Family Health Insurance Plan

Health insurance is a crucial aspect of financial planning for families, offering peace of mind and protection against unexpected medical expenses. With the rising costs of healthcare, having a comprehensive family health insurance plan is more important than ever. In this article, we will delve into the world of family health insurance, exploring its benefits, key considerations, and how to choose the right plan for your loved ones.

The Importance of Family Health Insurance

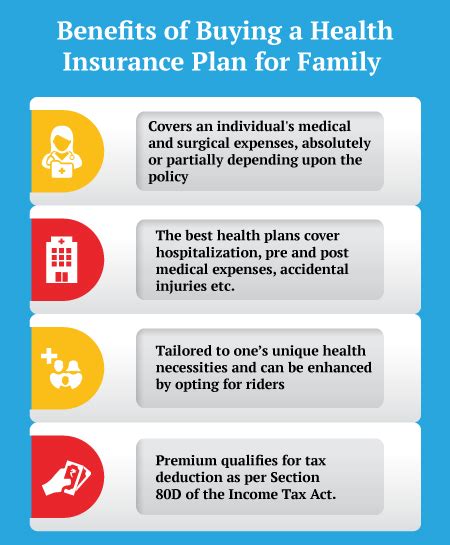

Family health insurance serves as a safety net, ensuring that you and your family members have access to necessary medical care without incurring substantial financial burdens. It provides coverage for a wide range of healthcare services, including routine check-ups, hospitalizations, prescription medications, and specialist consultations. By investing in a robust family health insurance plan, you can focus on your family’s well-being without worrying about the financial implications of medical emergencies.

Understanding the Basics of Family Health Insurance

Family health insurance plans are designed to cater to the unique needs of families, covering multiple individuals under one policy. These plans typically include coverage for parents, spouses, and dependent children. The coverage offered by family health insurance plans can vary widely, ranging from basic plans with limited benefits to comprehensive plans that cover a broad spectrum of medical expenses.

Key Components of a Family Health Insurance Plan

When evaluating family health insurance plans, it’s essential to understand the key components that make up these policies. Here are some crucial aspects to consider:

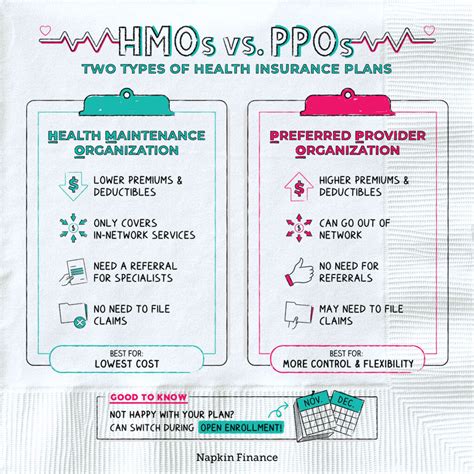

- Premiums: The premium is the amount you pay regularly (usually monthly or annually) to maintain your health insurance coverage. It's important to choose a premium that aligns with your family's budget and financial capabilities.

- Deductibles and Copayments: Deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. Copayments, on the other hand, are the fixed amounts you pay for specific services or prescriptions. Understanding these costs is crucial to managing your healthcare expenses effectively.

- Coverage Limits and Caps: Family health insurance plans often have limits on the total amount they will pay for certain services or within a specific timeframe. It's essential to review these limits to ensure they align with your family's potential healthcare needs.

- Network of Providers: Most family health insurance plans have a network of preferred healthcare providers, including hospitals, clinics, and specialists. Choosing a plan with a network that includes your preferred healthcare facilities and doctors can ensure better accessibility and potentially lower costs.

- Benefit Packages: Different family health insurance plans offer varying benefit packages. These packages outline the specific services and treatments covered, including outpatient care, inpatient hospitalization, maternity benefits, dental and vision care, and more. Choose a plan that aligns with your family's healthcare priorities.

- Pre-existing Condition Coverage: Some family health insurance plans may have provisions for covering pre-existing conditions, which are health issues you or your family members have had prior to enrolling in the plan. Understanding the plan's approach to pre-existing conditions is crucial, especially if you or your loved ones have ongoing medical needs.

Factors to Consider When Choosing a Family Health Insurance Plan

Selecting the right family health insurance plan involves careful consideration of various factors. Here are some key aspects to keep in mind:

Assessing Your Family’s Healthcare Needs

The first step in choosing a family health insurance plan is to evaluate your family’s unique healthcare needs. Consider the following:

- Are there any chronic illnesses or ongoing medical conditions in your family that require regular treatment or medications?

- Do you have young children who may need frequent check-ups and vaccinations?

- Are there any specific medical specialties or procedures that your family may require in the near future, such as maternity care, orthopedic surgery, or mental health services?

- Do you prefer a more holistic approach to healthcare, including alternative therapies or wellness programs?

Understanding the Plan’s Coverage and Benefits

Once you have a clear understanding of your family’s healthcare needs, it’s time to delve into the details of different family health insurance plans. Here’s what you should look for:

- Comprehensive Coverage: Opt for a plan that provides comprehensive coverage for a wide range of medical services, including inpatient and outpatient care, prescription medications, preventive care, and specialist consultations. A comprehensive plan ensures that your family's healthcare needs are well-covered.

- Maternity and Pediatric Benefits: If you have young children or are planning to start a family, it's crucial to choose a plan that offers robust maternity and pediatric benefits. These benefits typically cover prenatal care, childbirth, postnatal care, well-child visits, and immunizations.

- Dental and Vision Coverage: Dental and vision care are often overlooked but essential aspects of overall health. Look for a family health insurance plan that includes dental and vision coverage, ensuring your family's eye and oral health needs are met.

- Prescription Drug Coverage: If your family relies on prescription medications for chronic conditions or ongoing treatments, ensure that the plan you choose offers comprehensive prescription drug coverage. This coverage should include a wide range of medications and provide options for mail-order prescriptions.

- Mental Health and Wellness Benefits: Mental health is an increasingly important aspect of overall well-being. Choose a plan that covers mental health services, including counseling, therapy, and psychiatric care. Additionally, look for plans that offer wellness programs, such as fitness incentives or stress management resources.

Comparing Plan Options and Choosing the Right Fit

With a clear understanding of your family’s healthcare needs and the key components of family health insurance plans, you can now compare different plan options and make an informed decision. Here are some tips to guide you through the selection process:

- Research and compare multiple insurance providers to find the one that best aligns with your family's needs. Consider factors such as reputation, customer service, and financial stability.

- Review the plan's network of healthcare providers to ensure that your preferred doctors and facilities are included. A broad network can provide better accessibility and potentially lower out-of-pocket costs.

- Calculate the total out-of-pocket expenses, including premiums, deductibles, and copayments, to ensure that the plan is affordable and within your family's financial means.

- Don't forget to read the fine print! Carefully review the plan's policy document to understand any exclusions, limitations, or restrictions that may apply.

- Consider seeking advice from insurance brokers or financial advisors who specialize in health insurance. They can provide valuable insights and help you navigate the complexities of choosing the right plan.

Maximizing the Benefits of Your Family Health Insurance Plan

Once you’ve selected the perfect family health insurance plan, it’s essential to make the most of its benefits. Here are some strategies to ensure you get the most value from your coverage:

- Stay informed about your plan's benefits and coverage limits. Regularly review the policy document and reach out to your insurance provider if you have any questions or concerns.

- Take advantage of preventive care services, such as annual check-ups, screenings, and immunizations. These services can help identify potential health issues early on and prevent more serious conditions from developing.

- Utilize the plan's network of providers to access quality healthcare at a lower cost. Ensure that you understand the process for selecting in-network providers and the potential cost savings associated with staying within the network.

- Manage your prescription drug costs by exploring generic alternatives and taking advantage of mail-order prescription services, which often offer cost savings and convenience.

- Stay engaged with your healthcare providers and participate in shared decision-making. This approach ensures that your healthcare choices align with your family's needs and values.

Future Trends and Innovations in Family Health Insurance

The world of health insurance is constantly evolving, and family health insurance plans are no exception. Here are some trends and innovations that are shaping the future of family health insurance:

Telehealth and Virtual Care

The rise of telehealth services has revolutionized the way healthcare is delivered. Many family health insurance plans now offer telehealth benefits, allowing you to access medical advice, consultations, and even prescription refills remotely. This trend is expected to continue, making healthcare more accessible and convenient for families.

Value-Based Care Models

Value-based care models focus on providing high-quality healthcare while controlling costs. These models incentivize healthcare providers to deliver efficient and effective care, leading to better outcomes for patients. As value-based care gains traction, family health insurance plans may increasingly adopt these models, offering incentives for preventive care and wellness programs.

Personalized Medicine and Genetic Testing

Advancements in personalized medicine and genetic testing are transforming the way healthcare is personalized. Family health insurance plans may start to incorporate these innovations, offering coverage for genetic testing and tailored treatment plans based on individual genetic profiles. This approach can lead to more precise and effective healthcare.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are playing an increasingly important role in healthcare. Family health insurance plans may leverage these technologies to analyze vast amounts of healthcare data, identify trends, and predict potential health issues. This can lead to more proactive and personalized healthcare interventions.

Conclusion: Empowering Your Family’s Health and Well-being

Family health insurance is a powerful tool for safeguarding your family’s health and financial security. By choosing the right plan and understanding its benefits, you can ensure that your loved ones have access to quality healthcare when they need it most. Remember, a comprehensive family health insurance plan is an investment in your family’s future, providing peace of mind and the support necessary to navigate life’s unexpected health challenges.

How do I choose the right family health insurance plan for my family’s needs?

+Start by assessing your family’s unique healthcare needs, including any chronic conditions, ongoing treatments, or specific medical specialties. Review the coverage and benefits offered by different plans, ensuring they align with your family’s priorities. Consider factors like comprehensive coverage, maternity and pediatric benefits, dental and vision care, and mental health services. Finally, evaluate the plan’s affordability, network of providers, and any potential exclusions or limitations.

What are some common exclusions or limitations in family health insurance plans?

+Common exclusions and limitations in family health insurance plans may include experimental treatments, cosmetic procedures, certain pre-existing conditions, and services related to smoking cessation or weight loss. It’s important to carefully review the plan’s policy document to understand any exclusions or limitations that may apply to your specific plan.

How can I reduce my out-of-pocket expenses when using my family health insurance plan?

+To minimize out-of-pocket expenses, choose a plan with a broad network of providers, as in-network services often come with lower costs. Take advantage of preventive care services, which are typically covered without any out-of-pocket costs. Additionally, consider using generic prescription medications and exploring mail-order prescription services, which can offer significant cost savings.

Are there any tax benefits associated with family health insurance plans?

+Yes, there are tax benefits associated with family health insurance plans. In many countries, the premiums you pay for health insurance are tax-deductible, which can provide a significant financial advantage. Additionally, some countries offer tax credits or subsidies for certain health insurance plans, especially those aimed at low-income families or individuals with specific health conditions.