Different Life Insurance

In today's complex financial landscape, life insurance has evolved beyond the traditional whole life and term policies. The diverse needs of individuals and families have spurred the development of various life insurance options, each catering to specific financial goals and circumstances. This article aims to provide an in-depth exploration of the different types of life insurance, their unique features, and how they can be strategically employed to secure one's financial future.

Understanding the Core Life Insurance Types

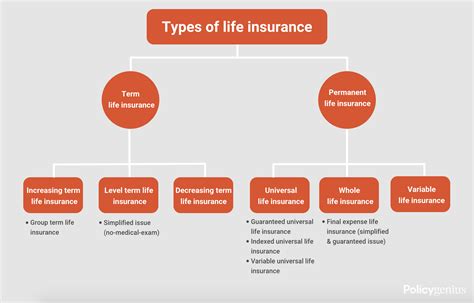

The life insurance market primarily consists of two broad categories: permanent life insurance and term life insurance. Permanent life insurance, as the name suggests, offers lifelong coverage and typically includes a cash value component. On the other hand, term life insurance provides coverage for a defined period, often ranging from 10 to 30 years, and is generally more affordable.

Term Life Insurance: A Cost-Effective Solution

Term life insurance is an excellent choice for those seeking coverage during specific life stages, such as while raising a family or paying off a mortgage. It offers a high level of coverage at a relatively low cost. For instance, a 35-year-old non-smoker can secure a 500,000 term life policy for approximately 20 to $30 per month.

Term life insurance is particularly useful for individuals with limited financial resources or those who need temporary coverage. It is a straightforward and affordable way to ensure financial protection for your loved ones during critical periods.

Permanent Life Insurance: Coverage for a Lifetime

Permanent life insurance, which includes whole life, universal life, and variable universal life policies, provides lifelong coverage. These policies typically have a higher premium cost but offer the added benefit of a cash value component that grows over time. This cash value can be borrowed against or withdrawn to meet various financial needs.

For example, a whole life insurance policy provides a fixed death benefit and a guaranteed cash value growth rate. The cash value can be used to pay for policy premiums or borrowed against to meet emergency financial needs. This makes whole life insurance an attractive option for those seeking long-term financial security and a reliable source of funds.

The Rising Star: Universal Life Insurance

Universal life insurance is a flexible permanent life insurance option that offers more flexibility than whole life insurance. It provides coverage for life and allows policyholders to adjust their premium payments and death benefit amounts as their financial needs change.

Universal life insurance policies have a cash value component that is credited with interest. This interest rate is typically higher than whole life policies, offering greater growth potential. For instance, a 40-year-old policyholder could adjust their premium payments to cover the cost of their child's college education or to increase their retirement savings.

| Life Insurance Type | Coverage | Premium Flexibility | Cash Value Growth |

|---|---|---|---|

| Term Life | Fixed period (e.g., 10-30 years) | Low to moderate | None |

| Whole Life | Lifetime | Fixed | Moderate to high |

| Universal Life | Lifetime | High | High |

Variable Life Insurance: Customizing Your Coverage

Variable life insurance policies offer a unique twist, allowing policyholders to invest their cash value in a range of investment options, including stocks, bonds, and mutual funds. This provides the potential for higher cash value growth, but also comes with the risk of investment losses.

While variable life insurance offers flexibility and the potential for higher returns, it also carries more risk. Policyholders must carefully consider their investment options and regularly monitor their policy's performance. This type of insurance is best suited for those with a high-risk tolerance and a solid understanding of financial markets.

The Benefits of Variable Life Insurance

- Potential for higher cash value growth

- Flexibility in investment choices

- Opportunity to customize coverage based on financial goals

Final Thoughts: Choosing the Right Life Insurance

The decision to purchase life insurance is a significant one, and the choice of policy type should align with your financial goals and life stage. Whether you opt for the affordability of term life insurance, the security of whole life insurance, or the flexibility of universal or variable life insurance, it’s crucial to understand the unique features and benefits of each type.

When making your decision, consider your financial needs, the length of coverage required, and your tolerance for risk. It's also advisable to consult with a financial advisor or insurance professional who can guide you through the process and help you select the best policy for your circumstances.

FAQ

Can I convert my term life insurance to permanent life insurance?

+Yes, many term life insurance policies offer a conversion option, allowing you to switch to a permanent life insurance policy without a medical exam. This can be a beneficial strategy if your financial needs change or you want to ensure lifelong coverage.

How does the cash value in life insurance work?

+The cash value in permanent life insurance policies grows over time and can be used for various financial needs. It can be borrowed against or withdrawn, providing a source of funds for emergencies, education expenses, or other financial goals. However, it’s important to note that borrowing against the cash value may reduce the death benefit.

What happens if I miss a premium payment on my life insurance policy?

+Missing a premium payment can have different consequences depending on the type of policy you have. Term life insurance policies may lapse if premiums are missed, resulting in the loss of coverage. Permanent life insurance policies often have a grace period, allowing you to make the missed payment without penalty. It’s crucial to understand the terms of your policy and make timely payments to maintain coverage.