Deductible In Insurance Means

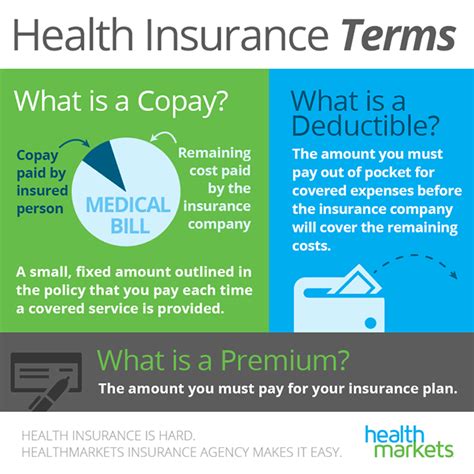

The concept of a deductible is a fundamental aspect of insurance policies, playing a crucial role in how insurance works and how policyholders manage their financial responsibilities. A deductible represents a predetermined amount that the policyholder agrees to pay out of pocket before the insurance company steps in to cover the remaining costs of a claim. This article aims to provide an in-depth exploration of deductibles, shedding light on their significance, various types, and their impact on insurance coverage.

Understanding Deductibles: A Key Component of Insurance Policies

In the world of insurance, deductibles serve as a vital mechanism to balance the interests of both the insurer and the insured. By introducing a deductible, insurance companies aim to discourage policyholders from making unnecessary or frivolous claims, thereby reducing administrative costs and keeping premiums affordable for all. Deductibles also promote a sense of financial responsibility among policyholders, encouraging them to carefully assess the need for a claim before submitting one.

Types of Deductibles

Deductibles come in various forms, each designed to suit specific insurance policies and the needs of different policyholders. Understanding the different types of deductibles is essential for making informed decisions when choosing an insurance policy.

Per-Claim Deductibles

A per-claim deductible is the most common type, applicable to each individual claim made by the policyholder. This means that for every incident or event that triggers a claim, the policyholder must first pay the specified deductible amount before the insurance company covers the remaining costs. For instance, if your car insurance policy has a 500 per-claim deductible and you're involved in an accident, you'll need to pay 500 before your insurance provider covers the rest of the repair costs.

Annual Deductibles

In contrast, an annual deductible is applied across all claims made within a policy year. This type of deductible is more common in health insurance policies. With an annual deductible, policyholders pay the specified amount once during the policy year, and after that, the insurance company covers all eligible costs for the remainder of the year. For example, if your health insurance policy has an annual deductible of 2,000, you'll need to pay the first 2,000 of covered medical expenses before your insurance kicks in.

Percentage-Based Deductibles

Some insurance policies use a percentage-based deductible, where the deductible amount is calculated as a percentage of the total claim amount. This type of deductible is often seen in property insurance policies, such as home insurance. For instance, if your home insurance policy has a 2% deductible and you make a claim for 50,000 worth of damage, you'll be responsible for paying 2% of that amount (1,000) before your insurance provider covers the rest.

Comprehensive and Collision Deductibles

In the context of auto insurance, there are specific deductibles for comprehensive and collision coverage. Comprehensive coverage typically protects against non-collision incidents like theft, vandalism, or natural disasters, while collision coverage covers damages resulting from collisions with other vehicles or objects. These deductibles are separate from the per-claim deductible and are applicable only when you make a claim under these specific coverages.

The Impact of Deductibles on Insurance Coverage

Deductibles have a significant influence on the overall insurance coverage and the financial obligations of policyholders. Choosing the right deductible can be a strategic decision, impacting both the cost of insurance premiums and the out-of-pocket expenses associated with claims.

A higher deductible generally results in lower insurance premiums, as policyholders assume more financial responsibility. This can be an attractive option for those who are comfortable with a higher upfront cost in exchange for lower long-term expenses. Conversely, a lower deductible means higher premiums, providing greater financial protection for policyholders but potentially resulting in higher costs over time.

The choice of deductible also affects the policyholder's decision-making process when it comes to filing claims. A higher deductible may deter policyholders from making smaller claims, as the out-of-pocket expense might outweigh the benefits. On the other hand, a lower deductible can encourage policyholders to file claims more frequently, knowing that their financial burden is minimized.

Real-World Examples of Deductibles in Action

Let’s explore some real-life scenarios to better understand how deductibles work in practice.

Scenario 1: Auto Insurance

Imagine you have an auto insurance policy with a 500 per-claim deductible for collision coverage. While driving one day, you're involved in a minor fender-bender that causes 3,000 worth of damage to your car. In this scenario, you’ll first pay the 500 deductible, and your insurance company will cover the remaining 2,500 of the repair costs.

Scenario 2: Health Insurance

Consider a health insurance policy with an annual deductible of 1,500. Throughout the year, you incur medical expenses totaling 8,000. In this case, you’ll pay the first 1,500 out of pocket, and your insurance provider will cover the remaining 6,500.

Scenario 3: Home Insurance

Suppose you have a home insurance policy with a 1% deductible for storm damage. During a severe storm, your home sustains 100,000 worth of damage. With a 1% deductible, you'll be responsible for paying the first 1,000, and your insurance company will cover the remaining $99,000.

Deductible Strategies for Policyholders

Policyholders can employ various strategies when it comes to managing deductibles. Here are some considerations:

- Risk Assessment: Evaluate your financial situation and risk tolerance. If you're comfortable with a higher deductible and have the means to cover potential out-of-pocket expenses, opting for a higher deductible can lead to lower premiums.

- Claim Frequency: Consider how often you anticipate making claims. If you anticipate frequent claims, a lower deductible may be more suitable to minimize your out-of-pocket costs.

- Budgeting: Plan for potential out-of-pocket expenses associated with your chosen deductible. Ensure you have the financial means to cover these expenses when needed.

- Policy Comparison: When shopping for insurance, compare policies with different deductible options. Consider the balance between premiums and deductibles to find the most suitable coverage for your needs.

Future Implications and Industry Trends

The role of deductibles in insurance is evolving, driven by changing industry dynamics and consumer preferences. Here are some potential future implications and trends to consider:

- Personalized Deductibles: Insurance companies may explore more personalized deductible options, tailoring them to individual policyholders' needs and risk profiles.

- Dynamic Deductibles: Dynamic deductibles that adjust based on factors like policyholder behavior or claim history could become more prevalent, offering incentives for responsible behavior.

- Bundled Deductibles: Insurance providers may offer bundled deductible options, allowing policyholders to manage deductibles across multiple policies more efficiently.

- Digital Deductible Management: With the rise of digital insurance platforms, policyholders may gain more control over deductible management, making it easier to understand and adjust their deductible choices.

Conclusion

Deductibles are a critical component of insurance policies, shaping the financial relationship between insurers and policyholders. By understanding the different types of deductibles and their impact on insurance coverage, policyholders can make informed decisions that align with their financial goals and risk preferences. As the insurance industry continues to evolve, the role and design of deductibles will likely adapt to meet the changing needs of policyholders, offering more personalized and flexible coverage options.

What happens if I can’t afford to pay my deductible?

+If you’re unable to pay your deductible, your insurance claim may not be processed, and you’ll be responsible for covering the full cost of the claim yourself. It’s important to choose a deductible that aligns with your financial capabilities to avoid such situations.

Can I negotiate my deductible with my insurance company?

+In some cases, insurance companies may be open to negotiating deductibles, especially if you have a strong claim history or are a long-term customer. However, it’s important to note that insurance companies have guidelines and standards for deductibles, and negotiations may not always be successful.

Are there any situations where the deductible doesn’t apply?

+Yes, there are certain situations where the deductible may not apply. For instance, some insurance policies offer waivers or eliminators for specific circumstances, such as natural disasters or accidents involving rental cars. These waivers eliminate the need to pay the deductible in those situations.