Federal Employee Health Insurance Cost

The cost of health insurance is a significant concern for many individuals, especially when it comes to federal employees and their families. Federal employee health insurance plans are designed to provide comprehensive coverage, but understanding the costs and the factors that influence them is crucial for making informed decisions. This article aims to delve into the intricacies of federal employee health insurance costs, exploring the various components, plans, and strategies to manage expenses effectively.

Understanding Federal Employee Health Insurance

Federal employee health insurance, often referred to as FEHB (Federal Employees Health Benefits), is a program administered by the Office of Personnel Management (OPM). It offers a wide range of health insurance plans from various carriers, allowing federal employees and their eligible family members to choose a plan that best suits their needs.

The FEHB program is renowned for its comprehensive coverage, including medical, dental, and vision benefits, along with prescription drug coverage. The plans vary in terms of cost, coverage, and provider networks, providing federal employees with a diverse set of options.

Factors Influencing Federal Employee Health Insurance Costs

The cost of federal employee health insurance is influenced by a multitude of factors, each playing a unique role in determining the overall expenses. Understanding these factors is essential for making informed choices and managing costs effectively.

Plan Type and Coverage

The type of health insurance plan chosen by a federal employee is a significant determinant of cost. FEHB offers various plan types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Fee-for-Service (FFS) plans. Each plan type has different cost structures and coverage options, impacting the overall expenses.

For instance, HMOs often have lower premiums but may restrict access to certain providers or require referrals for specialist care. On the other hand, PPOs offer more flexibility in choosing providers but generally come with higher premiums. Understanding the coverage and cost trade-offs is crucial for selecting an appropriate plan.

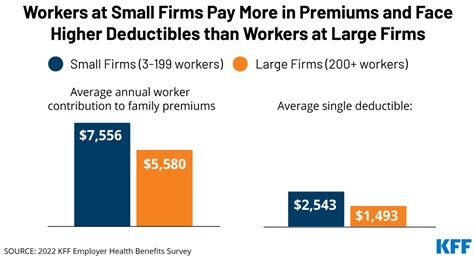

Employee Contribution

Federal employees contribute a portion of their salary towards health insurance premiums. The contribution is determined by the employee’s salary and the specific plan chosen. Higher-paying positions often have a higher contribution percentage, impacting the overall cost of health insurance.

| Salary Range | Contribution Percentage |

|---|---|

| $40,000 - $60,000 | 2.5% |

| $60,001 - $80,000 | 2.75% |

| $80,001 - $100,000 | 3% |

| Over $100,000 | 3.5% |

It's important to note that these contribution percentages are subject to change and may vary based on the specific plan and employee circumstances.

Family Coverage

Federal employees have the option to cover their eligible family members under their health insurance plan. Adding family members to the coverage increases the overall cost, as each individual’s premiums are added to the total. The cost of family coverage varies depending on the plan and the number of family members included.

| Plan Type | Family Coverage Premium |

|---|---|

| HMO | $500 - $800 per month |

| PPO | $600 - $1,000 per month |

| FFS | $700 - $1,200 per month |

These figures are approximate and may vary based on the specific plan and carrier.

Deductibles and Out-of-Pocket Costs

Deductibles and out-of-pocket costs are additional expenses that federal employees may incur under their health insurance plans. Deductibles are the amounts an individual must pay before the insurance coverage kicks in, while out-of-pocket costs include copayments, coinsurance, and any additional expenses not covered by the insurance.

Lower-premium plans often have higher deductibles and out-of-pocket costs, while higher-premium plans typically offer lower deductibles and more comprehensive coverage. The choice between lower premiums and higher out-of-pocket costs versus higher premiums and lower deductibles is a strategic decision that employees must make based on their anticipated healthcare needs.

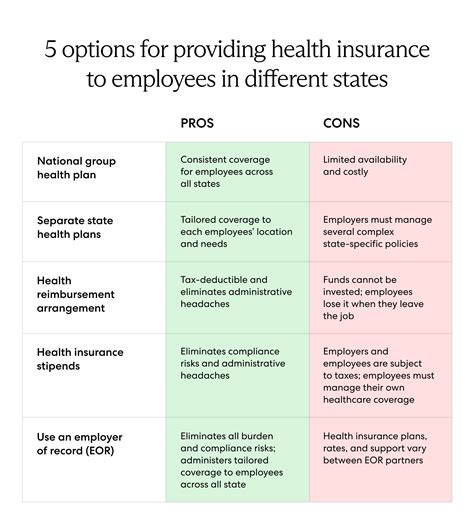

Geographic Location

The cost of federal employee health insurance can vary based on the employee’s geographic location. Health insurance premiums are often higher in urban areas with a higher cost of living and more extensive healthcare infrastructure. Conversely, rural areas may have lower premiums due to a lower cost of living and fewer healthcare facilities.

Understanding the impact of geographic location on insurance costs is essential for employees considering relocation or for those who frequently travel between different regions.

Age and Health Status

Age and health status are significant factors influencing health insurance costs. Younger, healthier individuals generally have lower premiums, while older individuals or those with pre-existing conditions may face higher premiums and limited coverage options.

Federal employees with pre-existing conditions should carefully consider their health insurance options, as some plans may offer more comprehensive coverage and support for managing these conditions.

Strategies for Managing Federal Employee Health Insurance Costs

Managing the cost of federal employee health insurance requires a strategic approach. Here are some strategies to consider:

Compare Plans and Carriers

The FEHB program offers a wide range of plans from different carriers. Take the time to compare the plans based on your specific needs, considering factors such as coverage, premiums, deductibles, and provider networks. Understanding the unique features of each plan can help you make an informed choice.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans, often paired with a Health Savings Account (HSA), can be a cost-effective option for federal employees. These plans typically have lower premiums but higher deductibles. HSAs allow individuals to save pre-tax dollars for healthcare expenses, providing a tax-efficient way to manage out-of-pocket costs.

Utilize Preventive Care

Many federal employee health insurance plans offer free or low-cost preventive care services, such as annual check-ups, immunizations, and screenings. Taking advantage of these services can help identify potential health issues early on, potentially preventing more costly treatments in the future.

Manage Prescription Drug Costs

Prescription drugs can be a significant expense under health insurance plans. Consider using generic drugs when possible, as they are often much more affordable than brand-name medications. Additionally, some plans offer mail-order options for prescription drugs, which can provide cost savings and convenience.

Explore Flexible Spending Accounts (FSAs)

Flexible Spending Accounts allow federal employees to set aside pre-tax dollars for qualified medical expenses. FSAs can be used to cover a wide range of healthcare costs, including copayments, deductibles, and even certain over-the-counter medications. Utilizing an FSA can help reduce the overall tax burden associated with healthcare expenses.

Understand Coverage Limitations

Familiarize yourself with the specific coverage limitations and exclusions of your chosen health insurance plan. Understanding these limitations can help you make more informed decisions about healthcare services and potential out-of-pocket expenses.

Conclusion: Navigating Federal Employee Health Insurance Costs

Federal employee health insurance costs are influenced by a multitude of factors, each playing a unique role in the overall expenses. By understanding these factors and implementing strategic cost-management strategies, federal employees can make informed choices and effectively manage their health insurance expenses.

The FEHB program offers a diverse range of plans, allowing employees to tailor their coverage to their specific needs. By comparing plans, considering cost-saving options like HDHPs and HSAs, and utilizing preventive care and prescription drug management strategies, federal employees can navigate the complexities of health insurance costs and make the most of their coverage.

How often can I change my health insurance plan as a federal employee?

+

Federal employees can change their health insurance plan during the annual open enrollment period, which typically occurs in the fall. This is the time when you can review your options and make changes to your coverage for the upcoming year. Outside of the open enrollment period, you may be able to make changes if you experience a qualifying life event, such as marriage, divorce, or the birth of a child.

Are there any tax benefits associated with federal employee health insurance plans?

+

Yes, federal employee health insurance plans offer certain tax advantages. Premiums paid for health insurance coverage, including vision and dental plans, are generally deducted from your salary on a pre-tax basis, reducing your taxable income. Additionally, as mentioned earlier, Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide tax-efficient ways to save for qualified medical expenses.

What happens if I retire as a federal employee? Will my health insurance coverage continue?

+

Yes, if you retire as a federal employee, you are eligible to continue your health insurance coverage through the FEHB program. The coverage options and costs may vary depending on your retirement status and whether you are eligible for Medicare. It’s important to carefully review your retirement options and the impact on your health insurance coverage to ensure a seamless transition.

Can I add my spouse and children to my federal employee health insurance plan?

+

Yes, federal employees can typically add their eligible family members, including spouses and children, to their health insurance plan. The cost of family coverage varies based on the plan and the number of family members included. It’s important to carefully review the coverage options and premiums for family coverage to ensure it aligns with your budget and needs.

Are there any discounts or incentives available for federal employees to reduce health insurance costs?

+

Some federal employee health insurance plans may offer discounts or incentives to encourage healthy behaviors or manage chronic conditions. These incentives can include reduced premiums, wellness program discounts, or reward programs for meeting certain health goals. It’s worth exploring these options to potentially reduce your overall health insurance costs.