Custom Travel Insurance

In today's dynamic world of travel, where experiences are tailored to individual preferences and every journey is unique, the need for personalized protection has become increasingly vital. This is where custom travel insurance steps in, offering a flexible and comprehensive solution to safeguard your adventures and provide peace of mind.

Gone are the days when one-size-fits-all travel insurance policies sufficed. With the diverse nature of modern travel, from luxurious getaways to adventurous treks, a customizable insurance approach has emerged as the preferred choice for many discerning travelers.

Understanding Custom Travel Insurance

Custom travel insurance is an innovative concept that allows travelers to create an insurance policy tailored to their specific needs and preferences. It goes beyond the traditional, pre-packaged policies, offering a level of flexibility and customization that caters to the diverse and often complex requirements of modern travelers.

The beauty of custom travel insurance lies in its ability to adapt to the unique circumstances of each trip. Whether you're embarking on a solo backpacking trip, a family vacation, a business trip, or even a luxurious cruise, a custom policy can be designed to fit your exact needs. This could include coverage for specific activities, like skiing or scuba diving, or for unique circumstances, such as travel delays or cancellations due to unforeseen events.

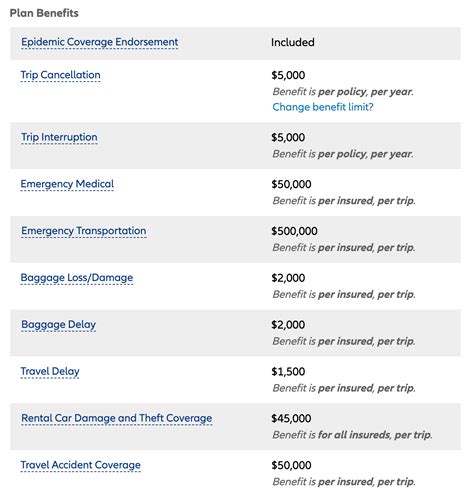

Furthermore, custom travel insurance often provides a more comprehensive level of coverage. It can include medical expenses, trip cancellations or interruptions, baggage loss or delay, personal liability, and more. By tailoring the policy to your specific needs, you can ensure that you're adequately protected against a wide range of potential risks and uncertainties that come with travel.

The Benefits of Customization

One of the key advantages of custom travel insurance is its cost-effectiveness. By choosing only the coverages you need, you can avoid paying for unnecessary features, which is often the case with standard travel insurance policies. This customization not only ensures a more precise fit for your needs but also makes your insurance more affordable.

Another significant benefit is the flexibility it offers. With a custom policy, you can adjust the coverage limits, choose the deductibles that suit your budget, and even add or remove coverage options as your travel plans evolve. This level of flexibility is especially beneficial for travelers with complex or changing itineraries, ensuring they remain adequately protected throughout their journey.

Additionally, custom travel insurance often provides enhanced benefits and services. These can include access to a 24/7 emergency assistance hotline, personalized travel advice, and support for a range of travel-related issues, from lost passports to medical emergencies. Such added services can make a significant difference in ensuring a smooth and stress-free travel experience.

Who Should Consider Custom Travel Insurance?

Custom travel insurance is particularly beneficial for a wide range of travelers, including:

- Adventurous Travelers: If you're planning activities like skiing, hiking, or water sports, custom travel insurance can provide specialized coverage for these adventures.

- Frequent Travelers: For those who travel multiple times a year, a custom policy can offer a more comprehensive and cost-effective solution, ensuring you're covered for all your trips.

- Business Travelers: Business trips often come with unique risks. Custom travel insurance can be tailored to cover business-related expenses and emergencies.

- Family Travelers: When traveling with children, custom insurance can provide additional coverage for family-related issues, such as child care or emergency medical expenses.

- Senior Travelers: Older travelers often have specific health and travel needs. Custom insurance can be designed to cater to these requirements, ensuring adequate medical coverage and assistance.

Key Considerations for Custom Travel Insurance

While custom travel insurance offers numerous advantages, it’s essential to approach it with a thoughtful and informed perspective.

Understanding Your Needs

The first step in creating a custom travel insurance policy is to thoroughly understand your travel plans and the potential risks associated with them. Consider the destination, the activities you plan to undertake, and any unique circumstances that could impact your trip. For instance, are you traveling to a country with a high risk of political unrest? Are you planning to participate in high-risk activities like bungee jumping or whitewater rafting? These factors will influence the type of coverage you’ll need.

Choosing the Right Provider

Selecting the right insurance provider is crucial. Look for companies that offer a high level of customization and flexibility in their policies. It’s also important to consider the provider’s reputation, financial stability, and customer service. Reviews and ratings can be a great way to gauge the provider’s reliability and the quality of their service.

Reading the Fine Print

When creating your custom policy, it’s essential to carefully review the terms and conditions. Pay close attention to the coverage limits, deductibles, and any exclusions. Make sure you understand what is and isn’t covered, and don’t hesitate to seek clarification from the provider if needed.

Comparing Quotes

To ensure you’re getting the best deal, compare quotes from different providers. While cost is an important factor, it’s not the only consideration. The level of coverage and the reputation of the provider should also be taken into account.

The Process of Customizing Your Travel Insurance

Customizing your travel insurance policy is a straightforward process that typically involves the following steps:

- Assess Your Needs: Begin by evaluating your travel plans and identifying the specific risks and potential issues you may face. This could include medical emergencies, trip cancellations, luggage loss, or travel delays.

- Choose Your Provider: Select a reputable insurance provider that offers customizable policies. Research their offerings, read reviews, and consider their financial stability and customer service record.

- Select Your Coverages: Based on your assessment, choose the coverages that best suit your needs. This could include medical expense coverage, trip cancellation or interruption protection, baggage loss or delay coverage, and more. You can also opt for additional coverages like rental car damage or personal liability protection.

- Set Your Limits and Deductibles: Decide on the coverage limits for each selected coverage. This is the maximum amount the insurance company will pay out in the event of a claim. You'll also need to set deductibles, which is the amount you'll pay out of pocket before the insurance kicks in.

- Review Your Policy: Carefully review the policy details, including the terms and conditions, coverage limits, and any exclusions. Ensure that the policy aligns with your initial assessment and that you understand all the provisions.

- Make Any Necessary Adjustments: If you identify any areas where the policy could be improved to better fit your needs, don't hesitate to make adjustments. This could involve adding or removing coverages, increasing or decreasing limits, or changing deductibles.

- Purchase Your Policy: Once you're satisfied with your customized policy, proceed to purchase it. This typically involves paying a premium, which is the cost of the insurance coverage for the specified period.

By following these steps, you can create a custom travel insurance policy that perfectly suits your needs, providing the right level of protection for your travels. Remember, the key to successful customization is understanding your travel plans and choosing a provider that offers the flexibility and options you require.

Case Studies: Real-World Examples of Custom Travel Insurance

Let’s explore some real-life scenarios to better understand how custom travel insurance can be tailored to specific needs.

Adventure Seekers

John, an avid adventure seeker, is planning a trip to New Zealand for a week of hiking and bungee jumping. He knows that these activities carry a higher risk of injury, so he opts for custom travel insurance that includes enhanced medical coverage with a high limit for adventure sports. He also adds coverage for trip cancellation in case severe weather conditions prevent his activities.

Business Travelers

Emily, a frequent business traveler, often needs to change her travel plans at short notice. She customizes her travel insurance to include flexible trip cancellation coverage that allows her to cancel her trip without penalty if her business schedule changes. She also adds coverage for business equipment, ensuring her laptop and other business essentials are protected.

Family Vacationers

The Smith family is planning a two-week vacation to Disney World. They want to ensure they’re covered for any potential issues, so they customize their travel insurance to include medical coverage for all family members, trip interruption coverage in case of severe weather or family emergencies, and baggage loss protection for their luggage and souvenirs.

The Future of Travel Insurance: Customization and Innovation

As the travel industry continues to evolve, so too will the demand for innovative and customizable insurance solutions. The future of travel insurance lies in providing travelers with the flexibility and protection they need for their unique journeys.

Emerging Trends

One emerging trend is the integration of technology into travel insurance. This includes the use of mobile apps for policy management, real-time updates on trip-related risks, and digital assistance for claims processing. Additionally, the use of data analytics is expected to enhance the customization process, allowing providers to offer more precise and tailored policies.

The Role of Sustainability

With the growing awareness of environmental issues, the concept of sustainable travel is gaining traction. Custom travel insurance policies can be designed to cater to this trend by offering incentives for travelers who choose sustainable travel options, such as eco-friendly accommodations or carbon-offset programs. This not only aligns with the values of environmentally conscious travelers but also contributes to a greener future.

Adapting to Global Challenges

In a post-pandemic world, travel insurance providers are adapting to new challenges. This includes offering enhanced medical coverage for travel-related illnesses and providing support for travelers in the event of global health crises. Customizable policies can provide peace of mind to travelers, knowing they have the necessary protection in an uncertain world.

Frequently Asked Questions

Can I customize my travel insurance policy after purchasing it?

+In most cases, you can make changes to your policy after purchasing it, but there may be limitations and additional fees involved. It’s best to check with your insurance provider for their specific policies regarding policy changes.

What happens if I need to make a claim on my custom travel insurance policy?

+If you need to make a claim, you’ll typically need to contact your insurance provider and provide them with the necessary details and documentation. The claims process can vary depending on the type of claim and the specific policy terms.

How do I choose the right insurance provider for my custom travel insurance needs?

+When choosing an insurance provider, consider factors such as their reputation, financial stability, the level of customization they offer, and their customer service. Reading reviews and comparing quotes from different providers can also help you make an informed decision.

Are there any additional costs associated with custom travel insurance?

+Custom travel insurance policies are typically more expensive than standard policies due to the increased level of customization and coverage. However, the exact cost will depend on the specific coverages and limits you choose, as well as any additional fees your provider may charge.

Can I get custom travel insurance for a single trip, or is it only for frequent travelers?

+Custom travel insurance is available for both single trips and frequent travelers. Whether you’re planning a once-in-a-lifetime adventure or multiple trips throughout the year, you can customize a policy to fit your specific needs and budget.