Do I Need Home Insurance

Protecting your home and its contents is an essential aspect of financial planning and risk management. Home insurance, often an overlooked aspect of homeownership, can provide a vital safety net in the face of unforeseen events. In this article, we delve into the world of home insurance, exploring its benefits, what it covers, and why it might be a crucial investment for your peace of mind and financial security.

Understanding Home Insurance: A Necessary Protection

Home insurance is a form of property insurance that offers financial protection for individuals who own a home. It covers a range of potential risks and liabilities associated with homeownership, providing a safety net against unexpected events that could result in significant financial loss. These events can include natural disasters, theft, and accidental damage, among others.

The primary purpose of home insurance is to safeguard your investment in your home and its contents. It provides a means to repair or rebuild your home and replace your belongings if they are damaged or destroyed. Additionally, home insurance can protect you from liability claims if someone is injured on your property.

While the specifics of home insurance policies can vary greatly depending on the insurer and the coverage chosen, there are several key aspects that are typically covered.

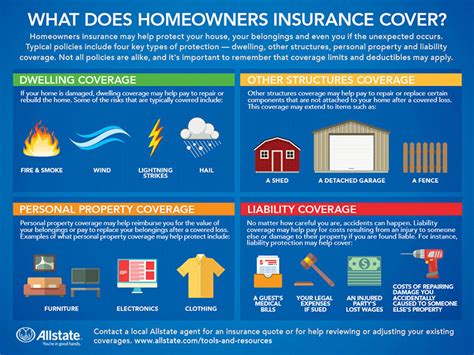

Coverage Types in Home Insurance

Home insurance policies are tailored to the needs and circumstances of the policyholder. Here’s a breakdown of the different types of coverage typically offered:

- Dwelling Coverage: This is the cornerstone of most home insurance policies. It covers the physical structure of your home, including the walls, roof, and permanent fixtures. In the event of a covered loss, dwelling coverage helps repair or rebuild your home.

- Personal Property Coverage: This aspect of home insurance covers the contents of your home, such as furniture, appliances, clothing, and electronics. It can provide compensation for the replacement or repair of these items if they are damaged or stolen.

- Liability Coverage: Liability insurance is a critical component of home insurance. It protects you if someone is injured on your property or if your actions off your property cause injury or property damage to someone else. This coverage can pay for medical bills, legal fees, and settlements.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage helps cover the additional costs of temporary housing and living expenses until your home is repaired or rebuilt.

- Optional Coverages: Many home insurance policies offer optional coverages to tailor the policy to your specific needs. These can include coverage for high-value items like jewelry or art, protection against identity theft, or coverage for specific natural disasters like earthquakes or floods.

The specific coverage and limits provided by a home insurance policy depend on the policyholder's needs and the policy chosen. It's important to carefully review the policy details and discuss any concerns or questions with your insurance provider to ensure you have the right coverage for your situation.

Real-Life Examples of Home Insurance Claims

Understanding how home insurance works in practice can help illustrate its value. Here are a few real-life scenarios where home insurance provided crucial protection:

- A homeowner's roof was severely damaged during a hailstorm. Dwelling coverage helped cover the cost of repairs, ensuring the home was weatherproof and structurally sound.

- A burglary resulted in the theft of valuable jewelry and electronics. Personal property coverage compensated the homeowner for the replacement of these items.

- A guest slipped and fell on a homeowner's icy driveway, resulting in a serious injury. Liability coverage helped pay for the guest's medical expenses and legal fees, protecting the homeowner from financial ruin.

- A fire damaged a home, making it uninhabitable. Additional living expenses coverage helped the family cover the cost of staying in a hotel and eating out until their home was repaired.

These examples demonstrate how home insurance can provide essential financial protection in a variety of scenarios, ensuring homeowners can recover from unexpected events without incurring significant financial burdens.

Analyzing the Benefits of Home Insurance

Home insurance offers a range of benefits that go beyond simply covering the cost of repairs or replacements. Here’s a deeper look at some of the key advantages of investing in home insurance:

Financial Protection and Peace of Mind

Perhaps the most significant benefit of home insurance is the financial protection it provides. By having home insurance, you can rest assured that you are covered in the event of a covered loss. Whether it’s a natural disaster, theft, or an accident, home insurance can help you manage the financial fallout and get your life back on track.

Home insurance provides a sense of peace of mind, knowing that you have the financial resources to rebuild or repair your home and replace your belongings. It also offers protection against liability claims, which can be costly and time-consuming to defend against.

Tailored Coverage Options

Home insurance policies are highly customizable, allowing you to choose the level of coverage that best suits your needs and budget. You can opt for basic coverage to protect against common risks, or you can add optional coverages to address specific concerns, such as flood or earthquake insurance.

This flexibility ensures that you can create a policy that provides the right level of protection for your home and your personal circumstances. It allows you to balance the cost of insurance with the potential risks you face, ensuring that you have adequate coverage without paying for coverage you don't need.

Protection Against Inflation

Over time, the cost of rebuilding or repairing a home, as well as the cost of replacing personal belongings, can increase due to inflation. Home insurance policies often include an inflation guard feature, which automatically adjusts the coverage limits to keep pace with rising costs.

This means that even if the cost of construction or replacement of your belongings increases, your home insurance policy will still provide adequate coverage. It ensures that you are not left with a gap in coverage that could leave you financially vulnerable in the event of a claim.

Potential for Lower Out-of-Pocket Costs

In many cases, home insurance policies have a deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in. While this can seem like an added expense, it can actually help lower your overall out-of-pocket costs in the event of a claim.

For instance, if you have a high deductible and experience a minor loss, you may choose to pay for the repairs yourself rather than filing a claim. This can help you avoid the potential increase in premiums that can result from filing multiple small claims. On the other hand, for more significant losses, having a higher deductible can reduce your overall out-of-pocket costs, as the insurance coverage will cover the majority of the expenses.

Factors to Consider Before Purchasing Home Insurance

While home insurance offers many benefits, it’s important to carefully consider your needs and circumstances before purchasing a policy. Here are some key factors to keep in mind:

Your Home’s Value and Location

The value of your home and its location can significantly impact the cost and coverage of your home insurance policy. Homes in high-risk areas for natural disasters, such as flood zones or wildfire-prone regions, may require specialized coverage or higher premiums.

Additionally, the age and condition of your home can affect the cost of insurance. Older homes may require more extensive coverage to address potential issues with outdated systems or structures, while newer homes may be more energy-efficient and have built-in safety features that can lower insurance costs.

Your Personal Belongings

When considering home insurance, it’s important to take stock of the value of your personal belongings. High-value items like jewelry, art, or electronics may require additional coverage to ensure they are adequately protected. You may also want to consider the cost of replacing essential items like clothing, furniture, and appliances.

It's worth noting that some high-value items, such as jewelry or artwork, may have coverage limits within a standard home insurance policy. If you have valuable possessions, you may need to purchase additional coverage or a separate policy to ensure they are fully protected.

Your Personal Circumstances

Your personal circumstances can also influence the type and amount of home insurance coverage you need. For instance, if you frequently host guests or have a home-based business, you may require additional liability coverage to protect against potential accidents or injuries that could occur on your property.

Additionally, if you have rental properties or other real estate investments, you may need specialized insurance policies to cover these assets. It's important to carefully review your personal circumstances and discuss your needs with an insurance professional to ensure you have the right coverage in place.

Comparing Home Insurance Policies

When shopping for home insurance, it’s crucial to compare different policies to find the one that best suits your needs and budget. Here are some key considerations when comparing home insurance policies:

Coverage Limits and Deductibles

Look at the coverage limits offered by each policy. Ensure that the limits are sufficient to cover the replacement cost of your home and its contents. Also, consider the deductibles. A higher deductible can lower your premiums, but it means you’ll pay more out of pocket if you need to file a claim.

Policy Exclusions and Endorsements

Pay close attention to the exclusions and endorsements in each policy. Exclusions are specific risks or events that are not covered by the policy. Endorsements, on the other hand, are add-ons that can expand the coverage of the policy. Understanding these can help you choose a policy that provides the right coverage for your needs.

Insurance Provider Reputation and Financial Stability

Research the reputation and financial stability of the insurance provider. A reputable insurer with a strong financial standing is more likely to be able to pay out claims promptly and fairly. You can check with independent rating agencies or consumer advocacy groups to get an idea of an insurer’s reliability.

Customer Service and Claims Handling

Consider the insurer’s customer service reputation and claims handling process. You want an insurer that is responsive, helpful, and efficient when it comes to filing and processing claims. Online reviews and customer testimonials can provide valuable insights into an insurer’s customer service and claims handling practices.

Future Implications and Advice

As the housing market and insurance landscape continue to evolve, it’s important to stay informed and adapt your home insurance coverage as needed. Here are some considerations for the future:

Regularly Review and Update Your Policy

Life circumstances and the value of your home and possessions can change over time. It’s important to regularly review your home insurance policy to ensure it still meets your needs. Update your policy whenever there are significant changes, such as renovations, additions to your home, or the acquisition of high-value items.

Keep Records and Take Preventative Measures

Maintain accurate records of your home’s value, as well as the value and condition of your possessions. This can help streamline the claims process if you ever need to file a claim. Additionally, take preventative measures to reduce the risk of losses, such as installing smoke detectors, maintaining your home’s systems, and securing your property against theft.

Stay Informed About Market Trends and Insurance Innovations

Keep up-to-date with market trends and insurance innovations. The insurance industry is constantly evolving, and new products and services may become available that can better meet your needs or provide more cost-effective coverage. Regularly review insurance websites and industry publications to stay informed.

FAQ

What is the average cost of home insurance?

+

The average cost of home insurance varies widely depending on factors such as location, the value of the home, and the coverage chosen. According to recent data, the average annual premium for home insurance in the United States is around $1,300. However, premiums can range from a few hundred dollars to several thousand dollars per year.

Can I bundle my home insurance with other policies to save money?

+

Yes, bundling your home insurance with other policies, such as auto insurance, can often result in significant savings. Many insurance providers offer discounts when you purchase multiple policies from them. This is known as a “multi-policy discount” and can lower your overall insurance costs.

What should I do if I need to file a home insurance claim?

+

If you need to file a home insurance claim, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves providing details about the loss, submitting documentation, and possibly scheduling an inspection. It’s important to follow the insurer’s instructions and keep records of all communications and documents related to the claim.