Flood Insurance Quote Online

Are you a homeowner or business owner located in a flood-prone area? Flood insurance is a crucial aspect of protecting your property and finances. Obtaining a flood insurance quote online is a convenient and efficient way to ensure you have the right coverage. In this comprehensive guide, we will delve into the world of flood insurance, exploring the process of obtaining quotes, understanding the coverage options, and providing valuable insights to help you make informed decisions.

Understanding Flood Insurance

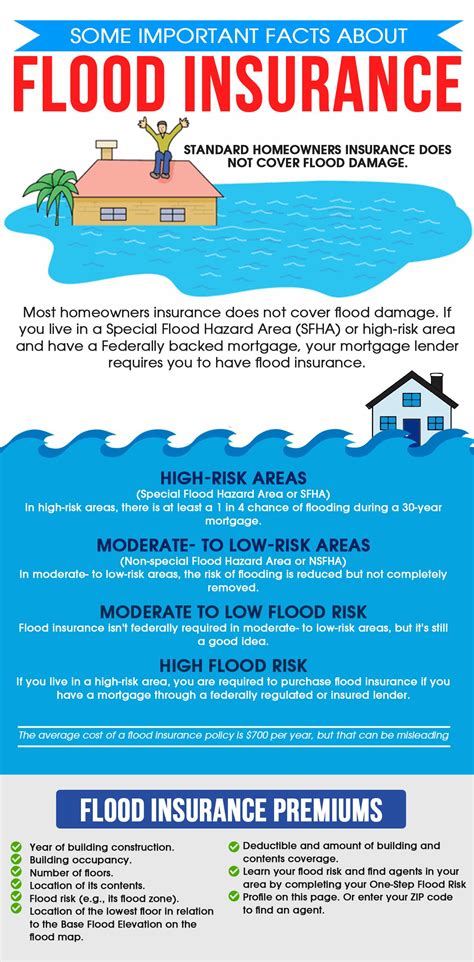

Flood insurance is a specialized type of insurance policy designed to provide financial protection against damages caused by flooding. Unlike standard homeowners or business insurance policies, flood insurance covers specific risks associated with rising waters, heavy rainfall, and other flood-related events. It is an essential safeguard for those residing in areas prone to flooding, as it can help mitigate the financial burden of repairing or rebuilding after a flood disaster.

Obtaining flood insurance is particularly crucial in the United States, where flooding is a common occurrence and can result in significant property damage. The National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA), offers flood insurance to homeowners, renters, and business owners. This program ensures that even those living in high-risk flood zones can access affordable insurance coverage.

Key Benefits of Flood Insurance

- Financial Protection: Flood insurance provides monetary coverage for damages to your building's structure, personal belongings, and additional living expenses if your home becomes uninhabitable due to flooding.

- Peace of Mind: Knowing that you have adequate flood insurance can alleviate the stress and anxiety associated with potential flood risks. It ensures that you are prepared and financially secure in the face of a disaster.

- Compliance with Lenders: If you have a mortgage on your property, your lender may require you to have flood insurance as part of the loan agreement. Obtaining a quote and securing coverage ensures you meet these obligations.

Obtaining a Flood Insurance Quote Online

The process of getting a flood insurance quote online has become increasingly convenient and accessible. Here's a step-by-step guide to help you navigate the process seamlessly:

Step 1: Gather Necessary Information

Before initiating the quote process, ensure you have the following details readily available:

- Your property address, including the city, state, and zip code.

- The age and type of your building (e.g., single-family home, condo, or commercial property).

- The square footage and number of floors in your building.

- Any recent improvements or renovations made to your property.

- The current market value of your property.

- Information about your existing homeowners or business insurance policy (if applicable).

Step 2: Visit Trusted Insurance Provider Websites

To obtain accurate and reliable flood insurance quotes, visit the websites of reputable insurance providers that offer flood insurance coverage. Some popular options include:

Step 3: Complete the Online Quote Form

Each insurance provider's website will have a dedicated section for flood insurance quotes. Follow these steps to complete the online form:

- Locate the "Get a Quote" or "Flood Insurance Quote" section on the website.

- Enter your property's address and select the appropriate coverage type (e.g., building and contents, or contents only).

- Provide the requested details about your property, including square footage, age, and any special features.

- Disclose any previous flood-related incidents or claims you may have had in the past.

- Review and confirm the accuracy of the information you've provided.

Step 4: Receive and Compare Quotes

Once you've submitted your information, the insurance provider will generate a personalized flood insurance quote based on your property's risk assessment and coverage needs. Compare quotes from multiple providers to find the best coverage at a competitive price.

Factors Affecting Flood Insurance Quotes

Several factors influence the cost of your flood insurance premium. Understanding these factors can help you make informed decisions:

- Location: The flood risk level of your property's location is a significant factor. Properties in high-risk areas (Special Flood Hazard Areas or SFHAs) generally have higher premiums.

- Building Age and Construction: Older buildings or those with certain construction materials may face higher premiums due to increased flood vulnerability.

- Coverage Amount: The amount of coverage you choose will impact your premium. Ensure you select an adequate coverage limit to protect your property's value.

- Deductible: Opting for a higher deductible can lower your premium, but it means you'll pay more out of pocket in the event of a claim.

- Discounts and Credits: Some insurance providers offer discounts for flood mitigation measures, such as installing flood barriers or elevating your property. Take advantage of these opportunities to reduce your premium.

Coverage Options and Considerations

Flood insurance policies typically offer two main types of coverage:

Building Coverage

Building coverage, also known as structural coverage, protects the physical structure of your building. It covers the cost of repairing or rebuilding the foundation, walls, roof, and other permanent fixtures. This coverage is essential for homeowners and business owners to ensure their property's structural integrity.

Contents Coverage

Contents coverage, or personal property coverage, provides protection for your personal belongings, such as furniture, appliances, clothing, and electronics. It is an optional coverage that can be added to your flood insurance policy to safeguard your valuable possessions.

Additional Considerations

- Coverage Limits: Choose coverage limits that align with the actual replacement cost of your building and its contents. Ensure you have sufficient coverage to cover potential losses.

- Policy Exclusions: Review the policy exclusions carefully to understand what is not covered. Common exclusions may include damage caused by sewer backups, gradual water accumulation, or certain types of water damage.

- Additional Living Expenses: Consider adding coverage for additional living expenses if your home becomes uninhabitable due to flooding. This coverage can help cover temporary housing and other related costs.

- Multiple Policies: If you have both a homeowners or business insurance policy and a flood insurance policy, ensure there is no overlap in coverage to avoid unnecessary expenses.

The Importance of Flood Insurance

Flooding can have devastating impacts on both residential and commercial properties. Here are some key reasons why flood insurance is crucial:

Financial Protection

Flood insurance provides financial security by covering the costs of repairing or rebuilding your property after a flood event. Without insurance, you may be left with significant out-of-pocket expenses, which can be financially devastating.

Peace of Mind

Knowing that you have adequate flood insurance coverage gives you peace of mind. It alleviates the stress and anxiety associated with potential flood risks, allowing you to focus on enjoying your home or running your business without constant worry.

Compliance with Regulations

In certain high-risk flood zones, flood insurance may be a mandatory requirement for obtaining a mortgage or complying with local regulations. By obtaining a flood insurance policy, you ensure that you meet these obligations and avoid any legal or financial penalties.

FAQs

How much does flood insurance cost on average?

+The cost of flood insurance can vary significantly based on factors such as location, property value, and coverage limits. On average, flood insurance policies can range from a few hundred to several thousand dollars per year. It's essential to obtain multiple quotes to find the best coverage at an affordable price.

Can I get flood insurance if I live in a high-risk flood zone?

+Absolutely! The National Flood Insurance Program (NFIP) specifically caters to homeowners and business owners in high-risk flood zones. By obtaining a flood insurance policy through the NFIP or a private insurance provider, you can secure the necessary coverage to protect your property.

Is flood insurance mandatory for all property owners?

+Flood insurance is not mandatory for all property owners. However, it is highly recommended, especially for those living in high-risk flood zones. Additionally, if you have a mortgage on your property, your lender may require you to have flood insurance as a condition of the loan.

What is the process for filing a flood insurance claim?

+Filing a flood insurance claim typically involves the following steps: 1) Contact your insurance provider to report the flood damage and initiate the claim process. 2) Document the damage with photographs and detailed descriptions. 3) Provide the necessary information and supporting documentation to your insurer. 4) Await the claim assessment and settlement, which may involve an inspection by an adjuster.

Are there any alternatives to flood insurance?

+While flood insurance is the primary method of protecting your property against flood risks, there are some alternative options. These include flood mitigation measures such as elevating your property, installing flood barriers, or implementing flood-resistant landscaping. However, it's important to note that these measures may not provide the same level of financial protection as a comprehensive flood insurance policy.

By understanding the importance of flood insurance and following the steps outlined in this guide, you can obtain the necessary coverage to protect your property and finances. Remember to compare quotes, review coverage options, and choose a reputable insurance provider to ensure you have the best protection against flood-related risks.