Cost Dental Insurance

Dental insurance is an essential component of overall healthcare coverage, offering individuals and families peace of mind and financial protection when it comes to maintaining optimal oral health. With rising healthcare costs, understanding the costs associated with dental insurance is crucial for making informed decisions about your healthcare plan. In this comprehensive article, we will delve into the world of dental insurance costs, exploring various factors that influence premiums, coverage options, and strategies to maximize your dental health benefits.

Understanding Dental Insurance Costs

Dental insurance costs, often referred to as premiums, can vary significantly based on several key factors. These factors include the type of plan, coverage options, provider networks, and the geographic location of the insured individual. Additionally, personal factors such as age, tobacco use, and pre-existing dental conditions can also impact the cost of dental insurance.

Types of Dental Insurance Plans

There are several types of dental insurance plans available, each with its own cost structure and coverage benefits. The most common types include:

- Indemnity Plans: Also known as fee-for-service plans, indemnity plans allow you to choose any dentist and receive reimbursement for covered services. These plans often have higher premiums but provide more flexibility in choosing dental providers.

- Preferred Provider Organization (PPO) Plans: PPO plans offer a network of preferred dentists, providing discounted rates for in-network services. You have the freedom to choose both in-network and out-of-network providers, but costs may be higher for out-of-network care.

- Health Maintenance Organization (HMO) Plans: HMO plans typically require you to choose a primary dentist within their network and may require referrals for specialist care. While premiums are often lower, you have limited flexibility in choosing providers.

- Dental Health Maintenance Organization (DHMO) Plans: DHMO plans are similar to HMO plans but are specifically designed for dental care. You must choose a primary dentist within the network, and specialist care may require a referral.

- Discount Dental Plans: Discount dental plans are not traditional insurance but offer savings on dental services. Members pay an annual fee and receive discounted rates on various dental procedures with participating dentists.

Factors Influencing Dental Insurance Costs

Several key factors contribute to the cost of dental insurance premiums. Understanding these factors can help you make more informed choices when selecting a plan that suits your needs and budget.

| Factor | Impact on Cost |

|---|---|

| Type of Plan | Different plan types have varying cost structures. Indemnity plans tend to have higher premiums, while HMO and DHMO plans offer more affordable options. |

| Coverage Options | The breadth of coverage, including preventive, basic, and major procedures, affects the premium. Plans with comprehensive coverage may have higher costs. |

| Provider Networks | Plans with larger, more extensive provider networks may have slightly higher premiums to cover the cost of negotiating discounted rates. |

| Geographic Location | Dental insurance costs can vary based on the cost of living and the availability of dental care providers in your area. |

| Age and Tobacco Use | Older individuals and those who use tobacco products may face higher premiums due to increased dental risks and costs associated with smoking-related oral health issues. |

| Pre-existing Dental Conditions | Individuals with pre-existing dental conditions may need to consider plans with specific coverage for their unique needs, which could result in higher premiums. |

Maximizing Your Dental Insurance Benefits

To get the most value from your dental insurance plan, it’s essential to understand your coverage and make informed decisions about your oral health care. Here are some strategies to maximize your benefits:

- Review Your Plan's Coverage: Carefully read your plan's summary of benefits to understand what procedures are covered, any waiting periods, and any limitations or exclusions.

- Choose an In-Network Dentist: If you have a PPO or HMO plan, selecting an in-network dentist can save you money on out-of-pocket expenses.

- Utilize Preventive Care: Take advantage of preventive services like dental cleanings, check-ups, and X-rays, which are typically covered at 100% and help prevent more costly procedures down the line.

- Understand Your Annual Maximum: Know the maximum amount your plan will cover in a year. If you anticipate significant dental work, consider timing your treatments to maximize your benefits.

- Consider Additional Coverage: Some plans offer optional add-ons or riders for specific procedures, such as orthodontics or cosmetic dentistry. Evaluate your needs and consider these options if necessary.

- Review Your Plan Annually: Dental insurance plans and costs can change annually. Review your options during open enrollment to ensure your plan still meets your needs and provides the best value.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a crucial role in promoting and maintaining good oral health. By providing financial coverage for dental procedures, insurance plans encourage individuals to seek regular dental care, which is essential for preventing and managing oral health issues. Here’s how dental insurance positively impacts oral health:

Preventive Care and Early Detection

Dental insurance plans often cover preventive services like dental cleanings, examinations, and X-rays at little to no cost to the insured. These preventive measures are vital for early detection of oral health problems, allowing for prompt treatment and potentially preventing more complex and costly issues down the line. Regular dental check-ups can identify cavities, gum disease, and other oral health concerns in their early stages, when they are easier and less expensive to treat.

Encouraging Regular Dental Visits

With dental insurance, individuals are more likely to prioritize regular dental visits, as they know that a significant portion of the cost will be covered by their insurance plan. This consistency in dental care is crucial for maintaining optimal oral health. Dentists can monitor the progression of any existing conditions and provide personalized advice and treatment plans to improve and maintain oral hygiene.

Financial Protection for Major Procedures

Dental insurance provides financial protection for more extensive and costly procedures, such as root canals, dental implants, or oral surgeries. Without insurance coverage, these procedures could be unaffordable for many individuals, leading to delayed or avoided treatment. Dental insurance helps ensure that necessary dental work can be accessed without putting a significant financial burden on the patient.

Improving Overall Health

Oral health is closely linked to overall health and well-being. Poor oral health has been associated with various systemic health conditions, including cardiovascular disease, diabetes, and respiratory infections. By promoting good oral hygiene and providing coverage for dental care, dental insurance plays a vital role in preventing and managing these health issues. Regular dental check-ups and timely treatment of oral health problems can have a positive impact on an individual’s overall health and quality of life.

Future Trends in Dental Insurance

The dental insurance landscape is continually evolving, with new trends and innovations shaping the industry. Here are some future trends to watch out for:

Digital Transformation

The digital revolution is making its mark on the dental insurance industry. Expect to see more digital tools and platforms that streamline the insurance process, from online enrollment and claims submission to digital dental records and telemedicine for oral health consultations. These digital advancements will enhance efficiency, convenience, and accessibility for both patients and providers.

Focus on Preventive Care

There is a growing recognition of the importance of preventive care in oral health. Dental insurance plans are likely to continue emphasizing and expanding coverage for preventive services, such as dental sealants, fluoride treatments, and oral cancer screenings. By investing in preventive care, insurance providers can help reduce the incidence of more complex and costly dental issues, ultimately benefiting both patients and insurers.

Integration with Overall Health Insurance

As the understanding of the link between oral health and overall health deepens, there may be a trend towards integrating dental insurance with overall health insurance plans. This integration could lead to more comprehensive coverage for dental procedures, especially those related to systemic health conditions. It could also result in improved coordination of care between dental and medical providers, ensuring a holistic approach to patient health.

Value-Based Care Models

Value-based care models, which focus on delivering high-quality care while controlling costs, are gaining traction in the healthcare industry. In the context of dental insurance, value-based care could mean incentivizing providers to deliver efficient, effective care, and rewarding patients for maintaining good oral health through preventive measures and healthy lifestyle choices. This approach aims to improve patient outcomes while reducing unnecessary costs.

How much does dental insurance cost on average?

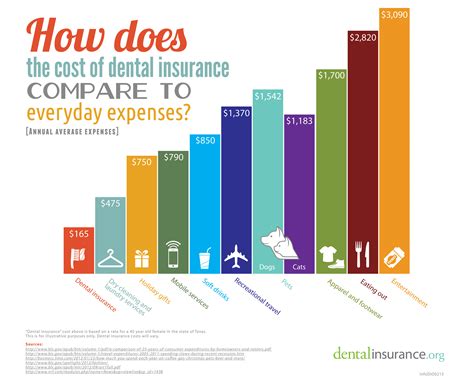

+The average cost of dental insurance can vary significantly based on factors like plan type, coverage, and location. As of 2023, the average annual premium for individual dental insurance plans ranges from 300 to 600, while family plans can cost upwards of $1,000 per year. It’s important to note that these averages can fluctuate, and actual costs may be higher or lower depending on your specific circumstances.

Are there any ways to reduce the cost of dental insurance?

+Yes, there are several strategies to potentially reduce the cost of dental insurance. One option is to choose a plan with a higher deductible or co-insurance, which can lower your monthly premiums. Additionally, some employers offer dental insurance as a voluntary benefit, which may be more affordable than individual plans. Finally, consider discount dental plans, which offer savings on dental services without the typical insurance structure.

What factors determine the cost of dental insurance premiums?

+The cost of dental insurance premiums is influenced by several factors, including the type of plan (e.g., indemnity, PPO, HMO), coverage options, provider networks, geographic location, age, tobacco use, and pre-existing dental conditions. Each of these factors can impact the premium, so it’s essential to consider your unique needs and circumstances when selecting a plan.

How does dental insurance impact oral health?

+Dental insurance plays a crucial role in promoting and maintaining good oral health. It encourages regular dental visits, provides financial coverage for necessary procedures, and allows for early detection and treatment of oral health issues. By facilitating access to dental care, insurance plans help individuals maintain their oral health, which, in turn, positively impacts their overall well-being.

What are some future trends in dental insurance?

+Future trends in dental insurance include a focus on digital transformation, with more online tools and platforms for managing insurance. There is also an increasing emphasis on preventive care and its coverage. Additionally, there may be a shift towards integrating dental insurance with overall health insurance plans, and value-based care models may become more prevalent, incentivizing quality care and patient health.