E Insurance Quote Online

In today's digital age, the insurance industry has evolved significantly, and one of the most notable advancements is the ability to obtain an insurance quote online. This revolutionary step has transformed the way individuals and businesses interact with insurance providers, offering convenience, efficiency, and a seamless experience. This article delves into the world of online insurance quotes, exploring its advantages, the process involved, and its impact on the industry and consumers.

The Rise of Online Insurance Quotes

The traditional method of obtaining insurance quotes often involved tedious paperwork, lengthy appointments with agents, and a time-consuming back-and-forth process. However, with the advent of technology, insurance companies recognized the need to adapt and meet the changing preferences of their customers.

Online insurance quotes emerged as a game-changer, providing a platform where individuals could quickly and easily obtain quotes for various insurance products, including health, auto, home, and life insurance. This shift towards digital solutions has not only enhanced customer experience but also revolutionized the insurance industry as a whole.

Advantages of Online Insurance Quotes

Convenience and Accessibility

One of the most significant advantages of online insurance quotes is the unparalleled convenience it offers. Customers can now access insurance quotes at their fingertips, anytime and anywhere, without the need for physical appointments or office visits. Whether it’s during a lunch break or late at night, the process is flexible and caters to modern lifestyles.

Furthermore, the accessibility of online quotes extends beyond geographical boundaries. Individuals in remote areas or with limited mobility can now easily compare insurance options, ensuring that location is no longer a barrier to obtaining the right coverage.

Time Efficiency

The traditional quote process often involved multiple steps, from gathering paperwork to scheduling appointments and waiting for agent responses. Online quotes streamline this process, eliminating unnecessary delays. With just a few clicks, individuals can obtain multiple quotes from different insurers, making it a swift and efficient experience.

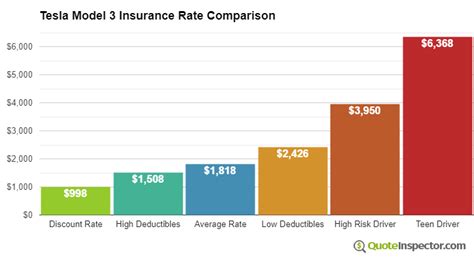

Transparency and Comparison

Online insurance quote platforms provide a transparent and comparative environment. Customers can easily view and analyze quotes from various providers, allowing them to make informed decisions based on coverage, premiums, and additional benefits. This transparency ensures that consumers are well-equipped to choose the policy that best suits their needs and budget.

Customization and Personalization

Online quote forms are designed to be highly customizable, allowing individuals to tailor their insurance needs precisely. Whether it’s adjusting coverage limits, adding optional riders, or providing specific details about their property or vehicle, the process ensures that quotes are personalized to each customer’s unique situation.

The Online Insurance Quote Process

Step 1: Selecting the Insurance Type

The journey begins with the customer selecting the type of insurance they require, such as auto, home, health, or life insurance. This initial step sets the foundation for the quote process, ensuring that the subsequent questions and calculations are relevant to the chosen insurance type.

Step 2: Providing Personal and Policy Information

Customers are then prompted to provide essential details, including personal information like name, date of birth, and contact details. Depending on the insurance type, additional information may be required, such as vehicle details for auto insurance or health history for health insurance.

This step ensures that the quote is accurate and tailored to the individual's specific circumstances. For instance, in the case of auto insurance, factors like driving history, vehicle make and model, and usage are considered to provide an accurate premium estimate.

Step 3: Quote Generation

Once the necessary information is provided, the online platform generates a quote based on the insurer’s algorithms and the customer’s inputs. This quote includes details such as the estimated premium, coverage limits, deductibles, and any applicable discounts. Customers can review and compare these quotes, often side by side, to make an informed decision.

Step 4: Policy Purchase or Further Customization

After reviewing the quotes, customers can choose to purchase the policy directly online or opt for further customization. Some platforms allow customers to adjust their coverage, add endorsements, or explore different payment options before finalizing their purchase.

Impact on the Insurance Industry

Digital Transformation

The introduction of online insurance quotes has accelerated the digital transformation of the insurance industry. Insurers have had to adapt their business models to meet the evolving expectations of tech-savvy consumers. This shift has led to a more competitive market, encouraging insurers to enhance their online presence and offer innovative solutions.

Data-Driven Decisions

Online quote platforms generate a wealth of data, providing insurers with valuable insights into customer behavior, preferences, and market trends. This data-driven approach allows insurers to make informed decisions, refine their underwriting processes, and develop more tailored products to meet customer needs.

Improved Customer Engagement

Online insurance quotes have enhanced customer engagement and satisfaction. The convenience and transparency of the process have fostered a more positive relationship between insurers and their customers. Additionally, the ability to obtain quotes quickly and easily has reduced customer frustration and improved overall satisfaction with the insurance purchasing experience.

Future Implications and Innovations

Artificial Intelligence and Machine Learning

The future of online insurance quotes lies in the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML). These technologies can further enhance the accuracy and efficiency of quote generation, allowing for more personalized and dynamic insurance offerings.

AI-powered chatbots and virtual assistants can provide real-time assistance to customers, answering queries and guiding them through the quote process. ML algorithms can analyze vast amounts of data to identify patterns and trends, enabling insurers to offer predictive and proactive insurance solutions.

Enhanced Security and Data Protection

As the online insurance quote process becomes more prevalent, ensuring the security and privacy of customer data is of utmost importance. Insurers must invest in robust cybersecurity measures to protect sensitive information and maintain customer trust. This includes implementing encryption protocols, two-factor authentication, and regular security audits.

Integration with Smart Devices

The Internet of Things (IoT) has the potential to revolutionize the insurance industry further. Integration with smart devices and sensors can provide insurers with real-time data, enabling them to offer usage-based insurance policies. For example, auto insurers can leverage telematics data to offer pay-as-you-drive policies, rewarding safe driving behavior with discounted premiums.

Seamless Omnichannel Experience

The future of online insurance quotes will likely focus on creating a seamless omnichannel experience. Customers should be able to start the quote process online, continue it via mobile apps or chatbots, and finalize their purchase through traditional channels if preferred. This integration of digital and physical touchpoints will ensure a consistent and personalized customer journey.

Frequently Asked Questions

How accurate are online insurance quotes?

+Online insurance quotes are designed to provide accurate estimates based on the information you input. However, the final premium may vary slightly during the policy issuance process, as insurers may require additional verification or take into account other factors not considered in the quote.

Can I obtain quotes anonymously without providing personal details?

+Some online quote platforms offer anonymous quote options, allowing you to get a general idea of premiums without providing personal information. However, for accurate and personalized quotes, insurers typically require certain details to assess risk and provide an accurate estimate.

Are online insurance quotes binding?

+Online insurance quotes are non-binding, meaning you are not obligated to purchase the policy once you receive the quote. They serve as estimates to help you compare options and make an informed decision. The actual policy purchase and binding contract occur during the finalization process.

How often should I update my insurance quotes online?

+It’s recommended to review and update your insurance quotes annually or whenever significant life changes occur. These changes may include buying a new car, moving to a new home, getting married, or experiencing a major life event that could impact your insurance needs and premiums.

Can I negotiate online insurance quotes?

+While online insurance quotes are generated based on standardized algorithms, there may be room for negotiation, especially for larger policies or complex coverage needs. Contacting the insurer directly or working with an insurance broker can provide opportunities to discuss and potentially negotiate premiums and coverage.

Online insurance quotes have revolutionized the way individuals and businesses interact with the insurance industry. The convenience, efficiency, and transparency offered by these digital platforms have transformed the customer experience, making insurance more accessible and personalized. As technology continues to advance, the future of online insurance quotes holds exciting possibilities, from AI-powered innovations to seamless omnichannel experiences. Embrace the digital transformation and explore the world of online insurance quotes to make informed decisions about your coverage needs.