Dental Insurance Plans Ga

Dental insurance is an essential aspect of maintaining good oral health and financial well-being. In the state of Georgia, residents have access to a range of dental insurance plans that offer comprehensive coverage and benefits. This article will delve into the world of dental insurance in Georgia, exploring the various options available, the key features to consider, and how to choose the right plan for your needs.

Understanding Dental Insurance in Georgia

Dental insurance in Georgia, like in many other states, provides individuals and families with access to affordable dental care. It helps cover the costs of various dental procedures, from routine check-ups and cleanings to more complex treatments like root canals and dental implants. With a dental insurance plan, Georgians can ensure they receive the necessary dental care without incurring significant out-of-pocket expenses.

The dental insurance market in Georgia is diverse, with numerous providers offering a wide array of plans. These plans can vary significantly in terms of coverage, network providers, and cost. Understanding the unique features of each plan is crucial for Georgians to make an informed decision and select the most suitable option for their dental needs.

Key Features of Dental Insurance Plans in Georgia

When exploring dental insurance plans in Georgia, there are several key features that individuals should consider to find the best fit:

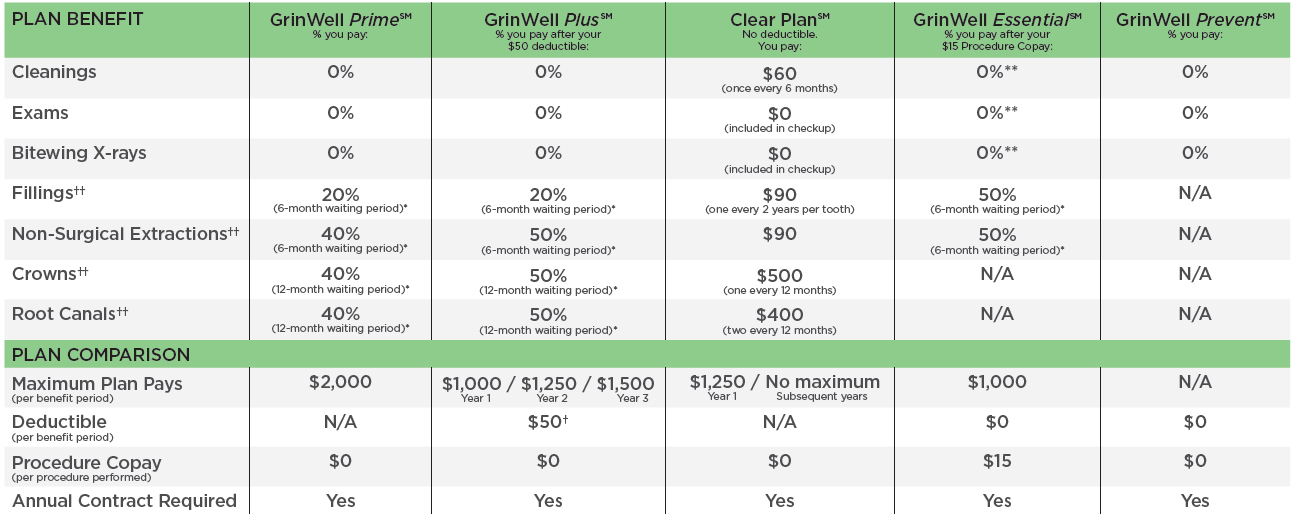

- Coverage Limits and Benefits: Each dental insurance plan has specific coverage limits and benefits. Some plans may offer more comprehensive coverage for procedures like orthodontics or dental surgeries, while others might prioritize preventive care with higher annual maximums for cleanings and check-ups. It's essential to assess your dental needs and choose a plan that aligns with them.

- Network Providers: Dental insurance plans often have a network of preferred providers. These are dentists and dental practices that have agreed to accept the insurance plan's rates. Choosing a plan with a robust network ensures you have access to a wide range of dental professionals and facilities. It's advisable to review the network list to ensure your preferred dentist or specialist is included.

- Waiting Periods: Certain dental insurance plans may impose waiting periods before certain procedures are covered. For instance, there might be a waiting period of 6 months to 1 year for major restorative work. Understanding these waiting periods is crucial to avoid surprises and plan your dental treatments accordingly.

- Cost and Deductibles: The cost of dental insurance plans can vary significantly, and it's important to consider the monthly premiums, deductibles, and co-pays. Some plans might have higher premiums but offer lower out-of-pocket costs, while others might have lower premiums with higher deductibles. Assess your budget and financial comfort to find a plan that strikes the right balance.

- Additional Benefits: Certain dental insurance plans offer additional benefits like discounts on vision care, hearing aids, or even wellness programs. These added perks can enhance the overall value of the plan. Consider whether these additional benefits align with your health and wellness goals.

Choosing the Right Dental Insurance Plan

With a plethora of dental insurance options available in Georgia, selecting the right plan can be a challenging task. Here are some steps to guide you through the process:

Assess Your Dental Needs

The first step is to evaluate your current and potential future dental needs. Consider your dental history, the dental care requirements of your family members, and any specific treatments you might anticipate in the coming years. Are you primarily focused on preventive care, or do you have more complex dental needs that require specialized treatment?

Compare Plans and Providers

Research and compare different dental insurance plans offered by reputable providers in Georgia. Look for plans that offer the coverage and benefits that align with your assessed needs. Pay close attention to the network providers to ensure your preferred dentists are included. Additionally, consider the reputation and customer service ratings of the insurance companies to ensure a smooth experience.

Review the Fine Print

Before finalizing your decision, carefully review the policy documents and terms of each plan. Understand the coverage limits, waiting periods, and any exclusions or limitations. Look for any hidden costs or restrictions that might impact your dental care. It’s essential to have a clear understanding of what is and isn’t covered to avoid unexpected expenses.

Consider Your Budget

While dental insurance is an investment in your oral health, it’s important to choose a plan that fits within your financial means. Assess your monthly budget and consider the impact of the premiums on your finances. Remember, a lower premium might mean higher out-of-pocket costs when you need treatment. Find a balance that works for your financial situation without compromising the quality of your dental care.

Seek Professional Advice

If you’re unsure about which dental insurance plan to choose, consider seeking advice from a financial advisor or an insurance broker. These professionals can provide expert guidance based on your specific needs and budget. They can also help you understand the intricacies of different plans and ensure you make an informed decision.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a pivotal role in promoting and maintaining good oral health. With the right coverage, Georgians can access the dental care they need without facing financial barriers. Regular dental check-ups and cleanings can prevent oral health issues from escalating into more serious problems, reducing the need for costly and invasive treatments down the line.

Additionally, dental insurance encourages individuals to seek timely treatment for dental emergencies or chronic conditions. This proactive approach to oral health not only improves overall well-being but also reduces the risk of complications and potential systemic health issues linked to poor oral hygiene.

| Plan Name | Coverage Highlights | Network Size | Premium Range |

|---|---|---|---|

| Bright Smile Dental Plan | 100% coverage for preventive care, 80% for basic services, 50% for major procedures | Over 5,000 providers statewide | $30 - $50 per month |

| Healthy Teeth Insurance | Includes orthodontics coverage, no waiting period for basic services | 4,000+ dentists and specialists | $45 - $65 per month |

| Dental Care Plus | High annual maximums, covers experimental treatments | Select network of 3,500 providers | $55 - $75 per month |

How often should I visit the dentist with dental insurance coverage?

+It is generally recommended to visit your dentist twice a year for check-ups and cleanings. Dental insurance plans often cover these preventive visits at 100%, encouraging regular dental care. Staying consistent with your dental visits can help catch potential issues early and maintain optimal oral health.

Are there any discounts available for families with multiple members seeking dental insurance?

+Yes, many dental insurance providers offer family plans with discounted rates. These plans ensure that all family members are covered under one policy, making it more affordable for families to maintain good oral health together.

Can I switch dental insurance plans if I’m not satisfied with my current coverage?

+While it’s generally possible to switch dental insurance plans, there might be restrictions and waiting periods involved. It’s advisable to review your current plan’s terms and conditions and consult with an insurance professional before making any changes to ensure a smooth transition.