Different Types Of Insurance Allstate Provides

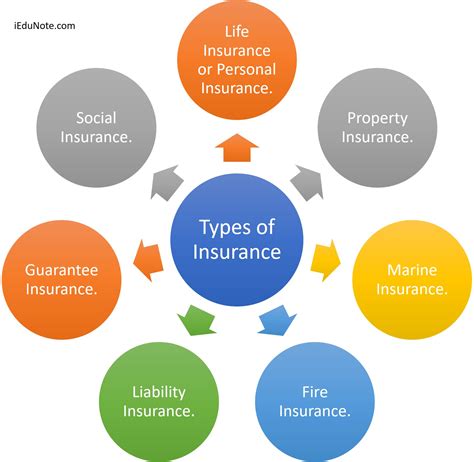

Insurance plays a pivotal role in our lives, offering financial protection and peace of mind against various risks and uncertainties. Allstate, a prominent player in the insurance industry, understands the diverse needs of its customers and provides a comprehensive range of insurance products to cater to these needs. Let's delve into the different types of insurance that Allstate offers and explore how they can provide security and stability in our lives.

Auto Insurance: Navigating the Road with Confidence

For many individuals, their vehicles are more than just a means of transportation; they are a symbol of independence and mobility. Allstate’s auto insurance policies are tailored to provide comprehensive coverage for car owners. These policies offer protection against accidents, theft, and other unforeseen events that can occur on the road.

Comprehensive Coverage Options

Allstate’s auto insurance policies come with a range of coverage options to suit different needs and budgets. Here’s a glimpse at some of the key features:

- Liability Coverage: This coverage protects policyholders against bodily injury and property damage claims made by others in the event of an accident.

- Collision Coverage: It covers the cost of repairs or replacements for the insured vehicle if it collides with another vehicle or object.

- Comprehensive Coverage: This option provides protection against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: Allstate’s policies often include this feature, which covers medical expenses for the policyholder and their passengers in the event of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards policyholders against financial losses if they are involved in an accident with a driver who has no insurance or insufficient insurance coverage.

Additional Benefits and Discounts

Allstate goes beyond traditional auto insurance by offering a range of additional benefits and discounts to its policyholders. These include:

- Safe Driving Bonuses: Policyholders who maintain a clean driving record may be eligible for discounts or other incentives.

- Accident Forgiveness: In certain situations, Allstate may waive rate increases after an at-fault accident, ensuring that one mistake doesn’t lead to higher premiums.

- Usage-Based Insurance: Programs like Allstate’s Drivewise allow drivers to earn discounts based on their driving habits, encouraging safer and more eco-friendly driving.

- Multi-Policy Discounts: Customers who bundle their auto insurance with other Allstate policies, such as home or renters’ insurance, often receive significant discounts.

| Coverage Type | Description |

|---|---|

| Liability | Protects against bodily injury and property damage claims. |

| Collision | Covers repair or replacement costs after an accident. |

| Comprehensive | Provides protection against non-collision events. |

| Medical Payments | Covers medical expenses for the insured and passengers. |

| Uninsured/Underinsured Motorist | Offers financial protection when involved with uninsured drivers. |

Home Insurance: Protecting Your Sanctuary

Your home is more than just a physical structure; it’s a sanctuary where you create cherished memories and build a life. Allstate’s home insurance policies are designed to protect your home and its contents against a wide range of risks.

Coverage Options for Homeowners

Allstate offers a comprehensive array of coverage options for homeowners, including:

- Dwelling Coverage: This provides protection for the physical structure of your home, including the walls, roof, and other permanent fixtures.

- Personal Property Coverage: Allstate’s policies cover the contents of your home, including furniture, electronics, and personal belongings, in the event of theft, damage, or loss.

- Liability Coverage: Similar to auto insurance, home insurance policies offer liability protection, safeguarding you against claims made by others for bodily injury or property damage that occurs on your property.

- Additional Living Expenses: In the event of a covered loss that makes your home uninhabitable, Allstate’s policies often include coverage for additional living expenses, such as temporary housing and meals.

Customizable Coverage for Your Home

Allstate understands that every home is unique, and so are its insurance needs. Here’s how Allstate allows homeowners to tailor their coverage:

- Replacement Cost vs. Actual Cash Value: Policyholders can choose between replacement cost coverage, which ensures your home and its contents are replaced with similar items, or actual cash value coverage, which provides compensation based on the item’s current value.

- Personal Property Coverage Limits: Allstate allows homeowners to adjust the limits of their personal property coverage to ensure they have adequate protection for their valuable belongings.

- Optional Coverages: Depending on the specific needs of the homeowner, Allstate offers additional coverages, such as protection against water damage, identity theft, or coverage for high-value items like jewelry or artwork.

| Coverage Type | Description |

|---|---|

| Dwelling | Covers the physical structure of the home. |

| Personal Property | Protects the contents of the home. |

| Liability | Offers protection against bodily injury and property damage claims. |

| Additional Living Expenses | Covers temporary living expenses in case of a covered loss. |

Renters Insurance: Peace of Mind for Renters

Renters often believe that their landlord’s insurance policy covers their personal belongings, but this is a common misconception. Allstate’s renters insurance policies are tailored to protect the possessions and liability of individuals living in rented properties.

Key Features of Renters Insurance

Here’s a closer look at what Allstate’s renters insurance policies typically include:

- Personal Property Coverage: This coverage provides protection for the tenant’s belongings, including furniture, clothing, electronics, and other personal items, in the event of theft, damage, or loss.

- Liability Coverage: Renters insurance also offers liability protection, similar to homeowners insurance. This coverage safeguards the tenant against claims made by others for bodily injury or property damage that occurs within the rented premises.

- Additional Living Expenses: In the event that a covered loss makes the rental unit uninhabitable, Allstate’s renters insurance policies often include coverage for additional living expenses, such as temporary housing and meals.

Customizing Your Renters Insurance

Allstate understands that renters have diverse needs and budgets. Here’s how they allow renters to personalize their insurance coverage:

- Coverage Limits: Renters can choose the limits of their personal property coverage based on the value of their belongings.

- Optional Coverages: Allstate offers additional coverages for renters, such as protection against water damage, identity theft, or coverage for high-value items like jewelry or artwork.

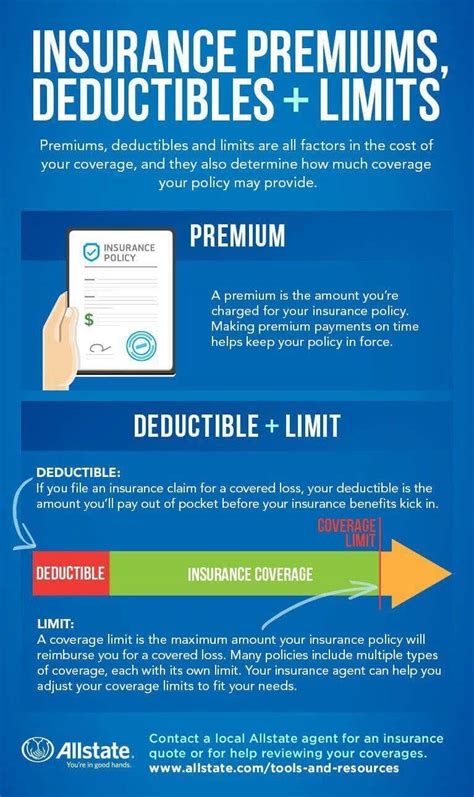

- Deductibles: Renters can select their preferred deductible amount, which affects the premium they pay. A higher deductible typically results in a lower premium.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers the tenant's belongings. |

| Liability | Offers protection against bodily injury and property damage claims. |

| Additional Living Expenses | Covers temporary living expenses in case of a covered loss. |

Life Insurance: Securing Your Loved Ones’ Future

Life insurance is an essential aspect of financial planning, providing a safety net for your loved ones in the event of your untimely demise. Allstate offers a range of life insurance policies to cater to different needs and life stages.

Types of Life Insurance Offered by Allstate

Allstate’s life insurance policies can be broadly categorized into two main types:

- Term Life Insurance: This type of policy provides coverage for a specified term, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. Term life insurance is often more affordable than permanent life insurance.

- Permanent Life Insurance: As the name suggests, permanent life insurance provides lifelong coverage. It includes a death benefit, as well as a cash value component that grows over time. The cash value can be borrowed against or withdrawn, providing flexibility and potential tax benefits.

Key Benefits of Allstate’s Life Insurance Policies

- Financial Security for Beneficiaries: Allstate’s life insurance policies ensure that your loved ones are financially secure in the event of your passing. The death benefit can help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

- Flexibility and Customization: Allstate allows policyholders to tailor their life insurance coverage to their specific needs. This includes choosing the amount of coverage, the term of the policy (for term life insurance), and adding optional riders to enhance the policy’s benefits.

- Potential Tax Benefits: Permanent life insurance policies, such as whole life or universal life insurance, offer tax advantages. The cash value component grows tax-deferred, and policyholders may be able to take tax-free loans or withdrawals from this cash value during their lifetime.

| Life Insurance Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specified term, offering a death benefit if the policyholder passes away during that term. |

| Permanent Life Insurance | Offers lifelong coverage, including a death benefit and a cash value component that grows over time. |

Business Insurance: Protecting Your Professional Endeavors

Whether you’re a sole proprietor, own a small business, or manage a large corporation, Allstate understands the unique risks associated with running a business. Their business insurance policies are designed to provide comprehensive protection, allowing business owners to focus on growth and success without worrying about unforeseen liabilities.

Coverage Options for Businesses

Allstate’s business insurance policies offer a wide range of coverage options to protect against various risks, including:

- Property Coverage: This coverage protects your business’s physical assets, such as buildings, equipment, inventory, and other tangible property, against damage or loss due to events like fires, storms, or vandalism.

- Liability Coverage: Allstate’s business insurance policies offer liability protection, which is essential for any business. This coverage safeguards your business against claims made by customers, employees, or the public for bodily injury, property damage, or other covered losses that occur due to your business operations.

- Business Interruption Coverage: In the event that your business is forced to shut down temporarily due to a covered loss, this coverage can provide financial support to help cover ongoing expenses and lost income.

- Workers’ Compensation Coverage: If your business has employees, this coverage is crucial. It provides benefits to employees who are injured or become ill due to work-related causes, including medical expenses and wage replacement.

Tailored Solutions for Different Businesses

Allstate recognizes that no two businesses are alike, and their insurance policies reflect this diversity. Here’s how they cater to different business needs:

- Industry-Specific Coverage: Allstate offers specialized coverage for various industries, such as healthcare, hospitality, retail, and more. These policies are designed to address the unique risks and liabilities associated with each industry.

- Small Business Coverage: Allstate understands the unique challenges faced by small businesses. Their small business insurance policies provide comprehensive coverage at an affordable cost, ensuring that even the smallest enterprises are protected.

- Customizable Limits and Deductibles: Business owners can choose coverage limits and deductibles that align with their risk tolerance and budget. This flexibility allows businesses to strike a balance between protection and cost.

| Coverage Type | Description |

|---|---|

| Property | Protects business assets against damage or loss. |

| Liability | Offers protection against bodily injury and property damage claims. |

| Business Interruption | Provides financial support in case of temporary business shutdown. |

| Workers' Compensation | Covers expenses for employees injured on the job. |

Conclusion: Allstate’s Comprehensive Insurance Solutions

Allstate’s commitment to providing a comprehensive range of insurance products reflects their understanding of the diverse needs of their customers. Whether you’re a homeowner, renter, driver, business owner, or planning for your family’s future, Allstate has an insurance solution tailored to your specific requirements. By offering customizable coverage options, competitive pricing, and a range of additional benefits and discounts, Allstate ensures that their customers can navigate life’s uncertainties with confidence and peace of mind.

FAQ

Can I bundle my auto and home insurance policies with Allstate to save money?

+

Absolutely! Allstate encourages customers to bundle their insurance policies to take advantage of multi-policy discounts. By combining your auto and home insurance, you can often save significantly on your premiums.

What additional coverages can I add to my renters insurance policy?

+

Allstate offers a range of optional coverages for renters insurance, including protection against water damage, identity theft, and coverage for high-value items. These coverages can be added to your policy to enhance your protection.

How does Allstate’s life insurance policy help with tax benefits?

+

Permanent life insurance policies, such as whole life or universal life insurance, offered by Allstate, include a cash value component that grows tax-deferred. This cash value can be borrowed against or withdrawn, providing potential tax advantages.