Dental Insurance Ppo

Dental insurance is an essential aspect of maintaining good oral health and can provide significant financial benefits for individuals and families. Among the various types of dental insurance plans available, Preferred Provider Organization (PPO) plans have gained popularity due to their flexibility and wide network of dental care providers. In this comprehensive article, we will delve into the world of Dental Insurance PPOs, exploring their features, advantages, and how they can impact your oral health journey.

Understanding Dental Insurance PPOs

A Preferred Provider Organization (PPO) dental insurance plan offers policyholders the freedom to choose from a network of contracted dentists and specialists. Unlike other plan types, PPOs prioritize convenience and flexibility, allowing individuals to visit any dentist within the network without requiring a referral. This flexibility is a key advantage, as it empowers individuals to select the dental professionals they trust and ensures access to a diverse range of oral health services.

Dental PPO plans typically offer a more comprehensive coverage compared to other insurance types. They often include a wide range of procedures, from routine check-ups and cleanings to more complex treatments like root canals, orthodontics, and even cosmetic dentistry. The level of coverage can vary depending on the specific plan and the insurer, but generally, PPOs provide a higher percentage of coverage for in-network services, making dental care more affordable for policyholders.

Key Features of Dental Insurance PPOs

Dental PPO plans come with several distinctive features that set them apart from other insurance options. Understanding these features is crucial when considering a PPO plan for your oral health needs.

Wide Network of Dentists

One of the most appealing aspects of PPO plans is their extensive network of dental providers. Insurers contract with a large number of dentists, specialists, and oral health professionals, ensuring policyholders have ample options when selecting a dental care provider. This network can include general dentists, orthodontists, endodontists, periodontists, and other specialists, providing comprehensive care for various dental needs.

| Specialty | Description |

|---|---|

| General Dentist | Provides routine dental care, including check-ups, cleanings, and basic treatments. |

| Orthodontist | Specializes in correcting misaligned teeth and jaws using braces or other orthodontic appliances. |

| Endodontist | Focuses on treating the inner parts of the tooth, often performing root canal procedures. |

| Periodontist | Specializes in the prevention, diagnosis, and treatment of gum diseases and conditions affecting the supporting structures of the teeth. |

The ability to choose from a diverse network of dentists ensures that individuals can find a provider who aligns with their specific needs, whether it's proximity to their residence, a preferred treatment approach, or a dentist who specializes in a particular area of concern.

Flexibility and Referral-Free Access

A significant advantage of PPO plans is the flexibility they offer. Policyholders can visit any dentist within the network without the need for a referral from a primary care dentist. This means individuals have the freedom to choose a dentist based on their personal preferences and needs, without the hassle of obtaining prior authorization.

The referral-free access not only saves time and administrative effort but also allows for a more personalized approach to dental care. Individuals can build a long-term relationship with their chosen dentist, ensuring consistent and familiar care over time.

Comprehensive Coverage

Dental PPO plans are known for their comprehensive coverage, providing policyholders with a wide range of oral health services. These plans typically cover:

- Preventive Care: Routine check-ups, cleanings, and diagnostic services like X-rays are often covered at a higher percentage, encouraging regular dental visits for early detection and prevention of oral health issues.

- Basic Procedures: Common procedures such as fillings, extractions, and minor surgical treatments are usually included in the coverage, with a lower out-of-pocket cost compared to other insurance types.

- Major Procedures: More complex and costly treatments like root canals, crowns, and bridges are also covered, although the specific coverage and out-of-pocket costs may vary depending on the plan and insurer.

- Orthodontic Services: Many PPO plans offer coverage for orthodontic treatments, making it more accessible for individuals seeking braces or other corrective procedures. The level of coverage can vary, and some plans may require a separate orthodontic rider or additional premium.

- Cosmetic Dentistry: While cosmetic procedures are often not covered by basic insurance plans, some PPOs may include a limited amount of coverage for cosmetic treatments, such as teeth whitening or veneers. The extent of coverage will depend on the specific plan and insurer.

The comprehensive nature of PPO plans ensures that policyholders can access a wide range of dental services, promoting better oral health and overall well-being.

Benefits of Choosing a Dental Insurance PPO Plan

Opting for a Dental Insurance PPO plan can offer numerous advantages, making it an appealing choice for individuals and families. Here are some key benefits to consider:

Convenience and Accessibility

PPO plans prioritize convenience by offering a wide network of dental providers. Policyholders can easily find a dentist located near their home or workplace, reducing the need for long commutes or travel. This accessibility is especially beneficial for individuals with busy schedules or those who prioritize convenience in their healthcare choices.

Freedom of Choice

The flexibility of PPO plans allows individuals to choose their preferred dentist without restrictions. This freedom is valuable, as it enables policyholders to select a dentist who understands their specific needs, whether it’s a gentle approach for anxious patients, a focus on preventative care, or expertise in a particular dental specialty.

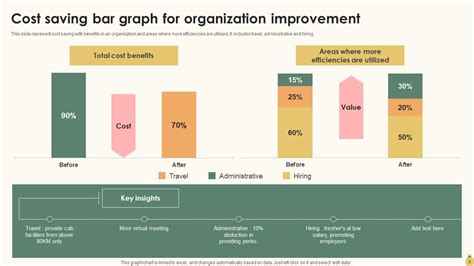

Cost Savings

Dental PPO plans often provide significant cost savings compared to paying out-of-pocket for dental services. With a PPO plan, policyholders can access discounted rates negotiated by the insurer with the network dentists. This means that even for more complex procedures, the out-of-pocket cost is typically lower than what an uninsured individual would pay.

Additionally, PPO plans encourage preventive care by offering higher coverage percentages for routine check-ups and cleanings. This incentive can lead to early detection of oral health issues, potentially preventing more costly and extensive treatments down the line.

Wide Range of Covered Services

PPO plans are known for their comprehensive coverage, including a wide array of dental services. From basic procedures like fillings and extractions to more specialized treatments like root canals and orthodontics, PPO plans provide a safety net for unexpected dental issues. This peace of mind is invaluable, ensuring that individuals can access the care they need without financial strain.

Potential for Discounted Specialist Services

The extensive network of dentists in PPO plans often includes specialists like orthodontists, endodontists, and periodontists. This means that individuals can access specialized care at discounted rates, making complex treatments more affordable. Whether it’s straightening teeth with braces or undergoing a root canal procedure, PPO plans can provide significant cost savings compared to paying for specialist services out-of-pocket.

Choosing the Right Dental Insurance PPO Plan

When selecting a Dental Insurance PPO plan, it’s crucial to consider your specific needs and preferences. Here are some factors to keep in mind:

Network of Dentists

Review the network of dentists available under the PPO plan. Ensure that the plan includes dentists located conveniently for you, whether it’s near your home, workplace, or a specific area of interest. Check if your preferred dentist is in-network, and if not, consider the ease of finding an alternative provider.

Coverage and Benefits

Carefully examine the coverage details of the PPO plan. Pay attention to the percentage of coverage for different types of procedures, such as preventive care, basic treatments, and major procedures. Understand any limitations or exclusions, and ensure that the plan aligns with your expected dental needs.

Consider any additional benefits the plan may offer, such as coverage for orthodontic services, cosmetic dentistry, or alternative treatments like dental implants. These added benefits can enhance the value of the plan and provide greater flexibility in your oral health journey.

Premiums and Out-of-Pocket Costs

Evaluate the monthly premiums and out-of-pocket costs associated with the PPO plan. Consider your budget and the expected frequency of dental visits. While PPO plans offer cost savings for in-network services, there may be differences in premiums and deductibles between plans. Choose a plan that balances your budget with the level of coverage and benefits you require.

Reputation and Reviews

Research the reputation and customer reviews of the insurance provider offering the PPO plan. Look for feedback on the ease of claim processing, customer service responsiveness, and overall satisfaction with the plan. Positive reviews and a strong reputation can indicate a reliable and trustworthy insurance provider.

Dental Insurance PPOs: A Comprehensive Approach to Oral Health

Dental Insurance PPO plans offer a flexible and comprehensive approach to oral health, providing policyholders with access to a wide network of dental providers and a range of covered services. The benefits of PPO plans, including convenience, freedom of choice, and cost savings, make them an attractive option for individuals seeking quality dental care.

By understanding the features and advantages of Dental Insurance PPOs, individuals can make informed decisions when selecting an insurance plan. With the right PPO plan, individuals can prioritize their oral health, access the care they need, and maintain a confident smile.

Frequently Asked Questions

How do I find a dentist within my PPO network?

+

To locate a dentist within your PPO network, you can use the insurer’s website or mobile app, which often provides a searchable database of in-network providers. Alternatively, you can contact the insurer’s customer service and provide your location or preferred specialty to receive a list of nearby dentists.

Are there any limitations or exclusions with PPO plans?

+

While PPO plans offer comprehensive coverage, there may be certain limitations or exclusions. These can include specific procedures, pre-existing conditions, or maximum annual benefits. It’s important to review the plan’s summary of benefits to understand any limitations and ensure that the plan aligns with your expected dental needs.

Can I switch dentists within the PPO network?

+

Yes, you can switch dentists within the PPO network at any time. The flexibility of PPO plans allows you to choose a different dentist based on your changing needs or preferences. Simply locate a new dentist within the network and schedule an appointment.

Do PPO plans cover emergency dental services?

+

PPO plans typically cover emergency dental services, including unexpected injuries or severe pain. However, the specific coverage and out-of-pocket costs may vary depending on the plan and the nature of the emergency. It’s advisable to review the plan’s coverage details or contact the insurer for clarification on emergency dental coverage.

Are there any age limits or restrictions for PPO plans?

+

PPO plans are generally available to individuals of all ages, including children and seniors. However, there may be variations in coverage or benefits for different age groups. It’s essential to review the plan’s details to understand any age-specific limitations or adjustments in coverage.