Define Unit Cost

Unit cost, a fundamental concept in economics and business, represents the total expenses incurred to produce, acquire, or provide a single unit of a good, service, or resource. This metric is crucial for businesses as it forms the basis for pricing strategies, cost management, and overall financial planning.

Understanding Unit Cost

Unit cost is a comprehensive measure that accounts for all expenses directly and indirectly associated with the production or procurement of a single unit. It is calculated by dividing the total cost of production or acquisition by the number of units produced or acquired. This metric is expressed in the same currency as the associated costs, allowing for easy comparison and analysis.

For instance, consider a manufacturing company that produces widgets. The unit cost for each widget includes not only the raw materials and labor costs directly involved in its production, but also a proportionate share of overhead expenses like rent, utilities, and administrative costs. By calculating the unit cost, the company can determine the minimum price at which each widget must be sold to cover all associated expenses.

Components of Unit Cost

Unit cost is comprised of various cost elements, each playing a significant role in the overall production or acquisition process. These elements can be categorized as follows:

- Direct Costs: These are the costs that can be directly attributed to the production or procurement of a specific unit. Examples include raw materials, direct labor, and any other expenses directly involved in the creation or acquisition process.

- Indirect Costs: Also known as overhead costs, these are the expenses that support the production or procurement process but cannot be directly attributed to a specific unit. Examples include rent, utilities, insurance, and general administrative costs.

- Variable Costs: These costs vary directly with the level of production or sales. For instance, if a company produces more units, it will incur higher costs for raw materials and direct labor. Variable costs can be directly attributed to each unit produced.

- Fixed Costs: In contrast, fixed costs remain relatively constant regardless of the production or sales volume. Examples include rent, insurance premiums, and certain administrative salaries. These costs are usually spread across the units produced to determine the unit cost.

By breaking down unit cost into these components, businesses can gain a deeper understanding of their cost structure and make informed decisions regarding pricing, production strategies, and cost-cutting measures.

| Cost Component | Description |

|---|---|

| Direct Costs | Raw materials, direct labor, and other expenses directly linked to production. |

| Indirect Costs | Overhead expenses such as rent, utilities, and administrative costs. |

| Variable Costs | Costs that vary with production volume, like raw materials and direct labor. |

| Fixed Costs | Costs that remain constant, such as rent and insurance premiums. |

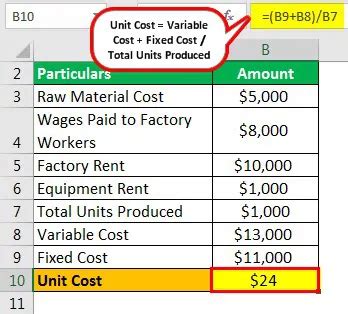

Calculating Unit Cost

The calculation of unit cost is a straightforward process that involves dividing the total cost by the number of units. However, it’s essential to ensure that all relevant costs are included and correctly allocated to each unit. Here’s a step-by-step guide to calculating unit cost:

- Identify all relevant costs: This includes direct costs, indirect costs, variable costs, and fixed costs.

- Determine the production or acquisition volume: Count the total number of units produced or acquired during the specified period.

- Calculate the total cost: Sum up all the relevant costs identified in step 1.

- Divide the total cost by the production or acquisition volume: This gives you the unit cost.

For example, if a company produces 10,000 units with a total cost of $100,000, the unit cost would be $100,000 divided by 10,000, resulting in a unit cost of $10.

Challenges and Considerations

While calculating unit cost seems simple, there are several challenges and considerations to keep in mind. These include:

- Cost Allocation: Allocating overhead costs to individual units can be complex, especially when dealing with shared resources. Businesses often use allocation bases like machine hours, labor hours, or square footage to distribute overhead costs fairly.

- Cost Behavior: Understanding how costs behave in relation to production volume is crucial. Variable costs change with production levels, while fixed costs remain constant. Misinterpreting cost behavior can lead to inaccurate unit cost calculations.

- Changing Market Conditions: Market dynamics, such as fluctuations in raw material prices or labor rates, can impact unit costs. Regularly reviewing and updating cost data is essential to ensure accurate calculations.

Unit Cost in Decision-Making

Unit cost is a critical factor in various business decisions. It influences pricing strategies, production planning, and cost-control measures. By analyzing unit costs, businesses can:

- Determine the minimum price at which products can be sold to cover all associated expenses (break-even point)

- Identify cost-saving opportunities by comparing unit costs across different products, processes, or locations

- Make informed decisions about expanding production capacity or introducing new products based on expected unit costs

- Negotiate better terms with suppliers by understanding the impact of raw material costs on unit cost

Example: Pricing Strategy

Consider a software company developing and selling a new application. By calculating the unit cost, which includes development expenses, marketing costs, and a proportionate share of overhead expenses, the company can set a price that ensures profitability while remaining competitive in the market.

For instance, if the unit cost for developing and marketing the application is $50, the company might set the price at $75 to cover costs and generate a reasonable profit margin. This pricing strategy takes into account the unit cost, market demand, and the company's desired profit level.

Unit Cost and Cost Management

Unit cost is a powerful tool for cost management. By regularly monitoring and analyzing unit costs, businesses can identify trends, anomalies, and areas for improvement. This enables them to:

- Implement cost-saving measures by reducing variable costs or negotiating better deals with suppliers

- Optimize production processes to minimize waste and increase efficiency, thereby reducing unit costs

- Make strategic decisions about product mix, pricing, and production volume based on the latest unit cost data

- Conduct break-even analysis to determine the minimum level of production or sales required to cover all costs

Cost Reduction Strategies

To reduce unit costs, businesses can explore various strategies, including:

- Negotiating with Suppliers: Bargaining for better prices or terms can significantly impact unit costs. For instance, negotiating bulk discounts or longer payment terms can reduce costs.

- Process Optimization: Improving production processes to eliminate waste and increase efficiency can lower unit costs. This may involve investing in new technology, training employees, or streamlining workflows.

- Cost Allocation Review: Regularly reviewing the allocation of overhead costs can ensure fairness and accuracy. Adjusting allocation bases or methods based on changing production patterns can improve cost allocation and unit cost calculations.

Unit Cost and Performance Analysis

Unit cost is a key performance indicator (KPI) that can provide valuable insights into a business’s financial health and operational efficiency. By tracking and analyzing unit costs over time, businesses can identify trends and make informed decisions.

Performance Metrics

Several performance metrics can be derived from unit cost analysis, including:

- Gross Profit Margin: This metric measures the profitability of each unit sold. It is calculated as the selling price per unit minus the unit cost. A higher gross profit margin indicates better profitability.

- Contribution Margin: This metric represents the amount each unit sold contributes to covering fixed costs and generating profits. It is calculated as the selling price per unit minus the variable cost per unit. A higher contribution margin indicates greater potential for profitability.

- Break-Even Point: The break-even point is the level of production or sales at which total revenue equals total costs. It can be calculated using unit cost and selling price information. Understanding the break-even point helps businesses set realistic production and sales targets.

Example: Performance Analysis

Suppose a bakery calculates its unit cost for producing a loaf of bread, including the cost of ingredients, labor, and a proportionate share of overhead expenses. The unit cost is 2.50. If the bakery sells each loaf for 4.00, its gross profit margin would be 1.50 per loaf (4.00 selling price - $2.50 unit cost). This information can guide pricing strategies and help the bakery understand its financial performance.

Future Implications and Strategies

Unit cost analysis provides a solid foundation for strategic planning and decision-making. By understanding current unit costs and their trends, businesses can:

- Anticipate future cost trends and make proactive decisions to maintain profitability

- Develop pricing strategies that align with market conditions and cost fluctuations

- Identify potential cost-saving opportunities through process improvements or technology upgrades

- Assess the financial feasibility of new product launches or market expansions

Long-Term Cost Management

Effective long-term cost management involves regular unit cost analysis and strategic planning. Businesses should:

- Conduct periodic cost-benefit analyses to evaluate the financial impact of proposed changes

- Monitor market trends and competitor pricing to stay competitive

- Invest in research and development to improve production processes and reduce unit costs over time

- Stay informed about changes in regulations, taxes, and labor costs that may impact unit costs

By adopting a proactive approach to cost management and staying responsive to market dynamics, businesses can ensure sustainable profitability and long-term success.

How often should unit costs be calculated and reviewed?

+Unit costs should be calculated and reviewed periodically, typically on a monthly or quarterly basis. This allows businesses to stay updated on their cost structure and make timely adjustments to pricing, production, or cost-saving strategies.

Can unit costs vary significantly between different products or services within the same company?

+Yes, unit costs can vary significantly between different products or services. Factors such as raw material costs, labor intensity, and overhead expenses can lead to differences in unit costs. Understanding these variations is crucial for pricing strategies and resource allocation.

What happens if unit costs exceed the selling price?

+If unit costs exceed the selling price, the business is operating at a loss. This situation is unsustainable in the long term and requires immediate attention. Businesses may need to reconsider their pricing strategy, reduce costs, or explore alternative products or markets.

How can businesses reduce unit costs without compromising quality or customer satisfaction?

+Businesses can reduce unit costs by optimizing processes, negotiating better deals with suppliers, investing in technology to improve efficiency, and exploring cost-effective alternatives without compromising quality. Regular feedback from customers and market research can help ensure that cost-saving measures do not impact customer satisfaction.