Find Home Insurance

In today's world, protecting your home and belongings is more crucial than ever. Home insurance is an essential safeguard against unexpected events that could potentially cause financial ruin. From natural disasters to accidents, home insurance policies provide the necessary coverage to help homeowners recover and rebuild. With the right policy, you can have peace of mind knowing that you and your family are protected.

Understanding Home Insurance: A Comprehensive Guide

Home insurance, also known as homeowners insurance, is a form of property insurance that provides financial protection for individuals who own a home. It covers a wide range of potential risks, ensuring that homeowners can recover from losses and damages caused by various events.

The importance of home insurance cannot be overstated, as it offers protection against some of life's most unpredictable challenges. Whether it's a fire, a burglary, or a natural disaster, having the right home insurance policy can make a significant difference in your ability to bounce back and rebuild.

Coverage Options: Tailoring Your Policy

Home insurance policies are highly customizable, allowing homeowners to choose the level of coverage that best suits their needs and circumstances. Here are some key coverage options to consider when tailoring your home insurance policy:

- Dwelling Coverage: This provides protection for the physical structure of your home, covering damages caused by perils such as fire, windstorms, hail, and vandalism. It ensures that you can repair or rebuild your home in the event of a covered loss.

- Personal Property Coverage: This coverage safeguards the contents of your home, including furniture, electronics, clothing, and other personal belongings. In the event of a loss, personal property coverage helps replace or repair your belongings.

- Liability Coverage: This aspect of your policy protects you from financial loss in the event that someone is injured on your property or you are found legally responsible for their injuries. It covers medical expenses and legal defense costs, providing peace of mind in such situations.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage provides reimbursement for additional living expenses, such as temporary housing and meals, until you can return to your home.

- Optional Coverages: Depending on your specific needs and location, you may consider adding optional coverages to your policy. These could include flood insurance, earthquake insurance, or coverage for specific high-value items like jewelry or art.

The Process of Finding Home Insurance

The process of finding the right home insurance policy can be complex, but with the right approach and resources, it becomes more manageable. Here's a step-by-step guide to help you navigate the process:

- Assess Your Needs: Start by evaluating your specific needs and circumstances. Consider factors such as the value of your home, the location, the type of structure, and any unique risks associated with your area. This assessment will help you determine the coverage options and limits that are most appropriate for you.

- Research Insurance Companies: Take the time to research and compare different insurance companies. Look for reputable companies with a strong financial standing and positive customer reviews. Consider factors such as their coverage options, customer service reputation, and any additional benefits or discounts they offer.

- Obtain Quotes: Reach out to multiple insurance companies and request quotes for home insurance policies. Provide accurate and detailed information about your home, including its age, construction materials, and any recent improvements. Compare the quotes based on coverage, limits, deductibles, and overall cost.

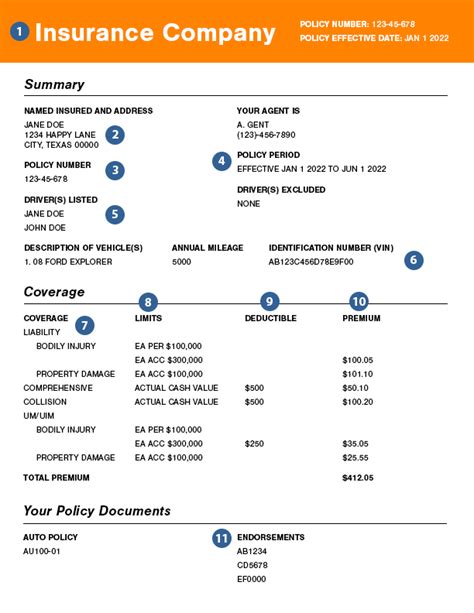

- Review Policy Details: Carefully review the policy documents provided by each insurance company. Pay attention to the coverage limits, exclusions, and any specific conditions or restrictions. Ensure that the policy aligns with your assessed needs and provides adequate protection.

- Consider Discounts and Bundling: Explore opportunities for discounts and consider bundling your home insurance with other policies, such as auto insurance. Many insurance companies offer multi-policy discounts, which can help reduce your overall insurance costs.

- Ask Questions: Don't hesitate to reach out to insurance agents or customer service representatives with any questions or concerns you may have. They can provide clarification on specific policy details, explain exclusions, and help you understand the fine print.

- Make an Informed Decision: Based on your research, quotes, and understanding of the policy details, choose the home insurance policy that best meets your needs and provides the most comprehensive coverage at a competitive price.

Expert Tips for Choosing the Right Home Insurance

Here are some additional tips from industry experts to help you find the right home insurance policy:

- Understand Your Policy Limits: Ensure that the coverage limits provided by your policy are sufficient to cover the full replacement cost of your home and its contents. Review the policy documents to understand the specific limits and consider adjusting them as needed to ensure adequate protection.

- Review Exclusions: Carefully examine the exclusions listed in your policy. Some common exclusions include flood damage, earthquake damage, and damage caused by pests or insects. If you live in an area prone to such risks, consider purchasing separate insurance policies or endorsements to cover these exclusions.

- Consider Replacement Cost Coverage: When selecting dwelling coverage, opt for replacement cost coverage instead of actual cash value coverage. Replacement cost coverage ensures that you receive enough money to rebuild your home as it was before the loss, whereas actual cash value coverage may not cover the full cost of rebuilding.

- Bundle and Save: Bundling your home insurance with other policies, such as auto insurance, can lead to significant savings. Many insurance companies offer multi-policy discounts, so take advantage of these opportunities to reduce your overall insurance costs.

- Regularly Review and Update Your Policy: Your home insurance needs may change over time. Regularly review your policy to ensure that it aligns with your current circumstances and any improvements or upgrades you've made to your home. Update your coverage limits and policy options as necessary to maintain adequate protection.

| Home Insurance Provider | Coverage Highlights |

|---|---|

| Company A | Offers comprehensive coverage with optional add-ons, including flood and earthquake insurance. Known for excellent customer service and claims handling. |

| Company B | Provides competitive rates and specializes in customized policies for unique homes. Offers flexible payment options and a user-friendly online platform for policy management. |

| Company C | Focuses on high-value homes and provides specialized coverage for luxury residences. Known for their expertise in insuring unique and historic properties. |

FAQs: Common Questions About Home Insurance

What factors influence the cost of home insurance?

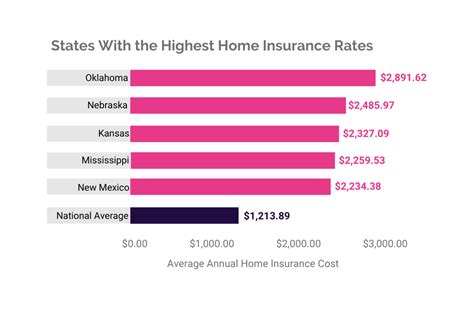

+The cost of home insurance is influenced by various factors, including the location and value of your home, the level of coverage you choose, the insurance company, and any discounts or bundling options available. Additionally, factors such as the age and condition of your home, your claims history, and any security features or improvements you've made can also impact the cost.

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right coverage limits for my home insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Choosing the right coverage limits involves assessing the replacement cost of your home and its contents. Consider factors such as the cost of rebuilding or repairing your home, the value of your personal belongings, and any additional living expenses you may incur in the event of a covered loss. It's important to strike a balance between adequate coverage and affordability.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I need to file a claim with my home insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you need to file a claim with your home insurance policy, the first step is to contact your insurance company as soon as possible. They will guide you through the claims process, which typically involves providing documentation and evidence of the loss. The insurance company will then assess the claim and determine the coverage and compensation based on the terms of your policy.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I customize my home insurance policy to fit my specific needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, home insurance policies are highly customizable. You can choose the coverage options and limits that best suit your needs. This includes selecting the type of coverage (such as dwelling, personal property, or liability), adjusting coverage limits, and adding optional endorsements or riders to cover specific risks or high-value items. Work with your insurance agent to tailor your policy to your unique circumstances.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review and update my home insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's recommended to review your home insurance policy annually or whenever significant changes occur in your life or home. This could include renovations, additions to your home, changes in your personal belongings, or even changes in your marital status or the number of residents in your household. Regular reviews ensure that your policy remains up-to-date and provides the necessary coverage.</p>

</div>

</div>

</div>