Dental Insurance Individual Plan

Dental health is a vital aspect of overall well-being, and having access to affordable and comprehensive dental care is essential for maintaining healthy teeth and gums. For individuals seeking dental coverage outside of traditional group plans, individual dental insurance plans offer a flexible and personalized solution. In this comprehensive guide, we will delve into the world of individual dental insurance plans, exploring their features, benefits, and how they can empower individuals to take control of their oral health.

Understanding Individual Dental Insurance Plans

Individual dental insurance plans are designed specifically for individuals who are not covered by employer-sponsored group plans or other forms of collective coverage. These plans provide an opportunity for individuals to obtain dental benefits tailored to their unique needs, ensuring access to preventive care, treatments, and potential cost savings.

The primary objective of individual dental insurance is to promote regular dental check-ups, cleanings, and early intervention, thereby preventing more extensive and costly dental procedures down the line. By investing in an individual plan, individuals can prioritize their oral health and potentially avoid the financial burden of unexpected dental emergencies.

Key Features of Individual Dental Insurance Plans

Individual dental insurance plans offer a range of features and benefits that cater to the diverse needs of individuals. Here are some key aspects to consider when exploring these plans:

Comprehensive Coverage

Individual dental plans often provide coverage for a wide array of dental services, including routine check-ups, cleanings, X-rays, fillings, root canals, extractions, and even more specialized treatments like orthodontics and dental implants. Some plans may also include coverage for cosmetic procedures, although this varies based on the specific policy.

Flexible Plan Options

Insurers offer a variety of plan options to suit different budgets and dental needs. These plans may vary in terms of premium costs, deductibles, copayments, and coverage limits. Individuals can choose plans that align with their expected dental care requirements, ensuring they receive the right level of coverage without unnecessary expenses.

Network of Dentists

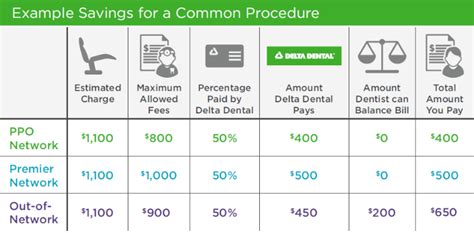

Individual dental plans typically come with a network of preferred dentists and specialists. These networks can include both general dentists and specialists like orthodontists, periodontists, and endodontists. By utilizing in-network providers, individuals can often access reduced rates and simplified claim processes.

| Plan Type | Coverage |

|---|---|

| Basic | Includes preventive care, fillings, and simple extractions |

| Enhanced | Offers additional coverage for root canals, crowns, and bridges |

| Comprehensive | Provides extensive coverage for major procedures like implants and orthodontics |

Preventive Care Focus

Individual dental insurance plans emphasize the importance of preventive care. Many plans cover 100% of the cost for routine check-ups and cleanings, encouraging individuals to maintain regular dental visits. By catching potential issues early on, these plans aim to prevent more serious and costly dental problems in the future.

Discounts and Rewards

Some individual dental plans offer discounts or reward programs to incentivize members to maintain good oral health. These incentives may include reduced rates for certain procedures, discounts on dental products, or even cash back rewards for maintaining a consistent record of preventive care.

The Benefits of Individual Dental Insurance

Opting for an individual dental insurance plan can bring a range of advantages, empowering individuals to take a proactive approach to their oral health and financial well-being.

Access to Quality Care

Individual dental plans provide access to a network of qualified dentists and specialists, ensuring individuals receive high-quality care. By choosing an in-network provider, individuals can benefit from negotiated rates and streamlined claim processes, making dental care more affordable and accessible.

Cost Savings

With individual dental insurance, individuals can save money on dental treatments. The plans often cover a significant portion of the costs for various procedures, reducing the financial burden. Additionally, by encouraging preventive care, these plans help individuals avoid more costly procedures associated with untreated dental issues.

Flexibility and Customization

Individual dental plans offer flexibility in terms of coverage and plan options. Individuals can choose plans that align with their specific needs and budget, ensuring they receive the right level of coverage without unnecessary expenses. This customization allows for a personalized approach to dental care.

Peace of Mind

Having dental insurance provides individuals with peace of mind, knowing that they have access to necessary dental treatments without facing unexpected financial challenges. It eliminates the worry of unexpected dental emergencies and allows individuals to focus on their oral health without financial stress.

How to Choose the Right Individual Dental Plan

Selecting the appropriate individual dental insurance plan requires careful consideration of your unique needs and circumstances. Here are some factors to keep in mind when making your choice:

Evaluate Your Dental Needs

Assess your current and anticipated dental needs. Consider factors such as the frequency of dental check-ups, the likelihood of requiring major treatments, and any specific dental concerns you may have. This evaluation will help you determine the level of coverage you require.

Compare Plan Options

Research and compare different individual dental plans offered by various insurers. Look at the coverage limits, deductibles, copayments, and any additional benefits or incentives provided. Consider the network of dentists and specialists available to ensure access to quality care.

Consider Premium Costs

Evaluate the monthly premium costs associated with each plan. Balance the cost of the premium with the coverage and benefits provided. Remember that a higher premium may not always equate to better coverage, so carefully review the details of each plan.

Read the Fine Print

Pay close attention to the policy details, including any exclusions, limitations, and waiting periods. Understand the terms and conditions to avoid any surprises later on. This ensures that you are fully aware of what is and isn’t covered by your chosen plan.

Seek Professional Advice

If you’re unsure about which plan to choose, consider seeking advice from a licensed insurance agent or financial advisor. They can provide expert guidance based on your specific circumstances, helping you make an informed decision.

Real-Life Examples of Individual Dental Insurance in Action

Let’s explore a few real-life scenarios to illustrate the impact and benefits of individual dental insurance plans:

Scenario 1: Preventive Care and Early Intervention

Imagine Sarah, a young professional who recently moved to a new city and doesn’t have access to employer-sponsored dental coverage. She purchases an individual dental insurance plan with a focus on preventive care. Through regular check-ups and cleanings, Sarah’s dentist identifies early signs of gum disease. With timely intervention and treatment, Sarah avoids more serious complications and maintains her oral health.

Scenario 2: Emergency Dental Care

John, a self-employed individual, invests in an individual dental plan to ensure he has access to emergency dental care. While on a business trip, John experiences severe tooth pain and needs immediate attention. Thanks to his dental insurance, he can locate an in-network dentist in the area and receive the necessary treatment without worrying about excessive out-of-pocket expenses.

Scenario 3: Orthodontic Treatment

Emily, a college student, has always wanted to straighten her teeth but couldn’t afford orthodontic treatment. She opts for an individual dental plan that includes coverage for orthodontics. With the financial support provided by her insurance, Emily is able to pursue her desired treatment, improving her smile and boosting her self-confidence.

Future Implications and Industry Trends

The individual dental insurance market continues to evolve, and several trends and developments are shaping the industry’s future.

Digital Innovations

The rise of digital technology is transforming the dental insurance landscape. Insurers are leveraging digital platforms to enhance customer experiences, offering online enrollment, claim submissions, and policy management. This digital transformation streamlines processes, improves efficiency, and provides greater convenience for policyholders.

Focus on Wellness and Prevention

There is a growing emphasis on wellness and preventive care within the dental insurance industry. Insurers are recognizing the importance of early intervention and are offering incentives and rewards for members who actively engage in preventive dental practices. This shift towards wellness-focused plans aims to reduce overall healthcare costs and improve oral health outcomes.

Personalized Dental Plans

Insurers are exploring personalized dental plans that take into account an individual’s unique oral health needs and history. These plans may utilize advanced analytics and data-driven insights to offer customized coverage and benefits, ensuring that policyholders receive the most appropriate and cost-effective care for their specific circumstances.

Collaborative Care Models

The industry is witnessing a shift towards collaborative care models, where dentists, specialists, and insurers work together to provide integrated and comprehensive dental care. This approach aims to improve patient outcomes, enhance coordination of care, and optimize the overall patient experience.

FAQ

How do I know if an individual dental insurance plan is right for me?

+

Assessing your dental needs, considering your budget, and understanding the coverage options available are key factors in determining if an individual plan is suitable for you. If you value access to quality dental care, want to prioritize preventive measures, and seek financial protection against unexpected dental issues, an individual plan could be a wise choice.

Can I switch my individual dental insurance plan if I’m not satisfied with my current coverage?

+

Yes, you have the flexibility to switch your individual dental insurance plan. However, it’s important to carefully review the terms and conditions of your current plan, including any waiting periods or restrictions, before making a change. Research and compare alternative plans to ensure you find the best fit for your needs.

Are there any discounts or savings available for individual dental insurance plans?

+

Many individual dental insurance plans offer discounts or savings opportunities. These may include multi-policy discounts if you bundle your dental plan with other insurance policies, such as life or health insurance. Additionally, some insurers provide discounts for timely premium payments or for enrolling in automatic payment programs. It’s worth exploring these options to maximize your savings.

What happens if I need dental treatment during the waiting period of my individual plan?

+

Waiting periods are common in individual dental insurance plans and are typically in place to prevent individuals from purchasing coverage solely to receive immediate benefits for pre-existing conditions. If you require dental treatment during the waiting period, you will need to pay for those services out-of-pocket. However, it’s essential to note that certain emergency treatments may be covered immediately, so be sure to review your policy details carefully.

How can I ensure I’m getting the most value from my individual dental insurance plan?

+

To maximize the value of your individual dental insurance plan, stay informed about your coverage limits, deductibles, and copayments. Utilize in-network providers to take advantage of negotiated rates and streamlined claims processes. Prioritize preventive care to avoid more costly procedures down the line. Additionally, keep track of your policy’s renewal dates and explore any available plan upgrades or enhancements to ensure you have the most up-to-date coverage.

Individual dental insurance plans empower individuals to take control of their oral health and financial well-being. By offering comprehensive coverage, flexible plan options, and a focus on preventive care, these plans provide access to quality dental care and potential cost savings. As the industry continues to evolve, individuals can expect to see enhanced digital experiences, a greater emphasis on wellness, and personalized plan options that cater to their unique needs.