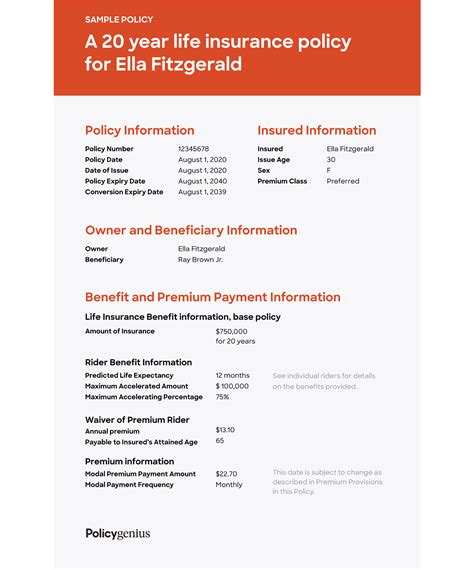

Do Employers Have To Offer Health Insurance

The issue of health insurance coverage for employees is a complex topic that varies significantly based on regional laws and employer policies. This article aims to provide an in-depth exploration of the obligations and considerations surrounding employer-provided health insurance, offering a comprehensive guide to the legal and ethical aspects of this critical employee benefit.

The Legal Framework: Understanding the Employer’s Responsibility

The requirement for employers to offer health insurance to their workforce is largely dictated by the legal framework within a given jurisdiction. While there is no universal mandate across the globe, many countries and regions have implemented laws to ensure employees have access to adequate healthcare coverage.

Mandatory vs. Voluntary Health Insurance

The landscape of employer-provided health insurance can be broadly categorized into two primary models: mandatory and voluntary coverage.

In regions with a mandatory health insurance system, such as many European countries, employers are legally obligated to contribute to the cost of their employees' health insurance. This often takes the form of a public healthcare system, where contributions are made to a national health fund. Employees then have access to a range of healthcare services based on their contributions and the specific regulations of the system.

On the other hand, in voluntary health insurance systems, such as the United States, employers are not legally required to provide health insurance. However, many employers choose to offer health benefits as a way to attract and retain talent. This is often done through private insurance plans, where the employer negotiates coverage and premiums with insurance providers. In such cases, the employer may fully or partially subsidize the cost of the insurance, with employees sometimes contributing a portion of the premium.

Legal Obligations by Region

The specific legal obligations regarding health insurance coverage vary widely across different regions. Here’s a glimpse into the variations:

- United States: The Affordable Care Act (ACA) mandates that certain employers with 50 or more full-time equivalent employees offer "affordable" health insurance coverage to their employees. However, smaller businesses are not subject to this mandate.

- European Union: Many EU countries have a comprehensive public healthcare system where employers are required to contribute to national health insurance funds. For example, in France, employers must pay a percentage of their employees' salaries to the national health insurance system.

- Canada: Canada has a universal healthcare system, but the structure varies by province. While employers may offer additional private health insurance plans, public healthcare coverage is primarily funded through tax revenue, ensuring universal access.

- Asia-Pacific: Countries like Japan, Australia, and Singapore have their own unique systems. In Japan, for instance, employers are required to enroll their employees in the national health insurance program, with contributions based on income.

Benefits and Challenges of Employer-Provided Health Insurance

The decision to offer health insurance as an employee benefit carries both advantages and challenges for employers. Understanding these aspects is crucial for employers to make informed decisions about health insurance coverage.

Advantages for Employers

Employers who choose to offer health insurance can gain several benefits:

- Attracting and Retaining Talent: Health insurance is a highly valued benefit for employees. Offering competitive health coverage can make an organization more attractive to potential hires and help retain current employees.

- Improved Employee Health and Productivity: Access to healthcare services can lead to better overall health among employees, reducing absenteeism and improving productivity. It also shows a commitment to employee well-being.

- Compliance with Legal Requirements: In regions with mandatory health insurance, offering coverage ensures employers comply with the law and avoid potential penalties.

Challenges and Considerations

However, there are also challenges and considerations associated with providing health insurance:

- Cost: Health insurance can be a significant expense for employers. The cost of premiums, administrative fees, and potential increases over time can impact an organization's bottom line.

- Complexity: Navigating the health insurance landscape can be complex. Employers must understand the various plan options, negotiate with insurance providers, and ensure compliance with legal requirements.

- Employee Variability: Employees have diverse healthcare needs. Designing a health insurance plan that caters to a wide range of requirements can be challenging, and some employees may still find the coverage inadequate.

Designing an Effective Health Insurance Strategy

Employers who choose to offer health insurance have a range of options and considerations to explore. Here’s a guide to designing an effective health insurance strategy:

Assessing Employee Needs

Understanding the healthcare needs of your employee population is crucial. Conduct surveys or focus groups to gather insights into the types of coverage employees value most. This could include dental, vision, prescription drug coverage, mental health services, or specific chronic condition management.

Choosing the Right Plan

There are various types of health insurance plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan has its own network of providers, cost-sharing structures, and coverage limitations. Research and compare different plans to find the best fit for your employees.

Negotiating with Insurance Providers

When negotiating with insurance providers, consider factors like premium costs, deductibles, co-pays, and the specific services covered. Look for plans that offer a balance between cost and comprehensive coverage. Leverage your employee population size and other benefits you offer to negotiate better rates.

Communicating the Benefits

Effective communication about the health insurance benefits you offer is essential. Ensure employees understand the value of the coverage, how to access it, and any changes or improvements made to the plan. Use clear and concise language to explain the benefits, and consider providing educational resources to help employees make informed decisions about their healthcare.

The Future of Employer-Provided Health Insurance

The landscape of employer-provided health insurance is evolving, influenced by factors like changing healthcare regulations, advancements in technology, and shifting employee expectations. Here’s a glimpse into the future:

Increasing Focus on Preventive Care

There is a growing emphasis on preventive care and wellness initiatives. Employers are recognizing the long-term benefits of investing in employee health. This includes offering incentives for employees to engage in healthy behaviors, providing access to wellness programs, and designing health insurance plans that encourage preventive care.

Technology Integration

Technology is playing an increasingly significant role in healthcare and health insurance. Employers are exploring ways to leverage technology to improve the efficiency and effectiveness of health insurance plans. This includes the use of digital platforms for enrollment, claims management, and accessing healthcare services.

Personalized Health Plans

The future may see a shift towards more personalized health insurance plans. With advancements in healthcare technology and data analytics, employers could offer plans that are tailored to individual employee needs. This could involve dynamic coverage based on an employee’s health status, risk factors, and preferences.

Collaborative Healthcare Models

Collaborative models, such as Accountable Care Organizations (ACOs), are gaining traction. These models focus on coordinated care, with providers, insurers, and employers working together to improve healthcare quality and reduce costs. Employers could play a more active role in these collaborative efforts, ensuring better outcomes for employees.

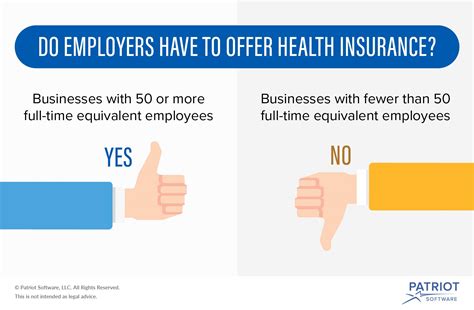

| Region | Health Insurance System | Employer Obligations |

|---|---|---|

| United States | Voluntary | Employers with 50+ full-time employees must offer affordable coverage (ACA) |

| European Union | Mandatory | Employers contribute to national health insurance funds |

| Canada | Universal Public Healthcare | Varies by province; employers may offer additional private plans |

| Asia-Pacific | Varies by Country | Japan: Employers enroll employees in national health insurance; Australia: Private insurance with government subsidies |

Are there any tax benefits for employers who offer health insurance?

+

Yes, in many regions, employers can claim tax deductions or credits for the cost of providing health insurance to their employees. This can significantly reduce the overall expense of offering this benefit.

How do small businesses handle health insurance costs without a mandate?

+

Small businesses have various options, including joining associations that offer group health insurance, purchasing coverage through state-based insurance exchanges, or offering limited health benefits like dental or vision insurance.

What happens if an employer doesn’t offer health insurance in regions with no mandate?

+

In regions without a mandate, employers are not legally obligated to provide health insurance. However, they may face challenges in attracting and retaining talent, as many employees value this benefit.

Can employers change health insurance plans annually or more frequently?

+

Yes, employers can change health insurance plans annually during open enrollment periods. However, certain life events like marriage, divorce, or the birth of a child may allow for more frequent changes.

How can employers ensure their health insurance plans are competitive in the market?

+

Employers can stay competitive by regularly reviewing their health insurance offerings, comparing them to industry standards, and soliciting employee feedback to understand their needs and preferences.