Enroll In Health Insurance

In today's fast-paced world, having access to quality healthcare is more important than ever. Health insurance serves as a crucial safety net, providing financial protection and peace of mind when unexpected health issues arise. Whether you're an individual, a family, or a business owner, understanding the process of enrolling in health insurance is essential to ensure you have the coverage you need. In this comprehensive guide, we will delve into the intricacies of enrolling in health insurance, offering expert insights and practical tips to help you navigate the process seamlessly.

Understanding Health Insurance Enrollment

Enrolling in health insurance involves selecting a plan that aligns with your healthcare needs and budget. This process can be complex, with various options and considerations to keep in mind. Let’s break it down into manageable steps to help you make informed decisions.

Step 1: Assess Your Healthcare Needs

The first step in enrolling in health insurance is to evaluate your unique healthcare requirements. Consider factors such as your current health status, any pre-existing conditions, the number of individuals in your family or household, and your anticipated healthcare needs in the coming year. This assessment will guide you in choosing a plan that provides adequate coverage for your situation.

For instance, if you have a family history of chronic illnesses, you may want to prioritize plans with robust preventive care benefits and comprehensive coverage for specialized treatments. On the other hand, if you lead an active lifestyle and are generally healthy, a plan with lower premiums and higher deductibles might be a suitable choice.

Step 2: Research Insurance Providers

Once you have a clear understanding of your healthcare needs, it’s time to explore the available insurance providers in your area. Researching different companies will give you an overview of their offerings, reputation, and customer service. Look for providers with a strong track record of financial stability and positive customer experiences.

You can start by checking with your state’s Department of Insurance for a list of licensed insurers. Additionally, online resources and review platforms can provide valuable insights into the experiences of other policyholders. Consider factors such as the range of plans offered, network of healthcare providers, and any additional benefits or perks included in the coverage.

Step 3: Compare Plan Options

With a shortlist of insurance providers, the next step is to compare the specific plan options they offer. Health insurance plans come in various types, each with its own set of features and costs. Common plan types include:

- Health Maintenance Organization (HMO): HMOs typically offer lower premiums but require you to choose a primary care physician (PCP) and seek referrals for specialist care.

- Preferred Provider Organization (PPO): PPOs provide more flexibility, allowing you to visit healthcare providers inside or outside the network, although out-of-network care may be more costly.

- Exclusive Provider Organization (EPO): EPOs resemble PPOs but generally do not cover out-of-network care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs, giving you the option to choose between in-network and out-of-network providers.

When comparing plans, pay attention to the following key aspects:

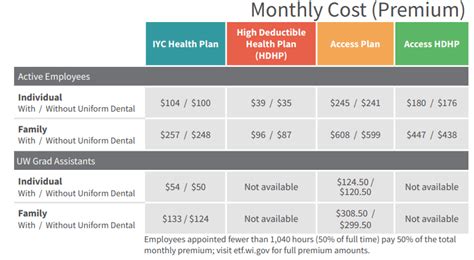

- Premiums: The amount you pay monthly to maintain your coverage.

- Deductibles: The amount you must pay out of pocket before your insurance coverage kicks in.

- Copayments (Copays): Fixed amounts you pay for certain services, such as doctor visits or prescription medications.

- Coinsurance: Your share of the costs for covered services, typically expressed as a percentage (e.g., 20% coinsurance means you pay 20% of the cost, and the insurance covers the remaining 80%).

- Out-of-Pocket Maximum: The most you’ll pay in a year for covered services before your insurance covers 100% of the costs.

- Network of Providers: The list of healthcare professionals and facilities that are in-network and offer discounted rates.

- Covered Services: The types of medical care, treatments, and procedures that are included in your plan.

- Prescription Drug Coverage: The extent to which your plan covers prescription medications, including any tiers or restrictions.

Step 4: Choose the Right Plan

After thorough research and comparison, it’s time to select the plan that best suits your healthcare needs and budget. Consider your assessment of healthcare requirements, the providers’ reputation, and the specific plan details. Remember, the plan with the lowest premium may not always be the most cost-effective option in the long run, especially if it has high deductibles or limited coverage.

Additionally, pay attention to any exclusions or limitations in the plan. Some plans may not cover certain pre-existing conditions or specific types of care. Understanding these exclusions will help you make an informed decision and avoid any unpleasant surprises down the road.

Step 5: Complete the Enrollment Process

Once you’ve chosen your preferred plan, it’s time to complete the enrollment process. This typically involves filling out an application form, providing personal and medical information, and making the initial premium payment. The specific steps may vary depending on the insurance provider and the type of coverage you’re seeking.

During the enrollment process, be sure to double-check all the information you provide to avoid any errors or delays in processing your application. If you have any questions or need assistance, don’t hesitate to reach out to the insurance provider’s customer support team.

Special Considerations for Different Enrollment Scenarios

The health insurance enrollment process can vary depending on your circumstances. Let’s explore some specific scenarios and the unique considerations they entail.

Enrolling as an Individual

If you’re enrolling in health insurance as an individual, you have the flexibility to choose a plan that aligns with your personal healthcare needs and budget. You can explore various options, including plans offered through the Affordable Care Act (ACA) marketplace, employer-sponsored plans (if you’re eligible), or directly from insurance providers.

When enrolling as an individual, consider factors such as your age, health status, and anticipated medical expenses. Younger, healthier individuals may opt for plans with lower premiums and higher deductibles, while those with chronic conditions or a higher risk of illness may prioritize plans with comprehensive coverage and lower out-of-pocket costs.

Enrolling as a Family

Enrolling in health insurance as a family requires careful consideration of the healthcare needs of all family members. You’ll need to assess the health status of each individual, including any pre-existing conditions or anticipated medical needs. Plans with family coverage typically offer more comprehensive benefits and may include additional services such as pediatric care or maternity benefits.

When enrolling as a family, it’s essential to strike a balance between affordability and coverage. Look for plans that offer a good balance of premiums, deductibles, and copays, ensuring that the costs are manageable for your household budget while providing adequate protection for all family members.

Enrolling as a Business Owner

As a business owner, offering health insurance to your employees can be a significant benefit and a crucial aspect of attracting and retaining talent. When enrolling in health insurance for your business, you’ll need to consider the healthcare needs of your employees and their families, as well as your budget and the cost of providing coverage.

Small business owners may have access to the Small Business Health Options Program (SHOP) marketplace, which offers group health plans tailored to small businesses. This program can provide cost-effective options and tax benefits for businesses that meet certain eligibility criteria.

For larger businesses, negotiating with insurance providers to obtain group rates can be a strategic move. By offering competitive health insurance options, you can enhance employee satisfaction and loyalty, leading to a more productive and engaged workforce.

Special Enrollment Periods

In certain situations, you may be eligible for a Special Enrollment Period (SEP), which allows you to enroll in health insurance outside of the typical open enrollment period. Special enrollment periods are typically granted for specific life events, such as losing other health coverage, getting married, having a baby, or moving to a new area.

It’s important to note that the eligibility criteria and timeframes for special enrollment periods can vary depending on your circumstances and the insurance provider. Stay informed about the specific requirements and deadlines to ensure you take advantage of these opportunities when necessary.

Maximizing Your Health Insurance Benefits

Now that you’ve enrolled in health insurance, it’s essential to understand how to make the most of your coverage. Here are some tips to ensure you’re getting the full value from your plan:

Choose In-Network Providers

Whenever possible, choose healthcare providers that are in your insurance plan’s network. In-network providers have negotiated rates with the insurance company, resulting in lower costs for you. Out-of-network care may be more expensive and may not be fully covered by your plan.

Understand Your Benefits and Coverage

Take the time to thoroughly review your insurance policy documents and understand the specifics of your coverage. This includes knowing your plan’s benefits, limitations, and exclusions. By familiarizing yourself with your policy, you can make informed decisions about your healthcare and avoid unexpected costs.

Utilize Preventive Care Services

Most health insurance plans offer preventive care services at little to no cost. These services, such as annual check-ups, immunizations, and screenings, are designed to help you stay healthy and detect potential health issues early on. Take advantage of these services to maintain your well-being and potentially avoid more costly treatments in the future.

Manage Your Out-of-Pocket Costs

While health insurance provides financial protection, it’s important to be mindful of your out-of-pocket costs. These costs include deductibles, copays, and coinsurance. Keep track of your expenses and consider ways to minimize them, such as reaching your deductible early in the year or negotiating lower rates for certain procedures.

Explore Additional Benefits

Health insurance plans often come with additional benefits and perks beyond basic medical coverage. These may include discounts on fitness memberships, vision or dental care, or even wellness programs. Take advantage of these added benefits to enhance your overall health and well-being.

Future Trends in Health Insurance

The health insurance landscape is constantly evolving, with new trends and innovations shaping the industry. Here’s a glimpse into the future of health insurance and how it may impact your coverage and choices:

Telehealth and Virtual Care

The rise of telehealth services has transformed the way healthcare is delivered. Virtual care allows you to consult with healthcare professionals remotely, offering convenience and accessibility. Many insurance plans now cover telehealth services, making it easier for you to access care from the comfort of your home.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models incentivize healthcare providers to improve patient outcomes and reduce unnecessary procedures. As value-based care gains traction, you may see more insurance plans incorporating these models, leading to better overall healthcare experiences.

Consumer-Directed Health Plans

Consumer-directed health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are becoming increasingly popular. These plans give you more control over your healthcare spending, allowing you to save pre-tax dollars for qualified medical expenses. With consumer-directed plans, you can actively manage your healthcare costs and potentially save money in the long run.

Personalized Medicine

Advancements in technology and genomics are paving the way for personalized medicine. This approach tailors healthcare treatments and interventions to an individual’s unique genetic makeup. As personalized medicine becomes more prevalent, insurance plans may need to adapt to cover these specialized treatments, offering a more customized approach to healthcare.

Conclusion

Enrolling in health insurance is a crucial step toward ensuring your access to quality healthcare and financial protection. By following the steps outlined in this guide and staying informed about the latest trends, you can navigate the enrollment process with confidence and select a plan that meets your unique needs. Remember, health insurance is an essential tool for safeguarding your well-being and financial stability, so take the time to make an informed decision and stay proactive in managing your healthcare.

What is the Affordable Care Act (ACA)?

+The Affordable Care Act, often referred to as Obamacare, is a federal law in the United States that aims to make health insurance more affordable and accessible. It introduces various reforms, including the establishment of health insurance marketplaces, the expansion of Medicaid, and the implementation of individual and employer mandates.

How do I know if I qualify for a Special Enrollment Period (SEP)?

+Special Enrollment Periods are typically granted for specific life events, such as losing other health coverage, getting married, having a baby, or moving to a new area. You can check the eligibility criteria and deadlines on the official government website or by contacting your insurance provider.

What is the difference between a Health Savings Account (HSA) and a Flexible Spending Account (FSA)?

+A Health Savings Account (HSA) is a tax-advantaged savings account that allows you to set aside pre-tax dollars for qualified medical expenses. HSAs are typically paired with high-deductible health plans. On the other hand, a Flexible Spending Account (FSA) is an employer-sponsored account that allows you to set aside pre-tax dollars for specific medical, dental, and vision expenses. Unlike HSAs, FSAs do not roll over from year to year, and any unused funds are forfeited.