Find Renters Insurance

In the bustling world of urban living, where renting a home is a common choice, ensuring the safety and security of your belongings is paramount. Renters insurance, a specialized form of property insurance, offers a vital layer of protection for individuals and families who lease their living spaces. This comprehensive guide aims to delve into the intricacies of renters insurance, providing an in-depth analysis to assist prospective policyholders in making informed decisions.

Understanding Renters Insurance

Renters insurance is a contract between an individual and an insurance company, designed to protect the policyholder’s possessions and provide liability coverage in case of various unforeseen events. Unlike homeowners insurance, which covers the dwelling itself, renters insurance primarily focuses on the contents of the rented space and the liability of the tenant.

This type of insurance is particularly crucial for renters, as it safeguards their personal belongings from risks such as theft, fire, water damage, and other perils outlined in the policy. Additionally, it offers liability coverage, which can protect the policyholder from financial loss in the event they are sued for bodily injury or property damage caused to others.

Key Components of Renters Insurance

Renters insurance typically consists of the following essential components:

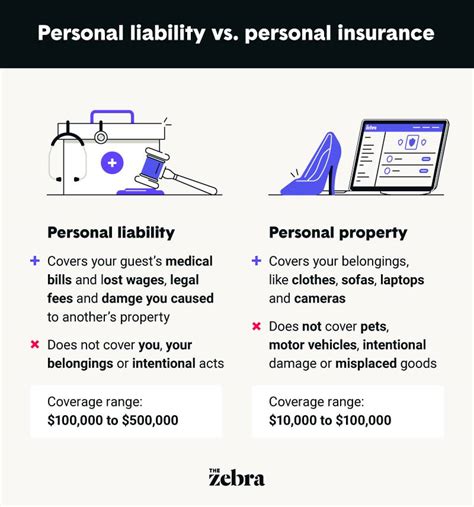

- Personal Property Coverage: This aspect of the policy covers the cost of repairing or replacing the policyholder’s belongings, including furniture, electronics, clothing, and other personal items, should they be damaged or lost due to a covered peril.

- Liability Coverage: In the event the policyholder is found legally responsible for another person’s injury or property damage, liability coverage can help pay for associated costs, including legal fees and settlements.

- Additional Living Expenses: If a covered peril makes the rented residence uninhabitable, this coverage can reimburse the policyholder for additional living expenses, such as temporary accommodation and meals.

- Medical Payments: This coverage provides for the medical expenses of guests who are injured on the policyholder’s rented premises, regardless of fault.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers the cost of repairing or replacing belongings damaged or lost due to covered perils. |

| Liability | Protects the policyholder from financial loss due to lawsuits for bodily injury or property damage caused to others. |

| Additional Living Expenses | Reimburses policyholders for temporary living expenses if their rented residence becomes uninhabitable due to a covered peril. |

| Medical Payments | Covers medical expenses for guests injured on the policyholder's rented premises, regardless of fault. |

Why Renters Insurance Matters

The significance of renters insurance extends beyond simply covering one’s belongings. Here are some key reasons why it is an essential consideration for anyone renting a home or apartment:

- Peace of Mind: Renters insurance provides a crucial sense of security, knowing that your personal possessions are protected against unforeseen events. This peace of mind can significantly reduce stress and worry.

- Financial Protection: In the event of a covered loss, renters insurance can cover the cost of replacing damaged or stolen items, which can be a substantial financial burden without insurance.

- Liability Coverage: This aspect of renters insurance is often overlooked but is vital. It can protect you from significant financial loss if you are found liable for causing injury or property damage to others.

- Additional Living Expenses: If a covered event, such as a fire or flood, makes your rented home uninhabitable, renters insurance can cover the cost of temporary accommodation and other living expenses until you can return home.

Common Misconceptions

Despite its importance, there are several misconceptions surrounding renters insurance. Addressing these myths is crucial to ensuring renters understand the true value of this insurance:

- Myth: Renters Insurance is Expensive: Renters insurance is often more affordable than many people realize. The average cost of a policy is typically lower than other types of insurance, and it can provide significant financial protection for a relatively small investment.

- Myth: My Landlord’s Insurance Covers My Belongings: This is a common misconception. Landlord insurance typically covers the building itself, but not the tenant’s personal belongings. Renters insurance is necessary to protect your possessions.

- Myth: I Don’t Need Renters Insurance if I Rent an Apartment: Whether you live in an apartment, condo, or house, if you rent your living space, you need renters insurance. It provides the same level of protection regardless of the type of dwelling.

Choosing the Right Renters Insurance Policy

Selecting the appropriate renters insurance policy involves careful consideration of various factors. Here’s a guide to help you make an informed decision:

Assess Your Needs

Start by evaluating your specific needs and the value of your personal belongings. Consider the following:

- The replacement cost of your furniture, electronics, clothing, and other possessions.

- The amount of liability coverage you may need, taking into account factors like your assets and potential liability risks.

- Whether you have any high-value items, such as jewelry or artwork, that may require additional coverage.

Understand Policy Options

Renters insurance policies can vary significantly between insurance companies. Here are some key policy options to consider:

- Replacement Cost vs. Actual Cash Value: Replacement cost policies reimburse you for the full cost of replacing your belongings, while actual cash value policies consider depreciation. Opt for replacement cost coverage for better protection.

- Policy Limits: Ensure that the policy limits for personal property coverage and liability coverage are sufficient to cover your needs. Higher limits typically provide more comprehensive protection.

- Additional Coverages: Some policies offer optional additional coverages, such as coverage for high-value items or identity theft protection. Consider whether these add-ons are necessary for your situation.

Compare Providers

Different insurance companies offer varying levels of coverage, prices, and customer service. Here are some key factors to consider when comparing providers:

- Price: While cost is an important factor, it should not be the sole determinant. Ensure that you are comparing policies with similar coverage levels.

- Reputation and Financial Stability: Choose an insurance company with a solid reputation and financial stability. This ensures that the company will be able to pay out claims if needed.

- Customer Service: Look for a company with a good track record of customer service. This includes prompt claim handling and easy-to-reach customer support.

- Discounts: Many insurance companies offer discounts for various reasons, such as bundling policies, having safety features, or being a loyal customer. Check for available discounts to potentially save on your premium.

The Claims Process

Understanding the claims process is essential to ensure a smooth and efficient resolution in the event of a covered loss. Here’s an overview of what you can expect:

Filing a Claim

When a covered loss occurs, the first step is to file a claim with your insurance company. This typically involves the following steps:

- Contact your insurance company as soon as possible to report the loss.

- Provide detailed information about the incident, including the date, time, and nature of the loss.

- Take photos or videos of the damage and keep any damaged items for the adjuster’s inspection.

- Compile a list of damaged or lost items, including their purchase price, age, and any available receipts or appraisals.

- Submit your claim and supporting documentation to your insurance company.

Claim Investigation

Once you’ve filed a claim, the insurance company will initiate an investigation to determine the validity and extent of the loss. This process typically involves the following:

- An insurance adjuster will be assigned to your case to assess the damage and determine the value of your claim.

- The adjuster may inspect the damaged property and request additional information or documentation to support your claim.

- If necessary, the adjuster may arrange for repairs or replacements, or provide an estimate for the cost of doing so.

Settlement and Payment

After the investigation is complete, the insurance company will offer a settlement for your claim. Here’s what you can expect during this phase:

- The insurance company will provide a written settlement offer, outlining the amount they are willing to pay for your claim.

- Review the settlement offer carefully, ensuring it covers the full extent of your losses as outlined in your policy.

- If you agree with the settlement, you can accept the offer and the insurance company will issue payment for the agreed-upon amount.

- If you disagree with the settlement offer, you can negotiate with the insurance company or, if necessary, seek legal advice to pursue a fair resolution.

Renters Insurance: A Necessary Investment

Renters insurance is an essential investment for anyone leasing a home or apartment. It provides a vital layer of protection for your belongings and offers financial security in the event of a covered loss. By understanding the components of renters insurance, its importance, and the process of selecting and using a policy, you can make informed decisions to safeguard your possessions and your peace of mind.

Frequently Asked Questions

How much does renters insurance typically cost?

+The cost of renters insurance can vary depending on several factors, including the value of your belongings, the location of your rental property, and your chosen coverage limits. On average, renters insurance policies can range from 15 to 30 per month, or around 180 to 360 per year. However, it’s important to note that the cost can be significantly higher or lower depending on your specific circumstances.

What is the process for filing a renters insurance claim?

+When filing a renters insurance claim, you’ll typically need to follow these steps: Contact your insurance company to report the claim, provide detailed information about the incident, take photos or videos of the damage, compile a list of damaged or lost items with their values, and submit your claim and supporting documentation to the insurance company. It’s important to act promptly and provide accurate and comprehensive information to facilitate a smooth claims process.

What are some common perils covered by renters insurance?

+Renters insurance typically covers a range of perils, including fire, lightning, windstorm or hail damage, smoke, vandalism, theft, and water damage from plumbing, heating, or air conditioning systems. It’s important to review your policy to understand the specific perils covered, as some policies may have exclusions or limitations. Additionally, certain natural disasters like floods or earthquakes may require separate coverage.

Can I get renters insurance if I have a roommate?

+Yes, you can still obtain renters insurance even if you have a roommate. However, it’s important to understand that a renters insurance policy typically covers the personal belongings of the named insured and their family members residing in the rental unit. If your roommate has their own belongings, they should also have their own renters insurance policy to protect their possessions. It’s a good idea to discuss this with your roommate to ensure that both of you are adequately covered.

How can I save money on my renters insurance premium?

+There are several ways to potentially save money on your renters insurance premium. Some common strategies include increasing your deductible, bundling your renters insurance with other policies (such as auto insurance), maintaining a good credit score, and exploring discounts offered by your insurance company. Additionally, shopping around and comparing quotes from multiple insurance providers can help you find the best rates for your specific circumstances.