Dental Insurance Plans For Individuals

In the world of dental care, having a reliable insurance plan can make a significant difference in your oral health journey. For individuals seeking comprehensive coverage, understanding the intricacies of dental insurance plans is crucial. This comprehensive guide aims to unravel the complexities, offering an expert perspective on the best individual dental insurance plans available today.

Unraveling the Complexity of Dental Insurance

Dental insurance plans are designed to provide financial support for a range of dental procedures, from routine check-ups and cleanings to more complex treatments like root canals and orthodontic work. For individuals, choosing the right plan involves careful consideration of their specific dental needs and preferences.

Understanding Coverage Levels

Dental insurance plans typically offer coverage at three main levels: basic, major, and preventive. Basic coverage includes routine procedures like fillings and simple extractions. Major coverage extends to more complex and costly procedures such as crowns, bridges, and root canals. Preventive coverage focuses on maintaining oral health through regular check-ups, cleanings, and X-rays.

| Coverage Type | Procedures Covered |

|---|---|

| Basic | Fillings, simple extractions, and minor procedures |

| Major | Crowns, bridges, root canals, and complex treatments |

| Preventive | Check-ups, cleanings, X-rays, and fluoride treatments |

Most dental insurance plans offer a combination of these coverage levels, allowing individuals to tailor their plan to their specific needs. For instance, those with a history of gum disease might prioritize preventive coverage, while individuals with complex dental issues may opt for a plan with a higher major coverage limit.

Evaluating Plan Features

Beyond coverage levels, individual dental insurance plans differ in various features, each impacting the overall value and suitability of the plan. These features include:

- Annual Maximum: This is the maximum amount the insurance company will pay out in a year. Plans with higher annual maximums can provide more financial protection for costly procedures.

- Waiting Periods: Some plans have waiting periods for certain procedures, especially for major treatments. Understanding these periods is crucial to avoid surprises when seeking treatment.

- Network Providers: Dental insurance plans often have a network of preferred providers, offering discounted rates. Choosing a plan with a network that includes your preferred dentist can lead to significant savings.

- Coverage Limitations: Plans may have specific limitations or exclusions, such as age restrictions or coverage caps for certain procedures. These limitations can significantly impact the value of the plan for different individuals.

Top Individual Dental Insurance Plans

When it comes to selecting the best individual dental insurance plan, several factors come into play. These include the scope of coverage, the quality of the provider network, the plan’s flexibility, and of course, the cost. Here are some of the top-rated plans currently available on the market, along with a detailed breakdown of their key features and benefits.

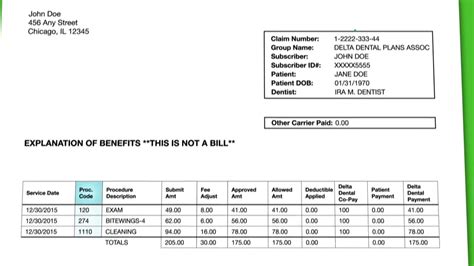

Delta Dental Premier

Delta Dental Premier is renowned for its extensive coverage and provider network. This plan offers 100% coverage for diagnostic and preventive services, 80% coverage for basic procedures, and 50% coverage for major treatments. One of the standout features of Delta Dental Premier is its large network of over 150,000 dentists, ensuring individuals have access to quality care nationwide.

MetLife Dental Choices Standard

MetLife Dental Choices Standard provides a comprehensive range of benefits, making it an excellent choice for individuals seeking a well-rounded plan. This plan covers 100% of preventive services, 80% of basic procedures, and 50% of major treatments. What sets MetLife apart is its flexibility, allowing individuals to choose from a broad network of dentists, including specialists, for their care.

Cigna Dental 1000

Cigna Dental 1000 is a popular choice for its balance of coverage and affordability. This plan covers 100% of preventive services, 80% of basic procedures, and 50% of major treatments. Cigna’s network includes over 90,000 dental professionals, ensuring individuals can find quality care close to home. Additionally, Cigna offers a unique benefit - a free annual oral cancer screening, adding an extra layer of preventive care.

Aetna Dental Access

Aetna Dental Access is known for its simplicity and value. This plan offers straightforward coverage with 100% preventive services, 50% basic procedures, and 30% major treatments. While the coverage levels are lower compared to other plans, Aetna Dental Access shines in its network of over 140,000 dentists, ensuring individuals can access quality care without sacrificing convenience.

Guardian DentalGuard Premier

Guardian DentalGuard Premier is a premium plan designed for individuals seeking the highest level of coverage. This plan covers 100% of preventive services, 80% of basic procedures, and a generous 70% of major treatments. Guardian’s network includes over 120,000 dentists, providing individuals with a wide range of choices for their dental care needs. Additionally, Guardian offers unique benefits such as orthodontic coverage for adults, making it an excellent choice for those seeking comprehensive orthodontic treatment.

Navigating the Selection Process

Choosing the right individual dental insurance plan involves careful consideration of your unique dental needs and financial situation. Here are some key steps to guide you through the selection process:

- Assess Your Dental Needs: Begin by evaluating your current and potential future dental needs. Consider your oral health history, any ongoing treatments, and any specific procedures you anticipate needing in the near future.

- Compare Coverage Levels: Review the coverage levels offered by different plans. Look for plans that provide adequate coverage for the procedures you're most likely to need. Remember, preventive coverage is essential for maintaining good oral health.

- Evaluate Provider Networks: Ensure the plan's provider network includes your preferred dentist or specialists. A broad network can provide more flexibility and potentially lower out-of-pocket costs.

- Consider Annual Maximums: Higher annual maximums can provide more financial protection for costly procedures. If you anticipate needing extensive dental work, a plan with a higher maximum could be a wise choice.

- Review Waiting Periods: Understand the waiting periods for different procedures. Some plans may have shorter waiting periods, allowing you to access certain treatments sooner.

- Assess Cost and Value: Compare the cost of different plans against their coverage and benefits. Look for plans that offer the best value for your specific needs. Remember, the cheapest plan might not always be the best choice if it lacks the coverage you require.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a pivotal role in promoting and maintaining good oral health. By providing financial support for a range of dental procedures, insurance plans encourage individuals to seek regular preventive care and address dental issues promptly. This proactive approach can lead to improved overall health, as oral health is closely linked to general well-being.

Furthermore, dental insurance plans often include coverage for essential preventive services such as check-ups, cleanings, and X-rays. These procedures are vital for detecting and addressing dental issues in their early stages, preventing more complex and costly problems down the line. By covering these preventive measures, insurance plans not only improve oral health but also reduce the financial burden of dental care.

Conclusion: Empowering Your Dental Health Journey

Navigating the world of individual dental insurance plans can be complex, but with the right knowledge and tools, you can make an informed decision that best suits your needs. By understanding the various coverage levels, plan features, and the impact of dental insurance on your oral health, you can take control of your dental care and make choices that promote a healthy smile.

Remember, choosing the right dental insurance plan is an investment in your long-term oral health. With the right coverage, you can access the care you need, when you need it, ensuring a lifetime of healthy smiles.

How do I know if I’m eligible for an individual dental insurance plan?

+Eligibility for individual dental insurance plans typically depends on factors such as age, residency, and employment status. Most plans are open to individuals of all ages, including students and retirees. However, some plans may have specific eligibility criteria, so it’s important to review the plan’s guidelines carefully.

Can I use my dental insurance plan outside of my network?

+While most dental insurance plans offer discounted rates when you use in-network providers, many plans also provide coverage for out-of-network care. However, the level of coverage may be lower, and you may incur higher out-of-pocket costs. It’s essential to review your plan’s specific guidelines regarding out-of-network coverage.

What happens if I change my dentist within the same insurance network?

+Changing dentists within the same insurance network should not affect your coverage. However, it’s a good idea to notify your insurance provider of the change to ensure that your records are updated. This can help streamline the claims process and avoid any potential issues with your coverage.

How often should I review my dental insurance plan’s coverage and benefits?

+It’s a good practice to review your dental insurance plan’s coverage and benefits annually, or whenever you experience significant changes in your oral health needs. This ensures that your plan continues to meet your needs and provides the necessary coverage for any ongoing or anticipated treatments.

Related Terms:

- Full coverage dental insurance

- Cigna dental insurance

- Best dental insurance

- Delta Dental insurance

- Humana dental insurance