Do You Have Health Insurance

Health insurance is a vital aspect of modern healthcare systems, providing financial protection and access to essential medical services. In an era where healthcare costs can be exorbitant, having the right health insurance coverage can mean the difference between receiving timely and comprehensive care and facing significant financial burdens. This article aims to delve into the world of health insurance, exploring its significance, how it works, and why it is an indispensable component of our healthcare ecosystem.

Understanding Health Insurance: More Than Just a Policy

At its core, health insurance is a contractual agreement between an individual (or a group) and an insurance provider. This agreement, or policy, outlines the terms and conditions under which the insurance company agrees to provide financial coverage for medical expenses incurred by the policyholder. It is a complex yet crucial mechanism that ensures individuals have the means to access healthcare services without facing unaffordable out-of-pocket expenses.

The concept of health insurance is founded on the principle of risk-sharing. By pooling resources from a large number of policyholders, insurance companies can effectively manage the financial risks associated with healthcare. This pooling mechanism allows for the distribution of costs across a diverse population, ensuring that the healthy subsidize the healthcare needs of the sick, and those with lower healthcare expenses contribute to covering the costs of those with higher medical needs.

Health insurance policies typically cover a wide range of medical services, including but not limited to:

- Doctor visits and consultations

- Hospitalization and surgical procedures

- Prescription medications

- Diagnostic tests and imaging

- Preventive care and screenings

- Mental health services

- Specialist referrals and treatments

The specific coverage and benefits offered by a health insurance plan can vary widely, depending on factors such as the type of plan, the insurance provider, and the geographical location. Some plans may offer comprehensive coverage for a broad spectrum of services, while others may have more limited benefits and higher out-of-pocket costs.

The Importance of Health Insurance: A Comprehensive View

Financial Protection and Peace of Mind

One of the primary advantages of having health insurance is the financial protection it provides. In the event of an unexpected illness or injury, the cost of medical treatment can quickly escalate, often leading to substantial financial strain. Health insurance acts as a safety net, ensuring that policyholders have access to the necessary funds to cover their healthcare expenses without compromising their financial stability.

Furthermore, health insurance offers peace of mind, knowing that one's healthcare needs are financially secured. This security can alleviate the stress and anxiety often associated with medical emergencies, allowing individuals to focus on their recovery and well-being.

Promoting Preventive Care and Early Intervention

Health insurance plays a pivotal role in encouraging preventive healthcare measures. Many insurance plans offer coverage for preventive services, such as annual check-ups, vaccinations, and screenings for various health conditions. By covering these services, health insurance providers incentivize individuals to take a proactive approach to their health, identifying and addressing potential issues early on when they are often more manageable and less costly to treat.

Preventive care not only improves individual health outcomes but also has broader societal benefits. By preventing or detecting health issues early, health insurance can help reduce the burden on healthcare systems, lower the overall cost of healthcare, and improve the quality of life for individuals and communities.

Access to Quality Healthcare Services

Health insurance expands access to quality healthcare services, ensuring that individuals have the opportunity to receive timely and appropriate medical attention. With health insurance, individuals can choose from a network of healthcare providers, including doctors, specialists, and hospitals, who have contracted with the insurance company to provide services at agreed-upon rates.

This network of providers offers a range of expertise and specializations, allowing policyholders to access the most suitable care for their specific health needs. Additionally, health insurance often covers a portion or all of the costs associated with these services, making quality healthcare more affordable and accessible to a wider population.

How Health Insurance Works: A Comprehensive Overview

Choosing a Health Insurance Plan

Selecting a health insurance plan is a crucial step in ensuring adequate coverage. Individuals have various options to choose from, including individual plans, family plans, and employer-sponsored group plans. The choice of plan depends on factors such as individual or family needs, budget, and the availability of employer-provided coverage.

When selecting a plan, it is essential to consider the following:

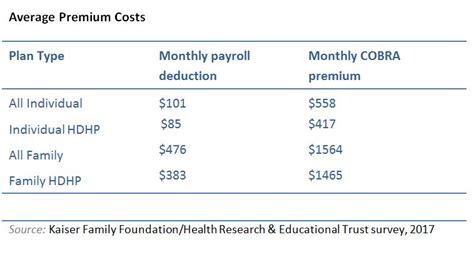

- Premium: The amount paid regularly (usually monthly) to maintain the insurance coverage.

- Deductible: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Copayment: A fixed amount paid by the policyholder for a covered service, often paid at the time of service.

- Coinsurance: The percentage of the total cost of a covered service that the policyholder must pay.

- Out-of-Pocket Maximum: The maximum amount the policyholder will have to pay out of pocket during a policy period before the insurance company covers the remaining eligible expenses.

Understanding Coverage and Benefits

Health insurance plans vary significantly in their coverage and benefits. It is crucial to carefully review the policy documents to understand what is covered and what is excluded. Some plans may have broad coverage for a wide range of services, while others may have more specific coverage tailored to certain health conditions or treatments.

Key aspects to consider when reviewing coverage include:

- Network Providers: Whether the plan requires the use of in-network providers (doctors and hospitals contracted with the insurance company) or allows for out-of-network options.

- Prescription Drug Coverage: The extent to which prescription medications are covered and the associated costs.

- Specialist Referrals: The process for obtaining referrals to specialists and the associated costs.

- Mental Health and Substance Abuse Coverage: The extent of coverage for mental health services and substance abuse treatment.

- Maternity and Newborn Care: The coverage for pregnancy, childbirth, and newborn care.

Using Your Health Insurance

Once enrolled in a health insurance plan, it is essential to understand how to utilize the coverage effectively. This includes knowing how to find in-network providers, how to access emergency care, and how to submit claims for reimbursement.

Most insurance plans provide members with access to an online portal or mobile app, allowing them to manage their coverage, view benefits, and find in-network providers. These digital tools often offer convenient features such as scheduling appointments, refilling prescriptions, and tracking claims.

When seeking medical care, it is important to inform the healthcare provider that you have health insurance and to provide them with the necessary information, such as your insurance ID card and policy details. This ensures that the provider can bill the insurance company directly, reducing your out-of-pocket expenses.

The Future of Health Insurance: Navigating Challenges and Innovations

Addressing Rising Healthcare Costs

One of the significant challenges facing the health insurance industry is the rising cost of healthcare. Medical advancements, technological innovations, and an aging population have all contributed to increasing healthcare expenses. This, in turn, has led to higher insurance premiums and out-of-pocket costs for policyholders.

To address this challenge, the industry is exploring various strategies, including:

- Value-Based Care: Shifting the focus from volume-based to value-based care, where providers are incentivized to deliver high-quality, cost-effective care.

- Telehealth and Digital Health Solutions: Embracing technology to improve access to care, reduce costs, and enhance patient engagement.

- Chronic Disease Management: Developing programs to better manage chronic conditions, preventing complications and reducing overall healthcare costs.

- Healthcare Data Analytics: Utilizing advanced analytics to identify cost drivers, improve efficiency, and optimize healthcare delivery.

Expanding Access and Affordability

Ensuring access to affordable health insurance remains a critical goal for the industry and policymakers. Efforts are being made to expand coverage to underserved populations, such as low-income individuals and those with pre-existing conditions. This includes initiatives like the Affordable Care Act (ACA) in the United States, which aims to make health insurance more accessible and affordable for all.

Additionally, there is a growing focus on developing innovative insurance products and delivery models, such as:

- Short-Term Health Insurance: Offering more affordable, limited-duration plans for those who cannot afford or do not qualify for traditional health insurance.

- Association Health Plans (AHPs): Allowing small businesses and self-employed individuals to band together and negotiate better rates and coverage.

- Health Savings Accounts (HSAs): Encouraging individuals to save for healthcare expenses, providing tax benefits and long-term financial planning.

Embracing Digital Transformation

The healthcare industry, including health insurance providers, is undergoing a digital transformation. This transformation is aimed at improving efficiency, enhancing the customer experience, and reducing administrative burdens. Digital technologies, such as artificial intelligence, blockchain, and data analytics, are being leveraged to streamline processes, automate tasks, and personalize healthcare services.

For example, digital platforms are being used to facilitate easier enrollment and claims processes, provide personalized health recommendations, and offer virtual care services. These innovations not only improve convenience but also contribute to cost savings and better healthcare outcomes.

Conclusion

Health insurance is a complex yet essential component of modern healthcare systems. It provides financial protection, promotes preventive care, and expands access to quality healthcare services. As the industry continues to evolve, addressing challenges and embracing innovations, the focus remains on ensuring that individuals have the necessary coverage to lead healthy and fulfilling lives.

As we navigate the future of healthcare, health insurance will continue to play a pivotal role in shaping the accessibility, affordability, and quality of medical care. By staying informed and actively engaged, individuals can make informed decisions about their health insurance coverage, ensuring they have the support they need to thrive.

How do I choose the right health insurance plan for me?

+Choosing the right health insurance plan involves careful consideration of your individual needs, budget, and the available options. Start by evaluating your healthcare requirements, including any existing or potential health conditions, and consider the coverage and benefits that are most important to you. Compare plans based on factors such as premiums, deductibles, copayments, and out-of-pocket maximums. Assess the network of providers and ensure that your preferred doctors and hospitals are included. Finally, review the policy documents thoroughly to understand the coverage exclusions and limitations.

What happens if I need medical treatment but don’t have health insurance?

+Seeking medical treatment without health insurance can be financially challenging. You may be responsible for paying the full cost of your treatment out of pocket, which can be expensive, especially for emergency or specialized care. In some cases, healthcare providers may offer payment plans or financial assistance programs for uninsured patients. It’s crucial to explore all options and consider enrolling in health insurance to avoid significant financial burdens.

Can I change my health insurance plan if I’m not satisfied with my current coverage?

+Yes, you have the option to change your health insurance plan during designated enrollment periods, such as the annual open enrollment period or if you experience a qualifying life event, like getting married, having a baby, or losing other health coverage. During these periods, you can explore different plans and make a change if your current coverage doesn’t meet your needs. It’s important to review the specific rules and timelines for changing plans in your region.