |

Factors to Consider When Choosing a Plan

While Consumer Reports’ top-rated plans offer excellent coverage, it’s important to consider your individual needs and circumstances. Here are some factors to keep in mind:

- Premium Cost: Premiums can vary significantly between plans and providers. Consider your budget and choose a plan that offers the best coverage within your means.

- Health Status: If you have ongoing health issues or require frequent medical care, a plan with more comprehensive coverage might be beneficial. Conversely, if you're generally healthy, a plan with lower premiums could be a suitable choice.

- Provider Network: Some Medigap plans have networks, while others allow you to choose any doctor or hospital that accepts Medicare. Consider your preferences and choose a plan that aligns with your healthcare needs.

- Plan Availability: Not all plans are available in every state. Check the availability of your preferred plan in your area before making a decision.

The Role of Medicare Advantage Plans

Medicare Advantage Plans, also known as Part C, are an alternative to original Medicare and Medigap. These plans are offered by private insurance companies and often include additional benefits, such as prescription drug coverage and vision or dental care. Consumer Reports also evaluates Medicare Advantage Plans, providing insights into their advantages and potential drawbacks.

Making an Informed Decision

Navigating the world of Medicare Supplemental Insurance can be complex, but with Consumer Reports’ comprehensive analysis, you’re equipped with the knowledge to make a confident choice. Remember, your healthcare coverage is a crucial aspect of your financial and personal well-being. Take the time to understand your options and select a plan that best meets your needs.

Can I switch Medigap plans at any time?

+You can switch Medigap plans during certain times, including your Initial Enrollment Period, when you move to a new plan’s service area, or if you have certain changes in your Medicare coverage.

What if I have a pre-existing condition?

+Medigap plans cannot deny coverage or charge more due to health problems. However, you may have to wait up to 6 months for coverage of your pre-existing condition to begin.

Are there any age restrictions for Medigap plans?

+Medigap plans cannot deny you coverage or charge more based on your health or age. However, premiums can vary based on your age when you first buy the plan.