Costco Visa Rental Car Insurance

Renting a car can be a convenient way to travel, especially when exploring new places. However, understanding the insurance coverage provided by rental car companies and credit cards can be a bit confusing. In this comprehensive guide, we will delve into the specifics of Costco Visa rental car insurance, covering everything you need to know to make informed decisions when renting a vehicle.

The Basics of Costco Visa Rental Car Insurance

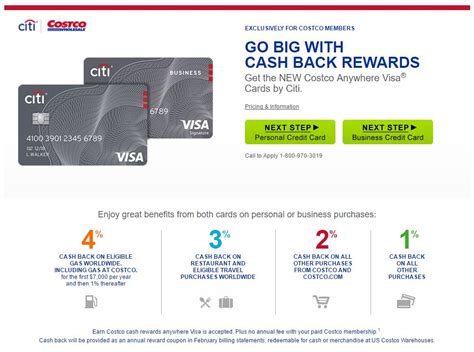

Costco, the popular membership-based warehouse club, offers its members an array of benefits, including a co-branded Visa credit card. This Costco Visa card provides cardholders with various perks, one of which is rental car insurance coverage. Understanding how this insurance works and what it covers is crucial for anyone planning to rent a car using their Costco Visa.

Understanding the Coverage

The Costco Visa rental car insurance acts as a secondary insurance, meaning it kicks in after the primary insurance coverage provided by the rental car company. This secondary insurance coverage is designed to cover damages to the rental vehicle itself and, in some cases, personal liability. Here’s a breakdown of the key aspects of this insurance:

- Collision Damage Waiver (CDW): This coverage protects you from costs associated with accidental damage to the rental car. It waives your financial responsibility for repairs or replacements, providing peace of mind during your rental period.

- Theft Protection: As the name suggests, this coverage ensures you're not liable for the cost of the rental car if it's stolen during your rental. It covers the value of the vehicle, reducing your financial risk.

- Liability Insurance: Costco Visa's rental car insurance may also include liability coverage, which protects you against claims for bodily injury or property damage caused by you or an authorized driver. This coverage can vary, so it's essential to review the terms and conditions.

It's important to note that the specific coverage and limits can vary based on the type of Costco Visa card you hold and the rental car company you choose. Some cards may offer enhanced coverage, while others might have certain exclusions or limitations. Therefore, always review the Guide to Benefits provided by Costco Visa to understand the exact coverage applicable to your card.

Eligible Rental Period and Vehicles

The rental car insurance coverage through Costco Visa is applicable to most rental situations, including personal use, business travel, and leisure trips. However, there are a few key eligibility requirements to keep in mind:

- Rental Duration: The rental period must be between 24 hours and 42 days to be eligible for insurance coverage. Any rentals exceeding this duration may not be covered.

- Rental Location: This insurance is valid for rentals within the United States (including Puerto Rico and the U.S. Virgin Islands), Canada, and Mexico. Rentals in other countries might not be covered.

- Vehicle Type: The rental car must be a passenger vehicle, light truck, or van. Certain types of vehicles, such as luxury cars, SUVs, or exotic vehicles, might have specific exclusions or limitations. Always check the terms for your specific rental.

Additionally, it's crucial to remember that the insurance coverage extends only to the primary cardholder and authorized drivers listed on the rental agreement. Any additional drivers not listed may not be covered, so it's essential to add them to the rental agreement to ensure comprehensive protection.

How to Maximize Your Costco Visa Rental Car Insurance Benefits

Now that we’ve covered the basics, let’s explore some strategies to make the most of your Costco Visa rental car insurance benefits:

Review the Guide to Benefits

Before renting a car, take the time to carefully read the Guide to Benefits provided by Costco Visa. This document outlines the specific coverage, exclusions, and limitations applicable to your card. By understanding the fine print, you can make informed decisions and ensure you’re fully protected during your rental.

Choose the Right Rental Car Company

Not all rental car companies accept the Costco Visa rental car insurance as a primary insurance. Some companies may require you to purchase their own insurance policies, which can be more expensive. To maximize your benefits, consider renting from companies that accept Costco Visa insurance as primary coverage. This way, you can avoid unnecessary additional expenses.

Utilize the Benefits of the Costco Visa Card

The Costco Visa card offers a range of benefits beyond rental car insurance. These benefits can further enhance your rental experience and provide additional protection. For example, some cards offer roadside assistance, which can be invaluable in case of emergencies during your rental. Additionally, the card may provide travel accident insurance, covering you and your authorized drivers in case of accidents while on your trip.

Consider Additional Coverage Options

While the Costco Visa rental car insurance offers comprehensive coverage, there might be situations where you require additional protection. For instance, if you’re renting an expensive or high-end vehicle, the standard coverage limits might not be sufficient. In such cases, you can consider purchasing supplemental insurance from the rental car company to ensure complete peace of mind.

Understand the Claims Process

In the unfortunate event of an accident or damage to the rental car, it’s crucial to understand the claims process. Familiarize yourself with the steps outlined in the Guide to Benefits to ensure a smooth and efficient claims experience. Promptly report any incidents to the rental car company and follow their procedures to initiate the claims process.

Comparing Costco Visa Rental Car Insurance to Other Options

To provide a comprehensive analysis, let’s compare the Costco Visa rental car insurance to other common insurance options available to rental car customers:

Primary Rental Car Insurance

Primary rental car insurance is typically offered by the rental car company itself. This insurance option provides coverage for the rental car and, in some cases, liability protection. While it offers comprehensive coverage, it can be more expensive than secondary insurance options like the Costco Visa rental car insurance. It’s essential to compare the coverage, limits, and costs to determine the most suitable option for your needs.

Credit Card Rental Car Insurance

Many credit cards, including other Visa and Mastercard products, offer rental car insurance as a benefit. These insurance coverages often provide similar benefits to the Costco Visa, including CDW and theft protection. However, the specific coverage and limits can vary significantly between credit cards. It’s crucial to review the terms and conditions of your specific credit card to understand the coverage it provides.

Personal Auto Insurance

Your personal auto insurance policy may also provide coverage for rental cars. This option is beneficial as it typically covers you and any authorized drivers on your policy, regardless of the rental car company or location. However, it’s essential to review your policy to understand the exact coverage and any limitations or exclusions that may apply.

Travel Insurance

Travel insurance policies can include rental car insurance as part of their comprehensive coverage. These policies often offer benefits similar to those provided by credit cards, but with potentially higher limits and more extensive coverage. If you’re planning an extensive trip or frequently rent cars, a travel insurance policy with rental car coverage might be a worthwhile investment.

Conclusion: Navigating Rental Car Insurance with Costco Visa

Understanding and maximizing your Costco Visa rental car insurance benefits is crucial for any traveler. By reviewing the coverage, eligible rental periods and vehicles, and utilizing the various benefits of the Costco Visa card, you can ensure a stress-free rental experience. Additionally, comparing Costco Visa’s insurance to other options allows you to make an informed decision about your rental car insurance needs.

Remember, rental car insurance is designed to provide peace of mind and financial protection during your travels. By staying informed and proactive, you can enjoy your rental car adventures with confidence, knowing you're adequately covered.

Can I use my Costco Visa rental car insurance for business travel?

+Yes, the Costco Visa rental car insurance covers personal use, business travel, and leisure trips. However, it’s essential to review the specific terms and conditions to ensure your business travel is eligible for coverage.

Are there any exclusions or limitations to the Costco Visa rental car insurance coverage?

+Yes, there may be certain exclusions and limitations depending on your specific Costco Visa card and the rental car company. It’s crucial to review the Guide to Benefits to understand any potential restrictions.

Can I rent an exotic or luxury vehicle using my Costco Visa rental car insurance coverage?

+While Costco Visa rental car insurance covers most passenger vehicles, light trucks, and vans, there might be exclusions for certain luxury or exotic vehicles. Always check with the rental car company and review the terms for your specific rental to ensure coverage.

What should I do in case of an accident while using my Costco Visa rental car insurance coverage?

+In the event of an accident, it’s crucial to follow the procedures outlined in the Guide to Benefits. This typically involves reporting the incident to the rental car company, providing all necessary information, and initiating the claims process promptly.