Does Liability Insurance Cover

Liability insurance is a crucial aspect of risk management and financial protection for individuals and businesses alike. It provides coverage for various legal and financial liabilities that may arise due to accidents, injuries, or property damage caused by the insured party. However, the scope of coverage offered by liability insurance policies can vary significantly, and it is essential to understand what is and isn't covered to ensure adequate protection.

In this comprehensive guide, we will delve into the world of liability insurance, exploring the ins and outs of coverage, the factors that influence it, and the key considerations for individuals and businesses seeking to safeguard their assets and future. Whether you are a homeowner, a business owner, or an individual looking to protect your personal assets, this article will provide you with the expertise and insights needed to navigate the complex landscape of liability insurance.

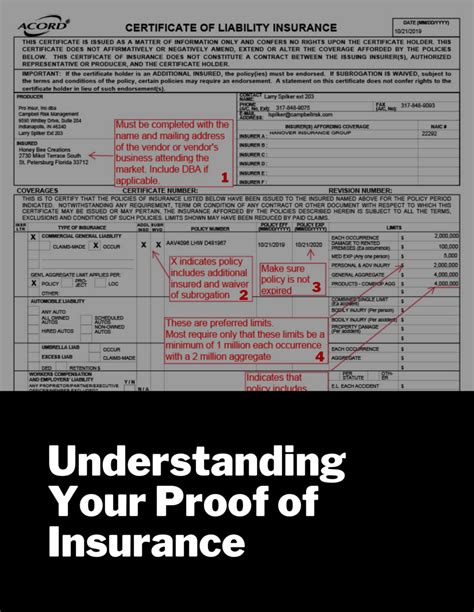

Understanding Liability Insurance Coverage

Liability insurance serves as a financial safety net, protecting policyholders from the potentially devastating consequences of legal claims and financial liabilities. It is designed to cover the costs associated with lawsuits, settlements, and damages arising from various incidents or accidents. However, it is important to note that liability insurance coverage is not a one-size-fits-all solution; it varies based on the type of policy, the specific circumstances, and the jurisdiction in which the incident occurs.

The coverage provided by liability insurance policies typically includes:

- Bodily Injury Claims: Liability insurance covers claims arising from accidents or incidents that result in physical injuries to others. This may include medical expenses, pain and suffering, and lost wages for the injured party.

- Property Damage Claims: In the event of property damage caused by the insured, liability insurance steps in to cover the costs of repairs or replacements. This could apply to damage to a third party's property, such as a vehicle or a home.

- Legal Defense Costs: If a lawsuit is filed against the insured, liability insurance often provides coverage for the associated legal expenses, including attorney fees and court costs.

- Personal Liability: Personal liability coverage protects individuals from claims related to their everyday activities, such as accidents occurring on their property or injuries caused by their pets.

- Business Liability: Businesses can benefit from liability insurance to cover a wide range of potential liabilities, including product liability, professional liability (errors and omissions), and claims arising from business operations.

Factors Influencing Liability Insurance Coverage

The extent of liability insurance coverage can be influenced by several key factors. Understanding these factors is crucial when evaluating and selecting the right insurance policy to meet your specific needs.

Policy Limits and Deductibles

Liability insurance policies typically come with policy limits, which represent the maximum amount the insurance company will pay for covered claims. Policy limits can vary significantly and are often chosen based on the level of risk and the value of assets being protected. Additionally, policies may include deductibles, which are the amounts the insured party must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, but they also shift more financial responsibility onto the policyholder.

Type of Insurance Policy

The type of liability insurance policy chosen plays a significant role in determining coverage. Different policies cater to specific needs and risks. For example:

- Homeowners Insurance: Provides liability coverage for accidents occurring on the insured's property, such as slips and falls. It also covers personal liability for activities off the premises.

- Auto Insurance: Includes liability coverage for bodily injury and property damage caused by the insured's vehicle. It is a legal requirement in most states.

- General Liability Insurance (GLI): Designed for businesses, GLI covers a broad range of liabilities, including product defects, advertising injuries, and slip-and-fall accidents on business premises.

- Professional Liability Insurance (Errors and Omissions): Tailored for professionals like doctors, lawyers, and consultants, this policy covers claims arising from mistakes or omissions in professional services.

Jurisdictional Differences

Liability insurance coverage can vary depending on the jurisdiction in which the incident occurs. Laws and regulations regarding liability differ from one region to another, and these differences can impact the scope of coverage provided by insurance policies. For example, some jurisdictions may have mandatory insurance requirements or specific liability caps, which can affect the limits and terms of insurance policies.

Real-World Examples of Liability Insurance Coverage

To better understand how liability insurance works in practice, let’s explore a few real-world scenarios and the coverage they entail:

Scenario 1: Homeowner’s Liability

Imagine a homeowner, John, who hosts a backyard barbecue for friends and family. During the party, one of the guests slips on a wet deck and falls, injuring their wrist. The guest requires medical attention and files a lawsuit against John for negligence. In this scenario, John’s homeowners insurance policy would likely provide coverage for the guest’s medical expenses and any legal costs associated with the lawsuit. Additionally, if the guest’s injury results in permanent disability or lost wages, the policy may cover those expenses as well.

Scenario 2: Product Liability

A small business owner, Sarah, manufactures and sells handmade candles. Unfortunately, one of her candles causes a fire in a customer’s home due to a manufacturing defect. The customer sustains property damage and files a claim against Sarah’s business. In this case, Sarah’s general liability insurance policy, which includes product liability coverage, would step in to cover the costs of repairing or replacing the damaged property, as well as any legal expenses associated with the claim.

Scenario 3: Professional Liability

Dr. Smith, a renowned psychologist, provides counseling services to a client who later alleges that the therapy sessions caused emotional distress and led to the client’s divorce. The client sues Dr. Smith for negligence and emotional harm. Dr. Smith’s professional liability insurance policy would provide coverage for the legal defense costs and any settlements or judgments resulting from the lawsuit.

Analyzing Performance and Implications

Liability insurance coverage plays a critical role in protecting individuals and businesses from financial ruin. By understanding the scope of coverage, policyholders can make informed decisions about their insurance needs and ensure they have adequate protection. However, it is essential to regularly review and assess one’s liability insurance coverage to account for changing circumstances, increasing liabilities, and evolving legal landscapes.

Regular policy reviews are crucial to ensure that coverage remains appropriate and up-to-date. As businesses grow or individuals acquire new assets, the level of liability insurance required may change. Additionally, staying informed about industry trends and legal developments can help policyholders anticipate potential risks and adjust their coverage accordingly.

Furthermore, it is essential to carefully review policy exclusions and limitations. While liability insurance provides broad coverage, certain incidents or claims may be specifically excluded from coverage. Understanding these exclusions is vital to avoid any unexpected gaps in protection. Policyholders should consult with their insurance providers or brokers to clarify any uncertainties regarding coverage and exclusions.

| Liability Scenario | Coverage Provided |

|---|---|

| Slip and Fall on Business Premises | Medical expenses, pain and suffering, and legal defense costs. |

| Product Defect Leading to Injury | Medical costs, legal fees, and compensation for the injured party. |

| Professional Negligence Claim | Legal defense and potential settlement or judgment amounts. |

Conclusion

Liability insurance serves as a vital safeguard for individuals and businesses, offering protection against a wide range of potential liabilities. By comprehending the intricacies of liability insurance coverage, policyholders can make informed choices to secure their financial well-being and peace of mind. Regular policy assessments, a deep understanding of exclusions, and staying abreast of industry developments are key to maintaining effective liability insurance coverage.

As we navigate an ever-changing legal and financial landscape, liability insurance remains an essential tool for managing risk and safeguarding assets. With the right coverage and a proactive approach to insurance management, individuals and businesses can confidently face the challenges and uncertainties that come with modern life and business operations.

How do I determine the right amount of liability insurance coverage for my needs?

+The appropriate level of liability insurance coverage depends on various factors, including the value of your assets, the nature of your business or personal activities, and your risk tolerance. It’s recommended to consult with an insurance professional who can assess your specific needs and provide tailored advice. They can help you understand the potential risks you face and guide you toward an adequate coverage amount.

Are there any common exclusions in liability insurance policies that I should be aware of?

+Yes, liability insurance policies often exclude coverage for certain types of incidents or claims. Common exclusions may include intentional acts, contractual liabilities, pollution-related damages, and claims arising from illegal activities. It’s crucial to carefully review your policy’s exclusions to ensure you understand what is and isn’t covered.

Can I customize my liability insurance policy to meet specific needs?

+Absolutely! Liability insurance policies can often be customized to fit your unique circumstances. This may involve increasing policy limits, adding specific endorsements for unique risks, or choosing optional coverages that address your specific needs. Consult with your insurance provider to explore customization options and create a policy that provides comprehensive protection.