Dvla Check For Insurance

The Driver and Vehicle Licensing Agency (DVLA) is a vital organization in the UK, responsible for a range of services related to vehicles and their owners. One crucial aspect of their role is the DVLA insurance check, which plays a significant role in ensuring road safety and compliance with the law. This comprehensive guide will delve into the details of the DVLA insurance check, exploring its purpose, process, and implications for vehicle owners and drivers.

Understanding the DVLA Insurance Check

The DVLA insurance check is a mandatory procedure designed to verify that all vehicles on UK roads have valid and up-to-date insurance coverage. It is a critical step in maintaining road safety, as it ensures that vehicle owners are financially liable for any accidents or incidents involving their vehicles. This check is an essential component of the DVLA's broader mission to promote road safety and enforce the law.

The insurance check is particularly important because it provides a legal framework for dealing with accidents and incidents on the road. Without proper insurance, drivers and vehicle owners can face severe consequences, including hefty fines, legal penalties, and even the seizure of their vehicles. The DVLA's insurance check helps to deter such illegal activities and ensures that all road users are protected.

Purpose and Legal Framework

The DVLA's insurance check is mandated by the Road Traffic Act 1988, which requires all vehicles used on public roads to have valid insurance. This act sets out the legal requirements for motor insurance, defining the types of cover, minimum standards, and penalties for non-compliance. It is a crucial piece of legislation that underpins the DVLA's work in ensuring road safety.

The insurance check is also aligned with the Motor Insurance Directive, a European Union directive that sets out minimum standards for motor insurance across member states. This directive ensures that all drivers, regardless of their country of origin, have adequate insurance when driving in the UK. It is a vital tool for cross-border cooperation and ensures that road users are protected even when travelling internationally.

Scope and Coverage

The DVLA's insurance check applies to all vehicles used on public roads in the UK, including cars, motorcycles, vans, and trucks. It covers a wide range of insurance types, including third-party, third-party fire and theft, and comprehensive insurance. The check ensures that all these different types of insurance meet the minimum standards set out in the Road Traffic Act and other relevant legislation.

In addition to vehicle insurance, the DVLA also checks for motor insurance database (MID) coverage. The MID is a central database that records all insured vehicles in the UK. It is a vital tool for the DVLA and other law enforcement agencies to quickly verify insurance status and ensure compliance. The MID is continuously updated, ensuring that the DVLA's checks are accurate and up-to-date.

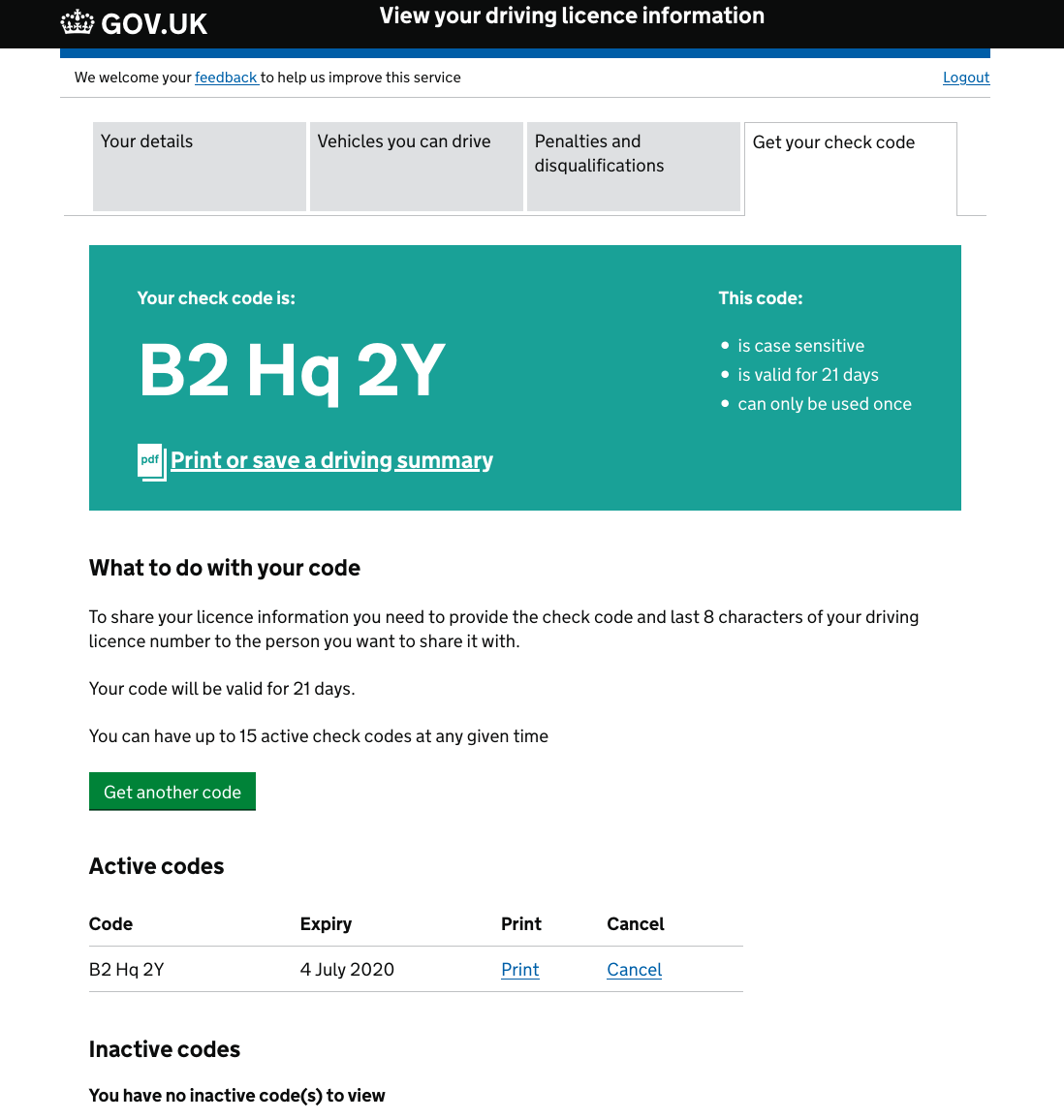

The DVLA Insurance Check Process

The DVLA's insurance check is a comprehensive and well-defined process that involves several steps. Understanding this process is crucial for vehicle owners and drivers to ensure compliance and avoid any legal issues.

Step 1: Initial Check

The first step in the insurance check process is the initial verification. This is a routine check that the DVLA conducts on a regular basis. It involves checking the MID to ensure that all registered vehicles have valid insurance. This step is automated and continuous, with the DVLA's systems continuously scanning the MID for any discrepancies or expired policies.

If a vehicle is found to have expired insurance or is not listed on the MID, the DVLA will flag it for further investigation. This initial check is a vital step in identifying potential issues and ensuring that all vehicles on the road are insured.

Step 2: Investigation and Verification

Once a vehicle is flagged during the initial check, the DVLA initiates an investigation. This involves a more detailed examination of the vehicle's insurance status. The DVLA will contact the vehicle owner or registered keeper to request proof of insurance. This can be done through various methods, including mail, email, or even a phone call.

During this step, the DVLA will also verify the insurance details with the insurance company. They will check the policy's validity, coverage type, and any other relevant details. This ensures that the insurance provided by the vehicle owner is accurate and up-to-date.

Step 3: Legal Action and Penalties

If a vehicle owner fails to provide proof of insurance or if the insurance is found to be invalid, the DVLA will take legal action. This can include a range of penalties, such as:

- Fines: Vehicle owners can be issued with a fixed penalty notice, which carries a significant financial penalty. These fines can be substantial and are designed to deter non-compliance.

- Prosecution: In more serious cases, vehicle owners can be prosecuted in court. This can result in more severe penalties, including heavy fines, community service, or even a prison sentence.

- Vehicle Seizure: As a last resort, the DVLA can seize the vehicle and impound it. This is a severe penalty and is typically reserved for repeat offenders or cases where there is a high risk to public safety.

Implications and Benefits of the DVLA Insurance Check

The DVLA's insurance check has significant implications for vehicle owners and drivers, as well as wider benefits for road safety and the insurance industry.

Road Safety and Accident Management

The primary benefit of the insurance check is its contribution to road safety. By ensuring that all vehicles on the road are insured, the DVLA helps to protect other road users and pedestrians. In the event of an accident, having valid insurance ensures that there is financial coverage for any damages, injuries, or losses. This protects not only the vehicle owner but also those affected by the incident.

Furthermore, the insurance check ensures that vehicle owners are held accountable for their actions. It deters reckless driving and encourages responsible behavior on the roads. This, in turn, leads to safer driving practices and a reduction in accidents and incidents.

Compliance and Legal Protection

For vehicle owners, the insurance check provides legal protection and ensures compliance with the law. By having valid insurance, vehicle owners can drive with confidence, knowing that they are covered in the event of an accident. This protects them from financial liabilities and legal penalties.

The insurance check also helps to prevent fraudulent activities. It ensures that all vehicles on the road are legitimately insured, reducing the risk of insurance scams and illegal activities. This protects both the insurance industry and law-abiding vehicle owners.

Efficiency and Cost-Effectiveness

The DVLA's insurance check is designed to be efficient and cost-effective. The automated initial check process ensures that resources are used effectively, with the majority of vehicles passing this stage without issue. This allows the DVLA to focus its resources on more complex cases and investigations.

Additionally, the insurance check helps to reduce administrative burdens for both vehicle owners and the insurance industry. By ensuring that all vehicles are insured, the DVLA simplifies the process of accident management and claims handling. This leads to faster resolution of incidents and reduced costs for all parties involved.

Frequently Asked Questions

What happens if my vehicle is not insured during the DVLA check?

+If your vehicle is found to be uninsured during the DVLA check, you may face severe penalties. This can include a fixed penalty notice, a fine, or even prosecution in court. In some cases, the DVLA may also seize your vehicle.

How often does the DVLA conduct insurance checks?

+The DVLA conducts insurance checks on a regular basis. The exact frequency may vary, but it is typically done at least once a year. These checks are automated and continuous, ensuring that all vehicles are regularly verified.

Can I drive my vehicle while waiting for insurance verification from the DVLA?

+It is not advisable to drive your vehicle while waiting for insurance verification from the DVLA. If you are stopped by the police or involved in an accident during this time, you may face penalties for driving without insurance. It is best to wait for the DVLA's verification before using your vehicle.

How can I prove my insurance to the DVLA during an investigation?

+If the DVLA requests proof of insurance during an investigation, you should provide them with your insurance certificate or policy documents. These documents should include the vehicle's registration number, the policy number, and the insurance company's details. Ensure that the documents are up-to-date and valid.

What happens if my insurance company fails to update the MID?

+If your insurance company fails to update the MID, it may result in your vehicle being flagged during the DVLA's initial check. In this case, you should contact your insurance company and provide them with the necessary details to update the MID. Ensure that your insurance is properly registered to avoid any issues.

The DVLA's insurance check is a critical component of road safety and legal compliance in the UK. It ensures that all vehicles on the road are insured, protecting road users and deterring illegal activities. By understanding the process and implications of the insurance check, vehicle owners can ensure they are compliant and avoid any legal issues.

The DVLA's work in this area is vital for maintaining road safety and promoting responsible driving practices. It is a comprehensive and well-regulated system that ensures the safety and well-being of all road users.