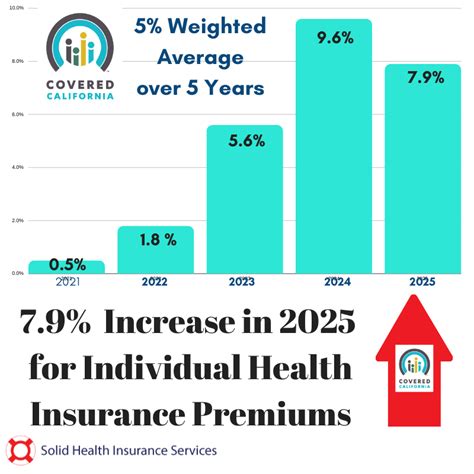

Coverage California Health Insurance

Health insurance is a crucial aspect of our lives, providing us with the peace of mind that we can access necessary medical care without facing financial ruin. In the state of California, the healthcare system and insurance options have undergone significant transformations over the years, making it essential to understand the landscape and the benefits available to residents. This comprehensive guide aims to delve into the world of Coverage California Health Insurance, shedding light on its history, current offerings, and the impact it has on the lives of Californians.

A Historical Perspective: The Evolution of Healthcare in California

The journey of healthcare insurance in California is a fascinating one, marked by pivotal moments and policy changes that have shaped the current system. In the early 20th century, healthcare was largely unaffordable for many, with limited access to quality medical services. The introduction of Blue Cross in 1939 marked a significant step towards making healthcare more accessible, offering pre-paid hospital plans to state employees.

The 1960s brought about a significant shift with the establishment of Medicare and Medicaid, federal programs aimed at providing healthcare coverage to the elderly and low-income individuals, respectively. California played a vital role in implementing these programs, ensuring that vulnerable populations had access to essential medical services.

The late 20th century saw the emergence of managed care organizations (MCOs) and health maintenance organizations (HMOs), which aimed to control healthcare costs by emphasizing preventative care and managing healthcare utilization. These organizations played a pivotal role in shaping the healthcare landscape in California, influencing the way healthcare services were delivered and reimbursed.

Coverage California: An Overview

Coverage California is a comprehensive health insurance marketplace established in response to the Affordable Care Act (ACA), also known as Obamacare. It serves as a one-stop shop for Californians seeking affordable health insurance options. The marketplace offers a range of plans from various insurance carriers, providing individuals and families with the flexibility to choose coverage that best suits their needs.

One of the key features of Coverage California is its commitment to ensuring that healthcare is accessible and affordable. The marketplace offers financial assistance in the form of premium tax credits and cost-sharing reductions, making insurance more affordable for low- and middle-income households. These subsidies are based on income and family size, ensuring that those who need it most can access quality healthcare without financial strain.

Plan Options and Coverage

Coverage California offers a diverse range of health insurance plans, categorized into metal tiers based on the level of coverage they provide. These tiers include Bronze, Silver, Gold, and Platinum plans, with each offering a different balance between premiums and out-of-pocket costs.

| Metal Tier | Coverage Level | Premium Share | Out-of-Pocket Costs |

|---|---|---|---|

| Bronze | Lower Coverage, Higher Out-of-Pocket Costs | 70% | Higher |

| Silver | Balanced Coverage | 70% | Moderate |

| Gold | Higher Coverage, Lower Out-of-Pocket Costs | 80% | Lower |

| Platinum | Highest Coverage, Lowest Out-of-Pocket Costs | 90% | Lowest |

Each metal tier offers a range of plans with varying provider networks, allowing individuals to choose plans that align with their preferred healthcare providers and facilities. Additionally, Coverage California offers Catastrophic Plans for individuals under 30 or those with a hardship exemption, providing a basic level of coverage at a lower cost.

Special Enrollment Periods

In addition to the annual open enrollment period, Coverage California offers Special Enrollment Periods (SEPs) for qualifying life events. These events include marriage, divorce, birth or adoption of a child, loss of other health coverage, and changes in income or household composition. SEPs allow individuals to enroll in a health plan outside of the regular open enrollment window, ensuring that life changes do not leave them without adequate healthcare coverage.

Impact and Benefits of Coverage California

The implementation of Coverage California has had a profound impact on the lives of Californians, improving access to healthcare and providing financial relief to many.

Increased Healthcare Access

Coverage California has played a pivotal role in increasing the number of insured individuals in the state. According to a study by the Kaiser Family Foundation, the uninsured rate in California dropped significantly from 17.2% in 2013 to 7.3% in 2019, largely attributed to the expansion of Medicaid and the implementation of the ACA marketplace.

This increase in insurance coverage has resulted in improved access to healthcare services. With more Californians insured, medical facilities and providers can focus on delivering quality care without the burden of uncompensated care, ultimately leading to better health outcomes for the population.

Financial Protection and Affordability

One of the key advantages of Coverage California is the financial protection it provides. The marketplace offers a range of affordable plans, with the option to receive financial assistance based on income. This ensures that individuals and families can access essential healthcare services without facing devastating financial consequences.

Additionally, Coverage California has introduced value-based insurance design principles, which aim to reduce out-of-pocket costs for certain services, such as preventative care and chronic disease management. This approach not only encourages individuals to seek necessary healthcare but also helps manage the overall cost of healthcare by promoting early intervention and disease prevention.

Improved Health Outcomes

The expansion of healthcare coverage through Coverage California has had a positive impact on the overall health of Californians. Studies have shown that individuals with insurance are more likely to receive timely and appropriate healthcare, leading to better management of chronic conditions and improved health outcomes.

Furthermore, the focus on preventative care and early intervention has resulted in a reduction in emergency room visits and hospitalizations for preventable conditions. This not only improves the quality of life for individuals but also helps control healthcare costs by addressing health issues before they become more complex and expensive to treat.

Challenges and Future Outlook

While Coverage California has made significant strides in improving healthcare access and affordability, challenges remain. The ongoing COVID-19 pandemic has highlighted the importance of healthcare coverage and the need for continuous improvements.

Pandemic Response and Future Preparedness

During the pandemic, Coverage California played a crucial role in ensuring that individuals could access healthcare services without barriers. The marketplace extended its open enrollment period and implemented special enrollment periods to accommodate those who lost employer-sponsored coverage or experienced other qualifying life events.

Looking ahead, there is a need to enhance pandemic preparedness and response capabilities within the healthcare system. This includes improving access to telemedicine services, expanding the healthcare workforce, and investing in public health infrastructure to better manage future public health crises.

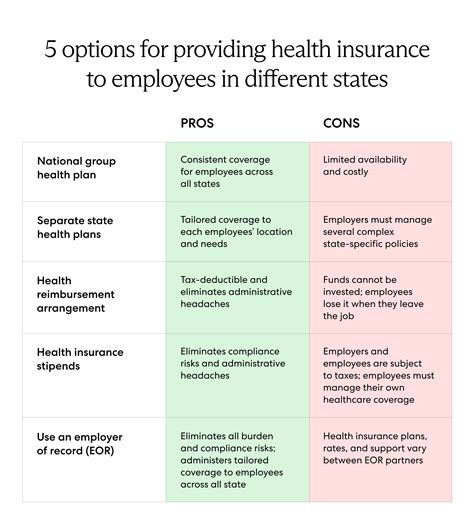

Addressing Healthcare Disparities

Despite the progress made, healthcare disparities persist among certain populations, including racial and ethnic minorities, low-income individuals, and those residing in rural areas. Coverage California, in collaboration with state and local agencies, must continue to address these disparities by improving access to culturally competent care, increasing provider diversity, and ensuring that healthcare services are affordable and accessible to all.

Continued Innovation and Cost Control

The healthcare industry is constantly evolving, and Coverage California must stay ahead of the curve to ensure that its offerings remain relevant and accessible. This includes embracing technological advancements, such as artificial intelligence and digital health solutions, to improve efficiency and reduce costs.

Additionally, ongoing efforts to control healthcare costs are essential. This involves negotiating fair rates with providers, promoting competition among insurance carriers, and exploring innovative payment models that reward value and quality over volume.

Conclusion

Coverage California Health Insurance has emerged as a vital component of the state’s healthcare system, providing millions of residents with access to affordable and comprehensive healthcare. Its evolution over the years, coupled with the implementation of the ACA, has resulted in significant improvements in healthcare access and financial protection for Californians.

As we move forward, it is crucial to build upon the successes of Coverage California and address the remaining challenges. By continuing to innovate, improve access, and control costs, we can ensure that healthcare remains a fundamental right for all Californians, regardless of their background or financial situation.

How do I enroll in Coverage California Health Insurance?

+To enroll in Coverage California Health Insurance, you can visit the official website Covered California or call their toll-free number 1-800-300-1506. You can also find in-person assistance by visiting a local Certified Enrollment Center. The enrollment process involves creating an account, providing personal and household information, and selecting a health plan that suits your needs. Financial assistance is available to eligible individuals and families to make insurance more affordable.

What are the eligibility criteria for Coverage California?

+Eligibility for Coverage California Health Insurance is primarily based on income and citizenship status. You must be a resident of California, a U.S. citizen or legal permanent resident, and have an annual household income that falls within certain limits. The exact income thresholds depend on the size of your household and the metal tier plan you choose. You can use the Covered California eligibility tool to determine if you qualify for financial assistance or Medicaid coverage.

Are there any discounts or financial assistance available for Coverage California plans?

+Yes, Coverage California offers financial assistance to make health insurance more affordable. Eligible individuals and families can receive premium tax credits to lower their monthly premiums. Additionally, those with lower incomes may qualify for cost-sharing reductions, which further reduce out-of-pocket expenses. You can estimate your potential savings by using the Covered California savings calculator.

Can I keep my current doctor if I enroll in Coverage California?

+Yes, Coverage California offers a variety of plans with different provider networks. When choosing a plan, you can check if your preferred doctors and hospitals are included in the network. If you wish to continue seeing your current doctor, it’s important to select a plan that covers them. You can search for providers by plan and location on the Covered California website.