Dental Insurance Medicare

Dental care is an essential aspect of overall health, and for many individuals, having access to affordable and comprehensive dental coverage is crucial. While Medicare, the federal health insurance program for older adults and individuals with disabilities, provides a range of health benefits, dental coverage is often a gray area. In this comprehensive guide, we will delve into the world of dental insurance under Medicare, exploring the options, benefits, and considerations for those seeking dental care coverage.

Understanding Medicare’s Dental Coverage

Medicare, a cornerstone of the American healthcare system, offers a variety of services and benefits to its beneficiaries. However, when it comes to dental care, the coverage landscape is somewhat complex. Let’s break it down and explore the nuances of dental insurance within the Medicare framework.

The Basics of Medicare Dental Coverage

Medicare is divided into different parts, each covering specific health services. Medicare Part A covers hospital stays, skilled nursing facility care, and hospice services, while Part B covers outpatient medical services, including doctor visits, lab tests, and durable medical equipment. Part D focuses on prescription drug coverage, offering plans that help individuals manage the cost of medications.

Now, here's where it gets interesting: dental care is not explicitly covered by Original Medicare (Parts A and B). This means that routine dental services like cleanings, fillings, and root canals are typically not included in the standard Medicare benefits package. However, this doesn't mean that dental care is entirely out of reach for Medicare beneficiaries.

| Medicare Part | Coverage |

|---|---|

| Part A | Hospital stays, skilled nursing, hospice |

| Part B | Outpatient medical services, doctor visits, lab tests |

| Part D | Prescription drug coverage |

Exceptions and Limited Coverage

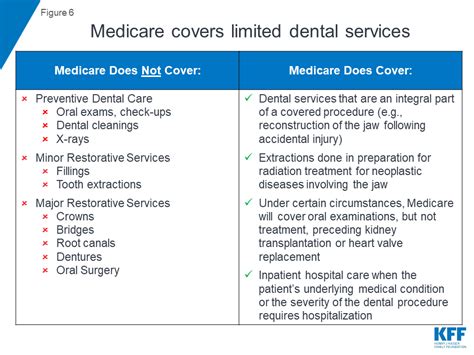

While Medicare doesn’t provide comprehensive dental coverage, there are a few exceptions and limited benefits worth noting. Medicare Part A may cover certain dental services if they are deemed medically necessary as part of a larger medical treatment plan. For example, if a dental issue is related to a covered condition or requires hospitalization, Medicare might step in.

Additionally, Medicare Part B offers limited coverage for specific dental procedures. These include services like oral cancer screenings, diagnostic tests, and certain oral surgeries that are directly related to a covered medical condition. However, it's important to understand that these exceptions are rare and typically involve complex medical situations.

Exploring Dental Insurance Options for Medicare Beneficiaries

Given the limited dental coverage under Original Medicare, many individuals turn to other options to ensure they have access to necessary dental care. Let’s explore some of the avenues available to Medicare beneficiaries seeking dental insurance.

Medicare Advantage Plans (Part C)

One of the most popular ways to gain access to dental coverage is through Medicare Advantage plans, also known as Medicare Part C. These plans are offered by private insurance companies and must provide, at a minimum, the same benefits as Original Medicare (Parts A and B). However, Medicare Advantage plans often go beyond this baseline coverage.

Many Medicare Advantage plans include dental benefits, ranging from basic to comprehensive coverage. These benefits can include routine cleanings, X-rays, fillings, and even more complex procedures like root canals and dentures. The specific coverage and costs vary depending on the plan and the insurance provider.

Enrolling in a Medicare Advantage plan with dental coverage can provide a more seamless and cost-effective solution for individuals who prioritize dental health. These plans often bundle dental care with other health services, making it convenient for beneficiaries to manage their overall health under one plan.

Stand-Alone Dental Insurance Plans

For those who prefer to keep their dental coverage separate from their Medicare benefits, stand-alone dental insurance plans are an option. These plans are specifically designed to cover dental care and can be purchased from private insurance companies. They typically offer a range of coverage levels, from basic to comprehensive, allowing individuals to choose a plan that suits their needs and budget.

Stand-alone dental insurance plans often provide benefits such as annual cleanings, fluoride treatments, and discounts on various dental procedures. Some plans may also cover orthodontia, though this is usually an optional add-on. The costs and coverage limits vary, so it's essential to carefully review the plan details before enrolling.

Discount Dental Plans

An alternative to traditional dental insurance is a discount dental plan. These plans are not insurance in the traditional sense, but rather membership programs that offer reduced rates on dental services. Members pay an annual fee and, in return, receive access to a network of dentists who have agreed to provide services at discounted rates.

Discount dental plans can be a cost-effective solution for individuals who require occasional dental care but don't anticipate frequent or extensive procedures. While they don't provide insurance coverage, they can make dental services more affordable and accessible. It's important to note that these plans typically don't cover the full cost of procedures, and members may still incur out-of-pocket expenses.

Choosing the Right Dental Insurance Option

Selecting the appropriate dental insurance option depends on various factors, including individual needs, budget, and the frequency of dental care required. Let’s explore some considerations to help you make an informed decision.

Assessing Your Dental Needs

The first step in choosing the right dental insurance is understanding your dental needs. Consider the following questions:

- Do you require regular dental check-ups and cleanings, or do you anticipate needing more extensive procedures like root canals or implants?

- Have you had any recent dental issues or concerns that might require ongoing care?

- Are you interested in preventive care to maintain optimal oral health, or do you primarily seek coverage for emergency situations?

Answering these questions will help you gauge the level of coverage you require and guide your decision-making process.

Evaluating Costs and Coverage

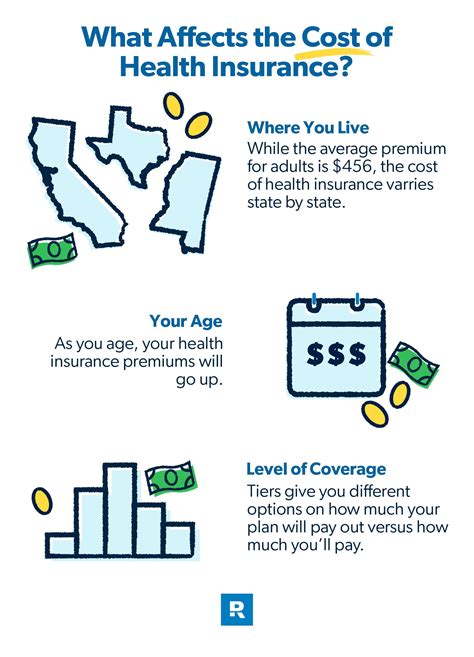

Dental insurance plans come with various costs and coverage levels. When comparing options, consider the following:

- Premiums: This is the monthly cost of the insurance plan. Evaluate whether the premium fits within your budget and consider whether it offers value for the coverage provided.

- Deductibles and Co-payments: Understand the out-of-pocket costs associated with the plan. Deductibles are the amount you pay before insurance coverage kicks in, while co-payments are the fixed amounts you pay for specific services. These can significantly impact your overall expenses.

- Coverage Limits: Review the plan’s coverage limits, including annual maximums and lifetime limits. These limits dictate the maximum amount the insurance company will pay for your dental care. Ensure that the limits align with your anticipated needs.

- Network Restrictions: Some plans have network providers, meaning you must visit dentists within their network to receive coverage. Consider whether you have a preferred dentist or if you’re open to exploring new providers.

Researching Plan Details

To make an informed decision, it’s crucial to thoroughly research the plan details. Consider the following aspects:

- Waiting Periods: Some plans have waiting periods before certain procedures are covered. This means you might need to wait a certain amount of time after enrolling before specific treatments are eligible for coverage.

- Pre-existing Condition Clauses: Check if the plan has any restrictions or exclusions for pre-existing dental conditions. This is particularly important if you have ongoing dental issues.

- Additional Benefits: Explore the extra benefits offered by the plan. This could include orthodontia coverage, discounts on vision care, or even hearing aid discounts.

Maximizing Your Dental Insurance Benefits

Once you’ve selected a dental insurance plan, it’s essential to understand how to make the most of your benefits. Here are some tips to ensure you’re getting the most value from your coverage.

Understanding Your Plan’s Benefits

Take the time to thoroughly read and understand your dental insurance plan’s benefits. Pay attention to the following key aspects:

- Covered Services: Review the list of procedures and services covered by your plan. This will help you anticipate what costs are included and which might be out of pocket.

- Coverage Levels: Different procedures may have different coverage levels. For example, preventive care like cleanings might have higher coverage, while more complex procedures like crowns might have lower coverage.

- Pre-authorization Requirements: Some plans require pre-authorization for certain procedures. This means you must obtain approval from the insurance company before undergoing the treatment. Failing to do so might result in reduced or denied coverage.

Choosing an In-Network Dentist

If your plan has a network of providers, it’s generally more cost-effective to choose a dentist within that network. Here’s why:

- Lower Out-of-Pocket Costs: In-network providers have agreed to accept the plan’s negotiated rates, which are often lower than their usual fees. This can significantly reduce your out-of-pocket expenses.

- Reduced Paperwork: Working with an in-network dentist often simplifies the billing process. The dentist’s office is familiar with the insurance company’s procedures, making it easier to navigate the claims process.

- Better Communication: In-network dentists are more likely to have a direct line of communication with the insurance company, ensuring smoother coordination of care and coverage.

Maintaining Regular Dental Check-ups

One of the most effective ways to maximize your dental insurance benefits is to maintain regular dental check-ups. Here’s why:

- Early Detection: Regular check-ups allow your dentist to identify potential issues early on. This can prevent small problems from becoming major (and costly) procedures.

- Preventive Care: Many insurance plans offer higher coverage for preventive care, such as cleanings and X-rays. By taking advantage of these benefits, you can maintain optimal oral health and potentially avoid more extensive (and expensive) treatments down the line.

- Building a Relationship: Establishing a long-term relationship with your dentist can be beneficial. They can keep track of your oral health history, making it easier to identify any changes or potential concerns.

Future Outlook and Industry Trends

The landscape of dental insurance for Medicare beneficiaries is evolving, and understanding the potential changes and trends can help individuals make informed decisions about their coverage.

Growing Awareness and Demand

There is a growing awareness among Medicare beneficiaries about the importance of dental care and the need for comprehensive coverage. This increased awareness is driving a demand for dental insurance options that better meet the needs of this population.

As more individuals recognize the link between oral health and overall well-being, the demand for dental coverage is likely to continue rising. Insurance providers and Medicare Advantage plans are responding to this demand by offering more robust dental benefits to attract and retain beneficiaries.

Expansion of Dental Benefits

In response to the growing demand, we can expect to see an expansion of dental benefits within Medicare Advantage plans. These plans are increasingly including dental coverage as a standard feature, making it easier for beneficiaries to access necessary dental care without the added complexity of managing multiple insurance policies.

Additionally, there may be a trend toward more comprehensive dental coverage, with plans offering benefits for a wider range of procedures. This could include increased coverage for orthodontia, implants, and other restorative treatments, making it more affordable for individuals to address long-standing dental issues.

Focus on Preventive Care

The industry is also likely to place a greater emphasis on preventive dental care. Insurance providers and Medicare Advantage plans may incentivize beneficiaries to prioritize regular check-ups and cleanings by offering higher coverage levels for these services. This shift towards preventive care can lead to better oral health outcomes and potentially reduce the need for costly treatments down the line.

Technological Advancements

The dental industry is embracing technological advancements, and this trend is expected to continue. Insurance providers may leverage technology to improve the claims process, making it more efficient and convenient for beneficiaries. This could include digital claim submissions, real-time benefit verification, and streamlined prior authorization processes.

Additionally, telemedicine and teledentistry are gaining traction, offering remote consultations and even some treatment options. This can provide greater accessibility to dental care, especially for individuals in rural or underserved areas.

Conclusion

Navigating the world of dental insurance under Medicare can be complex, but with the right information and resources, individuals can make informed decisions about their dental care coverage. Whether through Medicare Advantage plans, stand-alone dental insurance, or discount plans, there are options available to ensure access to necessary dental services.

As the industry evolves, we can expect to see continued improvements in dental coverage for Medicare beneficiaries. By staying informed about the latest trends and options, individuals can take control of their oral health and ensure they receive the care they need to maintain a healthy smile.

Can I get dental coverage through Original Medicare (Parts A and B)?

+Original Medicare (Parts A and B) generally does not cover routine dental care. However, there are limited exceptions for medically necessary dental procedures that are part of a larger treatment plan.

What are the benefits of enrolling in a Medicare Advantage plan with dental coverage?

+Medicare Advantage plans often provide more comprehensive dental coverage than Original Medicare. Enrolling in a plan with dental benefits can offer convenience, as it bundles dental care with other health services, and may provide better value for those who require regular dental care.

Are there any disadvantages to stand-alone dental insurance plans?

+Stand-alone dental insurance plans can be a great option for those who prioritize dental care. However, they may come with additional costs, such as separate premiums and out-of-pocket expenses. It’s important to carefully review the plan details and ensure it aligns with your budget and coverage needs.

How can I find the best dental insurance option for my needs?

+To find the best dental insurance option, assess your dental needs, budget, and preferences. Research and compare different plans, considering factors like premiums, coverage limits, network restrictions, and additional benefits. Seeking advice from insurance brokers or financial advisors can also be beneficial.