Find Cheaper Auto Insurance

Are you searching for ways to lower your auto insurance costs? Many factors can impact the price of your policy, and understanding these elements can help you make informed decisions to potentially save money on your insurance premiums. This comprehensive guide will delve into the various strategies and considerations to find cheaper auto insurance tailored to your needs.

Understanding Auto Insurance Premiums

Before diving into cost-saving strategies, it's crucial to grasp the fundamentals of how auto insurance premiums are calculated. Insurance companies use a combination of personal and vehicle-related factors to assess the level of risk associated with insuring you. These factors include your age, gender, driving history, the type of vehicle you drive, and where you live. By understanding these variables, you can make informed choices to reduce your perceived risk and, consequently, lower your insurance costs.

Factors Influencing Premium Costs

Several key factors influence the cost of your auto insurance premiums. Here's a breakdown of some of the most significant ones:

- Age and Gender: Younger drivers, especially males, tend to be associated with higher risk, leading to higher premiums. As you age and gain more driving experience, your premiums may decrease.

- Driving Record: A clean driving record is essential for keeping premiums low. Traffic violations, accidents, and DUIs can significantly increase your insurance costs.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage (e.g., daily commute, occasional travel, or pleasure driving), can impact your premiums. Sports cars and luxury vehicles often come with higher insurance costs due to their higher repair and replacement expenses.

- Location: Where you live and park your vehicle can affect your insurance rates. Urban areas with higher crime rates and more traffic accidents may result in higher premiums.

- Coverage Levels: The type and amount of coverage you choose also play a role in your premium costs. Higher coverage limits and additional coverage options, such as collision and comprehensive coverage, can increase your premiums.

By being aware of these factors and making conscious choices, you can potentially lower your insurance costs. Let's explore some practical strategies to find cheaper auto insurance.

Strategies to Find Cheaper Auto Insurance

Here are some effective strategies to consider when searching for more affordable auto insurance options:

Shop Around and Compare Quotes

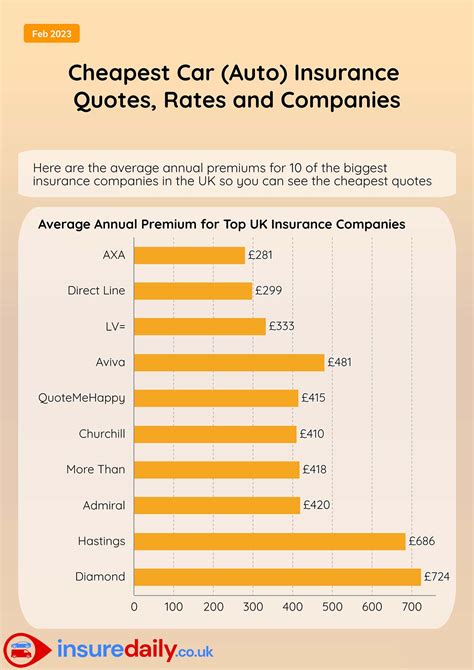

One of the most effective ways to find cheaper auto insurance is to compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three to five insurers can give you a good idea of the average cost and help you identify the most competitive rates.

Use online quote comparison tools or contact insurance agents directly to request quotes. Make sure you're comparing apples to apples by obtaining quotes for the same coverage levels and deductibles. This process can be time-consuming, but it's an essential step to ensure you're getting the best deal.

Bundle Policies for Discounts

If you have multiple insurance needs, such as auto, home, or renters' insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts when you purchase multiple policies from them. This strategy can lead to significant savings on your overall insurance costs.

By bundling your policies, you not only save money but also simplify your insurance management. You'll have a single point of contact for all your insurance needs, making it easier to handle claims and policy changes.

Explore Discount Opportunities

Insurance companies offer a variety of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discount: Many insurers reward drivers with clean records by offering discounts for accident-free and violation-free driving.

- Multi-Car Discount: If you have multiple vehicles in your household, insuring them all with the same company can qualify you for a multi-car discount.

- Good Student Discount: Students under 25 who maintain a certain GPA or are on the Dean's List may be eligible for a good student discount.

- Loyalty Discount: Some insurers reward long-term customers with loyalty discounts, so staying with the same company for an extended period can pay off.

- Safety Features Discount: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, and collision avoidance systems may qualify for discounts.

When shopping for insurance, inquire about the discounts available and how you can qualify for them. Taking advantage of these opportunities can significantly reduce your insurance costs.

Adjust Your Coverage Levels

Review your current insurance coverage and consider adjusting your levels to find a more cost-effective balance. While it's important to have adequate coverage, you may be paying for more than you need. Here are some considerations:

- Liability Coverage: The minimum liability coverage required by law varies by state. Ensure you meet these requirements but consider increasing your limits if you have significant assets to protect.

- Collision and Comprehensive Coverage: These coverages protect your vehicle against physical damage. If you have an older vehicle with a low market value, it may not be worth paying for comprehensive and collision coverage. You can save money by opting out of these coverages if the cost of repairs exceeds the vehicle's value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no or insufficient insurance. It's a valuable coverage to have, but you can adjust the limits to find a balance between protection and cost.

Consult with an insurance agent to understand the implications of adjusting your coverage levels and make informed decisions based on your specific needs and budget.

Improve Your Driving Record

Your driving record plays a significant role in determining your insurance premiums. A clean driving record is essential for keeping costs low. Here are some tips to improve your driving record and potentially reduce your insurance costs:

- Avoid Traffic Violations: Traffic tickets and moving violations can increase your insurance rates. Drive cautiously and obey traffic laws to avoid citations.

- Complete Defensive Driving Courses: Some insurance companies offer discounts to drivers who complete approved defensive driving courses. These courses can also help you become a safer and more confident driver.

- Avoid Accidents: Accidents, especially at-fault accidents, can lead to higher insurance premiums. Be a defensive driver and take precautions to avoid collisions.

- Consider a Telematics Program: Some insurers offer telematics programs that monitor your driving behavior. If you're a safe driver, you may qualify for discounts through these programs.

By maintaining a clean driving record and becoming a safer driver, you can not only reduce your insurance costs but also contribute to safer roads for everyone.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is an innovative approach that tailors your insurance premiums to your actual driving behavior. These programs use telematics devices or smartphone apps to track your driving habits, such as miles driven, time of day, and braking patterns.

If you drive fewer miles or exhibit safe driving behaviors, you may qualify for significant discounts. Usage-based insurance is a great option for low-mileage drivers or those who want their insurance costs to reflect their actual driving habits. However, it's important to note that these programs may not be available in all states or with all insurance companies.

Maintain a Good Credit Score

Your credit score is another factor that insurance companies consider when determining your premiums. A good credit score can lead to lower insurance rates, while a poor credit score may result in higher costs. Here's how you can maintain a good credit score to potentially save on insurance:

- Pay Your Bills on Time: Late payments can negatively impact your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Your Debt: High levels of debt can lower your credit score. Work on paying down your debts and maintaining a healthy credit utilization ratio.

- Monitor Your Credit Report: Regularly check your credit report for errors or signs of identity theft. Dispute any inaccuracies to maintain an accurate credit profile.

By maintaining a good credit score, you not only save on insurance but also improve your financial health overall.

Choose a Safer Vehicle

The type of vehicle you drive can impact your insurance costs. Insurers generally charge higher premiums for sports cars, luxury vehicles, and SUVs due to their higher repair and replacement costs. Opting for a safer, more economical vehicle can lead to lower insurance rates.

When shopping for a new car, consider vehicles with good safety ratings and lower repair costs. Some insurance companies offer discounts for hybrid or electric vehicles, so this could be an additional benefit to consider.

Explore Group Discounts

Many insurance companies offer group discounts to members of certain organizations or affiliations. These groups can include professional associations, alumni associations, credit unions, or even specific employers. If you're a member of such a group, inquire about potential insurance discounts.

Group discounts can provide significant savings, so it's worth exploring these opportunities and taking advantage of any applicable discounts.

FAQs

How often should I review my auto insurance policy to find cheaper rates?

+It's a good practice to review your auto insurance policy annually or whenever your life circumstances change significantly. Factors like moving to a new location, getting married, or purchasing a new vehicle can impact your insurance rates. Regularly reviewing your policy ensures you're always getting the best value.

Can I switch insurance providers mid-policy to save money?

+Yes, you can switch insurance providers at any time, but be aware that you may incur a penalty for canceling your current policy early. It's important to compare rates and shop around before making a decision to ensure you're getting a better deal overall.

Are there any downsides to usage-based insurance programs?

+Usage-based insurance programs can be beneficial for safe, low-mileage drivers, but they may not be suitable for everyone. Some drivers may feel uncomfortable with the level of tracking involved, and there's a risk of higher premiums if you drive more miles or exhibit risky driving behaviors.

How can I improve my credit score quickly to save on insurance?

+Improving your credit score takes time and consistency. While there are no quick fixes, you can take immediate steps like paying down credit card balances, setting up automatic payments, and disputing any errors on your credit report. These actions can help boost your score over time.

What are some common mistakes to avoid when shopping for auto insurance?

+Some common mistakes include failing to compare quotes from multiple insurers, not adjusting coverage levels to find the right balance, and neglecting to explore available discounts. Taking the time to thoroughly research and understand your options can help you avoid these pitfalls and find the best insurance deal.

By implementing these strategies and staying informed about your insurance options, you can potentially save hundreds of dollars on your auto insurance premiums. Remember, finding cheaper auto insurance is a combination of conscious choices, thorough research, and taking advantage of available discounts and programs. Stay proactive in managing your insurance costs, and you’ll be well on your way to significant savings.