Employment Insurance Ontario Canada

Employment Insurance (EI) is a vital social safety net program in Canada, offering financial support and re-employment services to eligible individuals who have lost their jobs through no fault of their own. In Ontario, Canada's most populous province, the EI program plays a crucial role in assisting those facing unemployment and providing them with the necessary tools to re-enter the job market.

Understanding Employment Insurance in Ontario

EI in Ontario operates under the same national guidelines as the rest of Canada, but the province’s unique economic landscape and labor market dynamics influence its implementation. Let’s delve into the specifics of EI in Ontario and explore how it functions to support workers in the province.

Eligibility Criteria

To qualify for EI benefits in Ontario, individuals must meet certain criteria. These include having worked a minimum number of hours in a specified period, referred to as the qualifying period. The exact number of hours required depends on various factors, such as the unemployment rate in the region and the individual’s employment history. Typically, this period ranges from 420 to 700 hours of insurable employment.

Additionally, claimants must have earned a minimum amount during their qualifying period. The monetary threshold is set annually and varies based on regional unemployment rates. For instance, in 2023, the threshold for most of Ontario is $7,981, while in certain areas with higher unemployment rates, it is set at $4,331.

Other eligibility requirements include being available for work, actively seeking employment, and being willing to accept suitable job offers. Certain situations, such as maternity, parental, or compassionate care leaves, also qualify individuals for EI benefits.

Application Process

Applying for EI in Ontario involves several steps. Individuals must first create an EI account through the Government of Canada’s website. This account allows them to manage their EI claims online, providing convenience and efficiency.

Once the account is set up, claimants must complete an EI application form, providing detailed information about their employment history, earnings, and the reason for their claim. It is crucial to accurately report all relevant details to ensure a smooth application process and timely receipt of benefits.

After submitting the application, Service Canada reviews the claim and makes a decision. If approved, claimants will receive a ROE (Record of Employment), which outlines their eligibility period and the amount of benefits they are entitled to. It is important to note that the processing time can vary, and claimants should allow sufficient time for their application to be assessed.

EI Benefits in Ontario

EI benefits in Ontario are designed to provide financial support during periods of unemployment and to assist individuals in their job search. The amount and duration of benefits depend on several factors, including the individual’s earnings history, the type of claim, and the unemployment rate in their region.

Regular Benefits

The most common type of EI benefit is the regular benefit, which provides financial assistance to individuals who have lost their jobs due to circumstances beyond their control. The maximum duration for regular benefits is 45 weeks, but it can be shorter depending on the claimant’s earnings and the unemployment rate in their area.

The benefit rate is calculated based on the claimant's average insurable earnings during their qualifying period. It is important to note that EI benefits are taxable income and must be reported on the claimant's tax return.

Special Benefits

In addition to regular benefits, EI offers several special benefits to address specific circumstances. These include:

- Maternity and Parental Benefits: These benefits provide financial support to expectant mothers and parents who need time off work to care for their newborn or newly adopted child.

- Sickness Benefits: EI provides income support for individuals who are unable to work due to illness, injury, or quarantine related to a public health emergency.

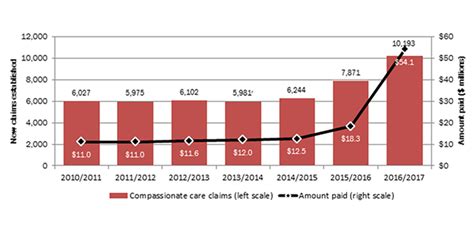

- Compassionate Care Benefits: These benefits are available to individuals who need to take time off work to provide care or support to a critically ill family member.

- Fisheries Benefits: This special benefit caters to individuals in the fishing industry who experience seasonal unemployment.

- Self-Employment Benefits: EI offers support to self-employed individuals who have experienced a drop in income due to circumstances beyond their control.

EI Services and Resources

EI in Ontario goes beyond financial support, offering a range of services and resources to help individuals find new employment and enhance their job prospects.

Job Search Assistance

EI provides job search services to assist claimants in finding suitable employment. These services include access to job boards, career counseling, resume and cover letter assistance, and help with interview preparation. Claimants can also receive referrals to local employers and participate in job fairs organized by Service Canada.

Skills Training and Development

EI recognizes the importance of upskilling and reskilling to adapt to a changing job market. As such, it offers skills training programs to help individuals develop new skills or enhance existing ones. These programs can be especially beneficial for those who have been out of the workforce for an extended period or are looking to transition to a new career path.

Workplace Essential Skills

The Workplace Essential Skills program is a unique initiative offered by EI in Ontario. This program provides funding to employers who wish to enhance the essential skills of their workforce. By investing in employee development, employers can improve productivity, reduce turnover, and create a more skilled and adaptable workforce.

Performance Analysis and Future Implications

EI in Ontario has shown its effectiveness in providing financial support and re-employment services to individuals facing unemployment. The program’s comprehensive approach, which includes financial assistance, job search support, and skills development, has proven beneficial in helping Ontarians navigate the challenges of the job market.

However, like any social program, EI faces ongoing challenges and opportunities for improvement. One key area of focus is ensuring that the program remains adaptable to the evolving needs of the labor market. As industries and job roles change, EI must continually assess and update its services to provide relevant support to claimants.

Another critical aspect is ensuring equitable access to EI benefits for all eligible individuals. While the program aims to provide support to those in need, certain groups, such as part-time workers, self-employed individuals, and those with non-traditional employment arrangements, may face barriers in accessing benefits. Addressing these disparities is essential to ensuring that EI remains a robust and inclusive safety net.

Furthermore, the integration of technology and digital services within EI can enhance efficiency and accessibility. Online platforms and mobile applications can streamline the application process, provide real-time updates on claim status, and offer convenient access to job search resources and skills training opportunities.

As Ontario's labor market continues to evolve, EI will play a crucial role in supporting workers and ensuring their financial security and employability. By staying agile, inclusive, and technologically advanced, EI can continue to provide essential support to Ontarians during periods of unemployment and transition.

| EI Statistic | Ontario Data |

|---|---|

| Number of EI Beneficiaries (2022) | 458,300 |

| Average Weekly Benefit Amount (2022) | $545 |

| EI Claims Processed (2022) | Over 2.1 million |

How often can I apply for EI benefits in Ontario?

+

In Ontario, as in the rest of Canada, there are no restrictions on the number of times an individual can apply for EI benefits. However, each claim has a specific duration, and individuals must meet the eligibility criteria for each claim. It is important to note that the number of weeks an individual can receive benefits may decrease with each subsequent claim.

Are there any regional variations in EI benefits within Ontario?

+

Yes, EI benefits in Ontario can vary based on regional unemployment rates. The duration of regular benefits and the monetary threshold for eligibility may differ between regions. For instance, areas with higher unemployment rates may have a longer benefit duration and a lower monetary threshold.

Can I receive EI benefits if I quit my job voluntarily?

+

In most cases, quitting a job voluntarily makes individuals ineligible for EI benefits. However, there are certain circumstances, such as constructive dismissal or family-related reasons, where quitting may still qualify for benefits. It is important to understand the specific circumstances and consult with Service Canada or an employment advisor to determine eligibility.