Flood Insurance Quote

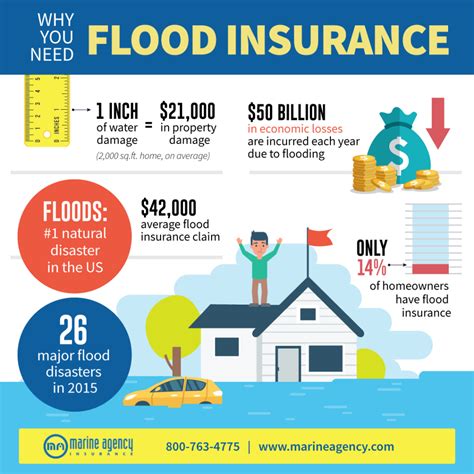

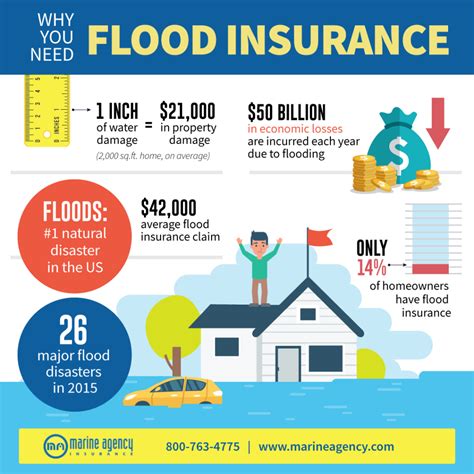

Flooding is a natural hazard that can have devastating impacts on communities and individuals, causing extensive damage to properties and disrupting lives. As a result, many homeowners and business owners seek ways to protect themselves financially from the potential risks associated with flooding. One of the primary methods of safeguarding against flood-related losses is through flood insurance. Obtaining a flood insurance quote is an essential step in understanding the coverage options and costs involved in protecting your property.

Understanding Flood Insurance and Its Importance

Flood insurance is a specialized form of coverage designed to provide financial protection against damage caused by flooding events. Unlike standard homeowners or renters insurance policies, which typically exclude coverage for flood-related losses, flood insurance is specifically tailored to address the unique risks posed by rising waters.

The importance of flood insurance cannot be overstated, especially for individuals and businesses located in high-risk flood zones. Floods are among the most common and costly natural disasters, capable of causing extensive damage to structures, personal belongings, and valuable assets. By obtaining flood insurance, policyholders can gain peace of mind knowing they have financial protection in the event of a flood, which can help them recover and rebuild more quickly.

The Process of Obtaining a Flood Insurance Quote

The journey to securing flood insurance begins with obtaining a quote, which provides an estimate of the cost and coverage options available to the policyholder. The quote-generation process typically involves several key steps:

Assessing Risk Factors

The first step in obtaining a flood insurance quote is evaluating the risk factors associated with the property in question. This assessment takes into account various elements, including the property’s location, proximity to bodies of water, historical flood data, and the likelihood of future flooding events. By understanding these risk factors, insurers can determine the potential level of risk and, consequently, the premium required to provide adequate coverage.

For instance, a property located in a high-risk flood zone, such as an area prone to flash floods or near a river with a history of overflows, will likely carry a higher premium than a property in a low-risk zone. This is because the likelihood of flood-related damage is greater in high-risk areas, necessitating a higher level of financial protection.

Determining Coverage Needs

Once the risk factors have been assessed, the next step is to determine the coverage needs of the policyholder. This involves evaluating the value of the property, the contents within it, and any additional structures or assets that may require protection. By understanding the full extent of the potential losses, insurers can tailor the coverage to meet the specific needs of the policyholder.

For example, a homeowner with a fully furnished house and valuable personal belongings may require a higher level of coverage to protect their assets in the event of a flood. On the other hand, a business owner with a warehouse full of inventory may need to consider additional coverage options to safeguard their merchandise and prevent significant financial losses.

Evaluating Policy Options

With the risk factors and coverage needs assessed, the next step is to explore the available policy options. Flood insurance policies can vary significantly in terms of coverage limits, deductibles, and additional benefits. Policyholders should carefully review the available options to ensure they select a policy that provides the necessary level of protection at a reasonable cost.

Some common policy options include:

- Basic Flood Insurance: This is the most fundamental level of coverage, typically providing protection for the structure of the building and its foundation. It may not cover the contents of the property, so additional coverage may be required.

- Contents Coverage: This option provides coverage for personal belongings and furniture within the insured property. It is often added to a basic policy to ensure comprehensive protection.

- Additional Living Expenses: In the event of a flood, this coverage can help policyholders cover the costs of temporary housing and other additional living expenses while their primary residence is uninhabitable.

- Business Interruption Coverage: Designed specifically for businesses, this option can provide financial support to cover lost revenue and additional expenses during the recovery period after a flood.

Obtaining a Quote

Once the risk factors, coverage needs, and policy options have been thoroughly evaluated, the policyholder can proceed to obtain a quote. This process can be initiated through various channels, including:

- Directly from Insurance Carriers: Many insurance companies offer online quote tools or dedicated customer service representatives who can provide personalized quotes based on the policyholder's specific needs.

- Insurance Brokers: Working with an insurance broker can be beneficial, as they have access to multiple insurance carriers and can shop around for the best rates and coverage options on behalf of the policyholder.

- Government-Sponsored Programs: In some regions, government-sponsored flood insurance programs are available. These programs, such as the National Flood Insurance Program (NFIP) in the United States, offer standardized policies and can provide quotes through authorized agents or directly through their websites.

Factors Influencing Flood Insurance Quotes

Several key factors influence the cost of flood insurance quotes, and understanding these factors can help policyholders make informed decisions about their coverage needs.

Risk Factors

As mentioned earlier, the primary determinant of flood insurance quotes is the level of risk associated with the property. Properties located in high-risk flood zones or areas with a history of flooding will generally carry higher premiums due to the increased likelihood of flood-related damage.

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by the policyholder also impact the cost of the insurance quote. Higher coverage limits, which provide greater financial protection in the event of a flood, will typically result in a higher premium. Similarly, selecting a lower deductible, which represents the out-of-pocket expense the policyholder must pay before the insurance coverage kicks in, can also increase the overall cost of the policy.

| Coverage Limit | Premium |

|---|---|

| $100,000 | $1,200 annually |

| $200,000 | $1,600 annually |

| $300,000 | $2,100 annually |

In this table, we can see how increasing the coverage limit results in a higher annual premium. Policyholders should carefully consider their financial situation and the potential risks to determine the appropriate coverage limits and deductibles.

Property Characteristics

The characteristics of the property itself can also influence the cost of flood insurance. For instance, older properties may require higher premiums due to potential structural vulnerabilities or outdated flood-proofing measures. Additionally, the construction materials used, the foundation type, and the overall condition of the property can all impact the insurance quote.

Policyholder’s Claims History

Insurance companies often take into account the policyholder’s claims history when generating quotes. A history of multiple claims, especially those related to flood damage, may result in higher premiums or even difficulties in securing coverage. Maintaining a clean claims record can help policyholders obtain more favorable quotes.

Benefits of Flood Insurance

Obtaining flood insurance offers several key benefits that can provide significant financial protection and peace of mind for policyholders.

Financial Protection

The primary benefit of flood insurance is the financial protection it provides against flood-related losses. Floods can cause extensive damage to properties and personal belongings, resulting in costly repairs and replacements. With flood insurance, policyholders can rest assured that they have the necessary financial resources to recover and rebuild after a flooding event.

Peace of Mind

Knowing that your property and belongings are protected in the event of a flood can provide significant peace of mind. Floods are unpredictable and can happen at any time, often with little warning. By having flood insurance, policyholders can focus on their safety and well-being during a flood emergency, without the added stress of financial concerns.

Quick Recovery and Rebuilding

Flood insurance can facilitate a quicker recovery and rebuilding process after a flood. With the financial support provided by the insurance policy, policyholders can more easily access the funds needed to repair or replace damaged structures and belongings. This can help them get back on their feet sooner and minimize the disruption to their lives and businesses.

Case Study: The Impact of Flood Insurance

To illustrate the real-world impact of flood insurance, let’s consider a case study of a family living in a high-risk flood zone. This family, consisting of two working parents and two young children, recently purchased a home in a coastal area known for its vulnerability to hurricanes and subsequent flooding.

Despite the risks, the family chose to purchase flood insurance to protect their new home and belongings. A few years later, their worst fears were realized when a powerful hurricane made landfall, causing extensive flooding in their neighborhood. The family's home was inundated with several feet of water, resulting in significant damage to the structure and its contents.

However, due to their foresight in obtaining flood insurance, the family was able to access the financial resources needed to repair their home and replace their damaged belongings. The insurance policy covered the cost of temporary housing while their home was being repaired, allowing them to maintain a sense of normalcy during this challenging time. Additionally, the insurance proceeds helped them quickly restore their home to its pre-flood condition, ensuring the safety and comfort of their family.

This case study highlights the critical role that flood insurance can play in protecting families and communities from the devastating financial impacts of flooding. By obtaining adequate coverage, individuals can safeguard their homes, belongings, and financial well-being, ensuring a more secure and resilient future.

Future Implications and Considerations

As the frequency and intensity of flooding events continue to rise due to climate change and other factors, the importance of flood insurance will only grow. Policyholders should remain vigilant and regularly review their coverage to ensure it aligns with their changing needs and the evolving flood risk landscape.

Furthermore, it is crucial to understand that flood insurance is not a one-size-fits-all solution. Policyholders should work closely with insurance professionals to tailor their coverage to their specific circumstances, taking into account factors such as the location and construction of their property, their financial situation, and their personal risk tolerance.

By staying informed, proactive, and well-insured, individuals and businesses can better prepare for the potential impacts of flooding and protect their assets and financial stability.

What is the National Flood Insurance Program (NFIP)?

+The NFIP is a federal program in the United States that provides standardized flood insurance policies to property owners. It is administered by the Federal Emergency Management Agency (FEMA) and offers coverage to properties in participating communities.

Can I get flood insurance if I live in a high-risk flood zone?

+Yes, even properties located in high-risk flood zones can obtain flood insurance. However, the cost of insurance may be higher due to the increased risk of flooding in these areas.

How long does it take to get a flood insurance quote?

+The time it takes to receive a flood insurance quote can vary depending on the insurance carrier and the complexity of the property. Typically, quotes can be obtained within a few business days, but it’s best to allow a week or more for a thorough assessment.

Are there any discounts available for flood insurance?

+Yes, some insurance carriers offer discounts for various reasons, such as having multiple policies with the same carrier, implementing flood-proofing measures, or living in a community that actively participates in flood mitigation programs.