Ethos Insurance

In the ever-evolving landscape of the insurance industry, the rise of innovative companies is transforming the way we perceive and access insurance services. Among these pioneers, Ethos Insurance stands out as a trailblazer, offering a fresh and technologically advanced approach to a traditionally complex and bureaucratic sector.

This article aims to delve deep into the world of Ethos Insurance, exploring its unique business model, groundbreaking technologies, and the profound impact it has had on the insurance sector. By examining its core principles, innovative strategies, and real-world applications, we can gain a comprehensive understanding of Ethos Insurance's role in shaping the future of the industry.

Revolutionizing the Insurance Landscape: Ethos Insurance’s Vision and Impact

Ethos Insurance has emerged as a disruptor in the insurance market, challenging the status quo with a mission to make insurance simpler, more accessible, and tailored to the needs of the modern consumer. At its core, Ethos believes in the power of technology to streamline processes, enhance transparency, and offer personalized insurance solutions.

One of the key aspects that sets Ethos apart is its commitment to digital transformation. The company has leveraged cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics to revolutionize every step of the insurance journey. From initial policy applications to claims processing, Ethos has digitalized and optimized processes, making them more efficient, accurate, and customer-centric.

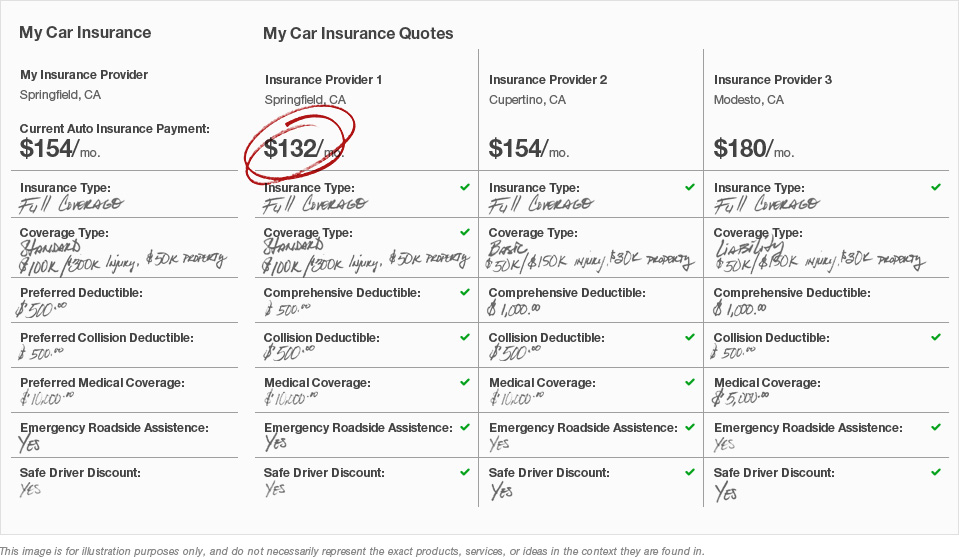

The impact of Ethos Insurance's innovative approach is evident in several key areas. Firstly, it has democratized access to insurance by making policies more affordable and accessible to a wider range of consumers. Through its digital platform, Ethos offers a seamless and intuitive experience, enabling individuals to easily compare and purchase insurance products online without the need for extensive paperwork or face-to-face interactions.

Ethos’ Technological Advancements: Unlocking New Possibilities

At the heart of Ethos Insurance’s success lies its ability to harness the power of technology to enhance its services. The company has invested significantly in research and development, continually pushing the boundaries of what is possible in the insurance sector.

One of the most notable technological advancements introduced by Ethos is its AI-powered underwriting system. This system utilizes advanced algorithms and machine learning techniques to assess risk factors and determine insurance premiums with unparalleled accuracy. By analyzing vast amounts of data, including traditional risk indicators and alternative data sources, Ethos' AI system can offer highly personalized policies that are fair and competitive.

Additionally, Ethos has pioneered the use of smart sensors and IoT devices to enhance risk management and claims processing. These devices, when installed in homes or vehicles, can provide real-time data on potential hazards, allowing Ethos to offer proactive risk mitigation strategies and more efficient claims handling. For instance, smart sensors can detect leaks or fire hazards in homes, enabling Ethos to respond swiftly and minimize potential damages.

The company's embrace of blockchain technology has also been a game-changer. By leveraging blockchain's decentralized and secure nature, Ethos has developed a transparent and tamper-proof system for policy documentation and claims management. This not only enhances security but also streamlines the entire claims process, reducing the time and resources required for settlement.

| Technology | Application |

|---|---|

| AI & Machine Learning | Accurate underwriting, personalized policies |

| Smart Sensors & IoT | Proactive risk management, efficient claims handling |

| Blockchain | Secure and transparent policy documentation, streamlined claims process |

Ethos Insurance’s Customer-Centric Approach: Redefining Insurance Services

Ethos Insurance understands that the key to success lies in putting the customer at the center of its operations. The company has implemented a range of strategies to ensure a seamless and satisfying experience for its policyholders.

One of the standout features of Ethos' customer-centric approach is its user-friendly digital platform. The platform is designed with simplicity and intuitiveness in mind, allowing customers to easily navigate through different insurance options, understand policy details, and make informed decisions. The online application process is streamlined, with minimal paperwork and fast approval times, making it a convenient choice for busy individuals.

Furthermore, Ethos emphasizes the importance of personalized support. The company has a dedicated team of insurance experts who are readily available to provide guidance and assistance throughout the insurance journey. Whether it's clarifying policy terms, offering advice on coverage options, or assisting with claims, Ethos ensures that its customers receive the support they need whenever they need it.

The company's proactive risk management strategies also demonstrate its commitment to customer well-being. By leveraging advanced technologies, Ethos can identify potential risks and offer preventive measures to its customers. For instance, through data analysis and predictive modeling, Ethos can alert customers about potential hazards in their homes or vehicles, helping them take necessary precautions to avoid accidents or losses.

The Future of Insurance: Ethos’ Vision and Industry Impact

As we look towards the future, Ethos Insurance’s vision and innovative strategies are poised to have a significant and lasting impact on the insurance industry.

Firstly, Ethos' focus on data-driven decision-making is set to revolutionize the way insurance companies operate. By harnessing the power of big data and advanced analytics, insurance providers can make more informed choices, develop more accurate risk models, and offer highly tailored policies. This shift towards data-centricity will not only enhance efficiency but also foster a more competitive and customer-oriented market.

Secondly, Ethos' commitment to digital transformation will continue to drive the industry forward. As more insurance companies adopt digital platforms and leverage technology to streamline processes, the industry will become more accessible and responsive to the needs of modern consumers. The days of lengthy paperwork and bureaucratic delays will give way to a seamless and user-friendly insurance experience.

Lastly, Ethos' emphasis on customer empowerment will shape the future of insurance services. By putting customers at the heart of their operations and offering personalized support, insurance providers can build stronger relationships and foster trust. This customer-centric approach will not only improve satisfaction levels but also encourage long-term loyalty, driving the industry towards a more sustainable and consumer-friendly model.

How does Ethos Insurance ensure data security and privacy for its customers?

+Ethos Insurance prioritizes data security and privacy by implementing robust encryption protocols and secure data storage systems. The company adheres to industry-leading security standards and regularly conducts security audits to identify and address potential vulnerabilities. Additionally, Ethos educates its customers about best practices for online security and provides resources to help them protect their personal information.

What types of insurance policies does Ethos Insurance offer?

+Ethos Insurance offers a comprehensive range of insurance policies, including life insurance, term life insurance, whole life insurance, universal life insurance, and accidental death and dismemberment insurance. The company also provides innovative products such as income protection policies and critical illness coverage.

How does Ethos Insurance’s AI-powered underwriting system work, and what benefits does it offer to customers?

+Ethos Insurance’s AI-powered underwriting system utilizes advanced algorithms and machine learning techniques to analyze a wide range of data points, including traditional risk factors and alternative data sources. This system enables Ethos to offer highly personalized policies with accurate risk assessments. Customers benefit from faster policy approvals, more competitive premiums, and tailored coverage options.