Cost Of Full Coverage Car Insurance

Full coverage car insurance is a comprehensive policy that provides protection against a wide range of potential risks and damages associated with owning and operating a vehicle. It goes beyond the basic liability coverage, offering financial security and peace of mind to drivers. The cost of full coverage car insurance can vary significantly depending on numerous factors, and understanding these factors is crucial for individuals seeking to make informed decisions about their automotive insurance coverage.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term used to describe a policy that includes both collision coverage and comprehensive coverage, in addition to the standard liability insurance. Collision coverage protects the insured vehicle in the event of an accident, regardless of fault, by covering the costs of repairs or replacement. Comprehensive coverage, on the other hand, provides protection against non-collision incidents such as theft, vandalism, natural disasters, and damage caused by animals.

By combining these coverages, full coverage car insurance offers a comprehensive safety net for vehicle owners. However, the breadth of protection comes at a cost, and the price of this insurance can vary greatly based on individual circumstances and the specific policy terms.

Factors Influencing the Cost of Full Coverage

Vehicle Type and Usage

The type of vehicle being insured plays a significant role in determining the cost of full coverage. Insurance providers consider factors such as the vehicle’s make, model, age, and safety ratings when calculating premiums. High-performance sports cars, for instance, often have higher premiums due to their increased risk of accidents and higher repair costs.

Additionally, the purpose for which the vehicle is used can impact insurance costs. Vehicles used for personal pleasure may have lower premiums compared to those used for business purposes or as part of a ridesharing service.

Driver Profile and History

The driver’s profile and history are crucial factors in determining insurance rates. Insurance companies evaluate a driver’s age, gender, driving record, and claims history to assess their risk level. Younger drivers, especially those under the age of 25, often face higher premiums due to their lack of experience and higher accident rates. Similarly, drivers with a history of accidents or traffic violations may also see increased insurance costs.

Location and Coverage Level

The geographical location where the vehicle is primarily driven and insured can significantly affect insurance rates. Areas with higher population densities, higher crime rates, or a history of frequent natural disasters tend to have higher insurance costs. Additionally, the level of coverage chosen, including the policy limits and deductibles, will directly impact the overall cost.

Insurance Provider and Discounts

Different insurance companies offer varying rates and discounts. It’s essential to compare quotes from multiple providers to find the most competitive rates. Insurance companies may provide discounts for a range of reasons, including multi-policy discounts (for bundling car insurance with other types of insurance), good student discounts, safe driver discounts, and loyalty discounts for long-term customers.

| Factor | Impact on Cost |

|---|---|

| Vehicle Type | High-performance cars typically have higher premiums. |

| Driver Age | Younger drivers often face higher costs. |

| Location | Urban areas or regions with higher crime rates may have increased premiums. |

| Coverage Level | Higher coverage limits and lower deductibles generally result in higher costs. |

| Discounts | Bundling policies, good driving records, and loyalty can lead to significant savings. |

Optimizing Full Coverage Costs

Shop Around and Compare

The insurance market is competitive, and rates can vary significantly between providers. Shopping around and comparing quotes from multiple companies is essential to finding the best deal. Online comparison tools and insurance brokerages can streamline this process, making it easier to identify the most cost-effective options.

Consider Higher Deductibles

Opting for a higher deductible can reduce the cost of your full coverage insurance. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you take on more financial responsibility in the event of a claim, which can lead to lower premiums.

Review Coverage Levels

Regularly reviewing your coverage levels and policy limits can help ensure you’re not overpaying for unnecessary coverage. As your circumstances change, you may find that you no longer need certain coverages or that you can reduce your policy limits without compromising your financial protection.

Utilize Discounts

Insurance companies offer a range of discounts, and it’s worth exploring all available options. Common discounts include multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts. Additionally, some providers offer discounts for vehicles equipped with advanced safety features or for those who drive low annual mileage.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep insurance costs down. Avoid traffic violations and accidents, as these can lead to increased premiums. Additionally, some insurance companies offer safe driver programs or discounts for completing defensive driving courses.

The Future of Full Coverage Insurance

The automotive insurance industry is evolving, and the future of full coverage insurance is likely to be shaped by several key trends. One significant development is the increasing use of telematics and usage-based insurance (UBI) programs. These programs use real-time data from vehicles to assess driving behavior and set insurance premiums accordingly. UBI programs reward safe driving habits and can lead to more accurate and personalized insurance rates.

Additionally, the rise of electric and autonomous vehicles is expected to impact insurance costs. Electric vehicles may have lower maintenance and repair costs, which could lead to reduced insurance premiums. Autonomous vehicles, while still in their early stages, have the potential to significantly reduce accident rates, which could also result in lower insurance costs over time.

Finally, advancements in technology and data analytics are enabling insurance companies to more accurately assess risk and set premiums. This increased precision may lead to more tailored insurance products and potentially lower costs for certain segments of drivers.

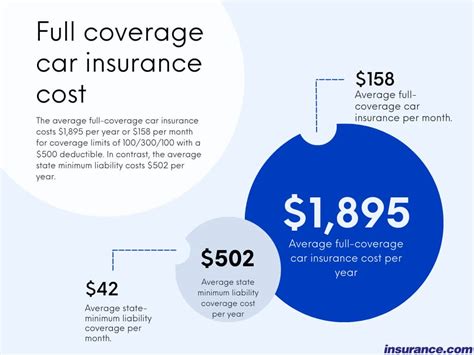

What is the average cost of full coverage car insurance in the United States?

+The average cost of full coverage car insurance in the US varies significantly by state and can range from a few hundred to several thousand dollars annually. Factors such as the state’s average car insurance rates, the driver’s age and driving history, and the type of vehicle being insured all contribute to this variation.

Can I get full coverage car insurance for a low-cost monthly premium?

+While it’s possible to find relatively affordable full coverage car insurance, the cost will depend on various factors such as your driving record, the value of your vehicle, and the level of coverage you choose. Shopping around and comparing quotes from multiple insurers is the best way to find the most cost-effective option for your specific situation.

Are there any ways to reduce the cost of full coverage car insurance without compromising on protection?

+Yes, there are several strategies to potentially reduce your full coverage car insurance costs while maintaining adequate protection. These include opting for a higher deductible, reviewing and adjusting your coverage levels, taking advantage of available discounts, and maintaining a good driving record. It’s important to regularly review your policy and explore all available options to ensure you’re getting the best value.