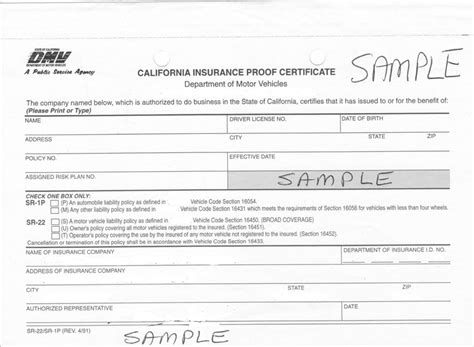

Dmv Ca Proof Of Insurance

In the state of California, providing proof of insurance is a crucial aspect of maintaining compliance with the law and ensuring the safety of yourself and others on the road. The Department of Motor Vehicles (DMV) in California has specific requirements and guidelines for proof of insurance, and it is essential for drivers to understand their responsibilities and the consequences of non-compliance.

Understanding Proof of Insurance in California

Proof of insurance is a document that serves as evidence that a vehicle owner or driver has valid and active insurance coverage. In California, having auto insurance is mandatory by law, and drivers must be able to provide proof when requested by authorized individuals, such as law enforcement officers or DMV officials.

The purpose of requiring proof of insurance is twofold. Firstly, it ensures that drivers are financially responsible and capable of covering potential damages or liabilities arising from accidents. Secondly, it promotes road safety by reducing the risk of uninsured motorists causing harm or facing financial difficulties in the event of an accident.

What is Acceptable Proof of Insurance in California?

The DMV in California accepts various forms of documentation as proof of insurance. Here are the commonly accepted options:

- Insurance ID Card: This is the most common form of proof. It is a wallet-sized card provided by your insurance company, which contains important details such as your policy number, effective dates, and the name of your insurance provider. Ensure that the card is up-to-date and valid.

- Insurance Policy Declaration Page: Another acceptable proof is a copy of the declaration page of your insurance policy. This page includes essential information, including policy limits, coverage details, and the insured vehicle's details. Make sure to have a clear and readable copy available.

- Electronic Proof: In today's digital age, many insurance companies offer electronic proof of insurance. This can be in the form of a digital ID card, an email confirmation, or a mobile app-based proof. Ensure that you have the necessary tools and access to present this electronic proof when needed.

It is important to note that the proof of insurance must be valid and current. Outdated or expired insurance documents are not acceptable, and they may lead to legal consequences.

Situations Where Proof of Insurance is Required

There are several scenarios in which you may be required to provide proof of insurance:

Traffic Stops and Law Enforcement

During a traffic stop, law enforcement officers have the authority to request proof of insurance. If you are unable to provide valid proof, you may face fines and penalties. It is always advisable to keep your insurance documents readily accessible in your vehicle.

Vehicle Registration and Renewal

When registering a vehicle or renewing your registration, the DMV will require proof of insurance. Failure to provide proof may result in your registration being denied or delayed. It is crucial to ensure that your insurance coverage aligns with the registration process and meets the state’s minimum requirements.

DMV Services and Transactions

When conducting various transactions at the DMV, such as applying for a driver’s license, title transfer, or vehicle registration, you may be asked to present proof of insurance. Having the necessary documentation ready will streamline the process and avoid any potential issues.

| DMV Transaction | Proof of Insurance Required |

|---|---|

| New Driver's License Application | Yes |

| Vehicle Registration Renewal | Yes |

| Title Transfer | Yes |

| Duplicate Registration | Yes |

| Vehicle Inspection | May be required |

Consequences of Failing to Provide Proof of Insurance

Non-compliance with the proof of insurance requirements in California can lead to significant consequences. Here are some potential outcomes:

- Fines and Penalties: If you are caught driving without proof of insurance, you may be issued a citation and face fines. The amount of the fine can vary depending on the circumstances and the discretion of the law enforcement officer.

- Suspension of Registration: In some cases, the DMV may suspend your vehicle registration if you fail to provide proof of insurance. This means you will not be able to legally operate your vehicle until the issue is resolved.

- Increased Insurance Costs: If you are involved in an accident or receive a citation for lack of insurance, your insurance company may increase your premiums or even cancel your policy. This can lead to higher costs for future insurance coverage.

- Legal Implications: In severe cases, driving without insurance can result in criminal charges. This can have long-lasting effects on your driving record and legal status.

How to Avoid Non-Compliance

To avoid the aforementioned consequences, it is crucial to maintain valid insurance coverage and ensure that your proof of insurance is always up-to-date and readily available. Here are some tips to help you stay compliant:

- Review your insurance policy regularly to ensure it meets the minimum requirements set by the state of California.

- Set reminders for insurance renewals to avoid lapses in coverage.

- Keep your insurance ID card or declaration page in a safe and accessible location.

- Familiarize yourself with the acceptable forms of proof and ensure you have the necessary documentation.

- Stay informed about any changes or updates to the proof of insurance requirements by visiting the official DMV website or consulting with your insurance provider.

Electronic Proof of Insurance: The Digital Alternative

With advancements in technology, many insurance companies now offer electronic proof of insurance options. These digital alternatives provide convenience and ease of access, especially for those who prefer paperless solutions.

Benefits of Electronic Proof

Using electronic proof of insurance offers several advantages:

- Convenience: Electronic proof can be easily accessed from your smartphone or digital devices, eliminating the need to carry physical documents.

- Real-Time Updates: Digital proof is often linked directly to your insurance provider's system, ensuring that the information is always up-to-date.

- Eco-Friendly: By opting for electronic proof, you contribute to a more sustainable and paperless environment.

- Quick Access: In the event of a traffic stop or inspection, you can quickly retrieve and present your electronic proof, saving time and effort.

How to Obtain Electronic Proof

To obtain electronic proof of insurance, you can follow these steps:

- Contact your insurance provider and inquire about their digital proof options.

- If available, request the digital proof to be sent to your email or downloaded onto your device.

- Familiarize yourself with the digital proof format and ensure it meets the requirements set by the DMV.

- Consider using reliable mobile apps or digital wallets to store and manage your electronic proof securely.

Future Implications and Changes

As technology continues to evolve, the DMV and insurance industry may explore further innovations in proof of insurance requirements. Here are some potential future developments:

- Blockchain Technology: Implementing blockchain-based insurance verification systems could enhance security and streamline the proof of insurance process.

- Digital Wallets and Passports: Integrating proof of insurance into digital wallets or passports could provide a more seamless and secure experience.

- Automated Vehicle Registration: With the rise of connected cars, automated vehicle registration systems may incorporate proof of insurance checks, ensuring compliance at the time of registration.

While these future implications are exciting, it is important to stay informed about any changes and updates to the proof of insurance requirements in California. Regularly check the official DMV website and consult reputable sources for the most accurate and up-to-date information.

Conclusion

Understanding and complying with the proof of insurance requirements in California is essential for every driver. By keeping valid insurance coverage and having the necessary proof readily available, you can avoid legal issues and contribute to a safer road environment. Remember, staying informed and proactive about your insurance obligations is key to a smooth driving experience.

What happens if I am involved in an accident without proof of insurance?

+If you are involved in an accident without proof of insurance, you may face significant financial and legal consequences. You could be held liable for damages and injuries caused, and your insurance company may deny coverage. It is crucial to maintain valid insurance and have proof readily available to protect yourself and others.

Can I use a printed copy of my insurance ID card as proof?

+Yes, a printed copy of your insurance ID card can be used as proof of insurance. Ensure that the copy is clear and legible, and keep it with you whenever you are driving. It is always a good idea to have multiple forms of proof available in case of emergencies.

Are there any exemptions from the proof of insurance requirement in California?

+There are limited exemptions to the proof of insurance requirement in California. Certain vehicles, such as those used exclusively for agricultural purposes or driven by individuals with certain religious beliefs, may be exempt. However, these exemptions are rare, and it is best to consult with the DMV or a legal professional for specific guidance.