Fight Health Insurance

Unveiling the Strategies to Fight Back Against Health Insurance Challenges

In today's complex healthcare landscape, navigating health insurance can be a daunting task. From understanding coverage options to tackling unexpected expenses, many individuals find themselves grappling with the intricacies of the system. This article aims to provide a comprehensive guide, shedding light on effective strategies to empower individuals and equip them with the tools to take on the challenges posed by health insurance.

Health insurance, while designed to protect individuals from financial ruin due to medical expenses, often comes with its own set of complexities and pitfalls. From high deductibles to unexpected out-of-pocket costs, the journey through the healthcare system can be fraught with financial challenges. This article will delve into the key aspects of health insurance, offering practical advice and insights to help individuals make informed decisions and take control of their healthcare journey.

Understanding Health Insurance Fundamentals

Before diving into the strategies to fight back, it's crucial to grasp the basics of health insurance. Health insurance is a contract between an individual and an insurance company, where the insurer agrees to cover a portion of the individual's medical expenses in exchange for regular premium payments. The key components of health insurance include premiums, deductibles, co-payments, and out-of-pocket maximums. Understanding these terms is essential for making informed decisions and managing healthcare costs effectively.

Premiums are the regular payments made to the insurance company to maintain coverage. Deductibles, on the other hand, are the amount an individual must pay out-of-pocket before the insurance company starts covering costs. Co-payments are fixed amounts paid by the insured for specific services, while out-of-pocket maximums represent the limit on an individual's financial responsibility for covered services in a given year.

The Impact of Health Insurance on Healthcare Access

Health insurance plays a pivotal role in determining an individual's access to healthcare services. Those with comprehensive coverage often have better access to a wide range of medical treatments and specialists. However, individuals with limited or no insurance coverage may face significant barriers to accessing quality healthcare. This disparity in access can lead to delayed or inadequate treatment, ultimately affecting an individual's overall health and well-being.

Furthermore, the complexity of health insurance plans and the varying levels of coverage can create confusion and deter individuals from seeking necessary medical care. Understanding the impact of health insurance on healthcare access is crucial for advocating for better coverage and ensuring that everyone has equal opportunities to receive the care they need.

Navigating the Maze of Health Insurance Plans

The healthcare market offers a diverse range of health insurance plans, each with its own set of features and benefits. From HMOs and PPOs to EPOs and CDHPs, the choices can be overwhelming. When selecting a health insurance plan, it's essential to consider factors such as the network of healthcare providers, the cost of premiums and out-of-pocket expenses, and the coverage for specific medical conditions or treatments.

Additionally, understanding the fine print and exclusions of a health insurance plan is crucial. Some plans may have limitations on pre-existing conditions, while others may exclude certain procedures or treatments. By carefully reviewing the details of each plan, individuals can make informed choices that align with their healthcare needs and financial capabilities.

Strategies to Fight Back Against Health Insurance Challenges

Armed with a solid understanding of health insurance fundamentals, individuals can now explore strategies to tackle the challenges head-on. Here are some effective approaches to navigate the complexities of health insurance and take control of one's healthcare journey.

Comparing Plans and Finding the Right Fit

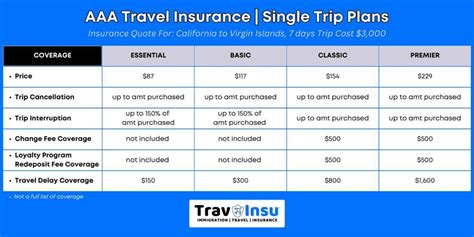

When selecting a health insurance plan, it's crucial to compare different options to find the one that best suits your needs. Consider factors such as the network of healthcare providers, coverage for specific conditions or treatments, and the balance between premiums and out-of-pocket expenses. Online comparison tools and resources can be invaluable in this process, providing detailed information about various plans and their features.

For example, let's consider a scenario where an individual is comparing two health insurance plans: Plan A and Plan B. Plan A has a lower premium but a higher deductible, while Plan B offers a higher premium with a lower deductible. By evaluating their healthcare needs and financial situation, the individual can determine which plan provides the most value and peace of mind.

| Plan | Premium | Deductible | Network Providers |

|---|---|---|---|

| Plan A | $300/month | $2,000 | Limited network |

| Plan B | $350/month | $1,500 | Wider network |

In this case, if the individual requires frequent specialist visits and prefers a wider network of providers, Plan B might be the better choice despite the slightly higher premium. By carefully comparing plans and considering their unique circumstances, individuals can make informed decisions and find the right fit for their healthcare needs.

Maximizing Benefits and Minimizing Costs

Understanding the nuances of your health insurance plan is key to maximizing benefits and minimizing costs. Take the time to review your plan's summary of benefits, which outlines what is covered, the associated costs, and any limitations or exclusions. By being proactive and familiar with your plan, you can make informed decisions about your healthcare and avoid unexpected expenses.

For instance, let's say you have a health insurance plan that covers preventative care services, such as annual physical exams and certain screenings, at no additional cost. By taking advantage of these covered services and scheduling regular check-ups, you can catch potential health issues early on, potentially avoiding more costly treatments down the line. Additionally, many health insurance plans offer discounts or incentives for utilizing certain healthcare providers or participating in wellness programs. By exploring these options and staying informed, you can make the most of your plan's benefits and keep your healthcare costs in check.

Negotiating Medical Bills and Managing Out-of-Pocket Expenses

Medical bills can often be confusing and daunting, especially when they involve unexpected expenses or discrepancies. Don't hesitate to contact your healthcare provider or insurance company to inquire about the charges and clarify any uncertainties. Many providers are open to negotiating payment plans or offering discounts for prompt payments. By actively managing your medical bills and seeking clarification, you can avoid unnecessary financial burdens and ensure a fair and transparent billing process.

For example, if you receive a medical bill that seems unusually high or includes charges for services you believe were not provided, it's essential to reach out to the provider or your insurance company. They can provide detailed explanations of the charges, verify the accuracy of the bill, and potentially adjust the amount if there are errors or discrepancies. By negotiating and advocating for yourself, you can ensure that you are not overcharged and that your financial responsibilities are aligned with the services received.

Utilizing Consumer Resources and Support

Navigating the complexities of health insurance can be less daunting with the support of consumer resources and advocacy groups. These organizations provide valuable information, tools, and guidance to help individuals understand their rights and make informed decisions. From explaining insurance terminology to offering assistance with claim disputes, these resources empower individuals to take control of their healthcare journey.

For instance, consumer resources like the Healthcare.gov website offer a wealth of information on health insurance plans, including detailed explanations of coverage options, cost estimates, and enrollment periods. Additionally, advocacy groups such as the National Alliance of Healthcare Purchaser Coalitions provide support and resources for individuals facing complex healthcare situations, offering guidance on navigating insurance coverage, understanding treatment options, and advocating for fair and affordable healthcare.

Exploring Alternative Payment Options

In certain situations, traditional health insurance plans may not fully meet your healthcare needs or financial capabilities. In such cases, exploring alternative payment options can be a viable strategy. This may include self-insured plans, health savings accounts (HSAs), or even direct payment models where you negotiate prices directly with healthcare providers. These alternatives can provide greater flexibility and control over your healthcare expenses.

For example, a self-insured plan allows individuals or small businesses to assume the risk of healthcare costs themselves, often with the support of an insurance administrator. This approach can offer more tailored coverage options and potentially lower premiums, especially for those with good health or specific healthcare needs. Additionally, health savings accounts (HSAs) allow individuals to set aside pre-tax funds for medical expenses, providing a tax-efficient way to manage healthcare costs.

Real-Life Success Stories: Fighting Back Against Health Insurance Challenges

Empowerment through knowledge and action is evident in the inspiring success stories of individuals who have fought back against health insurance challenges. From negotiating medical bills to advocating for better coverage, these stories showcase the power of taking control and making informed decisions.

John's Journey: Negotiating Medical Bills for a Fairer Outcome

John, a young professional, found himself facing a daunting medical bill after an unexpected emergency room visit. The bill, amounting to thousands of dollars, seemed excessive and included charges for services he believed were unnecessary. Determined to fight back, John took the initiative to review his insurance policy and understand his rights as a consumer.

With the support of consumer resources and advocacy groups, John learned about the process of negotiating medical bills. He contacted his insurance company and the healthcare provider, requesting detailed explanations of the charges. Through diligent research and persistent communication, John was able to identify errors and discrepancies in the billing. Armed with this information, he negotiated a fairer settlement, reducing the overall cost and ensuring a more accurate representation of the services received.

John's story highlights the importance of proactive engagement and advocacy. By taking control of the situation and leveraging the resources available, he achieved a more favorable outcome, reducing his financial burden and ensuring transparency in the billing process. John's experience serves as an inspiration for others facing similar challenges, demonstrating that knowledge and persistence can lead to positive changes in healthcare finances.

Sarah's Triumph: Advocating for Better Coverage and Access

Sarah, a single mother, faced significant barriers to accessing quality healthcare due to her limited insurance coverage. With a chronic health condition requiring specialized treatment, Sarah struggled to navigate the complexities of her insurance plan and often faced financial constraints when seeking necessary care.

Determined to improve her situation, Sarah became an advocate for herself and others in similar circumstances. She educated herself about her rights as a patient and the options available for better coverage. Through extensive research and engagement with consumer resources, Sarah learned about alternative insurance plans and the importance of comparing coverage options.

With newfound knowledge, Sarah approached her employer and insurance provider, advocating for changes in her coverage. She highlighted the importance of specialized care for her condition and the financial challenges she faced. Her persistence paid off, as her employer agreed to explore alternative insurance plans that offered more comprehensive coverage for her specific needs. Sarah's triumph demonstrates the power of advocacy and the impact it can have on improving healthcare access and financial well-being.

The Future of Healthcare: Embracing Innovation and Transparency

As the healthcare landscape continues to evolve, embracing innovation and transparency is crucial for tackling the challenges posed by health insurance. Emerging technologies, such as telemedicine and digital health platforms, offer new avenues for accessing healthcare services and managing costs. Additionally, the rise of consumer-driven healthcare models and value-based care initiatives is shifting the focus towards patient-centric approaches and improved outcomes.

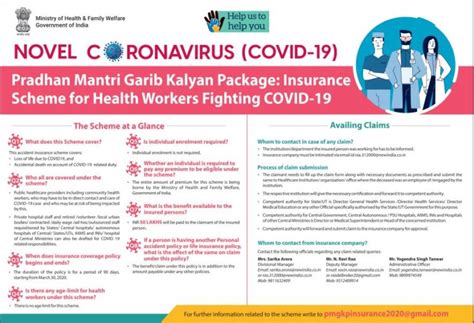

Telemedicine, for instance, has gained significant traction during the COVID-19 pandemic, offering convenient and safe access to healthcare services from the comfort of one's home. This technology enables individuals to consult with healthcare professionals remotely, reducing the need for in-person visits and associated costs. By leveraging telemedicine, individuals can receive timely medical advice, monitor their health conditions, and even obtain prescriptions without incurring unnecessary travel expenses.

Furthermore, digital health platforms are revolutionizing the way healthcare information is accessed and shared. These platforms provide users with personalized health records, allowing them to track their medical history, manage prescriptions, and connect with healthcare providers securely online. By empowering individuals with access to their own health data, these platforms foster a more proactive and engaged approach to healthcare management.

Embracing Consumer-Driven Healthcare and Value-Based Care

Consumer-driven healthcare models place the individual at the center of their healthcare journey, encouraging active participation and informed decision-making. These models often involve high-deductible health plans (HDHPs) paired with health savings accounts (HSAs), giving individuals greater control over their healthcare expenses. By aligning financial incentives with quality outcomes, consumer-driven healthcare promotes cost-consciousness and empowers individuals to make choices that best suit their needs.

Value-based care initiatives, on the other hand, focus on improving the overall quality and efficiency of healthcare delivery. These initiatives aim to shift the healthcare system from a fee-for-service model to one that rewards providers for delivering high-quality, cost-effective care. By emphasizing outcomes and patient satisfaction, value-based care incentivizes healthcare providers to adopt innovative practices, improve coordination of care, and reduce unnecessary costs.

The Role of Technology in Transforming Healthcare

Technology is playing a pivotal role in shaping the future of healthcare, revolutionizing the way services are delivered and experienced. From electronic health records (EHRs) to wearable health devices, technology is enhancing efficiency, accessibility, and patient engagement. EHRs, for instance, provide a comprehensive digital record of an individual's medical history, enabling healthcare providers to access critical information quickly and accurately.

Wearable health devices, such as fitness trackers and smartwatches, are empowering individuals to take charge of their health and wellness. These devices track vital signs, monitor physical activity, and provide insights into overall well-being. By collecting and analyzing real-time data, these devices enable individuals to make informed lifestyle choices and proactively manage their health. Additionally, these devices can facilitate remote patient monitoring, allowing healthcare providers to remotely assess and manage chronic conditions, thereby improving patient outcomes and reducing healthcare costs.

Conclusion: Empowering Individuals to Take Control

The world of health insurance may be complex, but with the right knowledge and strategies, individuals can fight back and take control of their healthcare journey. By understanding the fundamentals of health insurance, comparing plans, maximizing benefits, and utilizing consumer resources, individuals can navigate the challenges and make informed decisions. The inspiring success stories of those who have fought back against health insurance challenges serve as a testament to the power of empowerment and advocacy.

As we look to the future, embracing innovation and transparency in healthcare is essential. Emerging technologies and consumer-driven models are transforming the way healthcare is accessed and delivered, offering new opportunities for cost-effective and patient-centric care. By staying informed, engaging with consumer resources, and advocating for change, individuals can continue to shape a healthcare system that works for them.

In conclusion, this article aims to provide a comprehensive guide to fighting back against health insurance challenges. By arming individuals with knowledge and practical strategies, we can empower them to take control of their healthcare, make informed choices, and ultimately improve their overall well-being. Together, we can navigate the complexities of health insurance and create a healthcare system that is fair, accessible, and focused on patient empowerment.

What should I do if I receive a medical bill that seems incorrect or excessive?

+

If you receive a medical bill that appears incorrect or excessive, it’s important to take action. First, review your insurance policy to understand your coverage and rights as a consumer. Then, contact your healthcare provider and insurance company to request detailed explanations of the charges. By engaging in open communication and seeking clarification, you can identify any errors or discrepancies and negotiate a fairer settlement.

How can I compare health insurance plans effectively to find the best fit for my needs?

+

Comparing health insurance plans can be overwhelming, but there are several resources available to assist you. Online comparison tools and websites provide detailed information about various plans, including coverage options, costs, and network providers. Additionally, consumer resources and advocacy groups offer guidance and support in understanding insurance terminology and making informed choices. By carefully evaluating your healthcare needs and financial capabilities, you can find a plan that offers the right balance of coverage and affordability.

Are there any alternative payment options available for healthcare expenses?

+

Yes, alternative payment options can be a viable strategy for managing healthcare expenses, especially when traditional insurance plans may not fully meet your needs. Self-insured plans, health savings accounts (HSAs), and direct payment models are some alternatives to consider. These options provide greater flexibility and control over your healthcare costs, allowing you to tailor your coverage and manage expenses according to your specific circumstances.