Everly Life Insurance

Unlocking the Future of Health: A Comprehensive Guide to Everly Life Insurance

In today’s rapidly evolving healthcare landscape, Everly Life Insurance stands out as a pioneer, offering innovative solutions that revolutionize the way we approach health and insurance. This comprehensive guide aims to delve deep into the world of Everly Life, exploring its unique features, impact, and the transformative potential it holds for individuals and the industry as a whole. As we navigate the intricate web of health and insurance, Everly Life emerges as a beacon of progress, providing a fresh perspective on how we can safeguard our well-being and secure our future.

The Everly Life Revolution: A New Era in Health Insurance

Everly Life Insurance is more than just a traditional insurance provider; it's a visionary force driving a paradigm shift in the health industry. With a forward-thinking approach, Everly Life has crafted a suite of insurance products that go beyond the conventional, offering a personalized and holistic experience tailored to the unique needs of each individual.

At the heart of Everly Life's revolution is its commitment to leveraging cutting-edge technology and data-driven insights. By integrating advanced analytics and predictive modeling, Everly Life has developed a dynamic risk assessment framework that goes beyond static, one-size-fits-all policies. This innovative approach enables Everly Life to offer highly personalized coverage plans that adapt to the evolving health landscape and the unique circumstances of its policyholders.

Personalized Health Insights

One of the standout features of Everly Life is its emphasis on providing personalized health insights. Through a combination of wearable technology, mobile apps, and sophisticated algorithms, Everly Life collects and analyzes a wealth of health data, offering policyholders a comprehensive understanding of their well-being. From fitness tracking and nutritional guidance to sleep analysis and stress management tools, Everly Life empowers individuals to take charge of their health like never before.

This personalized approach not only encourages a proactive mindset towards health but also informs the insurance coverage process. By understanding an individual's unique health profile, Everly Life can offer tailored coverage plans that address specific needs, whether it's enhanced coverage for chronic conditions, support for mental health initiatives, or incentives for maintaining a healthy lifestyle.

Dynamic Coverage Options

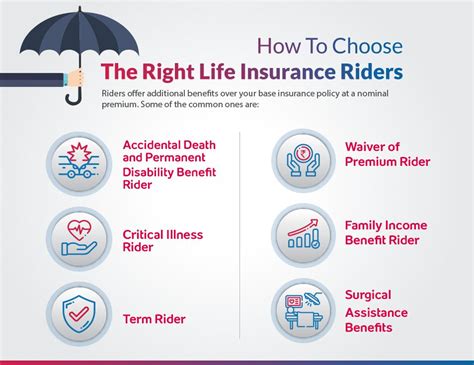

Everly Life's dynamic coverage options are a testament to its innovative spirit. Unlike traditional insurance policies that often remain static over their term, Everly Life's policies are designed to evolve alongside the policyholder's health journey. This dynamic approach ensures that coverage remains relevant and adequate throughout an individual's life, adapting to changing health needs, medical advancements, and personal circumstances.

| Coverage Type | Key Features |

|---|---|

| Flexible Health Plans | Customizable coverage limits, allowing policyholders to adjust their plans based on changing needs. |

| Adaptive Care Packages | Automatic adjustments based on health data, ensuring optimal coverage for evolving health conditions. |

| Wellness Rewards Programs | Incentives for healthy behaviors, rewarding policyholders for maintaining an active and healthy lifestyle. |

By embracing a dynamic coverage model, Everly Life not only provides comprehensive protection but also fosters a culture of continuous improvement and proactive health management.

Empowering Individuals: The Everly Life Experience

At Everly Life, the focus is firmly on empowering individuals to take control of their health and financial security. This people-centric approach is evident in every aspect of the Everly Life experience, from the initial enrollment process to ongoing policy management and claims support.

Seamless Enrollment and Policy Management

Everly Life has streamlined the often-daunting process of enrolling in a health insurance plan. With a user-friendly online platform and intuitive mobile apps, individuals can easily navigate through the enrollment process, providing relevant health information and personal details. Everly Life's advanced algorithms then analyze this data to offer a range of coverage options tailored to the individual's needs.

Once enrolled, policyholders can manage their policies with ease. The Everly Life platform provides a comprehensive dashboard, offering real-time updates on coverage, claims, and health insights. Policyholders can make adjustments to their coverage, track their health progress, and access a wealth of educational resources, all in one convenient location.

Exceptional Claims Support

Everly Life understands that the claims process can be stressful and time-consuming. To alleviate this burden, Everly Life has implemented a streamlined claims support system, ensuring a swift and hassle-free experience for policyholders. With a dedicated claims team and an online portal for claim submissions, Everly Life aims to provide prompt resolutions, ensuring that policyholders receive the financial support they need during times of medical need.

Furthermore, Everly Life's claims support extends beyond mere financial assistance. The company provides comprehensive care coordination services, guiding policyholders through the complex healthcare system. This includes helping policyholders navigate treatment options, understand medical bills, and access support services, ensuring a seamless and supportive experience throughout the claims process.

The Impact of Everly Life: Transforming Lives and the Industry

Everly Life's innovative approach and commitment to empowering individuals have had a profound impact, not only on the lives of its policyholders but also on the broader health insurance industry.

Improved Health Outcomes

By encouraging a proactive and personalized approach to health management, Everly Life has helped improve health outcomes for its policyholders. The combination of wearable technology, mobile apps, and health insights has enabled individuals to take a more active role in their well-being, leading to better health habits, earlier detection of potential issues, and more effective management of existing conditions.

Furthermore, Everly Life's dynamic coverage options ensure that policyholders have access to the right level of coverage when they need it most. This has led to more timely and effective treatment, improved recovery rates, and a reduced burden on the healthcare system.

Redefining Industry Standards

Everly Life's success has not gone unnoticed by the industry. Its innovative approach has sparked a wave of innovation and a shift towards more personalized and dynamic insurance models. Traditional insurance providers are now recognizing the importance of embracing technology and data-driven insights to better serve their customers.

Everly Life's focus on empowering individuals and providing exceptional customer experiences has set a new standard for the industry. Other providers are now investing in digital transformation, adopting user-friendly platforms, and offering more tailored coverage options. This shift towards a more consumer-centric approach is enhancing the overall customer experience and driving positive change within the industry.

The Future of Everly Life: Expanding Horizons and Continuous Innovation

As Everly Life continues to make its mark on the health insurance landscape, its future prospects are bright and filled with potential. With a commitment to continuous innovation and a customer-centric approach, Everly Life is well-positioned to address emerging health challenges and evolving consumer needs.

Expanding Global Reach

Everly Life's success in its core markets has paved the way for global expansion. The company is actively exploring opportunities to bring its innovative insurance solutions to new markets, offering its unique brand of personalized health management and protection to a wider audience.

By leveraging its advanced technology and data-driven insights, Everly Life can adapt its offerings to meet the unique health needs and cultural nuances of diverse populations. This global expansion not only expands Everly Life's customer base but also contributes to a more inclusive and accessible healthcare ecosystem worldwide.

Continuous Innovation and Research

Everly Life's commitment to innovation extends beyond its core insurance offerings. The company invests heavily in research and development, exploring new technologies and healthcare trends to enhance its products and services. From cutting-edge wearables and advanced analytics to emerging fields like telemedicine and personalized medicine, Everly Life is at the forefront of integrating the latest advancements into its platform.

By staying at the vanguard of healthcare innovation, Everly Life ensures that its insurance solutions remain relevant and effective in an ever-changing landscape. This commitment to continuous improvement positions Everly Life as a trusted partner in health and financial security for generations to come.

FAQs

How does Everly Life’s personalized health insights feature work?

+Everly Life’s personalized health insights utilize a combination of wearable technology and mobile apps to track and analyze an individual’s health data. This data includes fitness levels, sleep patterns, nutritional habits, and stress levels. Advanced algorithms then interpret this data, providing tailored health recommendations and insights to help policyholders improve their overall well-being.

What sets Everly Life’s dynamic coverage options apart from traditional insurance policies?

+Everly Life’s dynamic coverage options are designed to adapt to the evolving health needs of policyholders. Unlike traditional policies that remain static, Everly Life’s coverage plans can be adjusted based on an individual’s changing circumstances, ensuring that policyholders always have the right level of coverage to meet their specific needs.

How does Everly Life’s claims support system work, and what makes it different from traditional providers?

+Everly Life’s claims support system is designed to be streamlined and user-friendly. Policyholders can submit claims through an online portal or with the help of a dedicated claims team. Everly Life also provides care coordination services, guiding policyholders through the healthcare system and ensuring they receive the necessary support during the claims process. This holistic approach sets Everly Life apart from traditional providers, offering a more supportive and personalized experience.