Dmv Proof Of Insurance

Obtaining and maintaining proper vehicle insurance is a crucial aspect of responsible driving. One common requirement that drivers encounter is the need to provide Proof of Insurance (POI) when interacting with the Department of Motor Vehicles (DMV). This process ensures that vehicle owners are complying with state regulations and carrying adequate insurance coverage. In this comprehensive guide, we will delve into the world of DMV Proof of Insurance, exploring the requirements, procedures, and best practices to ensure a smooth and stress-free experience.

Understanding the Importance of Proof of Insurance

Proof of Insurance serves as a vital document that verifies your vehicle's insurance coverage. It acts as a safeguard, ensuring that all drivers on the road have the necessary financial protection in case of accidents or other incidents. By presenting a valid POI, you demonstrate your responsibility as a driver and your commitment to adhering to the legal requirements of your state.

The DMV plays a pivotal role in enforcing these regulations, as it is responsible for registering vehicles, issuing licenses, and ensuring overall road safety. By requiring Proof of Insurance, the DMV aims to minimize the financial burden on victims of accidents caused by uninsured drivers. This practice also encourages drivers to take their insurance obligations seriously, promoting a safer and more responsible driving environment for everyone.

What is Considered Proof of Insurance?

The concept of Proof of Insurance encompasses various documents that provide evidence of your vehicle's insurance coverage. While the specific requirements may vary depending on your state and insurance provider, there are some common forms of POI that are widely accepted:

- Insurance Card: Most insurance companies issue physical or digital insurance cards that serve as a convenient form of Proof of Insurance. These cards typically include important details such as your name, policy number, effective dates, and the name of your insurance company. It is a quick and easy way to demonstrate your insurance coverage.

- Insurance Policy Declaration Page: The declaration page of your insurance policy is a comprehensive document that outlines all the essential details of your coverage. It includes information about the insured vehicle, policy limits, deductibles, and coverage types. While it may not be as portable as an insurance card, it provides a detailed overview of your insurance status.

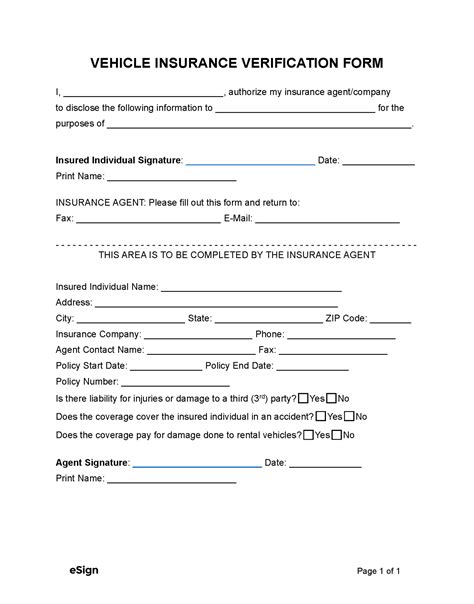

- Certificate of Insurance: A Certificate of Insurance is an official document that confirms your insurance coverage. It is often used in commercial settings or when renting a vehicle. This certificate typically includes information about the insured party, the effective dates of coverage, and the specific risks or perils covered by the policy.

- Insurance Binder: In some cases, an insurance binder can serve as temporary Proof of Insurance. An insurance binder is a document issued by your insurance company that confirms the initiation of your insurance policy. It provides proof of coverage until your official insurance documents are issued. Binders are commonly used when you need immediate coverage and are awaiting the final policy documents.

When is Proof of Insurance Required by the DMV?

The DMV typically requires Proof of Insurance during specific interactions or transactions related to your vehicle. Understanding when to present your POI can help you stay prepared and avoid any potential issues.

Vehicle Registration

When registering a new vehicle or renewing the registration of an existing one, the DMV will often request Proof of Insurance. This requirement ensures that your vehicle is properly insured before it can be legally driven on public roads. Providing valid POI is a mandatory step in the registration process, and failure to do so may result in penalties or the inability to register your vehicle.

Driver's License Renewal

In some states, the DMV may require Proof of Insurance when renewing your driver's license. This policy aims to verify that you have maintained continuous insurance coverage throughout your license period. By checking your insurance status, the DMV ensures that licensed drivers are responsible and financially protected.

Traffic Stops and Accidents

During a traffic stop or in the event of an accident, law enforcement officers may request Proof of Insurance. Having your POI readily available can help streamline the process and avoid any unnecessary delays or complications. It is important to note that failure to provide Proof of Insurance during a traffic stop may result in citations or other legal consequences.

Vehicle Inspections

In certain states or circumstances, the DMV may conduct vehicle inspections. These inspections often include a check for valid insurance coverage. By presenting your Proof of Insurance during an inspection, you can demonstrate compliance with state regulations and avoid any potential issues.

Obtaining and Maintaining Proof of Insurance

Ensuring that you always have valid Proof of Insurance is crucial for a smooth driving experience. Here are some tips and best practices to help you stay organized and compliant:

Choose a Reputable Insurance Provider

Selecting a reliable insurance company is the foundation of effective insurance coverage. Research and compare different providers to find one that offers comprehensive coverage at a competitive price. Look for companies with a strong reputation, positive customer reviews, and a solid financial standing to ensure long-term stability.

Understand Your Policy

Take the time to thoroughly review and understand your insurance policy. Familiarize yourself with the coverage limits, deductibles, and any specific exclusions or endorsements. By understanding your policy, you can make informed decisions and ensure that your coverage aligns with your needs and the requirements of your state.

Keep Your Documents Updated

Stay organized by keeping your insurance documents up to date. Regularly check the expiration dates of your insurance card and policy declaration page to ensure they are valid. If you notice any discrepancies or changes in your coverage, contact your insurance provider promptly to rectify the issue.

Utilize Digital Options

Many insurance companies now offer digital options for Proof of Insurance. These digital documents can be easily accessed and presented through mobile apps or online portals. Utilizing digital POI can save you the hassle of carrying physical documents and provide a convenient way to quickly provide proof when needed.

Maintain Continuous Coverage

It is crucial to maintain continuous insurance coverage to avoid any lapses. Ensure that your policy is renewed on time, and be mindful of any changes in your circumstances that may impact your insurance needs. By keeping your coverage consistent, you avoid the risk of facing penalties or restrictions on your driving privileges.

Tips for a Smooth DMV Experience

When interacting with the DMV, being prepared and organized can make a significant difference in the efficiency and success of your transactions. Here are some tips to ensure a smooth and stress-free experience:

Gather Required Documents

Before visiting the DMV, make a checklist of all the documents you will need for your specific transaction. This may include your driver's license, vehicle registration, proof of ownership, and, of course, your Proof of Insurance. Having all the necessary documents readily available will expedite the process and minimize any potential delays.

Understand DMV Requirements

Take the time to familiarize yourself with the specific requirements and procedures of your local DMV. Different states and even different DMV offices within a state may have slightly varying processes. By understanding the expectations and requirements in advance, you can prepare accordingly and avoid any surprises.

Utilize Online Services

Many DMVs now offer online services that allow you to complete certain transactions from the comfort of your own home. These services may include vehicle registration renewals, license plate replacements, and even some aspects of driver's license renewals. By taking advantage of online options, you can save time and avoid the need for an in-person visit.

Plan Your Visit

If an in-person visit to the DMV is necessary, plan your trip carefully. Check the operating hours and availability of appointments, if applicable. Arrive early to allow for any potential delays, and consider bringing a book or engaging in other activities to make the wait more bearable. Being prepared and organized can significantly improve your overall experience.

Frequently Asked Questions

Can I use a digital Proof of Insurance instead of a physical document?

+Yes, many states and insurance providers now accept digital Proof of Insurance. Digital POI can be accessed through mobile apps or online portals provided by your insurance company. However, it's important to check with your local DMV to ensure they accept digital forms.

What happens if I forget to bring my Proof of Insurance to the DMV?

+Forgetting your Proof of Insurance can result in delays or even the inability to complete your transaction. In such cases, you may need to schedule another appointment or visit, bringing your POI with you. It's always best to have your POI readily available to avoid any unnecessary complications.

Can I use an expired insurance card as Proof of Insurance?

+No, an expired insurance card is not considered valid Proof of Insurance. It's crucial to keep your insurance documents up to date and ensure that your policy is renewed on time. Using an expired card may result in penalties or the inability to complete certain transactions.

How long does it take to receive my Proof of Insurance after purchasing a policy?

+The time it takes to receive your Proof of Insurance can vary depending on your insurance provider and the method of delivery. Some companies may provide immediate digital access, while others may mail physical documents within a few business days. It's best to inquire with your insurance provider for an estimated timeline.

Can I provide Proof of Insurance for a vehicle I don't currently own but plan to purchase soon?

+Obtaining insurance for a vehicle you don't yet own can be challenging. In most cases, insurance companies require the vehicle to be registered in your name before providing coverage. However, some providers may offer temporary coverage or binders for vehicles that are in the process of being purchased. It's best to consult with your insurance provider for specific options.

Understanding the importance of Proof of Insurance and staying prepared can significantly enhance your driving experience. By choosing a reputable insurance provider, maintaining continuous coverage, and familiarizing yourself with DMV requirements, you can ensure a smooth and stress-free journey through the world of vehicle insurance and DMV interactions.