Define Comprehensive Insurance

Comprehensive insurance, often referred to as full coverage insurance, is a type of insurance policy that offers broad protection against a wide range of potential risks and perils. It is designed to provide financial coverage for unforeseen events that could result in significant losses for individuals or businesses. This type of insurance is particularly valuable in today's unpredictable world, where various risks can impact our lives and livelihoods.

Understanding Comprehensive Insurance

At its core, comprehensive insurance aims to mitigate the financial impact of unexpected events by offering a comprehensive suite of coverage options. Unlike basic insurance policies that cover specific risks, comprehensive insurance takes a more holistic approach, aiming to protect policyholders from a variety of potential losses.

The term "comprehensive" in insurance signifies a broad scope of coverage. It typically includes protection against damage or loss caused by events that are often excluded from standard insurance policies. These events can range from natural disasters and theft to accidents and even certain types of mechanical or electrical failures.

One of the key advantages of comprehensive insurance is its ability to provide peace of mind. By opting for this type of policy, individuals and businesses can rest assured that they are protected against a wide range of potential risks, many of which are difficult to predict or prevent.

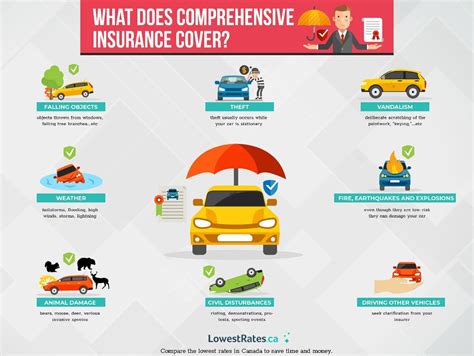

Coverage Included in Comprehensive Insurance

The coverage offered by comprehensive insurance policies can vary depending on the provider and the specific needs of the policyholder. However, there are several common elements that are typically included in these policies:

- Property Damage: Comprehensive insurance often covers damage to property caused by various events, including natural disasters like floods, hurricanes, or earthquakes. It may also cover damage from fire, theft, or vandalism.

- Liability Coverage: This aspect of the policy provides protection in case the policyholder is held legally responsible for an accident or injury that occurs on their property or as a result of their actions.

- Personal Injury: Comprehensive policies often include coverage for medical expenses and lost wages if the policyholder or their family members are injured in an accident, regardless of fault.

- Theft and Burglary: In addition to covering property damage from theft, comprehensive insurance may also reimburse policyholders for stolen items or provide coverage for the cost of replacing locks and keys.

- Natural Disasters: As mentioned earlier, comprehensive insurance typically covers losses resulting from natural disasters, which can be a significant benefit in regions prone to such events.

- Accidental Damage: This coverage applies to damage caused by accidents, such as a car collision or a slip and fall on the policyholder's property.

- Mechanical Breakdown: Some comprehensive insurance policies extend coverage to mechanical or electrical failures in appliances, vehicles, or other machinery.

| Coverage Type | Description |

|---|---|

| Property Damage | Protects against various forms of property damage, including natural disasters, theft, and vandalism. |

| Liability Coverage | Covers legal liabilities arising from accidents or injuries on the policyholder's property. |

| Personal Injury | Provides medical and wage coverage for policyholders and their families in the event of an accident. |

| Theft and Burglary | Reimburses for stolen items and covers the cost of replacing locks and keys. |

| Natural Disasters | Offers protection against losses resulting from natural disasters, such as floods and earthquakes. |

| Accidental Damage | Covers damage caused by accidents, like car collisions or slips and falls. |

| Mechanical Breakdown | Extends coverage to mechanical or electrical failures in appliances and vehicles. |

Benefits of Comprehensive Insurance

Comprehensive insurance offers a multitude of benefits to individuals and businesses alike. Here are some key advantages:

Financial Protection

The primary benefit of comprehensive insurance is the financial protection it provides. By covering a wide range of potential risks, policyholders can avoid the often devastating financial consequences of unexpected events. Whether it’s a natural disaster, a theft, or an accident, comprehensive insurance can help mitigate the financial impact and provide the necessary funds for recovery.

Peace of Mind

Knowing that you have comprehensive insurance can bring a sense of peace and security. Policyholders can rest assured that they are prepared for the unexpected, reducing anxiety and stress associated with potential risks. This peace of mind allows individuals and businesses to focus on their daily lives and operations without constantly worrying about potential losses.

Customizable Coverage

Comprehensive insurance policies can often be tailored to meet the specific needs of the policyholder. This flexibility allows individuals and businesses to select the coverage options that are most relevant to their circumstances and risks. By customizing their policy, policyholders can ensure they have the right level of protection without paying for unnecessary coverage.

Legal Protection

The liability coverage included in comprehensive insurance policies provides legal protection in case of accidents or injuries on the policyholder’s property. This coverage can be particularly valuable for businesses, as it helps protect them from potential lawsuits and the associated legal costs.

Quick Claim Settlement

Comprehensive insurance policies are often designed to provide efficient claim settlement processes. Many insurers offer quick and streamlined procedures for filing and processing claims, ensuring that policyholders receive the necessary funds promptly. This timely settlement can be crucial in helping individuals and businesses recover from losses and get back on their feet quickly.

Choosing the Right Comprehensive Insurance

When selecting a comprehensive insurance policy, it’s essential to consider several factors to ensure you choose the right coverage for your needs:

Risk Assessment

Start by conducting a thorough risk assessment. Identify the potential risks and perils that are most relevant to your situation. Consider factors such as your location, the type of property or assets you own, and your personal or business activities. This assessment will help you determine the specific coverage options you require.

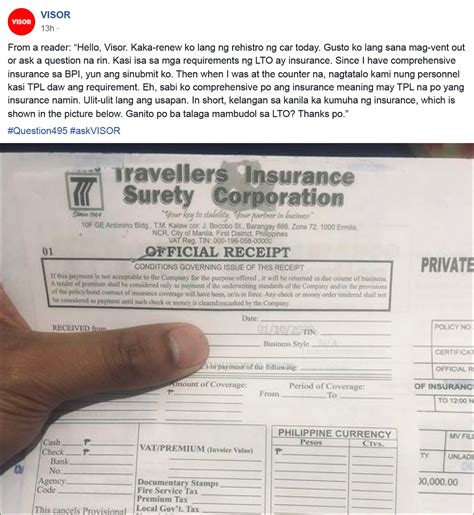

Compare Policies

Take the time to compare different comprehensive insurance policies from various providers. Look at the scope of coverage, any exclusions or limitations, and the reputation and financial stability of the insurance company. Consider the policy’s terms and conditions, including deductibles, coverage limits, and any additional benefits or perks.

Seek Expert Advice

Consulting with an insurance broker or financial advisor can be beneficial when choosing comprehensive insurance. These professionals can provide expert guidance based on your specific needs and circumstances. They can help you understand the intricacies of different policies and ensure you make an informed decision.

Review and Update Regularly

Comprehensive insurance policies should be reviewed and updated regularly to ensure they remain relevant and adequate. Life circumstances, such as changes in location, assets, or personal situation, can impact the level of coverage required. Regularly reviewing your policy and making necessary adjustments ensures that your coverage evolves with your needs.

FAQ

What is the difference between comprehensive and basic insurance policies?

+Basic insurance policies typically cover specific risks, such as fire or theft, while comprehensive insurance offers a broader range of coverage, including protection against natural disasters, accidents, and even mechanical breakdowns.

Are there any exclusions in comprehensive insurance policies?

+Yes, while comprehensive insurance provides extensive coverage, it may still have exclusions. Common exclusions include wear and tear, intentional damage, and certain types of high-risk activities.

How do I choose the right comprehensive insurance provider?

+When choosing a provider, consider factors such as their financial stability, customer service reputation, and the scope of coverage offered. It’s also beneficial to read reviews and seek recommendations from trusted sources.