Error And Omission Insurance

Error and Omission Insurance: A Comprehensive Guide for Professionals

Error and Omission (E&O) insurance is a vital aspect of risk management for professionals across various industries. This specialized form of liability insurance provides coverage for legal claims arising from mistakes, oversights, or negligent acts committed during the course of business. In today's highly litigious environment, understanding and acquiring appropriate E&O insurance coverage is crucial for professionals to protect their livelihoods and reputation.

This comprehensive guide aims to shed light on the significance of Error and Omission insurance, exploring its benefits, how it works, and why it is essential for professionals to have. By delving into real-world examples and industry insights, we will navigate the complexities of E&O insurance, ensuring professionals are well-informed about this critical aspect of their business.

Understanding Error and Omission Insurance

Error and Omission insurance, often referred to as Professional Liability insurance, is designed to protect professionals from the financial repercussions of errors or omissions made in the delivery of their services. It provides coverage for legal costs, settlements, and damages that may arise from such mistakes. This coverage is particularly crucial for professionals whose work involves a high degree of trust and responsibility, such as accountants, consultants, real estate agents, and IT professionals.

The need for E&O insurance stems from the reality that even the most diligent professionals can make errors. These errors can range from simple oversights to more complex failures in judgment, which can have significant financial and reputational consequences. For instance, an accountant might overlook a crucial tax deduction, leading to a client facing unexpected tax liabilities. Or, a consultant could provide incorrect advice, resulting in a client's project failing and incurring substantial losses.

Here's a breakdown of how E&O insurance typically works:

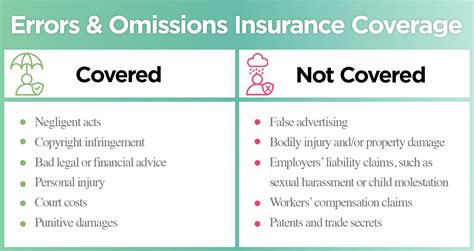

- Policy Coverage: E&O policies cover a wide range of professional services, including advice, consultations, designs, recommendations, and more. The specific coverage can vary depending on the type of professional practice and the insurance provider.

- Policy Exclusions: While E&O insurance is comprehensive, it does have certain exclusions. For instance, most policies do not cover intentional acts of fraud, criminal activities, or contractual disputes.

- Claims Process: In the event of a claim, the insured professional must notify their insurance provider as soon as possible. The insurer will then investigate the claim, assess the validity, and provide coverage or deny the claim based on the policy terms.

- Legal Defense: E&O insurance often includes legal defense coverage, which means the insurer will provide legal representation for the insured professional during the claim process.

- Limits and Deductibles: E&O policies have set limits on the amount of coverage provided. These limits can vary significantly, and professionals should carefully review their policies to ensure they have adequate coverage for their potential risks. Additionally, policies typically have deductibles, which the insured professional must pay before the insurance coverage kicks in.

The Benefits of Error and Omission Insurance

The advantages of Error and Omission insurance are numerous and can provide significant peace of mind for professionals. Here are some key benefits:

Financial Protection

E&O insurance serves as a financial safety net for professionals, protecting them from the potentially devastating costs of legal claims. In an industry where a single mistake can lead to substantial financial losses for clients, having E&O insurance ensures that professionals can focus on their work without the constant worry of potential liabilities.

For instance, consider a software development company that provides customized solutions to businesses. If a critical bug is overlooked in their software, leading to data breaches or system failures for their clients, the financial repercussions could be immense. With E&O insurance, the company can mitigate these financial risks, ensuring they can continue to operate even in the face of such incidents.

Reputation Management

In today's highly competitive professional landscape, reputation is everything. A single mistake can not only result in financial losses but also irreparable damage to a professional's reputation. E&O insurance provides a mechanism to manage such reputational risks.

Take the example of a marketing agency that develops a marketing campaign for a client. If the campaign fails to deliver the promised results due to an oversight in strategy, the agency's reputation could suffer significantly. With E&O insurance, the agency can address such issues promptly and effectively, minimizing the potential negative impact on their brand.

Client Confidence and Trust

Having E&O insurance demonstrates a professional's commitment to providing high-quality services and their willingness to take responsibility for any errors. This can enhance client confidence and trust, leading to stronger client relationships and potentially more business opportunities.

For instance, an independent financial advisor working with high-net-worth individuals must have E&O insurance to assure their clients that their assets are in safe hands. This assurance can lead to deeper client relationships and long-term business success.

Risk Management and Prevention

E&O insurance isn't just about covering potential mistakes; it also encourages professionals to implement robust risk management strategies. Many insurance providers offer resources and tools to help professionals identify and mitigate potential risks, thereby reducing the likelihood of errors and claims.

For example, a healthcare provider might receive resources from their insurance provider on best practices for medical record-keeping, reducing the risk of errors and potential malpractice claims.

Case Studies: Real-World Applications of E&O Insurance

Legal Services

A law firm specializing in estate planning overlooked a critical detail in a client's will, leading to a dispute among family members. The firm's E&O insurance covered the legal costs and settlement, allowing them to resolve the issue without significant financial burden.

Real Estate

A real estate agent failed to disclose a major property defect to a buyer, resulting in a lawsuit. The agent's E&O insurance provided legal defense and covered the settlement costs, protecting the agent's financial stability.

Consulting

A management consulting firm provided strategic advice to a client, leading to a significant business decision. However, due to an oversight, the advice was based on outdated market data. The client incurred losses, but the consulting firm's E&O insurance covered the damages, allowing the firm to maintain its reputation.

Choosing the Right E&O Insurance

Selecting the appropriate E&O insurance policy can be a complex task, given the variety of options and coverage specifics. Here are some key considerations for professionals:

Coverage Limits

Review the policy's coverage limits carefully. Ensure the limits are sufficient to cover potential claims based on your industry and the nature of your work. Higher limits might come with a higher premium, but they can provide greater peace of mind.

Policy Exclusions

Understand the exclusions in your policy. While most E&O policies cover a wide range of professional services, certain activities or errors might not be covered. Ensure you're aware of these exclusions to manage your risks effectively.

Policy Deductibles

Consider the policy deductibles. Higher deductibles can lower your premium, but they also mean you'll need to pay more out-of-pocket before the insurance coverage kicks in. Assess your financial preparedness to handle higher deductibles.

Claims Handling

Research the insurer's claims handling process. Ensure they have a responsive and efficient claims team. Timely handling of claims can be critical, especially in industries where reputation and client relationships are paramount.

Additional Coverages

Some E&O policies offer additional coverages, such as coverage for regulatory investigations or crisis management services. Depending on your industry and potential risks, these additional coverages might be beneficial.

The Future of E&O Insurance

As industries evolve and professional practices become more complex, the landscape of E&O insurance is also changing. Insurers are adapting their policies to cover emerging risks, such as cyber liabilities and data breaches, which are becoming increasingly common across various industries.

Furthermore, with the rise of remote work and digital transformations, E&O insurance is evolving to cover professionals working in these new environments. For instance, insurance providers are now offering policies that cover remote workers' professional liabilities, ensuring they are protected regardless of their physical location.

In conclusion, Error and Omission insurance is an essential tool for professionals to manage their risks and protect their businesses. By understanding the intricacies of E&O insurance and selecting the right policy, professionals can focus on delivering high-quality services without the constant worry of potential liabilities.

How much does Error and Omission insurance typically cost?

+The cost of E&O insurance can vary significantly based on the industry, the professional’s experience, and the level of coverage required. Premiums can range from a few hundred dollars to several thousand dollars annually. It’s essential to shop around and obtain quotes from multiple insurers to find the best coverage at a competitive price.

Are there any industries that don’t require E&O insurance?

+While E&O insurance is not legally mandated for all professions, it is highly recommended for professionals in industries where mistakes can lead to significant financial or reputational damage. Industries such as accounting, consulting, real estate, and legal services typically benefit the most from E&O insurance.

What happens if I don’t have E&O insurance and a claim is made against me?

+If you don’t have E&O insurance and a claim is made against you, you will be personally responsible for all legal costs, settlements, and damages. This can lead to significant financial strain and potentially impact your ability to continue operating your business.

Can E&O insurance cover claims that arise years after the work is completed?

+Yes, many E&O insurance policies provide coverage for claims made during the policy period, even if the error or omission occurred years prior. This is known as a “claims made” policy, and it’s important to understand the policy’s retroactive date and the length of the reporting period to ensure adequate coverage.