Dental Insurance Price

Dental insurance is an essential aspect of healthcare coverage, offering individuals and families financial protection and access to necessary dental services. The price of dental insurance is a crucial consideration for those seeking comprehensive oral health care, and it can vary significantly depending on various factors. In this comprehensive article, we delve into the world of dental insurance pricing, exploring the key elements that influence costs, providing real-world examples, and offering valuable insights to help you make informed decisions about your dental coverage.

Understanding the Factors That Impact Dental Insurance Prices

The cost of dental insurance is influenced by a multitude of factors, each playing a unique role in determining the overall price. By understanding these elements, individuals can better navigate the complex landscape of dental insurance and make choices that align with their specific needs and budget.

Coverage Plans and Benefits

One of the primary factors affecting dental insurance prices is the chosen coverage plan and the benefits it offers. Dental plans vary widely in terms of the services they cover and the extent of coverage provided. Basic plans often focus on preventive care, such as regular check-ups, cleanings, and X-rays, while more comprehensive plans may include additional benefits like orthodontics, restorative procedures, and emergency treatments.

For instance, let's consider two hypothetical dental plans: Plan A and Plan B. Plan A is a budget-friendly option, covering essential preventive services like biannual check-ups and cleanings. On the other hand, Plan B offers a more extensive coverage package, including orthodontics, root canals, and dental implants. Naturally, Plan B would carry a higher price tag due to the expanded range of benefits it provides.

| Plan | Coverage | Price |

|---|---|---|

| Plan A | Preventive Care | $25/month |

| Plan B | Comprehensive Care | $45/month |

Age and Demographic Factors

Another significant factor influencing dental insurance prices is the age of the insured individual. Generally, younger individuals tend to have lower dental insurance premiums compared to older adults. This is primarily due to the lower risk of extensive dental issues among younger populations, as they often have healthier teeth and gums and require fewer complex procedures.

Additionally, certain demographic factors can also impact dental insurance costs. For example, individuals residing in urban areas with a higher cost of living may encounter pricier dental insurance rates compared to those in rural regions. Furthermore, the state in which you reside can play a role, as some states have higher average dental care costs, leading to increased insurance premiums.

Consider the following scenario: John, a 35-year-old residing in a rural area, and Sarah, a 55-year-old living in an urban center, both seek dental insurance. Due to their differing ages and locations, their insurance premiums would likely vary significantly, with Sarah's premium being higher due to her age and the higher cost of living in her urban environment.

Network Size and Preferred Providers

The size and composition of the dental insurance network also contribute to pricing variations. Dental insurance providers typically maintain networks of preferred dentists and specialists, and the cost of insurance can be influenced by the number and quality of providers within these networks.

Insurance plans with extensive networks often offer a broader selection of dentists and specialists, providing greater flexibility and convenience for policyholders. Conversely, plans with smaller networks may limit your choices but can result in more affordable premiums. It's essential to strike a balance between network size and cost, ensuring you have access to a sufficient number of qualified dental professionals while staying within your budget.

Additional Features and Add-ons

Dental insurance plans may offer optional features and add-ons that can enhance your coverage but also increase the overall price. These additional benefits can include orthodontic coverage, vision care, or even discounts on dental products and services. While these add-ons can be beneficial, it’s crucial to carefully evaluate your needs and determine whether they are worth the added cost.

For example, if you have children and anticipate the need for orthodontic treatment in the future, opting for a plan that includes orthodontic coverage might be a wise decision. However, for individuals who primarily require basic preventive care, adding orthodontic coverage might be an unnecessary expense.

Real-World Examples of Dental Insurance Pricing

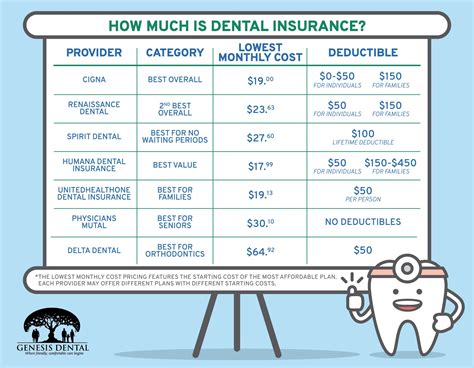

To illustrate the variability in dental insurance prices, let’s explore some real-world examples based on different scenarios and coverage needs.

Individual Coverage for Preventive Care

Imagine a 28-year-old individual, Emily, who is seeking dental insurance primarily for preventive care. She resides in a suburban area with a moderate cost of living. Based on her age and location, Emily’s insurance premium for a basic preventive care plan could range from 20 to 30 per month. This plan would typically cover biannual check-ups, cleanings, and X-rays, providing her with essential dental maintenance.

Family Coverage with Comprehensive Benefits

Now, consider a family of four consisting of two adults and two children. The parents, aged 40 and 38, are seeking comprehensive dental insurance coverage for themselves and their children, aged 10 and 7. Given the family’s age range and the need for more extensive coverage, their insurance premium could fall between 100 and 150 per month. This plan would likely include preventive care, orthodontics, and restorative procedures, ensuring the entire family’s oral health needs are met.

Senior Coverage for Specialized Care

John, a 65-year-old retiree, requires dental insurance to cover specialized care, including dentures and root canal treatments. Given his age and the nature of his required procedures, John’s insurance premium could range from 50 to 80 per month. This plan would typically offer coverage for a wider range of services, catering to the unique dental needs of seniors.

Tips for Finding Affordable Dental Insurance

Navigating the dental insurance market can be challenging, but with the right strategies, you can find affordable coverage that meets your needs. Here are some valuable tips to help you secure cost-effective dental insurance:

- Compare Plans: Research and compare multiple dental insurance plans to find the best value. Look for plans that offer the coverage you need at a reasonable price. Consider using online comparison tools to streamline the process.

- Evaluate Your Needs: Assess your current and future dental needs. If you primarily require preventive care, opt for a basic plan. However, if you anticipate more complex procedures, consider a comprehensive plan that provides the necessary coverage.

- Explore Discount Programs: In addition to traditional insurance plans, explore discount dental programs that offer reduced rates for dental services. These programs can be an affordable alternative, especially if you require occasional dental care rather than ongoing maintenance.

- Negotiate with Providers: If you frequently visit the same dental office, consider discussing potential discounts or payment plans with your dentist. Many dental practices offer flexible payment options or discounts for patients who pay out of pocket.

- Utilize Employee Benefits: If you're employed, inquire about dental insurance options through your employer. Many companies offer group dental insurance plans that can provide significant cost savings compared to individual plans.

The Future of Dental Insurance: Trends and Innovations

The dental insurance landscape is continually evolving, driven by advancements in dental technology, changing consumer needs, and innovative business models. Here’s a glimpse into some emerging trends and innovations that are shaping the future of dental insurance:

Tele-dentistry and Digital Health

The integration of technology into dental care is revolutionizing the way dental services are delivered and accessed. Tele-dentistry, for instance, allows patients to consult with dentists remotely, offering convenient and cost-effective solutions for minor dental issues and follow-up appointments. Additionally, digital health platforms are enhancing patient engagement and education, empowering individuals to take a more active role in their oral health management.

Value-Based Care Models

Traditional fee-for-service models are being challenged by value-based care approaches, which focus on delivering high-quality dental care while controlling costs. These models incentivize dental providers to prioritize preventive care and patient outcomes, shifting the emphasis from the quantity of services to the overall health and satisfaction of patients.

In-Network Discounts and Partnerships

Dental insurance providers are increasingly forming partnerships with dental practices and establishing in-network discounts. These arrangements can lead to significant cost savings for policyholders, as in-network providers agree to accept reduced fees for their services. As a result, patients benefit from lower out-of-pocket expenses and more affordable dental care.

Consumer-Driven Health Plans

Consumer-driven health plans, including health savings accounts (HSAs) and flexible spending accounts (FSAs), are gaining popularity in the dental insurance market. These plans offer individuals greater control over their healthcare spending, allowing them to save pre-tax dollars for dental and medical expenses. By combining consumer-driven plans with dental insurance, individuals can optimize their healthcare savings and potentially reduce their overall costs.

Conclusion

Understanding the factors that influence dental insurance prices is essential for making informed choices about your oral health coverage. By considering your specific needs, researching various plans, and staying abreast of industry trends and innovations, you can navigate the dental insurance landscape with confidence and find a plan that provides the necessary coverage at a price that aligns with your budget.

Remember, dental insurance is a crucial component of your overall healthcare strategy, and by staying informed and proactive, you can ensure that you and your family receive the dental care you deserve.

How much does dental insurance typically cost per month?

+The cost of dental insurance can vary significantly depending on factors such as coverage plans, age, and location. On average, individual dental insurance plans can range from 20 to 50 per month, while family plans may cost between 100 and 200 per month. It’s important to compare plans and assess your specific needs to find the most cost-effective option.

Are there any discounts available for dental insurance?

+Yes, there are several ways to obtain discounts on dental insurance. Some employers offer group dental insurance plans at discounted rates. Additionally, discount dental programs and consumer-driven health plans can provide cost savings for individuals and families. It’s worth exploring these options to find the most affordable coverage.

What factors determine the cost of dental insurance for seniors?

+The cost of dental insurance for seniors can be influenced by several factors, including their age, the type of coverage required (e.g., specialized care), and the location where they reside. Generally, seniors may face higher insurance premiums due to the increased likelihood of needing more extensive dental procedures. However, exploring senior-specific dental plans or discount programs can help mitigate these costs.