Cost Of Long Term Care Insurance By Age

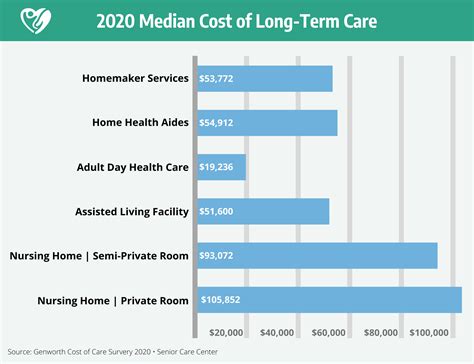

Long-term care insurance is an essential financial planning tool that can provide peace of mind and security for individuals and their families. As the name suggests, this type of insurance covers the costs associated with long-term care needs, which can be a significant burden both financially and emotionally. The cost of long-term care insurance is influenced by various factors, one of the most critical being the age of the policyholder. Let's delve into the intricate relationship between age and long-term care insurance costs, exploring the factors that drive these expenses and offering valuable insights for those considering this form of coverage.

Understanding the Impact of Age on Long-Term Care Insurance Costs

Age plays a pivotal role in determining the cost of long-term care insurance for several compelling reasons. Firstly, it is a strong indicator of the likelihood and severity of future health issues that may necessitate long-term care. As individuals age, their vulnerability to certain health conditions increases, leading to a higher probability of requiring extended medical attention and support.

Additionally, the financial considerations associated with long-term care become more prominent with age. Older individuals often have higher living expenses, more extensive medical histories, and potentially reduced earning capacities, all of which can influence the cost and coverage options available to them.

The Premium Structure: How Age Affects Insurance Costs

Long-term care insurance providers typically employ a premium structure that is heavily influenced by the age of the policyholder. This structure is designed to reflect the anticipated level of risk associated with each age group. Younger applicants are generally offered lower premiums, as they are considered to be at a lower risk of requiring long-term care in the near future. Conversely, older applicants, who are statistically more likely to need long-term care services sooner, are charged higher premiums to account for the increased risk.

For instance, consider a hypothetical scenario where two individuals, Jane and Mark, are seeking long-term care insurance coverage. Jane, aged 50, might be offered a premium of $1,200 annually, while Mark, aged 70, could be quoted a premium of $2,800 for the same level of coverage. This disparity is primarily driven by the statistical likelihood of Mark requiring long-term care sooner than Jane, thus necessitating a higher premium to offset the increased risk.

Factors Influencing Premium Rates

While age is a significant determinant of premium rates, it is not the sole factor. Insurance providers also consider other variables such as the individual’s health status, family medical history, and the specific benefits and coverage limits chosen for the policy. For example, if an individual has a history of chronic illnesses or a family predisposition to certain health conditions, their premium may be higher than that of someone with a clean bill of health.

Moreover, the chosen benefits and coverage limits can significantly impact the premium. Policies with more extensive coverage, including a higher daily benefit amount and a longer benefit period, will generally command a higher premium. On the other hand, policies with more limited coverage may offer a more affordable premium but may not provide the same level of financial protection.

The Benefits of Early Enrollment

Enrolling in long-term care insurance at a younger age offers several advantages. Firstly, it allows individuals to lock in a lower premium rate, which can provide significant savings over time. For instance, if Jane, aged 50, were to wait until she is 60 to purchase long-term care insurance, she could expect to pay a premium that is considerably higher than what she would have paid at age 50.

Secondly, enrolling early ensures that individuals are covered when they need it most. As the risk of requiring long-term care increases with age, securing coverage early can provide peace of mind and ensure that necessary care is accessible when health issues arise. Early enrollment also allows individuals to choose from a wider range of policy options, as older applicants may have fewer choices due to health conditions or other factors.

Potential Drawbacks of Early Enrollment

Despite the benefits, early enrollment in long-term care insurance is not without its potential drawbacks. One significant concern is the possibility of overpaying for coverage that may never be utilized. While this is a risk with any insurance policy, it is particularly pertinent in the context of long-term care insurance, as the likelihood of requiring care increases with age. Therefore, individuals must carefully consider their financial situation, health status, and the probability of needing long-term care when deciding whether to enroll early.

Another consideration is the potential for financial strain if the policyholder's circumstances change. For example, if an individual experiences a significant decrease in income or faces unexpected financial challenges, the ongoing cost of the insurance premium could become a burden. It is essential for policyholders to regularly review their financial situation and the terms of their policy to ensure that the coverage remains affordable and appropriate for their needs.

Comparing Costs: A Case Study

To illustrate the impact of age on long-term care insurance costs, let’s examine a hypothetical case study. Imagine two individuals, Sarah and David, who are both seeking long-term care insurance coverage. Sarah is 45 years old, while David is 65. Both individuals have similar health profiles and are seeking the same level of coverage.

| Age | Premium |

|---|---|

| Sarah (45 years) | $900 annually |

| David (65 years) | $2,100 annually |

As the table illustrates, Sarah, being younger, is offered a significantly lower premium than David. This difference in cost reflects the statistical likelihood that Sarah will require long-term care services later in life compared to David.

Real-World Considerations

While this case study provides a simplified illustration, real-world scenarios can be more complex. Factors such as the chosen policy benefits, the insurance provider’s risk assessment, and the individual’s health and lifestyle can further influence the premium. It is crucial for individuals to carefully review their options and consult with financial advisors or insurance experts to make informed decisions about long-term care insurance.

The Future of Long-Term Care Insurance Costs

The landscape of long-term care insurance is evolving, and future trends may impact the cost structure. As the healthcare industry advances and new treatment options emerge, the need for long-term care could shift, potentially influencing the risk assessment and pricing models used by insurance providers.

Additionally, the increasing focus on preventative healthcare and wellness initiatives may lead to a reduction in the overall need for long-term care. If successful, these initiatives could translate to lower insurance costs for policyholders. However, it is essential to note that the impact of these trends on insurance costs is speculative and may vary based on individual circumstances and the insurance provider's approach.

The Role of Technology

Technology is also playing an increasingly significant role in the long-term care insurance industry. The development of innovative care solutions, such as telemedicine and remote patient monitoring, could reduce the overall demand for traditional long-term care services. If these technologies become more widely adopted and integrated into insurance policies, they may lead to more affordable long-term care insurance options in the future.

Conclusion: Weighing the Costs and Benefits

Understanding the relationship between age and long-term care insurance costs is crucial for individuals seeking financial protection for their future healthcare needs. While age is a significant factor in determining insurance premiums, it is not the sole determinant. The decision to enroll in long-term care insurance should be made based on a comprehensive assessment of one’s health, financial situation, and the likelihood of requiring long-term care.

By staying informed about the latest developments in the healthcare and insurance industries, individuals can make more confident choices about their long-term care insurance needs. This knowledge, combined with professional guidance, can help ensure that individuals have the coverage they need at a cost they can afford.

How does my health status impact long-term care insurance costs?

+Your health status is a critical factor in determining the cost of long-term care insurance. Individuals with pre-existing health conditions or a history of chronic illnesses may be charged higher premiums or face challenges in obtaining coverage. It is important to disclose all relevant health information to insurance providers to ensure accurate pricing and appropriate coverage.

Are there any government programs that can help offset the cost of long-term care insurance?

+Yes, there are government programs available that can assist with the cost of long-term care. For example, Medicaid offers long-term care benefits for eligible individuals. Additionally, some states have partnership programs that combine private long-term care insurance with Medicaid coverage. It is advisable to research and understand the eligibility criteria and benefits offered by these programs.

What happens if I decide to cancel my long-term care insurance policy?

+If you decide to cancel your long-term care insurance policy, you may be entitled to a refund of a portion of your premium, depending on the terms of your policy and the insurance provider’s regulations. However, it is important to note that canceling your policy could leave you without coverage for future long-term care needs. It is recommended to carefully consider your options and consult with a financial advisor before making any decisions.