Estimated Auto Insurance

Welcome to this comprehensive guide on auto insurance and the factors that influence its estimated costs. Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. In this article, we will delve into the world of auto insurance estimates, exploring the key components that contribute to the overall cost. By understanding these factors, you can make informed decisions and potentially save money on your auto insurance coverage.

Understanding Auto Insurance Estimates

Auto insurance estimates serve as a crucial tool for both insurance providers and policyholders. These estimates provide an indication of the expected costs associated with insuring a specific vehicle and driver. The process of estimating auto insurance rates involves considering a multitude of variables, each playing a role in determining the final premium.

One of the primary factors influencing auto insurance estimates is the driver's profile. Insurance companies assess a variety of characteristics, including age, gender, driving history, and location, to evaluate the level of risk associated with insuring a particular individual. Younger drivers, for instance, are often considered higher-risk due to their lack of experience on the road, resulting in potentially higher insurance premiums.

Additionally, the type of vehicle being insured plays a significant role in determining the estimated cost. Different vehicles have varying levels of repair and replacement costs, which directly impact insurance rates. High-performance cars, luxury vehicles, and those with a history of frequent accidents or theft may carry higher insurance premiums due to the increased financial risk they pose.

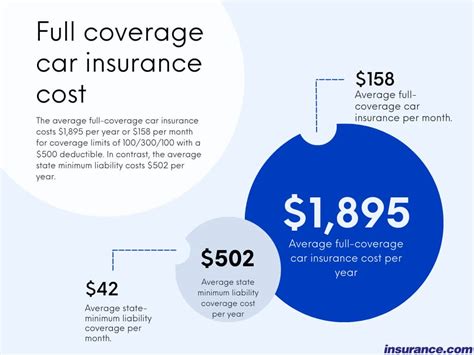

Another critical aspect that affects auto insurance estimates is the coverage selected. Auto insurance policies offer a range of coverage options, such as liability, collision, comprehensive, and additional add-ons. The more comprehensive the coverage, the higher the estimated cost is likely to be. It is essential to strike a balance between the desired level of protection and the affordability of the insurance policy.

Factors Influencing Auto Insurance Estimates

Several key factors come into play when calculating auto insurance estimates. Let’s explore some of the most significant influences:

- Driver's Age and Gender: As mentioned earlier, younger drivers, especially those under the age of 25, are often charged higher premiums due to their increased risk of accidents. Additionally, statistical data suggests that males tend to pay slightly higher insurance rates compared to females.

- Driving History: A clean driving record is highly favorable when it comes to auto insurance estimates. Insurance companies reward drivers with a history of safe driving and minimal claims with lower premiums. On the other hand, drivers with a record of accidents, traffic violations, or insurance claims may face higher estimated costs.

- Vehicle Type and Usage: The make, model, and year of the vehicle being insured are crucial factors. High-performance cars, sports vehicles, and luxury brands typically carry higher insurance costs due to their higher repair and replacement expenses. Furthermore, the primary usage of the vehicle, whether for personal or business purposes, can also impact insurance estimates.

- Location and Mileage: The geographical location where the vehicle is primarily driven plays a significant role in insurance estimates. Areas with higher rates of accidents, theft, or natural disasters may result in higher premiums. Additionally, the estimated annual mileage of the vehicle can influence the cost, as insurance providers consider the potential risk associated with frequent driving.

- Credit History: Surprisingly, your credit score can affect your auto insurance estimates. Insurance companies often use credit-based insurance scores to assess the risk of insuring a driver. A good credit history may lead to lower insurance premiums, while a poor credit score could result in higher estimated costs.

Obtaining Accurate Auto Insurance Estimates

When seeking auto insurance estimates, it is essential to provide accurate and detailed information to insurance providers. Being transparent about your driving history, vehicle usage, and personal circumstances can help ensure that you receive precise and tailored estimates. Here are some steps to consider:

- Compare Multiple Quotes: Obtain quotes from several insurance providers to compare their estimated premiums. This allows you to assess the range of prices and find the most competitive rates.

- Evaluate Coverage Options: Understand the different coverage options available and assess your specific needs. Consider the balance between comprehensive coverage and affordable premiums.

- Explore Discounts: Insurance companies often offer various discounts, such as safe driver discounts, multi-policy discounts, or loyalty rewards. Inquire about these discounts to potentially reduce your estimated insurance costs.

- Review Your Policy Regularly: Auto insurance estimates can change over time due to factors like age, vehicle upgrades, or changes in your driving record. Regularly review your policy to ensure it aligns with your current needs and circumstances.

| Factor | Influence on Insurance Estimates |

|---|---|

| Driver's Age | Younger drivers often face higher premiums due to increased risk. |

| Driving History | Clean records lead to lower premiums; accidents and violations increase costs. |

| Vehicle Type | High-performance and luxury cars generally carry higher insurance costs. |

| Location | Areas with higher accident rates may result in higher premiums. |

| Credit History | Good credit can lead to lower insurance estimates; poor credit may increase costs. |

The Impact of Deductibles and Coverage Levels

When exploring auto insurance estimates, it is crucial to understand the relationship between deductibles and coverage levels. Deductibles represent the amount you, as the policyholder, agree to pay out of pocket before your insurance coverage kicks in. The level of coverage you choose determines the scope of protection provided by your insurance policy.

Opting for a higher deductible can lead to lower estimated insurance premiums. This is because you are assuming a larger portion of the financial responsibility in the event of a claim. However, it's essential to strike a balance and choose a deductible amount that you can comfortably afford. A higher deductible may result in cost savings, but it also means you will have to pay more out of pocket if you need to make a claim.

On the other hand, selecting a lower deductible typically results in higher estimated insurance premiums. While this approach provides greater financial protection, it can increase the overall cost of your insurance policy. It's important to carefully consider your financial situation and the potential risks you may face to determine the appropriate deductible and coverage level for your needs.

Understanding Coverage Options

Auto insurance policies offer a range of coverage options to meet the diverse needs of policyholders. Here are some common types of coverage and their implications:

- Liability Coverage: This type of coverage is mandatory in most states and provides financial protection if you are found at fault in an accident. It covers damages to other people's property and medical expenses for their injuries. Liability coverage does not, however, cover damages to your own vehicle or injuries you sustain.

- Collision Coverage: Collision coverage is an optional add-on that protects your vehicle in the event of a collision, regardless of fault. It covers the cost of repairs or replacement of your vehicle if it is damaged in an accident. This coverage can be especially beneficial for newer or more valuable vehicles.

- Comprehensive Coverage: Comprehensive coverage provides protection for your vehicle against non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It offers a more comprehensive level of protection compared to collision coverage alone.

- Uninsured/Underinsured Motorist Coverage: This coverage is designed to protect you in the event of an accident with a driver who has insufficient or no insurance coverage. It can cover your medical expenses and property damage costs if the at-fault driver is unable to provide adequate compensation.

When selecting coverage options, it is essential to consider your individual circumstances and the level of protection you require. While comprehensive coverage offers the most extensive protection, it also comes at a higher cost. Evaluating your financial situation, the value of your vehicle, and the potential risks you face will help you make an informed decision about the coverage that best suits your needs.

Tips for Reducing Auto Insurance Estimates

If you’re looking to reduce your auto insurance estimates, there are several strategies you can employ. Here are some tips to consider:

- Shop Around and Compare: Don't settle for the first insurance quote you receive. Take the time to compare estimates from multiple insurance providers. This allows you to identify the most competitive rates and potentially save money.

- Improve Your Driving Record: Maintaining a clean driving record is crucial for obtaining lower insurance estimates. Avoid traffic violations, practice defensive driving, and consider taking a defensive driving course to improve your skills and potentially qualify for discounts.

- Consider Bundle Discounts: Many insurance companies offer bundle discounts when you combine multiple insurance policies, such as auto and home insurance. By insuring multiple aspects of your life with the same provider, you may be eligible for significant savings.

- Review Coverage Levels: Regularly review your coverage levels to ensure they align with your current needs and circumstances. You may find that adjusting your coverage, such as increasing your deductible or reducing certain add-ons, can result in lower estimated premiums.

- Explore Discounts and Rewards: Insurance companies often provide various discounts and rewards to policyholders. Look into safe driver discounts, good student discounts, loyalty rewards, or discounts for specific occupations or affiliations. These discounts can significantly impact your estimated insurance costs.

By implementing these strategies and being proactive in managing your auto insurance, you can potentially reduce your estimated premiums and save money on your coverage.

The Future of Auto Insurance: Technology and Personalization

The auto insurance industry is undergoing significant transformations, driven by advancements in technology and a shift towards personalized insurance solutions. These developments are reshaping the way insurance estimates are calculated and delivered, offering new opportunities for policyholders to save money and receive tailored coverage.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of GPS tracking and data analytics, is revolutionizing the auto insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is becoming increasingly popular. With this approach, insurance providers can gather real-time data on a driver’s behavior, including driving habits, mileage, and even the time of day they drive.

By analyzing this data, insurance companies can provide more accurate and personalized insurance estimates. Drivers who exhibit safe driving behaviors, such as maintaining a consistent speed, avoiding abrupt stops, and driving during safer hours, may be rewarded with lower insurance premiums. Conversely, drivers with riskier behaviors may face higher estimated costs.

Usage-based insurance offers a more dynamic and fair approach to auto insurance, as it takes into account an individual's actual driving behavior rather than relying solely on historical data or demographics. This technology has the potential to encourage safer driving habits and provide policyholders with incentives to improve their driving skills.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are playing a significant role in the future of auto insurance. Insurance companies are leveraging advanced algorithms and machine learning techniques to analyze vast amounts of data and make more precise predictions about risk factors.

AI-powered systems can process and interpret data related to vehicle models, repair costs, accident trends, and even weather patterns to generate more accurate insurance estimates. By considering a multitude of variables and historical data, insurance providers can offer personalized rates that reflect the unique circumstances of each policyholder.

Furthermore, AI-driven systems can automate certain aspects of the insurance process, such as claims handling and fraud detection. This not only improves efficiency but also reduces costs, which can potentially be passed on to policyholders in the form of lower insurance estimates.

Personalized Insurance Solutions

The combination of telematics, AI, and data analytics is leading to a new era of personalized insurance solutions. Insurance providers are now able to offer tailored coverage options based on an individual’s specific needs and driving behavior. This level of personalization ensures that policyholders receive the right amount of coverage at a fair and competitive price.

Personalized insurance solutions take into account factors such as the driver's age, gender, driving history, and even their preferred routes and destinations. By understanding these nuances, insurance companies can provide more accurate estimates and offer coverage options that align with the policyholder's unique circumstances.

Additionally, personalized insurance can provide policyholders with valuable insights and feedback on their driving habits. Through mobile apps or online portals, drivers can access real-time data on their driving performance, receive tips for improvement, and even track their progress over time. This level of engagement and feedback can encourage safer driving practices and potentially lead to reduced insurance estimates.

Conclusion: Navigating Auto Insurance Estimates

In conclusion, understanding the factors that influence auto insurance estimates is crucial for making informed decisions about your coverage. From driver’s profile and vehicle type to coverage options and deductibles, each aspect plays a role in determining the estimated cost of your auto insurance policy.

By exploring the various influences on insurance estimates and implementing strategies to reduce costs, you can navigate the auto insurance landscape with confidence. Whether it's comparing quotes, improving your driving record, or embracing the latest technological advancements, there are numerous opportunities to obtain affordable and comprehensive coverage.

As the auto insurance industry continues to evolve, staying informed and proactive is key. Keep an eye on emerging trends, such as usage-based insurance and personalized coverage options, as they have the potential to revolutionize the way we perceive and obtain insurance. With the right knowledge and approach, you can find the perfect balance between protection and affordability in your auto insurance policy.

What is the average cost of auto insurance in the United States?

+

The average cost of auto insurance in the U.S. varies depending on factors such as location, driving history, and coverage levels. According to recent data, the national average for annual auto insurance premiums is approximately $1,674. However, it’s important to note that this is just an average, and actual costs can vary significantly based on individual circumstances.

How can I lower my auto insurance premiums?

+

There are several strategies to lower your auto insurance premiums. These include shopping around for quotes from different providers, maintaining a clean driving record, increasing your deductible, bundling your insurance policies, and exploring discounts such as safe driver or good student discounts.

What factors impact the cost of auto insurance estimates?

+

Several factors influence auto insurance estimates, including driver’s age and gender, driving history, vehicle type and usage, location, credit history, and the level of coverage selected. Each of these factors plays a role in assessing the risk associated with insuring a specific driver and vehicle, ultimately impacting the estimated cost of the insurance policy.