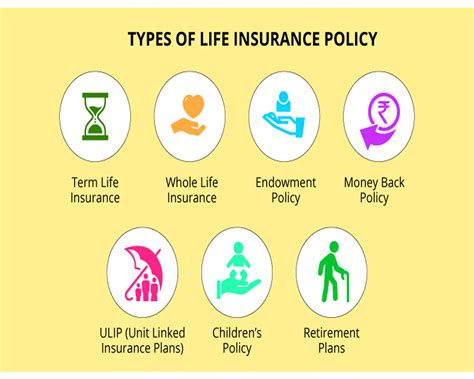

Different Types Of Life Insurance Policies

Life insurance is an essential financial tool that provides peace of mind and security for individuals and their loved ones. With various types of life insurance policies available, understanding the differences and selecting the right one is crucial to meet your specific needs. In this comprehensive guide, we will delve into the world of life insurance, exploring the key types, their features, and how they can benefit you.

Term Life Insurance

Term life insurance is the most basic and commonly chosen type of life insurance policy. It offers coverage for a specific period, typically ranging from 10 to 30 years, known as the term. During this term, the policy provides a death benefit to the beneficiaries in the event of the policyholder’s demise. The key characteristic of term life insurance is its affordability, making it an attractive option for individuals seeking temporary coverage.

Features and Benefits

- Affordability: Term life insurance policies are generally more cost-effective compared to permanent life insurance. The premiums are fixed for the duration of the term, ensuring predictable expenses.

- Flexibility: These policies offer flexibility in terms of coverage amounts and term lengths. You can choose a term that aligns with your specific needs, such as covering mortgage payments or providing financial support during your children’s education years.

- Guaranteed Protection: During the term, the policy ensures that your beneficiaries will receive the full death benefit, regardless of any changes in your health or personal circumstances.

- Renewal and Conversion Options: Many term life insurance policies allow for renewal or conversion to a permanent policy at the end of the term, providing an opportunity to extend coverage if needed.

Real-Life Example

John, a 35-year-old father of two, purchases a 20-year term life insurance policy with a $500,000 death benefit. He chooses this option to ensure his family’s financial security in the event of his untimely demise during their dependent years. The policy provides peace of mind, knowing that their mortgage, education expenses, and daily living costs are covered.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the entirety of the policyholder’s life, as long as the premiums are paid. This type of insurance offers more comprehensive benefits and can serve multiple purposes beyond just providing a death benefit.

Types of Permanent Life Insurance

- Whole Life Insurance: This is the most traditional form of permanent life insurance. It offers a fixed death benefit, cash value accumulation, and guaranteed premiums throughout the policyholder’s life. Whole life insurance provides stability and long-term financial protection.

- Universal Life Insurance: Universal life insurance offers more flexibility in terms of premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefit within certain limits, making it suitable for those seeking customization.

- Variable Life Insurance: Variable life insurance allows policyholders to invest a portion of their premiums in different investment options, such as stocks or mutual funds. While offering potential higher returns, it also carries more risk compared to whole or universal life insurance.

Key Advantages of Permanent Life Insurance

- Lifetime Coverage: Permanent life insurance ensures that your loved ones are protected, no matter your age or health status.

- Cash Value Accumulation: Many permanent life insurance policies build cash value over time, which can be borrowed against or withdrawn, providing financial flexibility.

- Tax Benefits: The cash value component of permanent life insurance often enjoys tax advantages, making it an attractive option for long-term wealth accumulation.

- Additional Riders: Permanent life insurance policies often offer optional riders, such as critical illness or long-term care coverage, providing comprehensive protection.

Performance Analysis

The performance of permanent life insurance policies can vary based on the type and the investment strategy chosen. Whole life insurance policies offer guaranteed returns and stability, making them ideal for conservative investors. On the other hand, variable life insurance policies can provide higher returns but also carry higher risks.

| Permanent Life Insurance Type | Key Features |

|---|---|

| Whole Life | Guaranteed death benefit, cash value growth, and fixed premiums. |

| Universal Life | Flexible premiums and death benefit, suitable for customization. |

| Variable Life | Investment options for potential higher returns, but with increased risk. |

Return of Premium (ROP) Life Insurance

Return of Premium life insurance is a unique type of policy that combines term life insurance with a refund feature. With this policy, if the policyholder outlives the term, a portion or all of the premiums paid are returned.

Benefits of ROP Life Insurance

- Peace of Mind: Like term life insurance, ROP policies provide financial protection during a specified term, ensuring your loved ones are taken care of.

- Premium Refund: If you survive the term, you receive a refund of your premiums, making it a cost-effective option in the long run.

- Flexibility: ROP life insurance policies often offer the option to convert to a permanent policy, providing the flexibility to extend coverage.

Considerations

While ROP life insurance can be appealing, it’s important to note that the refund feature may reduce the death benefit over time. Additionally, the premiums for ROP policies are typically higher compared to standard term life insurance.

Comparative Analysis

When choosing between different life insurance policies, it’s essential to consider your financial goals, the level of coverage needed, and your budget. Term life insurance is ideal for those seeking temporary coverage at an affordable cost. Permanent life insurance, on the other hand, provides lifetime protection and additional financial benefits, making it suitable for long-term financial planning.

| Policy Type | Coverage | Cost | Flexibility | Additional Benefits |

|---|---|---|---|---|

| Term Life | Temporary | Affordable | Renewal/Conversion Options | None |

| Whole Life | Lifetime | Higher Premiums | Limited Flexibility | Cash Value Accumulation |

| Universal Life | Lifetime | Flexible Premiums | High Flexibility | Cash Value and Customization |

| Variable Life | Lifetime | Varies | Investment Options | Potential Higher Returns |

| Return of Premium | Temporary | Higher than Term | Conversion Option | Premium Refund |

FAQs

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage ends, and you no longer have protection. However, some policies offer conversion options, allowing you to convert your term policy into a permanent one.

Can I borrow money from my life insurance policy?

+

Yes, with certain types of permanent life insurance policies, such as whole life or universal life, you can borrow against the cash value accumulated within the policy. However, this should be done with caution, as it can impact the death benefit and future cash value growth.

How do I know if I need life insurance?

+

Life insurance is crucial if you have financial dependents, such as a spouse, children, or aging parents. It provides a safety net to ensure their financial well-being in the event of your untimely demise. Even if you’re single, life insurance can cover funeral expenses and any outstanding debts.