Cost Comparison Of Auto Insurance Policies

Welcome to this comprehensive guide on the cost comparison of auto insurance policies. Navigating the world of automotive insurance can be a complex task, especially when considering the wide range of coverage options and the varying costs associated with them. In this article, we delve into the factors that influence insurance premiums, provide real-world examples, and offer insights to help you make informed decisions when choosing an auto insurance policy.

Understanding the Cost Factors in Auto Insurance

The price of an auto insurance policy is influenced by a multitude of factors, each playing a crucial role in determining the overall cost. These factors can be broadly categorized into personal, vehicle-related, and environmental aspects. Let’s explore each of these categories in detail to understand their impact on insurance premiums.

Personal Factors

Your personal characteristics and driving history are significant determinants of your insurance premium. Insurance providers assess these factors to gauge the level of risk associated with insuring you. Here are some key personal factors that can affect your insurance costs:

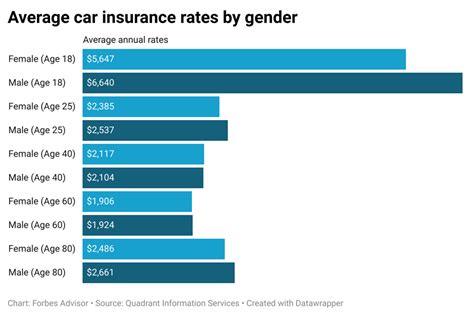

- Age: Younger drivers, especially those under 25, often face higher insurance premiums due to their lack of driving experience and the associated higher risk. As you age and gain more experience, premiums tend to decrease.

- Driving Record: A clean driving record with no accidents or traffic violations is favorable and can lead to lower insurance costs. On the other hand, a history of accidents or violations may result in higher premiums or even insurance cancellations.

- Credit Score: Believe it or not, your credit score can impact your insurance premium. Many insurance companies use credit-based insurance scores to assess risk, so maintaining a good credit score can potentially reduce your insurance costs.

- Marital Status: Being married can sometimes lead to lower insurance premiums, as married individuals are often considered lower-risk drivers.

Vehicle-Related Factors

The type of vehicle you drive and its specifications can significantly influence your insurance premium. Here’s how:

- Vehicle Type: Insurance costs vary depending on the make, model, and year of your vehicle. Sports cars and luxury vehicles, for instance, often come with higher insurance premiums due to their higher repair costs and theft risks.

- Vehicle Age: Older vehicles generally have lower insurance premiums as they are typically less expensive to repair or replace. However, classic or vintage cars may require specialized coverage, which can increase costs.

- Safety Features : Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for insurance discounts, as these features reduce the risk of accidents and injuries.

- Usage: How you use your vehicle also matters. If you primarily use your car for commuting, you’ll likely pay more than someone who uses their vehicle only occasionally. Commercial vehicle usage may also result in higher premiums.

Environmental Factors

The area where you live and drive your vehicle can impact your insurance costs. These environmental factors include:

- Location: Insurance rates can vary significantly based on your geographic location. Urban areas with higher populations and traffic congestion often have higher insurance premiums due to increased accident risks.

- Weather Conditions: Regions prone to severe weather events like hurricanes, tornadoes, or heavy snowfall may have higher insurance costs, as these conditions can lead to more frequent accidents and vehicle damage.

- Crime Rates: Areas with higher crime rates may experience increased vehicle theft and vandalism, which can result in higher insurance premiums to cover these risks.

Comparing Auto Insurance Policies: A Real-World Example

To better understand how these factors influence insurance costs, let’s consider a hypothetical scenario. Meet John, a 30-year-old professional living in a suburban area. John is considering purchasing a new vehicle and wants to compare insurance policies to find the best deal.

John’s Vehicle and Coverage Options

John has narrowed down his vehicle choices to two popular models: a mid-size sedan and a compact SUV. Both vehicles offer similar features and fall within his budget. Now, let’s explore the insurance costs associated with each vehicle.

Mid-Size Sedan

The mid-size sedan is a popular choice among commuters due to its fuel efficiency and affordability. Here’s a breakdown of John’s insurance costs for this vehicle:

| Coverage Type | Premium |

|---|---|

| Liability Coverage | 450 per year</td> </tr> <tr> <td>Collision Coverage</td> <td>600 per year |

| Comprehensive Coverage | 350 per year</td> </tr> <tr> <td>Uninsured Motorist Coverage</td> <td>150 per year |

| Total Annual Premium | $1,550 |

John's mid-size sedan is equipped with advanced safety features, which may qualify him for a safety discount, further reducing his insurance costs.

Compact SUV

The compact SUV offers a blend of versatility and practicality, making it a popular choice for families and outdoor enthusiasts. Here’s an overview of John’s insurance costs for this vehicle:

| Coverage Type | Premium |

|---|---|

| Liability Coverage | 500 per year</td> </tr> <tr> <td>Collision Coverage</td> <td>750 per year |

| Comprehensive Coverage | 400 per year</td> </tr> <tr> <td>Uninsured Motorist Coverage</td> <td>200 per year |

| Total Annual Premium | $1,850 |

Despite the compact SUV's versatility, its higher insurance costs can be attributed to factors such as its increased weight, which may result in higher repair costs, and its slightly higher theft risk compared to the mid-size sedan.

The Impact of Personal Factors

John’s age and clean driving record play a significant role in his insurance premiums. As a 30-year-old with a spotless driving record, he is considered a low-risk driver, which helps keep his insurance costs manageable.

Environmental Considerations

John’s suburban location also influences his insurance costs. Suburban areas often have lower insurance premiums compared to urban centers due to reduced congestion and accident risks. Additionally, the weather conditions in his area are relatively mild, which further lowers his insurance costs.

Tips for Getting the Best Auto Insurance Deal

Now that we’ve explored the factors influencing insurance costs and compared policies, here are some practical tips to help you secure the best auto insurance deal:

Shop Around

Don’t settle for the first insurance quote you receive. Compare quotes from multiple providers to find the best rates. Online comparison tools can be a great starting point, but be sure to also reach out to local insurance agents for personalized advice.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle multiple policies, potentially saving you a significant amount.

Maintain a Good Driving Record

A clean driving record is essential for keeping your insurance costs down. Avoid traffic violations and accidents, as these can lead to higher premiums or even policy cancellations.

Choose the Right Coverage

Assess your needs and choose the coverage that suits your requirements. While comprehensive coverage may be necessary for certain vehicles, others might only require liability coverage. Overinsuring your vehicle can lead to unnecessary expenses, so tailor your coverage to your needs.

Consider Usage-Based Insurance

Usage-based insurance programs, also known as pay-as-you-drive or telematics insurance, can offer significant savings for low-mileage drivers. These programs use tracking devices or smartphone apps to monitor your driving habits, rewarding safe and low-mileage driving with lower premiums.

Explore Discounts

Insurance providers offer a variety of discounts, including those for safe driving, good student status, senior citizens, military personnel, and vehicle safety features. Ask your insurance agent about the discounts you may be eligible for and ensure you’re taking advantage of all available savings.

Review Your Policy Regularly

Insurance needs can change over time. Review your policy annually to ensure it still meets your requirements and to take advantage of any new discounts or coverage options that may be available.

The Future of Auto Insurance: Trends and Innovations

The auto insurance industry is continuously evolving, with new technologies and trends shaping the way policies are priced and offered. Here’s a glimpse into the future of auto insurance:

Telematics and Usage-Based Insurance

Usage-based insurance, as mentioned earlier, is gaining popularity. With the advancement of telematics and connected car technologies, insurance providers can gather more precise data on driving behavior, allowing them to offer highly tailored insurance policies.

Artificial Intelligence and Data Analytics

AI and data analytics are transforming the way insurance companies assess risk and price policies. These technologies enable insurers to analyze vast amounts of data, including driving behavior, weather patterns, and traffic conditions, to develop more accurate risk models and offer personalized insurance products.

Autonomous Vehicles and Their Impact

The rise of autonomous vehicles is expected to revolutionize the auto insurance industry. As self-driving cars become more prevalent, insurance premiums may decrease due to the reduced risk of human error-related accidents. However, new challenges and risks associated with autonomous vehicles may also arise, requiring insurers to adapt their policies and coverage.

Pay-Per-Mile Insurance

Pay-per-mile insurance, a variation of usage-based insurance, is gaining traction. This model charges customers based on the actual miles driven, providing an incentive for drivers to reduce their mileage and, consequently, their insurance costs. This approach is particularly beneficial for low-mileage drivers who may otherwise pay higher premiums.

Conclusion: Empowering Your Auto Insurance Decisions

Understanding the factors that influence auto insurance costs is crucial for making informed decisions. By considering personal, vehicle-related, and environmental factors, you can compare policies effectively and choose the coverage that best suits your needs and budget. Remember, auto insurance is a vital aspect of vehicle ownership, offering protection and peace of mind in the event of accidents or other mishaps.

Stay informed about the latest trends and innovations in the auto insurance industry, as they can provide opportunities for savings and more personalized coverage. With the right knowledge and strategies, you can navigate the complex world of auto insurance with confidence, ensuring you're adequately protected at a price that fits your budget.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies significantly depending on factors such as location, driving record, and vehicle type. According to recent data, the national average annual premium for auto insurance is around 1,674, but it can range from 500 to over $3,000 depending on individual circumstances.

How can I lower my auto insurance premiums?

+There are several strategies to reduce your auto insurance premiums. These include maintaining a clean driving record, choosing a vehicle with good safety ratings, exploring usage-based insurance programs, bundling policies, and taking advantage of discounts offered by insurers. Regularly reviewing and comparing insurance quotes can also help you identify more affordable options.

What is comprehensive coverage, and is it necessary?

+Comprehensive coverage is an optional insurance coverage that protects against damage caused by events other than collisions, such as theft, vandalism, fire, and natural disasters. While it’s not legally required in most states, comprehensive coverage is highly recommended to protect your vehicle from unexpected damages. It provides peace of mind and can be particularly valuable for newer or more expensive vehicles.