Fha Insured Mortgage

The Federal Housing Administration (FHA) plays a pivotal role in the U.S. housing market, offering government-backed mortgage loans that provide stability and access to homeownership for millions of Americans. The FHA-insured mortgage program is a cornerstone of the American dream, enabling borrowers with diverse financial backgrounds to secure affordable home loans. In this comprehensive guide, we delve into the intricacies of FHA-insured mortgages, exploring their benefits, eligibility criteria, and the process of obtaining one. Whether you're a first-time homebuyer, a veteran, or a seasoned investor, understanding the FHA program is essential for navigating the complex world of mortgage financing.

The Fundamentals of FHA-Insured Mortgages

FHA-insured mortgages are a key initiative by the U.S. government to promote homeownership, particularly among borrowers who might face challenges securing conventional mortgage loans. These loans are insured by the Federal Housing Administration, a subsidiary of the U.S. Department of Housing and Urban Development (HUD). The program's primary objective is to facilitate homeownership by offering low down payment options, flexible credit requirements, and competitive interest rates.

FHA-insured mortgages are not directly provided by the government but rather through approved lenders, such as banks, credit unions, and mortgage companies. The FHA insures these loans against default, which encourages lenders to offer more favorable terms to borrowers who might not qualify for standard mortgage loans.

Key Benefits of FHA-Insured Mortgages

One of the most significant advantages of FHA-insured mortgages is their accessibility. The program caters to a wide range of borrowers, including those with lower credit scores, limited down payment funds, and moderate incomes. Here are some of the key benefits that make FHA-insured mortgages an attractive option:

- Low Down Payment Requirements: FHA loans typically require a down payment as low as 3.5% of the purchase price, making homeownership more affordable and attainable.

- Flexible Credit Guidelines: Borrowers with credit scores as low as 580 may qualify for FHA loans, although a score of 500 is the minimum to be considered. This flexibility allows individuals with less-than-perfect credit histories to secure mortgage financing.

- Competitive Interest Rates: FHA-insured mortgages often offer competitive interest rates, which can result in significant savings over the life of the loan compared to other loan types.

- Seller Concessions: In some cases, sellers can contribute up to 6% of the sale price towards the buyer's closing costs, further reducing the financial burden on the borrower.

- Streamlined Refinancing: The FHA offers streamlined refinancing options, making it easier for borrowers to take advantage of lower interest rates without incurring additional costs or delays.

Eligibility Criteria for FHA-Insured Mortgages

While FHA-insured mortgages are designed to be accessible, there are specific eligibility criteria that borrowers must meet. These criteria ensure that borrowers have the financial capacity and willingness to uphold their mortgage obligations. Here are the key eligibility requirements:

- Credit Score: As mentioned earlier, a credit score of at least 500 is required to be considered for an FHA loan. However, a score of 580 or higher is necessary to qualify for the minimum down payment of 3.5%. Borrowers with credit scores between 500 and 579 may still be eligible but will need to make a 10% down payment.

- Debt-to-Income Ratio: The FHA generally requires borrowers to have a debt-to-income ratio (DTI) of 43% or lower. This ratio compares your monthly debt payments to your gross monthly income, and it's a crucial factor in determining your ability to repay the loan.

- Down Payment: As mentioned, the minimum down payment for an FHA loan is 3.5% of the purchase price. However, borrowers can put down more if they choose to do so.

- Property Requirements: FHA loans are primarily intended for primary residences, and the property must meet certain standards to ensure its habitability and safety. FHA-approved appraisers will assess the property to ensure it meets these requirements.

- Mortgage Insurance Premium (MIP): FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) and annual mortgage insurance premiums (MIP). The UFMIP is typically financed into the loan amount, while the MIP is paid monthly and is based on the loan amount and the loan term.

The Application and Approval Process

The process of obtaining an FHA-insured mortgage involves several steps, each designed to ensure that borrowers are well-informed and that lenders have the necessary information to make informed lending decisions. Here's an overview of the application and approval process:

- Pre-Qualification: The first step is to obtain a pre-qualification letter from an FHA-approved lender. This letter provides an estimate of the loan amount for which you may be eligible based on your income, credit score, and other financial factors.

- Choose a Property: Once you have a pre-qualification letter, you can start searching for a suitable property within your budget. Keep in mind that the property must meet FHA standards, so it's advisable to work with a real estate agent who is familiar with FHA requirements.

- Loan Application: When you've found a property you wish to purchase, you'll need to submit a formal loan application to your lender. This application will require detailed information about your financial situation, including income, assets, and debts.

- Property Appraisal: The lender will order an appraisal of the property to determine its fair market value. The appraisal ensures that the property is worth at least the purchase price and meets FHA standards.

- Underwriting: During the underwriting process, the lender thoroughly reviews your financial information, employment history, and credit report to assess your ability to repay the loan. They may request additional documentation to verify your financial status.

- Final Approval: If the underwriter determines that you meet all the eligibility criteria and your loan application is complete, you'll receive final approval for the FHA-insured mortgage. At this point, you can proceed with the purchase of the property.

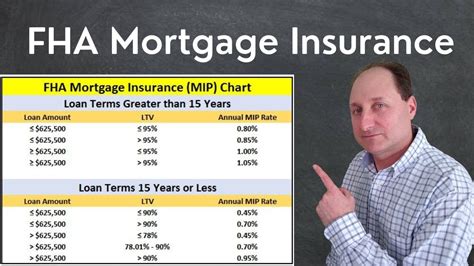

Mortgage Insurance Premiums (MIP)

As mentioned earlier, FHA loans require borrowers to pay mortgage insurance premiums. These premiums protect the lender in the event of default and are an essential part of the FHA program. There are two types of MIP:

- Upfront Mortgage Insurance Premium (UFMIP): This premium is typically financed into the loan amount and is equal to 1.75% of the loan amount. It's paid at the time of closing and can be rolled into the mortgage balance.

- Annual Mortgage Insurance Premium (MIP): The annual MIP is paid monthly and is based on the loan amount and loan term. The premium is typically between 0.45% and 1.05% of the loan amount per year. The exact rate depends on various factors, including the loan term, loan-to-value ratio, and the initial down payment.

Borrowers can request to cancel their MIP once they have reached a certain equity threshold in their home. However, the cancellation process and eligibility requirements vary depending on the loan term and other factors.

Using FHA Loans for Refinancing

FHA loans are not only beneficial for purchasing a home but also for refinancing an existing mortgage. The FHA offers several refinancing options, including the FHA Streamline Refinance program, which is designed to simplify the refinancing process for borrowers with existing FHA loans.

The FHA Streamline Refinance program allows borrowers to refinance their FHA loan without the need for an extensive credit check or appraisal. This program is ideal for borrowers who want to take advantage of lower interest rates or adjust their loan terms to improve their financial situation.

FHA Loan Limits and Coverage

FHA loan limits are set annually and vary depending on the county where the property is located. These limits are designed to ensure that FHA-insured mortgages remain accessible while also providing a level of protection to lenders and the FHA insurance fund. The loan limits are adjusted based on local housing market conditions and are intended to cover a range of property values.

| County | Loan Limit |

|---|---|

| Los Angeles County | $970,800 |

| New York County | $970,800 |

| San Francisco County | $1,451,500 |

| Miami-Dade County | $540,150 |

| Houston County | $424,100 |

It's important to note that these loan limits may change annually, so borrowers should consult the FHA's official website or their lender for the most up-to-date information.

Frequently Asked Questions

What is the minimum credit score required for an FHA loan?

+The minimum credit score for an FHA loan is 500. However, to qualify for the lowest down payment of 3.5%, you’ll need a credit score of at least 580. Borrowers with scores between 500 and 579 may still be eligible but will need to make a 10% down payment.

Can I use an FHA loan to purchase a vacation home or investment property?

+FHA loans are primarily intended for primary residences. However, there are specific FHA programs, such as the FHA 203k loan, that can be used for purchasing and rehabilitating investment properties or vacation homes.

How much can I borrow with an FHA loan?

+The amount you can borrow with an FHA loan depends on several factors, including your income, credit score, and the loan limits set by the FHA for the county where the property is located. Loan limits can range from around 400,000 to over 1 million in high-cost areas.

Are there any restrictions on the type of property I can purchase with an FHA loan?

+FHA loans are typically used for purchasing single-family homes, condos, and multifamily properties (up to four units). The property must meet certain standards to ensure it is safe, sound, and habitable. Mobile homes and manufactured homes are also eligible in some cases.

Can I use an FHA loan to refinance my existing mortgage?

+Yes, FHA loans can be used for refinancing. The FHA offers various refinancing options, including the FHA Streamline Refinance program, which simplifies the refinancing process for borrowers with existing FHA loans.