Erie Insurance Companies

Erie Insurance Companies is a prominent name in the insurance industry, offering a wide range of coverage options to individuals and businesses across the United States. With a strong focus on customer satisfaction and community involvement, this insurance group has built a solid reputation over the years. In this article, we delve into the history, products, and unique features of Erie Insurance, providing an in-depth analysis of their offerings and impact on the insurance landscape.

A Legacy of Trust and Community Engagement

Erie Insurance traces its roots back to 1918 when it was founded as the Erie Indemnity Company in Erie, Pennsylvania. The company’s early days were marked by a commitment to providing affordable and reliable insurance solutions to the local community. Over a century later, this commitment remains at the core of Erie Insurance’s philosophy, guiding its operations and growth.

The company's approach to community involvement is unique. Erie Insurance actively supports local initiatives and charities, fostering a sense of trust and loyalty among its customers. Their community-centric philosophy has helped them build strong relationships and establish a solid presence in the regions they serve.

A Century of Growth and Expansion

Erie Insurance’s growth trajectory has been steady and strategic. Starting as a local insurance provider, the company gradually expanded its reach, first within Pennsylvania and then across neighboring states. Today, Erie Insurance operates in 12 states, offering its comprehensive range of insurance products to a diverse customer base.

The company's expansion has been characterized by careful planning and a deep understanding of local markets. Erie Insurance has successfully tailored its products and services to meet the specific needs of each region, ensuring that its offerings remain relevant and competitive.

| States Covered by Erie Insurance | Number of States |

|---|---|

| Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, Wisconsin | 12 |

A Comprehensive Range of Insurance Products

Erie Insurance offers a wide array of insurance products, catering to the diverse needs of its customers. Their product portfolio includes:

Auto Insurance

Erie Insurance provides comprehensive auto insurance coverage, offering options for various vehicle types and driving profiles. Their policies include standard features like liability coverage, medical payments, and collision coverage, as well as additional benefits such as rental car reimbursement and glass repair.

One unique feature of Erie Insurance's auto policies is their Rate Lock Endorsement. This endorsement ensures that customers' rates will not increase due to accidents or violations, providing a sense of financial security and predictability.

Home Insurance

For homeowners, Erie Insurance offers customizable home insurance policies. These policies provide coverage for the structure of the home, as well as its contents, with options to add additional protection for high-value items like jewelry or artwork. Erie Insurance also offers liability coverage to protect homeowners from potential lawsuits.

A notable feature of their home insurance policies is the "New Homeowner Discount," which provides a discount for homeowners who have recently purchased a new home. This incentive not only attracts new customers but also demonstrates Erie Insurance's commitment to supporting homeowners at every stage of their journey.

Life Insurance

Erie Insurance understands the importance of life insurance as a financial safety net for families. Their life insurance policies offer flexible options, including term life insurance, whole life insurance, and universal life insurance. These policies provide coverage for various needs, such as final expense planning, income replacement, and estate planning.

One innovative aspect of Erie Insurance's life insurance offerings is their "Living Benefits Rider." This rider allows policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness, providing much-needed financial support during difficult times.

Business Insurance

Erie Insurance caters to the needs of small businesses with a range of business insurance products. Their policies offer coverage for property damage, liability, business interruption, and more. Erie Insurance also provides specialized coverage for unique business needs, such as professional liability insurance for consultants or errors and omissions insurance for service providers.

A standout feature of their business insurance offerings is the "Cyber Insurance" coverage. In an era where cyber threats are increasingly common, Erie Insurance recognizes the importance of protecting businesses from data breaches and cyber attacks. Their comprehensive cyber insurance policy provides coverage for data recovery, business interruption, and legal expenses related to cyber incidents.

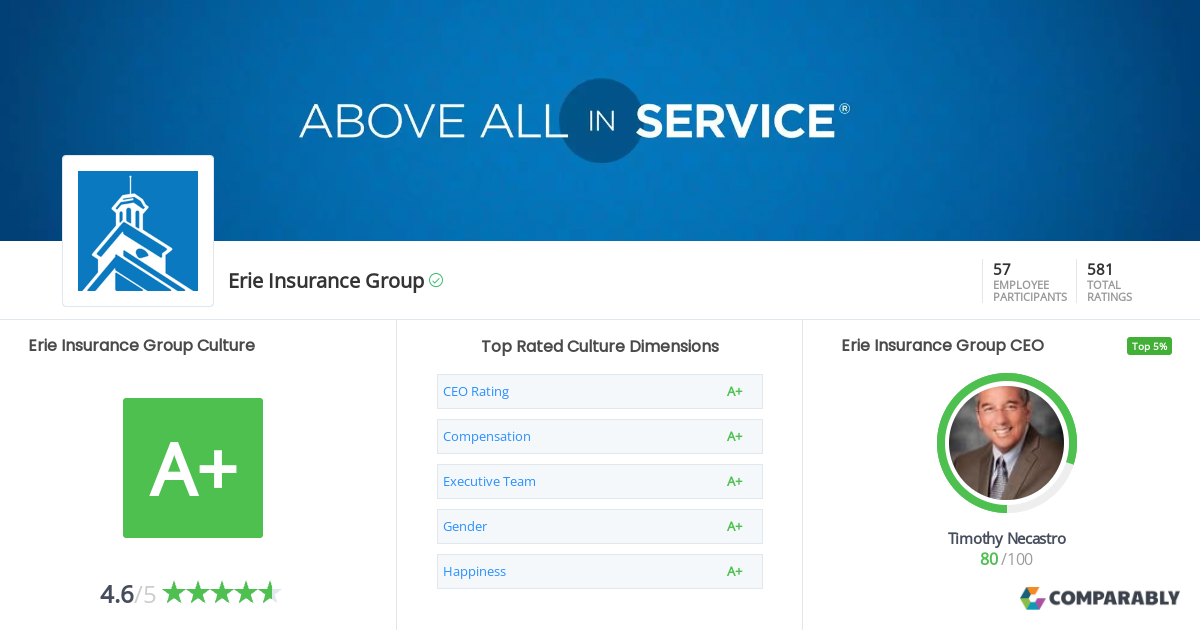

A Commitment to Customer Satisfaction

Erie Insurance places a strong emphasis on customer satisfaction, striving to provide excellent service and support to its policyholders. Their customer-centric approach is evident in various aspects of their operations, from claim handling to policy customization.

Claims Handling

Erie Insurance is known for its efficient and responsive claims handling process. Their claims adjusters are trained to provide timely assistance, ensuring that policyholders receive the support they need during challenging times. The company’s commitment to quick claim settlements has earned it a reputation for reliability and trustworthiness.

A unique aspect of Erie Insurance's claims process is their "Quick Claim Settlement Program." This program allows policyholders to receive immediate payments for smaller claims, providing financial relief and reducing the stress associated with the claims process.

Policy Customization

Erie Insurance understands that every customer has unique needs. To cater to this diversity, they offer highly customizable insurance policies. Policyholders can choose from a range of coverage options, deductibles, and endorsements to create a policy that aligns perfectly with their specific requirements and budget.

One example of Erie Insurance's commitment to policy customization is their "Erie Rate Locker." This program allows policyholders to lock in their auto insurance rates for up to 5 years, providing long-term rate stability and peace of mind. This innovative offering sets Erie Insurance apart from many competitors in the market.

Conclusion

Erie Insurance Companies stands as a testament to the power of community-centric and customer-focused business models. With a century of experience and a strong commitment to its values, the company has successfully expanded its reach and built a solid reputation in the insurance industry. Their comprehensive range of insurance products, coupled with their unique features and excellent customer service, positions Erie Insurance as a trusted partner for individuals and businesses seeking reliable coverage and peace of mind.

What is Erie Insurance’s rate for car insurance?

+Erie Insurance’s car insurance rates vary based on individual factors such as driving history, location, and coverage preferences. The company offers competitive rates and provides tools on their website to help customers estimate their premiums. However, for an accurate quote, it’s best to contact Erie Insurance directly or work with an authorized agent.

Does Erie Insurance offer insurance for rental properties?

+Yes, Erie Insurance provides insurance coverage for rental properties. Their policies cover the structure and contents of the rental property, as well as liability protection for the landlord. Erie Insurance’s rental property insurance offers flexible options to cater to the unique needs of landlords.

What sets Erie Insurance apart from other insurance companies?

+Erie Insurance distinguishes itself through its strong commitment to community involvement, customer satisfaction, and policy customization. Their unique features, such as the Rate Lock Endorsement for auto insurance and the Living Benefits Rider for life insurance, set them apart and provide added value to their policyholders.